Introduction to Economics

经济学导论

利率和货币政策代写 In the context of looming global recession, countries are grappling to salvage their economies from collapsing…

Interest rate and monetary policy

In the context of looming global recession, countries are grappling to salvage their economies from collapsing from wide-spread COVID-19 pandemic. It is the role of a central bank to influence the interest rates as the most critical aspect in controlling economic growth, job creation, and inflation (Greenlaw, Shapiro, & Taylor, 2018; Robert, & Bernanke, 2001). The method of control that the central banks use to control the demand and supply of money depends on the prevailing economic situation and its powers. The prominent central banks include Federal Reserve, Banks of England, People’s Bank of China, among others. These central banks adopt deductions of interest rate to influence economic activities.

利率和货币政策

译文:在全球经济衰退迫在眉睫的背景下,各国正在努力挽救其经济,以免因广泛传播的 COVID-19 大流行而崩溃。中央银行的作用是将利率作为控制经济增长、创造就业和通货膨胀的最关键方面来影响利率(Greenlaw、Shapiro 和 Taylor,2018 年;Robert 和 Bernanke,2001 年)。中央银行用于控制货币需求和供应的控制方法取决于当前的经济形势及其权力。著名的中央银行包括美联储、英格兰银行、中国人民银行等。这些中央银行通过扣除利率来影响经济活动。 利率和货币政策代写

