Application of Theory and Concepts

Name

Institution

Application of Theory and Concepts

Macroeconomic Issues in News Article

Macroeconomic代写 Brexit And Debt Threaten Strong Economy, Warns Moody’s.Credit rating agency rates the Republic a safe bet for lenders.

Brexit And Debt Threaten Strong Economy, Warns Moody’s

Credit rating agency rates the Republic a safe bet for lenders

Tue, Aug 6, 2019, 15:01

Barry O’Halloran

Brexit risk: trucks wait to be loaded onto a ferry at Dublin Port. Photograph: Artur Widak / Getty Images.

Part A:

Brexit and the Republic’s €200 billion-plus national debt threaten the strong economy, rating agency Moody’s warned on Tuesday.

Moody’s, which assesses businesses’ and countries’ creditworthiness, ranks the Republic as A2 stable in its latest analysis, indicating there is a low risk of the State defaulting on its debts.

Sarah Carlson, Moody’s senior vice president, and lead sovereign analyst for the Republic, attributes this to robust economic growth and prudent policies, in her latest opinion on the State’s finances. Macroeconomic代写**范文

Nevertheless, she warns that the Republic’s susceptibility to falling out from the UK’s planned exit from the EU next October, and high public and private debt, threaten the economy and pose a risk to the State’s good credit rating.

Ms. Carlson also highlights high wage and credit growth along with possible global corporate tax changes, as potential threats.

“Our credit view of Ireland balances the strong growth and fiscal track record of the past few years and our expectation that the positive trends will continue,” she says.

Challenges Macroeconomic代写

“However, challenges remain in the form of still elevated high public debt levels and a relatively high degree of economic volatility.”

Fears of a no-deal Brexit are growing as Britain’s Conservative Party government and Prime Minister Boris Johnson want the EU to ditch a backstop meant to keep open the border between the Republic and Northern Ireland, before agreeing on exit terms. Macroeconomic代写**范文

Part B:

The Irish Central Bank recently predicted that a hard Brexit could cut the number of new jobs created in the Republic by 34,000 and slow economic growth to 0.7 percent from 4.1 percent next year.

Ms. Carlson says that 11 percent of exports went to the UK last year while the two countries share deeply integrated supply chains.

She predicts that a switch from the EU single market to World Trade Organisation rules, likely to include tariffs, in a no-deal Brexit “would have a highly negative impact on the Irish economy.”

Part C:

Brexit poses problems for State finances, as the Government has to consider two directions for October’s budget depending on whether the UK crashes out of the EU or leaves the bloc with a deal. Macroeconomic代写**范文

Ms. Carlson indicates that spending on homes and infrastructure could slow the rate at which the Government repays the national debt, which is partly a hangover from the financial crisis that struck a decade ago.

Bad loans Macroeconomic代写

The Republic’s national debt is €215 billion while the Government expects to spend €2.4 billion more than it collects in revenues this year as it boosts investment in infrastructure.

The analyst argues that tackling other crisis-era leftovers, such as the high number of bad loans on Irish banks’ books, would help improve the Republic’s credit rating.

Ms. Carlson highlights changes in global tax rules as another risk as the Republic’s low 12.5 percent tax on company profits has helped lure job-creating multi-national investors to its territory. Macroeconomic代写**范文

High credit ratings from agency’s such as Moody’s should make lenders more willing to loan money to the State and its agencies while helping to keep down the interest charged on these debts.

Ms. Carlson’s opinion was not a “rating action,” which is where Moody’s changes or re-affirms its assessment of a country’s creditworthiness based on recent events.

News Article Citation Macroeconomic代写

O’Halloran, B. (2019, August 6). Brexit and debt threaten the strong economy, warns Moody’s. The Irish Times. Retrieved from https://www.irishtimes.com/business/economy/brexit-and-debt-threaten-strong-economy-warns-moody-s-1.3978574

Key Points in the Article

The UK and Ireland joined the EU in 1973. The membership of two countries in EU determines their current economic and political. The decision by the UK to leave the EU raises questions on how the decision will affect Ireland economically. Owing to the extensive economic integration between Ireland and the UK, it is fundamentally important to look into the future trading relationships between the two economies.

Difficulties and Dilemma Macroeconomic代写

The Irish government is faced by difficulties and dilemma since the economy is highly integrated with the UK. It is so because; more than 80 percent of exports Ireland are transported through the UK. Also, the UK provides 41 percent and 55 percent food imports and fuel respectively to Ireland. A report by the Irish Ministry of Finance shows that Brexit has a significant adverse effect on the Irish economy. Therefore, it is critically important for the Republic to have close trade relationships with the UK and the EU before and after Brexit.

Consequences Macroeconomic代写

Therefore, according to O’Halloran, Brexit threatens the Republic’s debts, which will have dare consequences to the economy. He observed that, although the country is doing well in terms of businesses and creditworthiness, the UK exit from the EU is a threat to the economy and overall credit rating. As such, the country is likely to be faced with increased wages, high debts, and unstable corporate taxation. Brexit has a spiraling impact on the economic performance in terms of slow GDP growth, reduction in employment, high government spending, bad debts, and non-competitive export market.

