1. Introduction

study of corporate finance代写 An interesting phenomenon in the study of corporate finance is that corporate investment in tangible assets

An interesting phenomenon in the study of corporate finance is that corporate investment in tangible assets has substantially decreased in the past 30 years, while cash holdings have increased at the same time. How to explain for this phenomenon has become a hot topic in the researches on corporate finance. For example, Bates et al. (2009) find that the average cash-to-assets ratio for U.S. industrial firms more than doubles from 1980 to 2006 and they propose that the increase of firms’ cash ratios is partly due to the increase of their volatilities. study of corporate finance代写

Jones and Philippon (2016) argue that a secular decline in competition can explain for weak corporate investment. Gutiérrez and Philippon (2017) find that US firms have been under-invested relative to Tobin’s Q since the 2000s and they claim that this phenomenon is partly due to the decline of competition.

This paper seeks to examine if the explanation for the increase of firms’ cash ratios in Bates et al.

(2009) still holds when more recent data is included. To be specific, this paper will use a dataset of the 100 largest US firms over the period 1980 to 2017 to replicate the finding in Bates et al. (2009) to examine if increased volatility can still explain the increase of firms’ cash holdings.

Historically, a lot of theories have been proposed to explain why there is an increase of firms’ cash holdings. For example, according to Jensen (1986), firms which have agency problems tend to have higher cash holdings. Also, to understand why cash holdings increase can help us better understand the leverage of firms. With this background. it is relevant to examine if the increase of cash volatility can explain for the recent increase of firms’ cash holdings. Following Bates et al. (2009), the ordinary least square regression method is used in this study.

The rest of this paper will be organized as follows. Section 2 introduces literature background. Section 3 describes the data. Section 4 presents the empirical results. Section 5 gives the discussion on the results. Section 6 concludes.study of corporate finance代写

2. Literature Background

Historically, a lot of studies have been conducted to examine the determinants of firms’ cash holdings. For example, Miller and Orr (1966) set up a model to solve for the optimal demand for cash. In their setting, a firm faces transaction costs in which it need to convert a financial asset with less liquidity into cash to make payments. In the setting of Miller and Orr (1966), large firms need less cash due to economies of scale. Jensen (1986) claims that entrenched managers in the firms which has high cash flow are less willing to pay out cash.

In this way, they propose that agency conflicts can explain for the change of firms’ cash holdings.

Dittmar, Mahrt-Smith, and Servaes (2003) use a cross-country data and find that firms in countries which have greater agency problems tend to hold more cash. Almeida, Campello, and Weisbach (2004) set up a model in which firms hold cash out of the precautionary demand. They propose that financially constrained firms tend to invest more in cash. Foley, Hartzell, Titman, and Twite (2007) find that corporations in United States which have tax burden related with earnings from other countries tend to hold more cash.

Following Bates et al. (2009), study of corporate finance代写

this study will examine how the increase of cash volatility contributes to the increase of firms’ cash holdings. In recent years, there is an increase in idiosyncratic risk. According to Irvine and Pontiff (2008), the increase of idiosyncratic risk mirrors an increase in the volatility of cash flow. These results indicate that firms are now facing higher unhedgeable risks, therefore, they have higher precautionary demand for cash, which leads to the increase of cash holdings.

Han and Qiu (2007) provides a theoretical evidence that an increase in the volatility of cash flow can lead to the increase of cash holdings in financially constrained firms, for other firms, the effect is ambiguous. They also provide an empirical evidence which shows that the cash holdings of firms which are financially constrained increase when the volatilities of cash flow increase. This study will replicate the analysis in Bates et al. (2009) to examine if the increase of cash volatility can explain the increase of firms’ cash holdings for the past 38 years. The hypothesis is that firms’ cash holdings are increase with the volatility of cash holdings. We will use the dataset of the 100 largest firms in United States from 1980 to 2017 to do the analysis. The cash holdings are measured as the ratio of firms’ total assets. Time trend is also included in our analysis.

3. Methodology and data

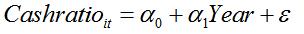

Following Bates et al. (2009), this paper will use the Ordinary Least Square regression method to study how the increase of cash volatility contributes to the increase of firms’ cash holdings. To be specific, First, an analysis is conducted to find out the average increase of cash holdings (measured as the ratio of total asset). A regression of cash holdings on year is used to get the result. The preliminary model is

In the regression, the year variable is calculated as the actual year minus 2000.

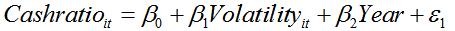

Then, following Bates et al. (2009), the volatility of firms’ cash holdings is added in the regression to examine how it contributes to the increase of firms’ cash holdings. The model is extended as follows

Finally, by comparing the values of coefficients of these two models and check for the significances of the coefficients, we can find how the increase of cash volatility contributes to the increase of firms’ cash holdings.