Global impact of COVID-19

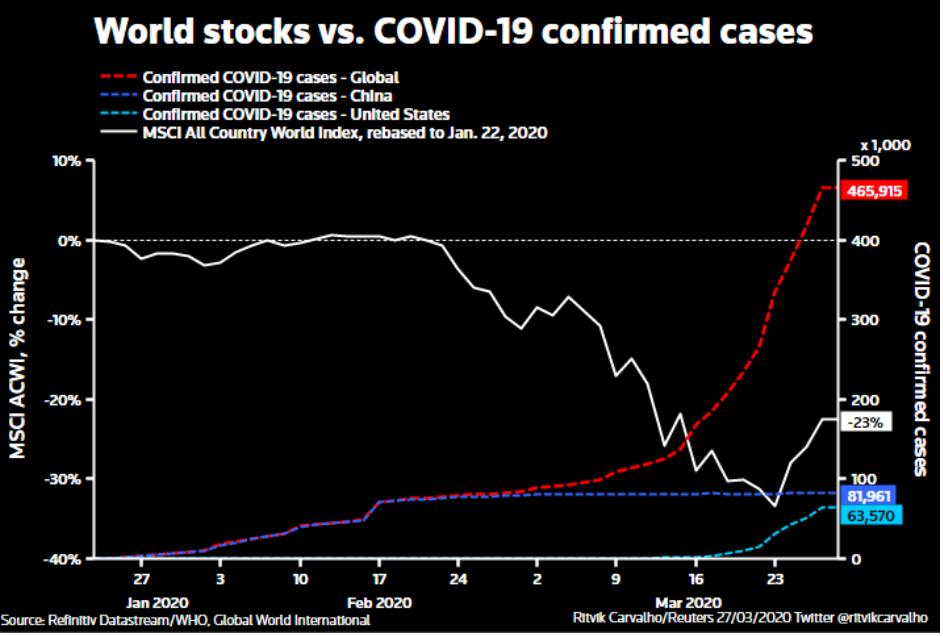

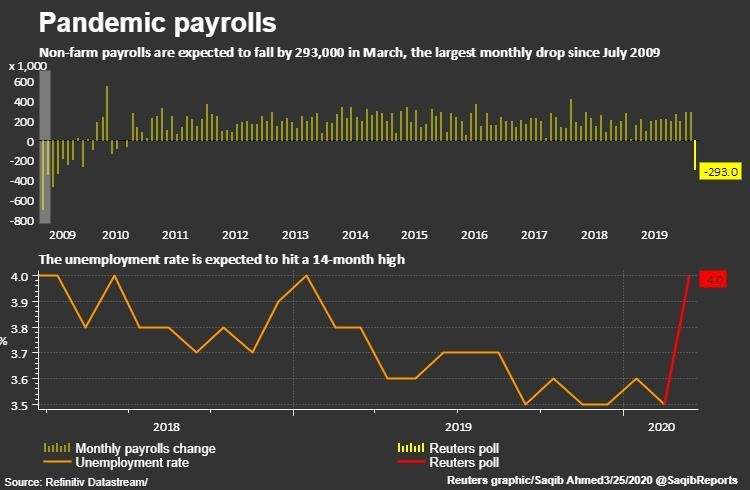

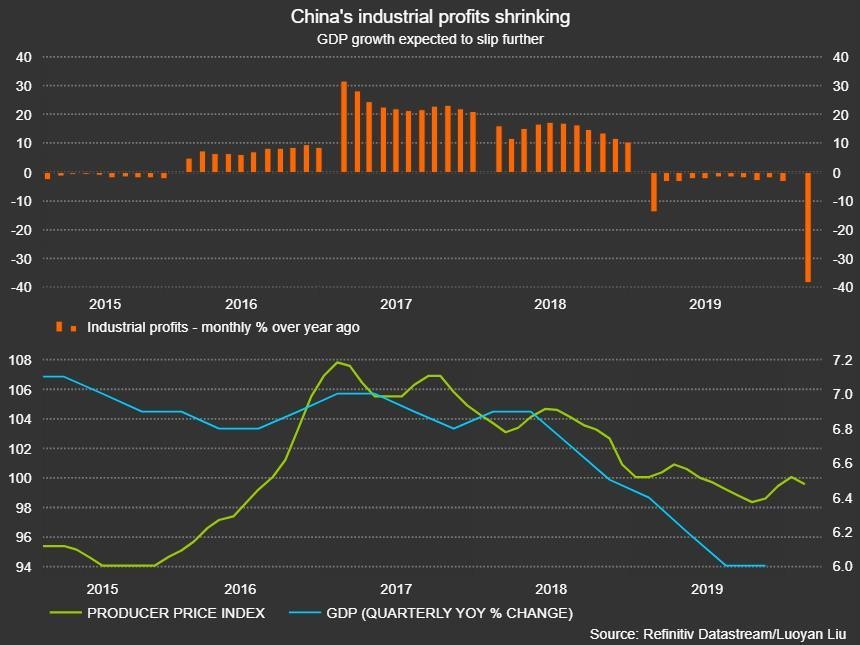

The panic for COVID-19 spread is higher than the rate of the range of the disease itself. Besides the economic dangers, economies are approaching recession. The world stock market is falling, as shown in figure 1. Figure 1 shows payroll data that millions of jobs are lost every day. China is a leading world economy, factories were closing, and profits are shrinking, as shown in figure 3 below. These are signs of economic downturns that the countries are working to mitigate.

COVID-19 的全球影响 利率和货币政策代写

译文:对 COVID-19 传播的恐慌程度高于疾病本身的范围。 除了经济危险之外,经济正接近衰退。 世界股市正在下跌,如图 1 所示。图 1 显示了每天有数百万工作岗位流失的工资数据。 中国是世界领先的经济体,工厂关闭,利润缩水,如下图 3 所示。 这些是各国正在努力缓解的经济衰退迹象。

Figure 1: The impacts of COVID-19 on World Stocks

Source: World Economic Forum (2020)

Figure 1: Pandemic Payrolls

Source: World Economic Forum (2020)

Figure 3: China’s Industrial Profits are Falling

Source: World Economic Forum (2020)

Central banks strategies

中央银行策略

Federal Reserve

The Fed took an emergency action to slash interest rate by full percentage to near zero at 0.5 percent (Rugaber, 2020). The move was a benchmark for other short-term rates and also affects longer-term rates. The Fed aimed at lowering the cost of lending on mortgages, auto loans, home equity loans, and other loans.

美国联邦储备

译文:美联储采取紧急行动,将利率下调至接近零的 0.5%(Rugaber,2020 年)。此举是其他短期利率的基准,也会影响长期利率。美联储旨在降低抵押贷款、汽车贷款、房屋净值贷款和其他贷款的贷款成本。 利率和货币政策代写

Bank of England

The central bank has cut the interest rate to 0.1 percent (Reynolds, Donegan, & Barrowman, 2020). It has injected 200 billion pounds into the economy to help boost spending and investment. Further, it has offered banks and building societies long-term funding at interest rates of 0.1 percent so that they can reduce their lending rates to customers.

英格兰银行

译文:央行已将利率下调至 0.1%(雷诺兹、多尼根和巴罗曼,2020 年)。它已向经济注入了 2000 亿英镑,以帮助刺激支出和投资。此外,它还以 0.1% 的利率向银行和建筑协会提供长期资金,以便它们可以降低对客户的贷款利率。

The People’s Bank of China

PBOC was the first to act in response to the Coronavirus pandemic. The central bank gave banks an extra 800 billion yuan without interest rate to lend out to struggling businesses and farmers. The aim was to main employment rate, productivity, and maintain gross domestic income.

