Applying Supply and Demand: Real-World Examples

Name

Institution

Applying Supply and Demand: Real-World Examples

Supply and Demand代写 The analysis of industrial real estate’s supply and demand is a critical task to the commercial real estate professional.

The Future of the Industrial Real Estate Market: Preparing for Slower Demand Growth Supply and Demand代写

Link https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-industrial-real-estate-market.html

The analysis of industrial real estate’s supply and demand is a critical task to the commercial real estate professional. The above article by Saurabh Mahajan analyzes how convergence of various factors in the market have reshaped the industrial real estate sector which has resulted in headwinds and uncertainty to the investors. Market leaders need to learn what these factors are and how they affect the real estate market in general and hence they can anticipate and adapt to prevailing conditions.

The industrial real estate sector has tremendously been growing for the last five years compared to the real estate segment. Supply and Demand代写

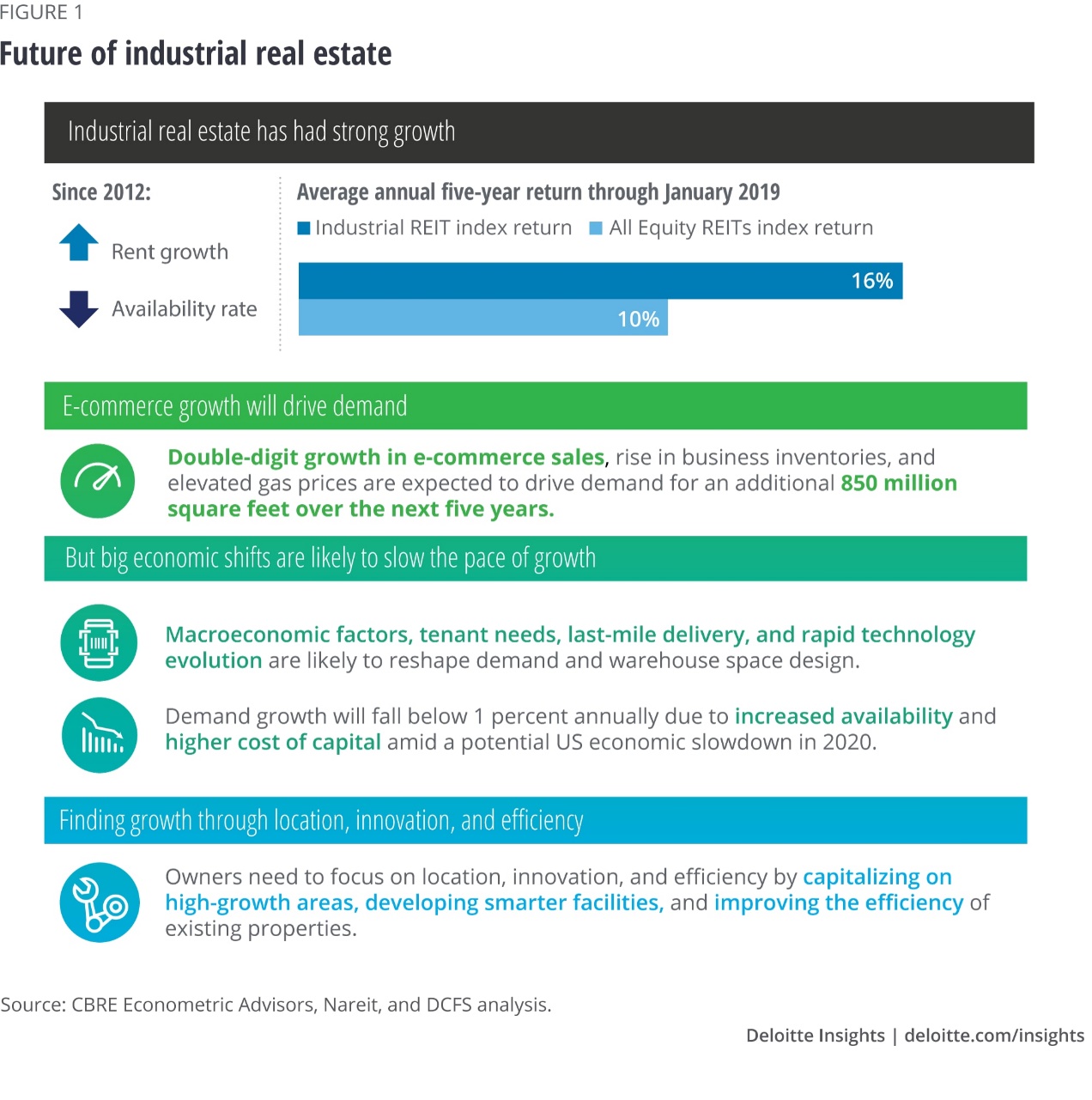

The rent growth has been on increasing trend as the spaces available continue to decline. Figure 1 below gives a brief overview of the industrial real estate sector. Mahajan identified “macroeconomic factors, tenant needs, last-mile delivery, and rapid technology evolution” as the main factors anticipated to reshape the market demand and supply in the sector (Mahajan, 2019). Deloitte’s US Economics team developed a Deloitte Center for Financial Services’ model that they used to estimate future demand for industrial real estate.

The model found that the sector demand is expected to grow by 850 million square feet by 2023. The growth in e-commerce have direct impact on the growth of the sector. The increase in available spaces and cost of capital will negatively impact demand growth in future. Developers need to understand these dynamics together with factors affecting the industry to consider whether there is sufficient demand to support the new developments.

Applicable Demand and Supply Curves Supply and Demand代写

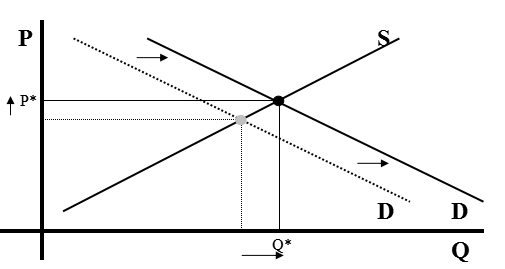

Graph A is most suitable to illustrate the industrial real estate market.

The sector is growing due to the high demand for rental spaces. In the case of industrial real estate, rents represent the prices and spaces available in the supply. At the market equilibrium, the rent at which consumers demand the spaces is equal to the spaces created by property developers. Increases in demand for spaces cause prices to increase and hence put pressure on the available spaces to let.

Due to changes in other factors other than the prices, the equilibrium price and quantity shift to the right to D’. As discussed above, some of these changes include but not limited “macroeconomic factors, tenant needs, last-mile delivery, and rapid technology evolution” (Mahajan, 2019). At the new equilibrium market, consumers will pay more to create incentives for real estate developers. As a result, investors will join the market to reduce the demand deficit. Supply and Demand代写

Therefore, it can be concluded that supply and demand forces also affect rents and availability rates. The two determine the value of the property and the developer’s rate of returns. The increase in demand for spaces in urban central business centers or on the outskirts reduces the availability rates of industrial rentals, and hence, the rent increase. At high rent developers will be willing to build more spaces to let.

Reference Supply and Demand代写

Mahajan, S. (2019). The future of the industrial real estate market. Retrieved from https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-industrial-real-estate-market.html

更多其他:Case study代写 Essay代写 Proposal代写 艾莎代写 Report代写 Academic代写 文学论文代写 研究论文代写 Admission Review代写