BAO3403

Investment and Portfolio Management代写 Investment and Portfolio ManagementAssignmentGroup Member: 4510407 Song Xi4510444 Shi Xiaonan 4510478 Bai Bihan4510480

Investment and Portfolio Management

Assignment

Group Member:

4510407 Song Xi

4510444 Shi Xiaonan

4510478 Bai Bihan

4510480 Wang Shenglin

Data source:CTD, HUB, MYX, GXL, FXL, JHX Investment and Portfolio Management代写

1. 1.1 Price Weighted Index

Price Weighted Index=

1.2Equally Weighted Index

We assumed 28-Feb-12-5-Mar-12 as the base week which index value is 100.

Equally Weighted Index= Beginning Index Value x (1+ )

1.3Value Weighted Index

Assign the beginning index value (100)

2.Graph 1: Price Weighted Index

According to the graph above, an obvious increasing trend can be seen in price weighted index in spite of some fluctuation. The indices reflect the changes of the average price of the six stocks, which goes up gradually.

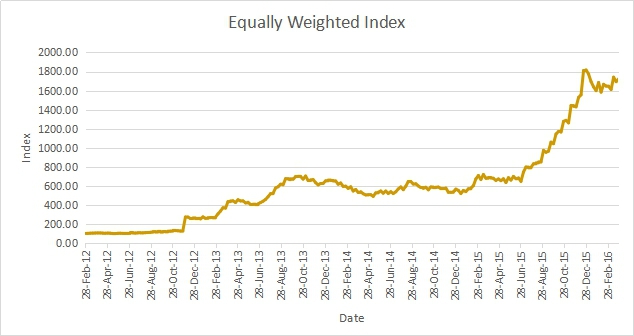

Graph 2: Equally Weighted Index

From the graph we can see that the equally weighted index which means the stocks carry equal weight regardless of price or market value sharply went up to 1800. The percentage price changes are mostly positive, so the general trend of the stock price is increasing in the past four years.

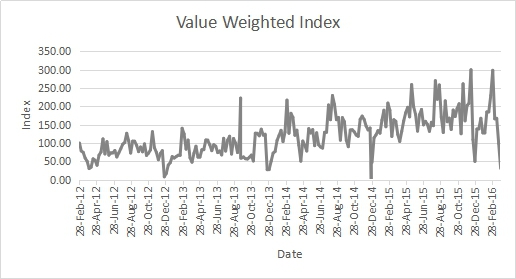

Graph 3: Value Weighted Index Investment and Portfolio Management代写

Graph 3 shows the value weighted index which takes both price and number of shares outstanding into consideration. The general trend of the index fluctuated dramatically,which is much different from the first two. It may indicates that the number of shares outstanding of these six stocks isn’t similar.

3.We assume the holding period as every week and we have 100 shares for each stock.

The results are shown in table 4.

![]()

Calculate the Annual HPR:

Step 1: The summed up HPR is going to be divided by 6, and table 5 shows the results (HPR1).

Step 2: ![]() , results showed in the table 6.Investment and Portfolio Management代写

, results showed in the table 6.Investment and Portfolio Management代写

Table 5:HPR1

| CTD | HUB | MYX | GXL | FXL | JHX | |

| 2012 | 0.012791 | -0.00643 | 0.013477 | 0.015852 | 0.013561 | 0.005343 |

| 2013 | 0.009585 | 0.026264 | 0.015327 | 0.018002 | 0.002954 | 0.006839 |

| 2014 | 0.011973 | -0.00341 | -0.00035 | -0.00011 | -0.00582 | 0.001018 |

| 2015 | 0.006938 | 0.032625 | 0.01729 | -0.00031 | 0.001819 | 0.005949 |

Table 6.the Annual HPR Investment and Portfolio Management代写

| MNE | MYX | ANZ | APA | BIG | AZJ | |

| 2012 | 0.7717 | -0.2519 | 0.8265 | 1.0294 | 0.8333 | 0.271 |

| 2013 | 0.632 | 2.9512 | 1.2362 | 1.5744 | 0.1692 | 0.4351 |

| 2014 | 0.8791 | -0.1656 | -0.0184 | 0.0058 | -0.2661 | 0.0554 |

| 2015 | 0.4327 | 4.309 | 1.4385 | -0.016 | 0.0991 | 0.3613 |

4.Mean Share Returns

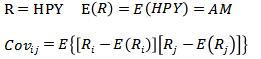

(a)Arithmetic Mean Return (AM)

![]()

Table 7. Arithmetic Mean Return (AM)

| MNE | MYX | ANZ | APA | BIG | AZJ | |

| AM |

(b)Geometric Mean Return (GM)

Table 8. Geometric Mean Return (GM)

| MNE | MYX | ANZ | APA | BIG | AZJ | |

| GM | 0.67034 | 0.90226 | 0.76826 | 0.50795 | 0.14670 | 0.27233 |

Standard Deviation of Share Returns Investment and Portfolio Management代写

Step 1: Computing the expected value of the HPR. (Equal to AM)

Step 2: Computing the variance of the series.

Step 3: Calculating SD which is the square root of the variance.