Analysis of the Article Macroeconomic代写

Part A

O’Halloran reports Brexit as a threat to increase in national debt and as a result, will likely cause an economic downturn. Macroeconomic代写**范文

He cites that the country has a good credit rating with the current economic operations. Currently, businesses and the economy are performing well, and hence, the Republic is ranked as a growing and stable country. According to Moody, there is a correlation between economic performance and national debt. Public and private debts are the main macroeconomic indicators and carry the country’s image in the global market. A analysis model is required to determine the relationship between national debt and economic growth.

Therefore, a change in any element of the model has an impact on the change in the economy. Macroeconomic代写

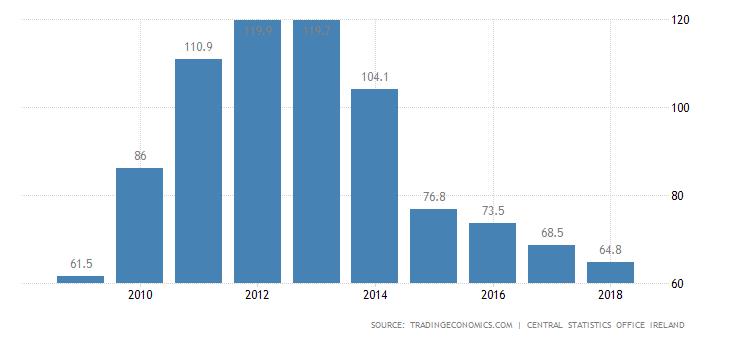

When the national debts are high, interest rates will increase due to the lower credit rating of the country. Also, the ratio of debts to the GDP stands at 71.62 percent, and hence, any increase will result in the government, resulting in fiscal and monetary policies such as offering bonds. The UK exit will also lead to a drop in economic growth to 0.7 percent. The debt to GDP is low as shown by the graph below before brexit. However, Brexit is likely to cause a dramatic increase national debt due to changes in tariffs. And increase in government expenditure in infrastructure.

(Source: https://tradingeconomics.com/ireland/government-debt-to-gdp)

Part B Macroeconomic代写

Brexit is also predicted to result in loss of employment. The article reports that job creation will be reduced by 34,000.

Although, there has been an increase in professional opportunities in Ireland since the announcement of Brexit. The rates at which they are created fall short on the rate they are supposed to be created. Jobs such as asset management, compliance, risk management, and financial control have been affected by the UK move. On the other hand, multinational companies from the UK are moving to Ireland because the country offers a better corporate tax of 12.5 percent compared to 19.71 percent in the EU. Macroeconomic代写**范文

As a result, there will be a high demand for labor, but at a decreasing rate. The reason being, at the time of migration of companies and labor, the economy will be underperforming. Notably, if there will be disorderly no deal, the Republic will lose more than 80,000 jobs.

There is a direct relationship between the employment rate and economic growth. Macroeconomic代写

Slow economic growth as a result of high debts and an increase in the balance of payment due to the high cost of export will have a ripple effect on employment. Therefore, a 0.7 percent decrease in economic growth may have double or more on the level of unemployment. Additionally, the article also predicts that the export market will be affected by changes in tariffs. Ireland is the dependent UK as a market and the way to the global market. Macroeconomic代写**范文

Exit from the EU treaties which has kept the ties together and as a result created strong trade integrations will provide previous privileges as well as trade policies between Ireland and the UK. Consequently, there may be a reduced export market or lower competitiveness, which is a blow to the local industries. This will trickle down to downsizing and hence affect the level of employment.

Part C Macroeconomic代写

Furthermore, Brexit is likely to cause bad debts to the economy of Ireland. The national debt stands at €215 billion. The debt is expected to grow as the government plan to spend on infrastructures beyond its revenue collection. The bad debts will tarnish already good rating of the country. Macroeconomic代写**范文

Increase in the national debt will be as a result of the need for investment in infrastructure at home due to changes in import and export EU and the UK market. When the UK exit, trade integrations will weaken and hence necessitating Ireland to spend more to increase or maintain economic growth. Home investments will also target to support local industries which have been dependent on the international market.

Generally Macroeconomic代写

National debt, expenditure, and economic productivity, as well as the balance of trade, are well analyzed using the economic model below:

GDP = C+I+G+(X-M)

Where: C is the consumption

I is the gross investment

G is the government expenditure

X-M is export fewer imports

Brexit will cause Ireland to spend more, invest less, import more, and hence reduce gross domestic product. The government will continue to borrow to invest in public services like transport. The global market for local products will decrease due to lower competitiveness. The balance of trade will be likely to increase due to the imbalance of imports and exports. Macroeconomic代写**范文

更多其他:论文代写 Essay代写 研究论文代写 Academic代写 Review代写 文学论文代写 数据分析代写 商科论文代写 Case study代写 Resume代写 Report代写 Proposal代写 Capstone Projects

您必须登录才能发表评论。