Q1

Regression results代写 The two to four period lagged consumption growth rates also have predictive power for the consumption growth rate.

a) Regression results代写

In Stata

b)

| Variable | Obs | Mean | Std. Dev. | Min | Max | Median |

| GDP | 243 | 0.005223 | 0.009801 | -0.03121 | 0.036052 | 0.005151 |

| ND | 243 | 0.007964 | 0.00519 | -0.00934 | 0.024995 | 0.008044 |

| DJ | 243 | 0.009407 | 0.057764 | -0.24608 | 0.161582 | 0.011949 |

c) Regression results代写

| GDP | ND | DJ | |

| GDP | 1 | ||

| ND | 0.4438 | 1 | |

| DJ | 0.1933 | 0.2677 | 1 |

d)

| GDP | ND | DJ | |

| LAG | AC | AC | AC |

| 1 | 0.3368 | 0.1931 | 0.3227 |

| 2 | 0.1792 | 0.1645 | 0.0569 |

| 3 | -0.0299 | 0.1406 | 0.0189 |

| 4 | -0.1119 | -0.0014 | 0.0083 |

| 5 | -0.1704 | -0.0388 | -0.0373 |

| 6 | -0.0937 | -0.0052 | -0.0731 |

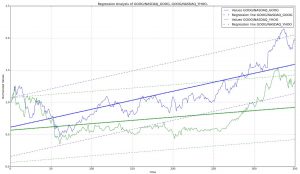

e)

Q2 Regression results代写

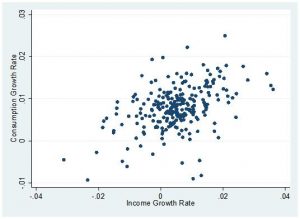

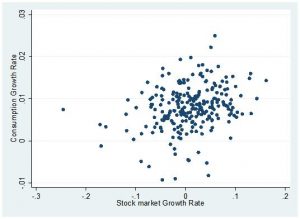

The regression results are as follows. We can see that the one period lagged income and wealth (stock market index) growth rate have predictive power for the consumption growth rate. The two to four period lagged consumption growth rates also have predictive power for the consumption growth rate. The one to four period lagged income growth rate do not have significant predict power for the consumption growth rate (the p-value is at the margin of 5% significant level). The one to four period lagged wealth growth rate have predictive power for the consumption growth rate. According to Hall (1978), the pure life cycle-permanent income hypothesis claims that Ct cannot be predicted by any variable dated t-1 or earlier other than Ct-1. The empirical result does not support the hypothesis.

| (1) | (2) | (3) | (4) | |

| Consumption Growth Rate | Consumption Growth Rate | Consumption Growth Rate | Consumption Growth Rate | |

| b/se | b/se | b/se | b/se | |

| L.Income Growth Rate | 0.1059*** | 0.1001*** | ||

| (0.0363) | (0.0385) | |||

| L2.Income Growth Rate | 0.0360 | |||

| (0.0366) | ||||

| L3.Income Growth Rate | -0.0326 | |||

| (0.0364) | ||||

| L4.Income Growth Rate | 0.0036 | |||

| (0.0348) | ||||

| L.Stock market Growth Rate | 0.0143** | 0.0167*** | ||

| (0.0057) | (0.0059) | |||

| L2.Stock market Growth Rate | -0.0042 | |||

| (0.0062) | ||||

| L3.Stock market Growth Rate | 0.0146** | |||

| (0.0061) | ||||

| L4.Stock market Growth Rate | -0.0005 | |||

| (0.0058) | ||||

| L.Consumption Growth Rate | 0.0626 | 0.1510** | 0.0900 | 0.1312* |

| (0.0700) | (0.0653) | (0.0720) | (0.0668) | |

| L2.Consumption Growth Rate | 0.1486** | |||

| (0.0642) | ||||

| L3.Consumption Growth Rate | 0.1016 | |||

| (0.0644) | ||||

| L4.Consumption Growth Rate | -0.0653 | |||

| (0.0634) | ||||

| Constant | 0.0067*** | 0.0053*** | 0.0067*** | 0.0067*** |

| (0.0006) | (0.0009) | (0.0006) | (0.0006) | |

| Joint Test P-value for coefficients other than Ct-1 | 0.0004 | 0.0268 | 0.0511 | 0.0080

|

| R-Square | 0.0986 | 0.0728 | 0.0739 | 0.0909 |

| Number of Observation | 242.0000 | 239.0000 | 239.0000 | 239.0000 |

Q3 Regression results代写

a)