Table 9. Standard Deviation of Share Returns (SD)

| CTD | HUB | MYX | GXL | FXL | JHX | |

| SD | 0.037169 | 5.220768 | 0.416147 | 0.619000 | 0.209711 | 0.027063 |

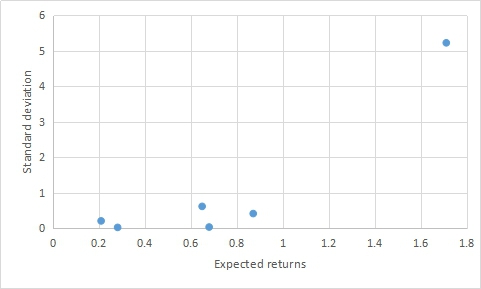

4.1Interpret the results and plotthem on a graph in Expected returns‐Standard deviation space

From the graph we can get that there is no evidence relationship with the standard deviation and expected returns. Most of the six companies’ share return are below 1 except the HUB with a extra high return of 1.710675. Also, five standard deviation scatter approximately at 0.2-0.6 while the HUB has a distinctive SD of 5.22. It indicate that most shares’ price have a smooth growth all the time and the HUB’s price rise sharply in some years.

5.

5.1Standard Deviation of Share Returns

Table 9 Standard Deviation of Share Returns (SD)

| CTD | HUB | MYX | GXL | FXL | JHX | |

| SD | 0.037169 | 5.220768 | 0.416147 | 0.619000 | 0.209711 | 0.027063 |

5.2Coefficient of variation for each company

![]()

Table 10 Coefficient of variation

| CTD | HUB | MYX | GXL | FXL | JHX | |

| CV | 0.054751 | 3.051876 | 0.477945 | 0.954658 | 1.004002 | 0.096413 |

6.Volatility describes the degree of how a value changes over a specified time period.Investment and Portfolio Management代写

Thevolatility of share returns can be measured by standard derivation and coefficient of variation.

High volatility means that the value changes dramatically, which usually due to high market uncertainty. In addition, the high volatility presents many opportunities to earn a profit. According to the standard derivation, HUB is far higher than other 5 companies apparently, which means the volatility is high and the prices change dramatically. Following are GXL, MYX, FXL whose volatility is more stable than HUB but more changeable than JHX and CTD.

Low volatility means values change minimally. Investors can gain benefits from low volatility because they are better able to lock in stable returns. JHX’s standard derivation is the lowest above 6 companies, which means the price of JHX is stable in some degree. Familiar with JHX, the volatility of CTD is stable that value change minimally.

7.Step 1: Computing covariance (COV) between share returns.

Step 2: Based on the results of SD and COV, compute correlation coefficients between share returns.

![]()

Table 11 Covariance Investment and Portfolio Management代写

| CTD | HUB | MYX | GXL | FXL | JHX | |

| CTD | 0.027876 | |||||

| HUB | -0.31391 | 3.915576 | ||||

| MYX | -0.08476 | 0.920921 | 0.31211 | |||

| GXL | 0.006714 | -0.02991 | 0.128926 | 0.46425 | ||

| FXL | -0.00206 | -0.16719 | 0.079467 | 0.14483 | 0.157283 | |

| JHX | -0.01827 | 0.210681 | 0.075735 | 0.057626 | 0.021495 | 0.020297 |

Table 12 Correlation coefficients

| CTD | HUB | MYX | GXL | FXL | JHX | |

| CTD

HUB |

1

-0.95015 |

1 |

||||

| MYX | -0.90868 | 0.833049 | 1 | |||

| GXL | 0.059014 | -0.02219 | 0.338695 | 1 | ||

| FXL | -0.03117 | -0.21304 | 0.358669 | 0.535972 | 1 | |

| JHX | -0.76817 | 0.74732 | 0.951531 | 0.593643 | 0.380436 | 1 |

The correlation coefficient shows the extent of correlation among shares. It has a numerical value of –1 to +1 which indicates the risk reduction between shares. Negative correlation (–1) refers to large risk reduction, while positive correlation (+1) means no risk reduction.

The correlation coefficients between shares CTD and HUB, CTD and MYH, CTD and FXL, CTD and JHK, HUB and GXL as well as HUB and FXY are negative, so it will be able to make a higher return at reduced risk.Investment and Portfolio Management代写

8.Coefficient of variation and correlation of coefficient are two determined factor to choose Investment and Portfolio Management代写

portfolio. A small CV means the share can gain higher returns while having lower risk and vice versa. A smaller correlation of coefficient indicates more diversification benefits from two-security portfolio. When choosing optimal portfolio, small coefficient of variations are preferred. Also, the coefficient correlations between every two shares of three chosen ones are supposed to be small ones and present both negative and positive results. According to these two principles, a reasonable portfolio is chosen, which are CTD, FXL and JHX.

Table 13 Coefficient correlation

| CTD | FXL | JHX | |

| CTD | 1 | -0.03117 | -0.76817 |

| FXL | -0.03117 | 1 | 0.380436 |

| JHX | -0.76817 | 0.380436 | 1 |

Table 14 CV

| CTD | FXL | JHX | |

| CV | 0.054751 | 1.004002 | 0.096413 |

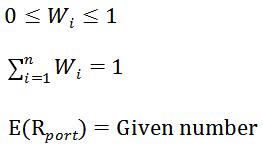

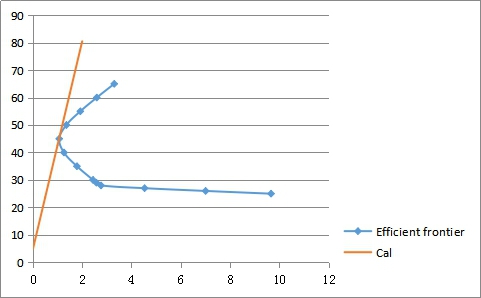

9.Step 1 Efficient frontier

Efficient frontier is the best diversified set of investments with the highest returns, and it is found by forming portfolios of securities with the lowest covariance at a given E(r) level. In this case, Excel Solver is used to graph efficient frontier of chosen portfolio.