中国人民银行

译文:中国人民银行率先采取行动应对冠状病毒大流行。央行无息向银行追加8000亿元贷款给陷入困境的企业和农民。目的是提高就业率、生产力和维持国内总收入。 利率和货币政策代写

Meaning of increase and decrease of the interest rate set by the central bank

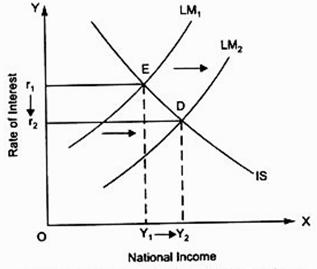

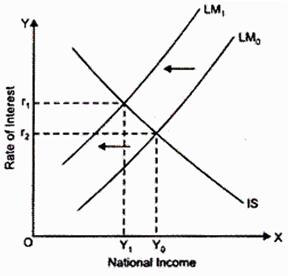

IS-LM model that show changes in the commodity market and money market at equilibrium when interest rates change (Samuelson, & Nordhaus, 2009). The model explains how the economy is kept at the equilibrium of money supply versus interest rates. The model is made of four components, including investment, savings, liquidity and money. In the current pandemic, central banks are using the monetary policy to influence the level of economic activities. Monetary policy can either be contractionary or expansionary, depending on the prevailing economic condition.

Therefore, IS-LM model is used to explain how expansionary function. When the money supply changes, in case money supply increases, the LM curve shift to the right and shifts to the left when the money supply decrease. When the economy is heading to the recession, expansionary monetary policies are used by central banks to increase the money supply in the market. The interest rates fall, assuming the liquidity preference or the money supply remains unchanged, when the money supply increases. Low-interest rates attract investments that increase income and aggregate demand. It is the expansionary effect that shifts LM curve to the right moving the equilibrium point from E to D and a fall in interest rates from r1 to r2 while at the same time income increase from Y1 to Y2. Expansion of money supply reduce interest rates and increase national income, as shown in figure 4.

央行加息和降息的意义 利率和货币政策代写

译文:IS-LM 模型显示了当利率变化时商品市场和货币市场处于均衡状态时的变化 (Samuelson, & Nordhaus, 2009)。该模型解释了经济如何保持货币供应与利率的平衡。该模型由四个部分组成,包括投资、储蓄、流动性和货币。在当前的大流行中,中央银行正在利用货币政策来影响经济活动的水平。货币政策可以是紧缩性的,也可以是扩张性的,这取决于当时的经济状况。

因此,IS-LM 模型被用来解释如何扩展函数。当货币供应量发生变化时,如果货币供应量增加,LM曲线向右移动,当货币供应量减少时LM曲线向左移动。当经济走向衰退时,中央银行会使用扩张性货币政策来增加市场的货币供应量。假设流动性偏好或货币供应量保持不变,当货币供应量增加时,利率下降。低利率吸引了增加收入和总需求的投资。正是扩张效应使 LM 曲线向右移动,均衡点从 E 移动到 D,利率从 r1 下降到 r2,同时收入从 Y1 增加到 Y2。扩大货币供应量降低利率,增加国民收入,如图4所示。

Figure 4: Effect of expansion in monetary supply on interest rates and income

However, is inflation is high, then the central bank adopts the contractionary monetary policy to reduce money supply in the market. The strategy reduces the liquidity in banks.

The central bank can also use the cash reserve to reduce the money supply. When the cash reserve ratio with the central bank is high, banks reduce lending and hence money supply is reduced. The LM curve shifts to the left when money supply decrease and hence increase the interest rates and lowering the national income. Investment and consumption lower when the interest rate is low and hence reduce inflation, as shown in figure 5.

译文:但是,如果通货膨胀率高,那么央行就会采取紧缩货币政策来减少市场上的货币供应量。 该策略减少了银行的流动性。

中央银行也可以使用现金储备来减少货币供应量。 当央行的现金准备金率较高时,银行会减少贷款,从而减少货币供应量。 当货币供应量减少时,LM 曲线向左移动,从而提高利率并降低国民收入。 低利率时投资和消费减少,从而降低通货膨胀,如图5所示。

Figure 5: Contractionary monetary policy

Gross national product

国民生产总值

Components of GDP

The GDP is the sum of the income or expenditure or output of goods and services in the economy (Robert, & Bernanke, 2001). It includes;

- Consumer expenditure (C): These are the final goods and services consumed by citizens, excluding the purchase of assets such as a new house.