The regressions of GDP growth on lagged values of GDP growth, lagged values of consumption growth and lagged stock market growth are as follows (four periods lags are used)

| (1) | (2) | (3) | |

| Income Growth Rate | Income Growth Rate | Income Growth Rate | |

| b/se | b/se | b/se | |

| L.Income Growth Rate | 0.3066*** | ||

| (0.0651) | |||

| L2.Income Growth Rate | 0.1321* | ||

| (0.0677) | |||

| L3.Income Growth Rate | -0.0952 | ||

| (0.0676) | |||

| L4.Income Growth Rate | -0.0943 | ||

| (0.0648) | |||

| L.Consumption Growth Rate | 0.7896*** | ||

| (0.1167) | |||

| L2.Consumption Growth Rate | 0.3298*** | ||

| (0.1146) | |||

| L3.Consumption Growth Rate | -0.1074 | ||

| (0.1150) | |||

| L4.Consumption Growth Rate | -0.0646 | ||

| (0.1132) | |||

| L.Stock market Growth Rate | 0.0508*** | ||

| (0.0108) | |||

| L2.Stock market Growth Rate | 0.0252** | ||

| (0.0114) | |||

| L3.Stock market Growth Rate | 0.0072 | ||

| (0.0114) | |||

| L4.Stock market Growth Rate | 0.0102 | ||

| (0.0107) | |||

| Constant | 0.0039*** | -0.0024 | 0.0044*** |

| (0.0008) | (0.0015) | (0.0006) | |

| R-Square | 0.1413 | 0.2094 | 0.1561 |

| Number of Observation | 239.0000 | 239.0000 | 239.0000 |

We can see that both the three groups of lagged variables have predictive power for GDP growth. I use choose the one to four lagged stock market growth rate as Xt-1 to forecast income growth. In this way, all the three variables (consumption, income, wealth) can be used in this question: lagged wealth variables used as IV, consumption and fitted income variables are used in the regression.

b) Regression results代写

The regression results are as follows

| (1) | (2) | |

| Consumption Growth Rate | Income Growth Rate | |

| b/se | b/se | |

| L.Stock market Growth Rate | 0.0193*** | 0.0508*** |

| (0.0058) | (0.0108) | |

| L2.Stock market Growth Rate | -0.0025 | 0.0252** |

| (0.0062) | (0.0114) | |

| L3.Stock market Growth Rate | 0.0144** | 0.0072 |

| (0.0061) | (0.0114) | |

| L4.Stock market Growth Rate | 0.0014 | 0.0102 |

| (0.0058) | (0.0107) | |

| Constant | 0.0077*** | 0.0044*** |

| (0.0003) | (0.0006) | |

| R-Square | 0.0759 | 0.1561 |

| Number of Observation | 239.0000 | 239.0000 |

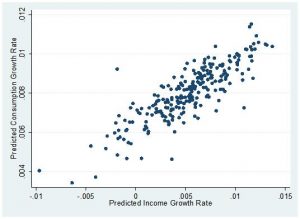

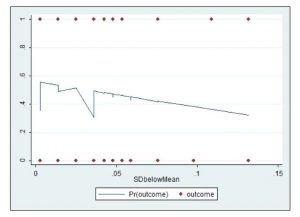

The scatter plot of the fitted values from the above regressions is as follows

We can see that compared with Q1 e), the points are more concentrated for the fitted values. And the scatter plot of fitted points is more like a line with positive slope. If equation (1) is true,

![]()

so ![]()

Therefore, we should have .

From the scatter plot, we can see that the income growth rate and consumption growth rate are positively correlated, this provides a preliminary support for equation (1).

c) Regression results代写

The regression result is as follows

| (1) | |

| Consumption Growth Rate | |

| b/se | |

| Income Growth Rate | 0.7333*** |

| (0.2293) | |

| Constant | 0.0041*** |

| (0.0013) | |

| Number of Observation | 243.0000 |

We can see that the coefficient on Income Growth Rate is 0.7333. The coefficient is highly significant (p value is below 1% level). The value of is between 0 and 1, which tends to be consistent with the model’s setting. The result suggests that 73.33% of consumers simply consume their current income.

更多其他: Assignment代写 Report代写 网课代修 代写CS数据分析代写 润色修改 代写案例 Assignment代写

您必须登录才能发表评论。