Constraint conditions:

Objective: Minimize

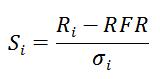

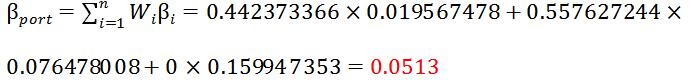

Step 2 Compute weights of optimal portfolio

Excel Solver is also used to determine weights.

Constraint conditions:

Objective: Maximize Sharp Ratio

(Assuming RFR=4.75%)

Table 15 Figures of efficient frontier

| Mean | CTD | FXL | JHX | SD |

| 25 | 0 | 0.427428 | 0.572572 | 9.660021 |

| 26 | 0 | 0.2882 | 0.7118 | 7.006984 |

| 27 | 0 | 0.148973 | 0.851027 | 4.532033 |

| 28 | 0 | 0.009746 | 0.990254 | 2.764149 |

| 29 | 0.02336 | 0 | 0.976645 | 2.576997 |

| 30 | 0.04847 | 0 | 0.951529 | 2.439455 |

| 35 | 0.17404 | 0 | 0.825956 | 1.787008 |

| 40 | 0.29962 | 0 | 0.700383 | 1.260918 |

| 45 | 0.42519 | 0 | 0.57481 | 1.067935 |

| 50 | 0.55076 | 0 | 0.449237 | 1.35835 |

| 55 | 0.67634 | 0 | 0.323664 | 1.924526 |

| 60 | 0.80191 | 0 | 0.198091 | 2.591629 |

| 65 | 0.92748 | 0 | 0.072518 | 3.298991 |

Graph 1 CAL & Optimal portfolio

When CAL dominated the EF, sharp ratio is maximized. The tangency point presents the portfolio, and proportion of three shares.

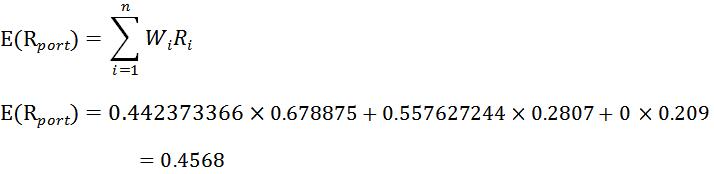

Table 16 Weights

| CTD | FXL | JHX | |

| Weights | 0.44237 | 0 | 0.557627 |

Table 17 Tangency point

| E(r) | Sharp Ratio | SD |

| 45.68422 | 37.8639 | 1.081088 |

9.1 Financial Investmentreturn

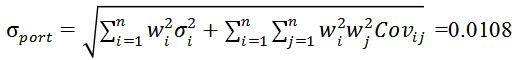

9.2 Standard Deviation

10.![]()

Based on Table10, CV of CTD and JHX is 0.054751 and 0.096413 respectively. Investment and Portfolio Management代写

However, the CV of portfolio is 0.02366 which is less than the coefficients of variation of CTD and JHX. Thus, this portfolio can be considered as a successful one because it reduces the risk of the investment.

11.

Table 18 HPR annual for the market portfolio

|

12.

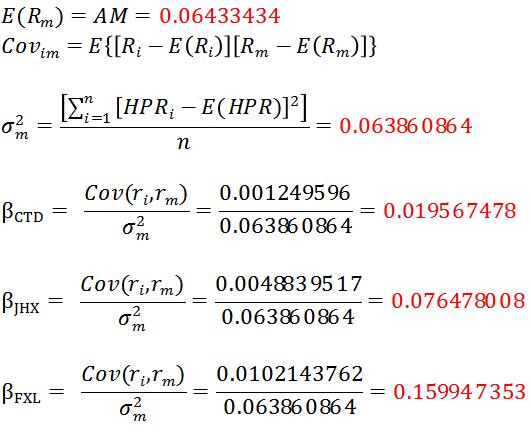

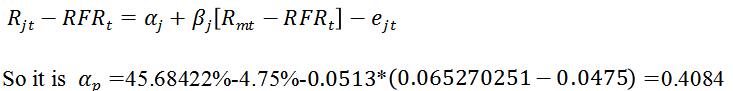

13.According to CAPM model

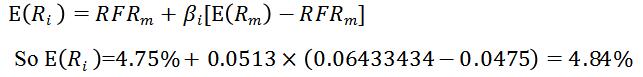

14.(1)Sharpe Portfolio Performance Measure

It shows the risk premium which earned over the risk free rate per unit of standard deviation is 37.8639

(2) Treynor Portfolio Performance Measure=

So Treynor Ratio=![]()

It shows the returns earned in excess of that which could have been earned on an investment that has no diversifiable risk per unit of market risk assumed.