The sample data comes from the database of The Center for Research in Security Prices (CRSP) and Compustat provided in Wharton Research Data Services (WRDS) for the period 1980 to 2017. The dataset covers the financial indicators of the 100 largest firms and the firm-year volatility (measured by taking the standard deviation in firms’ cash holdings over a 5-year period).study of corporate finance代写

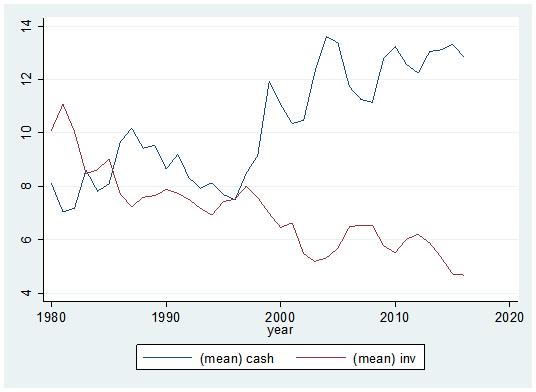

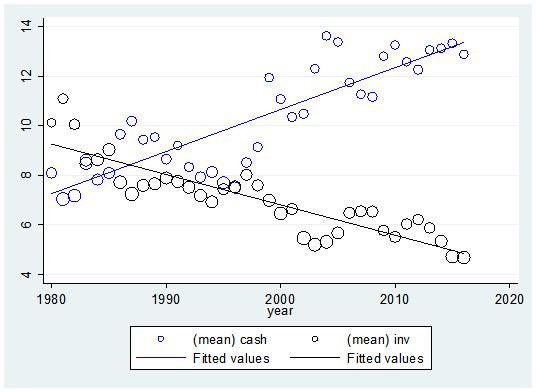

To get an intuitive understanding of the decrease of corporate investment and the increase of cash holdings in the sample over the past 38 years, the plot of cash holdings as percentage of book value of assets and investment as percentage of book value of assets over time is presented as follows (Figure 1 and Figure 2).

Figure 1: Cash holdings and Investment

Figure 2: Cash holdings and Investment (with fitted line)

From Figure 1 and Figure 2, we can see that in general, cash holdings as percentage of book value of assets has increased over time. The cash holding ratio has increased from about 8% in 1980 to about 13% in 2017, which means the cash ratio increases 5 percentage points in 38 years. At the same time, the investment as percentage of book value of assets has decreased. The investment as percentage of book value of assets is about 10% in 1980 and it has decreased to about 5% in 2017, which means the investment ratio decreases 5 percentage points in 38 years.

4. Results study of corporate finance代写

In this section we present empirical evidence on how the increase of cash volatility contributes to the increase of firms’ cash holdings. The results are in Table 1, Table 2 and Table 3.study of corporate finance代写

First, to get a preliminary quantitative understanding about how cash ratio and investment ratio of book value of assets change over years, two regressions for cash ratio and investment ratio are made on the year variable. The results of the two regressions on year are displayed in Table 1.

Table 1: Regression on year

| (1) | (2) | |

| Cash holdings | Investment | |

| year | 0.1760*** | -0.1059*** |

| (0.018043) | (0.007035) | |

| Constant | 10.4717*** | 6.7264*** |

| (0.183824) | (0.071675) | |

| R-Square | 0.0293 | 0.0671 |

| Number of Observation | 3151 | 3151 |

Then, the volatility of cash ratio is included in the analysis to examine if it can explain for the decrease of cash ratio and increase of investment ratio. The results of these two regressions on year and volatility are displayed in Table 2.

Table 2: Regression on year and volatility

| (1) | (2) | |

| Cash holdings | Investment | |

| year | 0.1201*** | -0.0986*** |

| (0.016474) | (0.007023) | |

| Volatility | 1.4489*** | -0.1896*** |

| (0.055034) | (0.023461) | |

| Constant | 6.4168*** | 7.2569*** |

| (0.226774) | (0.096674) | |

| R-Square | 0.2045 | 0.0861 |

| Number of Observation | 3151 | 3151 |

Note that extreme points such outliers can have extraordinary influence on analysis result, which makes the conclusion unreliable. To exclude the influence of extreme points in the sample, a robust check is made for the above results. The robust analysis is made by removing the 5 largest values (outliers) of cash holdings and volatility. After removing the 5 largest values (outliers) of cash holdings and volatility, the regression results in ii) and iii) are updated in Table 3 and Table 4.