- General government final consumption (G): These are the current expenditure on goods and services by the central bank and local government.

- Expenditure on fixed assets and fixed capital formation: These are the investment by the consumers and the government in the economy.

The three components above are added together to constitute Total domestic expenditure. The expenditure on export (X) is added to constitute total final expenditure, which is adjusted by deducting imports (M) to constitute gross domestic income at market prices. It is further adjusted by deducting taxes and adding subsidies to give gross domestic income at factor cost. Other adjustments include adding rents, interests, and dividends from abroad.

In summary, the GDP is calculated as;

Y = C + I + G (X – M)

GDP的组成部分

译文:GDP 是经济中商品和服务的收入或支出或产出的总和(罗伯特和伯南克,2001 年)。这包括;

消费者支出(C):这些是公民消费的最终商品和服务,不包括购买新房等资产。

广义政府最终消费(G):中央银行和地方政府在商品和服务上的经常性支出。

固定资产支出和固定资本形成:这些是消费者和政府对经济的投资。 利率和货币政策代写

上述三部分加在一起构成国内总支出。出口支出(X)加起来构成最终总支出,通过扣除进口(M)进行调整,构成按市场价格计算的国内总收入。它通过扣除税收和增加补贴进一步调整,以要素成本提供国内总收入。其他调整包括增加来自国外的租金、利息和股息。

总之,GDP计算如下:

Y = C + I + G (X – M)

Role of GDP

The level of GDP is used for national planning for goods and services available to consumption, government, capital, and export. Countries use GDP to compared economic performance and the standard of living over time. A country also uses GDP to assess the stability of the economy, various sectors, the balance of trade and investment levels.

Real and Nominal GDP

Nominal GDP is the value of all final goods and services at the current rate after deducting depreciation. Real GDP is the national output based on a base year or corrected for inflation.

GDP的作用

译文:GDP 水平用于对可用于消费、政府、资本和出口的商品和服务进行国家规划。 各国使用 GDP 来比较一段时间内的经济表现和生活水平。 一个国家还使用 GDP 来评估经济的稳定性、各个部门、贸易和投资水平的平衡。

实际和名义 GDP 利率和货币政策代写

名义 GDP 是所有最终商品和服务按现行汇率扣除折旧后的价值。 实际 GDP 是基于基准年或修正通货膨胀的国民产出。

How interest rate increase GDP

利率如何增加GDP

The impact of interest rate on GDP can be explained using the Keynesian Theory of the consumption function. According to Keynesian theory, current real national income is used to determine aggregate consumption expenditure (Mishkin, 2007). That is;

Aggregate consumption = C + mpc (Y)

Where:

C = autonomous consumption expenditure

Y = the level of current real income

Investment can be dependent on marginal propensity. It is a fraction of a change in income that is not spent detonated by MPC = ΔC/Δ Y.

Δ y changes in income. And because when income increase, some are consumed while the rest is saved, then

ΔC + ΔS = ΔY

When ΔY is used to divided all through, then

ΔC/ΔY + ΔS/ΔY = 1

Thus ΔC/ΔY + ΔS/ΔY = 1 can be expressed as

S = 1 – C

Investment is an endogenous expenditure (Mishkin, 2007). Therefore, any change in consumer income will increase the propensity to save and consequently increase investment. Investment expenditure is a component in the calculation of GDP. However, investment depends on people or business expectations on the chances of profit and availability of funds. When interest rates reduce, businesses can take loans for investment. In this case, savings and investments equilibrium is necessary to allow for the availability of investment funds.

In this regard, using the Frugal economy, it is assumed that businesses and private consumers are rational and will plan for the future through saving and investment (Mishkin, 2007). At the same time, savings and investment are dependent on interest rates at equilibrium. GDP is the total factor incomes from the process of producing the national income. Therefore, for GDP growth to be at optimum, withdrawals and injections that are savings and investment respectively have to be at equilibrium at the circular flow.