(3)Jensen Portfolio Performance Measure

It shows that the average excess return of the portfolio above the predicted by CAPM is 0.4084

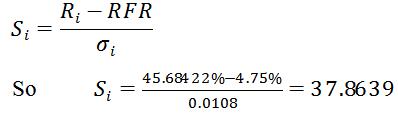

15. VaR=E(r)

So VAR=45.68%-1.64486* 0.0108=0.439

VAR=100,000*0.439=$43900

APPENDIX-I Investment and Portfolio Management代写

Table 1: Price Weighted Index

Week |

Index | Week | Index | Week | Index |

| 28-Feb-12 | 2.29 | 15-Jul-13 | 4.19 | 1-Dec-14 | 5.86 |

| 5-Mar-12 | 2.32 | 22-Jul-13 | 4.17 | 8-Dec-14 | 5.58 |

| 12-Mar-12 | 2.38 | 29-Jul-13 | 4.27 | 15-Dec-14 | 5.74 |

| 19-Mar-12 | 2.39 | 5-Aug-13 | 4.15 | 22-Dec-14 | 5.82 |

| 26-Mar-12 | 2.41 | 12-Aug-13 | 4.30 | 26-Dec-14 | 5.82 |

| 2-Apr-12 | 2.40 | 19-Aug-13 | 4.26 | 29-Dec-14 | 5.96 |

| 9-Apr-12 | 2.41 | 26-Aug-13 | 4.30 | 5-Jan-15 | 6.00 |

| 16-Apr-12 | 2.33 | 2-Sep-13 | 4.31 | 12-Jan-15 | 5.68 |

| 23-Apr-12 | 2.32 | 9-Sep-13 | 4.44 | 19-Jan-15 | 5.92 |

| 30-Apr-12 | 2.32 | 16-Sep-13 | 4.60 | 26-Jan-15 | 6.01 |

| 7-May-12 | 2.31 | 20-Sep-13 | 4.60 | 2-Feb-15 | 6.23 |

14-May-12 |

2.21 | 23-Sep-13 | 4.64 | 9-Feb-15 | 6.46 |

| 21-May-12 | 2.32 | 30-Sep-13 | 4.65 | 16-Feb-15 | 6.63 |

| 28-May-12 | 2.32 | 7-Oct-13 | 4.73 | 23-Feb-15 | 7.17 |

| 4-Jun-12 | 2.37 | 14-Oct-13 | 4.87 | 2-Mar-15 | 6.99 |

| 11-Jun-12 | 2.41 | 21-Oct-13 | 4.85 | 9-Mar-15 | 6.91 |

| 15-Jun-12 | 2.41 | 28-Oct-13 | 4.89 | 16-Mar-15 | 7.03 |

| 18-Jun-12 | 2.41 | 4-Nov-13 | 4.87 | 23-Mar-15 | 6.84 |

| 25-Jun-12 | 2.49 | 11-Nov-13 | 4.94 | 30-Mar-15 | 6.79 |

| 2-Jul-12 | 2.53 | 18-Nov-13 | 5.24 | 6-Apr-15 | 6.78 |

9-Jul-12 |

2.53 | 25-Nov-13 | 5.31 | 13-Apr-15 | 6.58 |

| 16-Jul-12 | 2.61 | 2-Dec-13 | 5.15 | 20-Apr-15 | 6.54 |

| 23-Jul-12 | 2.66 | 9-Dec-13 | 5.10 | 27-Apr-15 | 6.25 |

| 30-Jul-12 | 2.67 | 16-Dec-13 | 5.28 | 4-May-15 | 6.28 |

| 6-Aug-12 | 2.67 | 23-Dec-13 | 5.43 | 11-May-15 | 6.68 |

| 13-Aug-12 | 2.72 | 30-Dec-13 | 5.48 | 18-May-15 | 6.91 |

| 20-Aug-12 | 2.81 | 6-Jan-14 | 5.50 | 25-May-15 | 7.06 |

| 27-Aug-12 | 2.86 | 13-Jan-14 | 5.50 | 1-Jun-15 | 6.65 |

| 3-Sep-12 | 2.90 | 20-Jan-14 | 5.47 | 8-Jun-15 | 6.65 |

| 10-Sep-12 | 2.96 | 27-Jan-14 | 5.43 | 15-Jun-15 | 6.78 |

| 17-Sep-12 | 2.95 | 3-Feb-14 | 5.51 | 22-Jun-15 | 6.60 |

| 24-Sep-12 | 2.95 | 10-Feb-14 | 5.43 | 29-Jun-15 | 6.57 |

| 1-Oct-12 | 3.09 | 17-Feb-14 | 5.58 | 6-Jul-15 | 6.49 |

| 8-Oct-12 | 3.07 | 24-Feb-14 | 5.61 | 13-Jul-15 | 6.84 |

15-Oct-12 |

3.20 | 3-Mar-14 | 5.79 | 20-Jul-15 | 6.73 |

| 22-Oct-12 | 3.21 | 10-Mar-14 | 5.64 | 27-Jul-15 | 6.91 |

| 29-Oct-12 | 3.27 | 17-Mar-14 | 5.58 | 3-Aug-15 | 6.75 |

| 5-Nov-12 | 3.32 | 24-Mar-14 | 5.66 | 10-Aug-15 | 6.82 |

| 12-Nov-12 | 3.17 | 31-Mar-14 | 5.61 | 17-Aug-15 | 6.74 |

| 19-Nov-12 | 3.17 | 7-Apr-14 | 5.55 | 24-Aug-15 | 6.72 |

| 26-Nov-12 | 3.29 | 14-Apr-14 | 5.51 | 31-Aug-15 | 6.53 |

| 3-Dec-12 | 3.40 | 21-Apr-14 | 5.50 | 7-Sep-15 | 6.71 |