Table 3: Regression on year study of corporate finance代写

| (1) | (2) | |

| Cash holdings | Investment | |

| year | 0.1772*** | -0.1065*** |

| (0.017571) | (0.007024) | |

| Constant | 10.3856*** | 6.7433*** |

| (0.179139) | (0.071604) | |

| R-Square | 0.0314 | 0.0682 |

| Number of Observation | 3142 | 3142 |

Table 4: Regression on year and volatility

| (1) | (2) | |

| Cash holdings | Investment | |

| year | 0.1039*** | -0.0989*** |

| (0.015468) | (0.007046) | |

| Volatility | 1.8571*** | -0.1923*** |

| (0.058564) | (0.026678) | |

| Constant | 5.2935*** | 7.2707*** |

| (0.223829) | (0.101963) | |

| R-Square | 0.2664 | 0.0834 |

| Number of Observation | 3142 | 3142 |

5. Discussion study of corporate finance代写

From Table 1, The first regression result displays that the average increase in cash holdings is 0.176 (measured as percentage of book value) per year. The second regression result displays that the average decrease in investments is 0.106 (measured as percentage of book value) per year. The coefficients are both highly significant (significant at 1% level). These results display quantitatively that there is an increasing time trends for cash ratio and a decreasing time trend for investment ratio.

From Table 2, we can see that the coefficient on volatility in the first regression is positive and highly significant. This suggests that the increase of volatility can at least partly explain why the cash holding ratio increase over recent years. The R-square of this model is about 20%, note that the model includes only two independent variables, this result suggests that this regression model has a relatively strong explanatory power.

From the result of the first regression in Table 3 and Table 4,

we can see that after removing the 5 largest values (outliers) of cash holdings and volatility, the key results remain similar. Further, we can see that the coefficient on year for the regression of Cash holdings ratio to asset decreased from 0.177 to 0.104 after controlling for cash volatility, which means the trend effect on cash ratio has decreased by (0.177- 0.104)/ 0.177=41% when the impact of the volatility of cash ratio has been considered.

This suggests that 41% of the trend in cash holding ratio is due to volatility increase when outliers are removed. These results indicate that the increase of the volatility of cash ratio can explain a large portion of the trend in cash ratio. So, our results provide an empirical evidence that are similar to the analysis in Bates et al. (2009), implying that the increase of the volatility of cash ratio still contributes a lot to the increase of firms’ cash holding when the most recent data are used.

6. Conclusion

In the past 38 years, firms’ cash holdings have increase substantially. A lot of studies have been conducted to explain for this phenomenon. According to precautionary demand theory for firms’ cash holdings, higher volatility risk can cause firm to hold more cash. Then it becomes a relevant question if the increase of firms’ cash holdings in the recent 38 years can be explained by the increase of the volatility of cash holdings.

Following Bates et al. (2009),

this paper uses the most updated data to examine how the increase of the volatility of cash ratio contributes to the increase of firms’ cash ratios. This study documents that there is a significant increasing time trend in firms’ cash holdings. Also, the empirical results present a positive and significant correlation between firms’ cash ratios and the volatility of cash ratio.

Further, the results show that the increase of the volatility of cash ratio can explain a large portion (41%) of the increase of cash ratio, which indicates that the cash flow risk is still big factor that affects firms’ decisions for the amounts of cash holdings for the most recent data. This result suggests that the finding in Bates et al. (2009) can still help to explain why firms’ cash ratios have been increasing during recent years. The result in this study provide a support for precautionary demand theory for firms’ cash holdings and it helps to explain why firms’ cash holdings increase over the past 38 years.

Reference

Almeida, H., Campello, M., & Weisbach, M. S. (2004).

The cash flow sensitivity of cash. The Journal of Finance, 59(4), 1777-1804.

Bates, T. W., Kahle, K. M., & Stulz, R. M. (2009). Why do US firms hold so much more cash than they used to? The journal of finance, 64(5), 1985-2021.

Dittmar, A., Mahrt-Smith, J., & Servaes, H. (2003). International corporate governance and corporate cash holdings. Journal of Financial and Quantitative analysis, 38(1), 111-133.

Foley, C. F., Hartzell, J. C., Titman, S., & Twite, G. (2007). Why do firms hold so much cash? A tax-based explanation. Journal of Financial Economics, 86(3), 579-607.

Gutiérrez, G., & Philippon, T. (2017). Declining Competition and Investment in the US (No. w23583). National Bureau of Economic Research.

Han, S., & Qiu, J. (2007). Corporate precautionary cash holdings. Journal of Corporate Finance, 13(1), 43-57.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76(2), 323-329.

Jones, C., & Philippon, T. (2016). The Secular Stagnation of Investment? Unpublished manuscript, New York University, December.

Lee, D., Shin, H., & Stulz, R. M. (2016). Why does capital no longer flow more to the industries with the best growth opportunities? (No. w22924). National Bureau of Economic Research.

Miller, M. H., & Orr, D. (1966). A Model of the Demand for Money by Firms. The Quarterly journal of economics, 80(3), 413-435.

更多其他:prensentation代写 Resume代写 Report代写 Proposal代写 Capstone Projects 文学论文代写 商科论文代写

您必须登录才能发表评论。