译文:利率对 GDP 的影响可以用消费函数的凯恩斯理论来解释。根据凯恩斯理论,当前实际国民收入用于确定总消费支出(Mishkin,2007)。那是;

总消费 = C + mpc (Y)

在哪里:

C = 自主消费支出

Y = 当前实际收入水平

投资可能取决于边际倾向。这是 MPC = ΔC/Δ Y 引爆的未被支出的收入变化的一小部分。

Δ y 收入变化。因为当收入增加时,一些被消费而其余的被储蓄,那么

ΔC + ΔS = ΔY

当 ΔY 用于全部划分时,则

ΔC/ΔY + ΔS/ΔY = 1

因此ΔC/ΔY + ΔS/ΔY = 1 可以表示为

S = 1 – C

投资是一种内生支出(Mishkin,2007)。因此,消费者收入的任何变化都会增加储蓄倾向,从而增加投资。投资支出是计算 GDP 的一个组成部分。然而,投资取决于人们或企业对盈利机会和资金可用性的预期。当利率降低时,企业可以贷款进行投资。在这种情况下,储蓄和投资的平衡对于投资资金的可用性是必要的。

在这方面,使用节俭经济,假设企业和私人消费者是理性的,并将通过储蓄和投资来规划未来(Mishkin,2007)。同时,储蓄和投资取决于均衡利率。 GDP是国民收入生产过程中的全部要素收入。因此,为了使 GDP 增长处于最佳状态,分别是储蓄和投资的提取和注入必须在循环流中处于平衡状态。 利率和货币政策代写

Thus;

C + S = C + I or S = I

The incentive to either save or invest in the level of interest rates. The GDP is increased when interest rates are lower but at equilibrium. Change in investment expenditure, which means an increase in I will cause more change in Y than the initial change in I. The initial increase in Y, ΔY, will equal ΔI at the beginning. The change in Y itself produces a change in C, which further increases Y. The multiplier effect causes the final increase in income to be more than the initial increase in investment expenditure. Overall, the change in expenditure, regardless of the source, have an impact on income that is more than the initial change in expenditure. It results to increase in the GDP.

译文:因此;

C + S = C + I 或 S = I

在利率水平上储蓄或投资的动机。 当利率较低但处于均衡状态时,GDP 会增加。 投资支出的变化,这意味着 I 的增加将导致 Y 的变化大于 I 的初始变化。 Y 的初始增加 ΔY,在开始时将等于 ΔI。 Y本身的变化导致C的变化,进一步增加了Y。乘数效应导致最终的收入增加超过投资支出的初始增加。 总体而言,支出的变化,无论来源如何,对收入的影响都大于支出的初始变化。 它的结果是增加了 GDP。 利率和货币政策代写

Conclusion

In summation, monetary policy has been proved as the most effective tool in correcting or mitigating economic recession. Covid-19 has continued to lavage on the world economy and, at the same central banks are using monetary policies as an economic stimulus. Interest rate variations are useful to induce investment. When it is low, businesses acquire loans for investment. The multiplier effect from investment increases the income and hence the GDP.

结论 利率和货币政策代写

译文:总之,货币政策已被证明是纠正或缓解经济衰退的最有效工具。 Covid-19 继续影响世界经济,与此同时,各国央行正在使用货币政策作为经济刺激措施。 利率变动有助于吸引投资。 当它很低时,企业会获得贷款进行投资。 投资的乘数效应增加了收入,从而增加了 GDP。

References

Greenlaw, S. A., Shapiro, D., & Taylor, T. (2018). Principles of Economics-2e: OpenStax.

Jamrisko, M. (2020). Singapore’s Central Bank Takes Unprecedented Easing Action. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2020-03-30/singapore-s-central-bank-eases-monetary-policy-on-virus-threat

Mishkin, F. S. (2007). Monetary policy strategy. Mit press.

Reynolds, B., Donegan, T., & Barrowman, C. (2020). COVID-19: Bank of England Announces Policy Measures for Financial Market Participants. Shearman. Retrieved from https://www.shearman.com/perspectives/2020/03/covid-19–bank-of-england-announces-policy-measures-for-financial-market-participants

Rugaber, C. (2020). Federal Reserve Cuts Interest Rate to Near Zero in Response to COVID-19 Outbreak. Retrieved from https://time.com/5803563/federal-reserve-interest-rate-cut-zero/

Robert, F., & Bernanke, B. (2001). Principles of economics.

Samuelson, P. A., & Nordhaus, W. D. (2009). Economics. 19th International Edition.

World Economic Forum. (2020). 5 charts that show the global economic impact of coronavirus. WEF. Retrieved from https://www.weforum.org/agenda/2020/03/take-five-quarter-life-crisis/