| 10-Dec-12 | 3.38 | 28-Apr-14 | 5.55 | 14-Sep-15 | 6.67 |

| 17-Dec-12 | 3.36 | 5-May-14 | 5.40 | 21-Sep-15 | 6.49 |

| 24-Dec-12 | 3.38 | 12-May-14 | 5.49 | 28-Sep-15 | 6.59 |

| 31-Dec-12 | 3.47 | 19-May-14 | 5.52 | 5-Oct-15 | 6.81 |

| 7-Jan-13 | 3.46 | 26-May-14 | 5.81 | 12-Oct-15 | 6.83 |

14-Jan-13 |

3.51 | 2-Jun-14 | 5.79 | 19-Oct-15 | 6.99 |

| 21-Jan-13 | 3.59 | 9-Jun-14 | 5.63 | 26-Oct-15 | 7.15 |

| 28-Jan-13 | 3.73 | 16-Jun-14 | 5.75 | 2-Nov-15 | 7.18 |

| 4-Feb-13 | 3.66 | 23-Jun-14 | 5.77 | 9-Nov-15 | 6.84 |

| 11-Feb-13 | 3.71 | 30-Jun-14 | 5.85 | 16-Nov-15 | 7.01 |

| 18-Feb-13 | 3.69 | 7-Jul-14 | 5.76 | 23-Nov-15 | 6.87 |

| 25-Feb-13 | 3.76 | 14-Jul-14 | 5.81 | 30-Nov-15 | 6.65 |

| 4-Mar-13 | 3.90 | 21-Jul-14 | 5.86 | 7-Dec-15 | 6.44 |

| 11-Mar-13 | 4.00 | 28-Jul-14 | 5.94 | 14-Dec-15 | 7.25 |

| 18-Mar-13 | 3.91 | 4-Aug-14 | 5.91 | 21-Dec-15 | 7.49 |

| 25-Mar-13 | 4.00 | 11-Aug-14 | 5.93 | 28-Dec-15 | 7.71 |

| 1-Apr-13 | 3.92 | 18-Aug-14 | 6.06 | 4-Jan-16 | 7.27 |

8-Apr-13 |

4.01 | 25-Aug-14 | 6.00 | 11-Jan-16 | 7.06 |

| 15-Apr-13 | 3.87 | 1-Sep-14 | 6.05 | 18-Jan-16 | 7.10 |

| 22-Apr-13 | 4.12 | 8-Sep-14 | 5.98 | 25-Jan-16 | 7.18 |

| 29-Apr-13 | 4.17 | 15-Sep-14 | 5.82 | 1-Feb-16 | 7.05 |

| 6-May-13 | 4.35 | 22-Sep-14 | 5.71 | 8-Feb-16 | 6.79 |

| 13-May-13 | 4.42 | 29-Sep-14 | 5.68 | 15-Feb-16 | 7.25 |

| 20-May-13 | 4.06 | 6-Oct-14 | 5.59 | 22-Feb-16 | 7.46 |

27-May-13 |

4.14 | 13-Oct-14 | 5.59 | 29-Feb-16 | 7.79 |

| 3-Jun-13 | 3.91 | 20-Oct-14 | 5.79 | 7-Mar-16 | 7.72 |

| 10-Jun-13 | 3.91 | 27-Oct-14 | 5.80 | 14-Mar-16 | 7.83 |

| 17-Jun-13 | 3.98 | 3-Nov-14 | 5.86 | 21-Mar-16 | 7.76 |

| 24-Jun-13 | 3.92 | 10-Nov-14 | 5.95 | 28-Mar-16 | 7.80 |

| 1-Jul-13 | 4.10 | 17-Nov-14 | 5.78 | ||

| 8-Jul-13 | 4.25 | 24-Nov-14 | 5.79 | ||

APPENDIX-II Investment and Portfolio Management代写

Table 2: Equally Weighted Index Investment and Portfolio Management代写

| Week | Index | Week | Index | Week | Index |

28-Feb-12 |

100 | 15-Jul-13 | 456.70 | 1-Dec-14 | 577.50 |

| 5-Mar-12 | 101.37 | 22-Jul-13 | 485.22 | 8-Dec-14 | 532.44 |

| 12-Mar-12 | 103.24 | 29-Jul-13 | 517.54 | 15-Dec-14 | 531.68 |

| 19-Mar-12 | 103.42 | 5-Aug-13 | 521.52 | 22-Dec-14 | 538.16 |

| 26-Mar-12 | 105.29 | 12-Aug-13 | 577.16 | 26-Dec-14 | 550.68 |

| 2-Apr-12 | 104.97 | 19-Aug-13 | 589.98 | 29-Dec-14 | 565.02 |

| 9-Apr-12 | 104.97 | 26-Aug-13 | 616.51 | 5-Jan-15 | 551.73 |

| 16-Apr-12 | 101.50 | 2-Sep-13 | 609.87 | 12-Jan-15 | 519.25 |

| 23-Apr-12 | 102.79 | 9-Sep-13 | 674.83 | 19-Jan-15 | 551.17 |

| 30-Apr-12 | 103.72 | 16-Sep-13 | 671.76 | 26-Jan-15 | 539.50 |

| 7-May-12 | 100.16 | 20-Sep-13 | 664.61 | 2-Feb-15 | 568.52 |

| 14-May-12 | 97.90 | 23-Sep-13 | 673.28 | 9-Feb-15 | 576.93 |

21-May-12 |

99.42 | 30-Sep-13 | 667.70 | 16-Feb-15 | 601.28 |

| 28-May-12 | 102.51 | 7-Oct-13 | 697.04 | 23-Feb-15 | 672.66 |

| 4-Jun-12 | 100.93 | 14-Oct-13 | 699.39 | 2-Mar-15 | 707.96 |

| 11-Jun-12 | 100.16 | 21-Oct-13 | 696.70 | 9-Mar-15 | 666.77 |

| 15-Jun-12 | 100.09 | 28-Oct-13 | 670.58 | 16-Mar-15 | 718.33 |

| 18-Jun-12 | 100.37 | 4-Nov-13 | 702.39 | 23-Mar-15 | 679.61 |

| 25-Jun-12 | 100.23 | 11-Nov-13 | 655.41 | 30-Mar-15 | 687.36 |

| 2-Jul-12 | 109.87 | 18-Nov-13 | 663.49 | 6-Apr-15 | 680.65 |

| 9-Jul-12 | 103.52 | 25-Nov-13 | 665.71 | 13-Apr-15 | 676.64 |

| 16-Jul-12 | 104.47 | 2-Dec-13 | 633.10 | 20-Apr-15 | 656.80 |

23-Jul-12 |

107.98 | 9-Dec-13 | 609.97 | 27-Apr-15 | 671.93 |

| 30-Jul-12 | 105.42 | 16-Dec-13 | 624.28 | 4-May-15 | 654.00 |

| 6-Aug-12 | 107.09 | 23-Dec-13 | 626.32 | 11-May-15 | 673.62 |

| 13-Aug-12 | 109.15 | 30-Dec-13 | 652.19 | 18-May-15 | 634.75 |

| 20-Aug-12 | 110.52 | 6-Jan-14 | 660.38 | 25-May-15 | 685.16 |

| 27-Aug-12 | 112.99 | 13-Jan-14 | 656.33 | 1-Jun-15 | 660.24 |

| 3-Sep-12 | 119.17 | 20-Jan-14 | 650.21 | 8-Jun-15 | 698.10 |

| 10-Sep-12 | 114.44 | 27-Jan-14 | 650.82 | 15-Jun-15 | 674.56 |

| 17-Sep-12 | 121.68 | 3-Feb-14 | 617.05 | 22-Jun-15 | 684.61 |

| 24-Sep-12 | 113.84 | 10-Feb-14 | 629.48 | 29-Jun-15 | 646.87 |

1-Oct-12 |

120.06 | 17-Feb-14 | 594.01 | 6-Jul-15 | 744.34 |

| 8-Oct-12 | 116.34 | 24-Feb-14 | 597.57 | 13-Jul-15 | 797.08 |

| 15-Oct-12 | 123.74 | 3-Mar-14 | 572.88 | 20-Jul-15 | 788.60 |

| 22-Oct-12 | 123.84 | 10-Mar-14 | 589.55 | 27-Jul-15 | 793.95 |

| 29-Oct-12 | 131.88 | 17-Mar-14 | 545.43 | 3-Aug-15 | 830.79 |

| 5-Nov-12 | 128.99 | 24-Mar-14 | 561.36 | 10-Aug-15 | 841.16 |

| 12-Nov-12 | 127.10 | 31-Mar-14 | 530.92 | 17-Aug-15 | 851.27 |

| 19-Nov-12 | 123.56 | 7-Apr-14 | 538.82 | 24-Aug-15 | 850.08 |

| 26-Nov-12 | 132.53 | 14-Apr-14 | 516.35 | 31-Aug-15 | 971.97 |

| 3-Dec-12 | 272.26 | 21-Apr-14 | 504.56 | 7-Sep-15 | 952.14 |

10-Dec-12 |

271.34 | 28-Apr-14 | 507.34 | 14-Sep-15 | 963.81 |

| 17-Dec-12 | 256.74 | 5-May-14 | 506.76 | 21-Sep-15 | 1058.29 |

| 24-Dec-12 | 262.85 | 12-May-14 | 489.43 | 28-Sep-15 | 1042.59 |

| 31-Dec-12 | 255.75 | 19-May-14 | 525.78 | 5-Oct-15 | 1143.70 |

| 7-Jan-13 | 258.30 | 26-May-14 | 533.25 | 12-Oct-15 | 1170.66 |

| 14-Jan-13 | 250.84 | 2-Jun-14 | 545.42 | 19-Oct-15 | 1162.59 |

| 21-Jan-13 | 273.43 | 9-Jun-14 | 522.46 | 26-Oct-15 | 1276.45 |

| 28-Jan-13 | 258.60 | 16-Jun-14 | 544.96 | 2-Nov-15 | 1287.59 |

| 4-Feb-13 | 265.58 | 23-Jun-14 | 519.81 | 9-Nov-15 | 1260.75 |

| 11-Feb-13 | 266.78 | 30-Jun-14 | 537.82 | 16-Nov-15 | 1442.87 |

| 18-Feb-13 | 263.52 | 7-Jul-14 | 519.15 | 23-Nov-15 | 1433.74 |

| 25-Feb-13 | 271.48 | 14-Jul-14 | 536.84 | 30-Nov-15 | 1427.12 |

| 4-Mar-13 | 304.91 | 21-Jul-14 | 566.85 | 7-Dec-15 | 1528.06 |

| 11-Mar-13 | 334.59 | 28-Jul-14 | 587.94 | 14-Dec-15 | 1555.18 |

| 18-Mar-13 | 369.22 | 4-Aug-14 | 559.48 | 21-Dec-15 | 1810.33 |

25-Mar-13 |

364.26 | 11-Aug-14 | 595.25 | 28-Dec-15 | 1817.93 |

| 1-Apr-13 | 433.87 | 18-Aug-14 | 644.97 | 4-Jan-16 | 1773.32 |

| 8-Apr-13 | 441.90 | 25-Aug-14 | 645.41 | 11-Jan-16 | 1693.30 |

| 15-Apr-13 | 442.12 | 1-Sep-14 | 618.45 | 18-Jan-16 | 1638.46 |

| 22-Apr-13 | 425.11 | 8-Sep-14 | 622.70 | 25-Jan-16 | 1599.12 |

| 29-Apr-13 | 453.71 | 15-Sep-14 | 598.34 | 1-Feb-16 | 1684.48 |

| 6-May-13 | 441.16 | 22-Sep-14 | 582.04 | 8-Feb-16 | 1583.71 |

13-May-13 |

442.07 | 29-Sep-14 | 572.48 | 15-Feb-16 | 1665.41 |

| 20-May-13 | 420.73 | 6-Oct-14 | 584.70 | 22-Feb-16 | 1647.01 |

27-May-13 |

428.07 | 13-Oct-14 | 558.20 | 29-Feb-16 | 1642.73 |

| 3-Jun-13 | 404.18 | 20-Oct-14 | 587.55 | 7-Mar-16 | 1611.34 |

| 10-Jun-13 | 407.11 | 27-Oct-14 | 580.79 | 14-Mar-16 | 1740.35 |

| 17-Jun-13 | 402.31 | 3-Nov-14 | 585.44 | 21-Mar-16 | 1693.29 |

| 24-Jun-13 | 411.60 | 10-Nov-14 | 587.88 | 28-Mar-16 | 1722.91 |

| 1-Jul-13 | 424.08 | 17-Nov-14 | 571.00 | ||

| 8-Jul-13 | 438.20 | 24-Nov-14 | 571.51 | ||

APPENDIX-Ⅲ

Table 3: Value Weighted Index

| Week | Index | Week | Index | Week | Index |

28-Feb-12 |

100.00 | 15-Jul-13 | 67.52 | 1-Dec-14 | 164.37 |

| 5-Mar-12 | 78.35 | 22-Jul-13 | 112.71 | 8-Dec-14 | 146.33 |

| 12-Mar-12 | 74.47 | 29-Jul-13 | 78.10 | 15-Dec-14 | 135.72 |

| 19-Mar-12 | 58.83 | 5-Aug-13 | 107.77 | 22-Dec-14 | 140.80 |

| 26-Mar-12 | 50.09 | 12-Aug-13 | 118.39 | 26-Dec-14 | 0.00 |

| 2-Apr-12 | 30.24 | 19-Aug-13 | 69.87 | 29-Dec-14 | 46.97 |

| 9-Apr-12 | 34.02 | 26-Aug-13 | 112.31 | 5-Jan-15 | 114.18 |

| 16-Apr-12 | 56.66 | 2-Sep-13 | 99.85 | 12-Jan-15 | 122.25 |

| 23-Apr-12 | 52.93 | 9-Sep-13 | 73.95 | 19-Jan-15 | 133.69 |

| 30-Apr-12 | 39.36 | 16-Sep-13 | 110.47 | 26-Jan-15 | 126.93 |

| 7-May-12 | 66.77 | 20-Sep-13 | 222.56 | 2-Feb-15 | 162.40 |

| 14-May-12 | 75.34 | 23-Sep-13 | 58.62 | 9-Feb-15 | 189.50 |

| 21-May-12 | 111.12 | 30-Sep-13 | 61.92 | 16-Feb-15 | 144.45 |

| 28-May-12 | 70.20 | 7-Oct-13 | 57.10 | 23-Feb-15 | 208.99 |

4-Jun-12 |

103.71 | 14-Oct-13 | 55.77 | 2-Mar-15 | 189.65 |

| 11-Jun-12 | 66.89 | 21-Oct-13 | 61.09 | 9-Mar-15 | 117.97 |

| 15-Jun-12 | 71.84 | 28-Oct-13 | 66.93 | 16-Mar-15 | 163.52 |

| 18-Jun-12 | 73.44 | 4-Nov-13 | 50.99 | 23-Mar-15 | 159.28 |

| 25-Jun-12 | 72.70 | 11-Nov-13 | 126.68 | 30-Mar-15 | 123.37 |

| 2-Jul-12 | 79.45 | 18-Nov-13 | 125.48 | 6-Apr-15 | 104.31 |

| 9-Jul-12 | 61.96 | 25-Nov-13 | 119.77 | 13-Apr-15 | 131.72 |

| 16-Jul-12 | 73.17 | 2-Dec-13 | 137.71 | 20-Apr-15 | 160.37 |

| 23-Jul-12 | 84.44 | 9-Dec-13 | 121.67 | 27-Apr-15 | 182.66 |

| 30-Jul-12 | 96.92 | 16-Dec-13 | 124.27 | 4-May-15 | 197.42 |

| 6-Aug-12 | 101.24 | 23-Dec-13 | 27.24 | 11-May-15 | 171.51 |

| 13-Aug-12 | 126.46 | 30-Dec-13 | 27.93 | 18-May-15 | 259.46 |

| 20-Aug-12 | 105.75 | 6-Jan-14 | 50.43 | 25-May-15 | 199.35 |

| 27-Aug-12 | 72.71 | 13-Jan-14 | 72.42 | 1-Jun-15 | 177.97 |

3-Sep-12 |

105.05 | 20-Jan-14 | 76.83 | 8-Jun-15 | 132.53 |

| 10-Sep-12 | 104.55 | 27-Jan-14 | 107.17 | 15-Jun-15 | 177.31 |

| 17-Sep-12 | 93.77 | 3-Feb-14 | 120.77 | 22-Jun-15 | 191.59 |

| 24-Sep-12 | 76.49 | 10-Feb-14 | 134.58 | 29-Jun-15 | 149.61 |

| 1-Oct-12 | 89.03 | 17-Feb-14 | 103.83 | 6-Jul-15 | 159.08 |

| 8-Oct-12 | 76.05 | 24-Feb-14 | 129.72 | 13-Jul-15 | 150.78 |

| 15-Oct-12 | 97.52 | 3-Mar-14 | 217.06 | 20-Jul-15 | 131.96 |

| 22-Oct-12 | 66.17 | 10-Mar-14 | 126.75 | 27-Jul-15 | 156.50 |

| 29-Oct-12 | 72.26 | 17-Mar-14 | 181.06 | 3-Aug-15 | 147.42 |

5-Nov-12 |

81.22 | 24-Mar-14 | 170.19 | 10-Aug-15 | 270.14 |

| 12-Nov-12 | 130.80 | 31-Mar-14 | 121.24 | 17-Aug-15 | 219.47 |

| 19-Nov-12 | 87.32 | 7-Apr-14 | 134.96 | 24-Aug-15 | 258.45 |

| 26-Nov-12 | 74.47 | 14-Apr-14 | 93.96 | 31-Aug-15 | 170.84 |

| 3-Dec-12 | 54.37 | 21-Apr-14 | 50.50 | 7-Sep-15 | 128.81 |

| 10-Dec-12 | 71.35 | 28-Apr-14 | 105.29 | 14-Sep-15 | 215.06 |

| 17-Dec-12 | 79.01 | 5-May-14 | 93.69 | 21-Sep-15 | 158.21 |

| 24-Dec-12 | 7.75 | 12-May-14 | 78.24 | 28-Sep-15 | 167.85 |

| 31-Dec-12 | 16.90 | 19-May-14 | 139.15 | 5-Oct-15 | 137.00 |

| 7-Jan-13 | 39.77 | 26-May-14 | 127.36 | 12-Oct-15 | 189.93 |

| 14-Jan-13 | 46.21 | 2-Jun-14 | 136.57 | 19-Oct-15 | 172.29 |

21-Jan-13 |

62.85 | 9-Jun-14 | 92.79 | 26-Oct-15 | 194.51 |

| 28-Jan-13 | 58.98 | 16-Jun-14 | 127.84 | 2-Nov-15 | 207.07 |

| 4-Feb-13 | 62.84 | 23-Jun-14 | 95.05 | 9-Nov-15 | 125.36 |

| 11-Feb-13 | 66.58 | 30-Jun-14 | 89.07 | 16-Nov-15 | 261.56 |

| 18-Feb-13 | 66.28 | 7-Jul-14 | 86.20 | 23-Nov-15 | 160.62 |

| 25-Feb-13 | 140.18 | 14-Jul-14 | 129.14 | 30-Nov-15 | 202.22 |

| 4-Mar-13 | 124.76 | 21-Jul-14 | 129.85 | 7-Dec-15 | 208.41 |

| 11-Mar-13 | 83.34 | 28-Jul-14 | 203.80 | 14-Dec-15 | 299.95 |

| 18-Mar-13 | 107.96 | 4-Aug-14 | 163.70 | 21-Dec-15 | 109.19 |

| 25-Mar-13 | 59.64 | 11-Aug-14 | 229.63 | 28-Dec-15 | 49.93 |

| 1-Apr-13 | 47.75 | 18-Aug-14 | 205.35 | 4-Jan-16 | 138.15 |

| 8-Apr-13 | 72.24 | 25-Aug-14 | 163.74 | 11-Jan-16 | 139.66 |

| 15-Apr-13 | 91.12 | 1-Sep-14 | 169.80 | 18-Jan-16 | 167.49 |

22-Apr-13 |

61.57 | 8-Sep-14 | 107.82 | 25-Jan-16 | 127.63 |

| 29-Apr-13 | 61.52 | 15-Sep-14 | 169.33 | 1-Feb-16 | 127.52 |

| 6-May-13 | 81.60 | 22-Sep-14 | 158.34 | 8-Feb-16 | 184.80 |

| 13-May-13 | 83.34 | 29-Sep-14 | 107.35 | 15-Feb-16 | 185.15 |

| 20-May-13 | 108.18 | 6-Oct-14 | 89.96 | 22-Feb-16 | 229.75 |

27-May-13 |

106.02 | 13-Oct-14 | 135.56 | 29-Feb-16 | 298.46 |

| 3-Jun-13 | 95.12 | 20-Oct-14 | 136.49 | 7-Mar-16 | 166.16 |

| 10-Jun-13 | 79.15 | 27-Oct-14 | 130.51 | 14-Mar-16 | 167.62 |

| 17-Jun-13 | 95.19 | 3-Nov-14 | 121.82 | 21-Mar-16 | 98.98 |

| 24-Jun-13 | 91.20 | 10-Nov-14 | 118.33 | 28-Mar-16 | 30.51 |

| 1-Jul-13 | 73.82 | 17-Nov-14 | 164.75 | ||

| 8-Jul-13 | 78.11 | 24-Nov-14 | 173.44 | ||

APPENDIX-Ⅳ

Table 4: Share returns of each company weekly

| Date | CTD | HUB | MYX | GXL | FXL | JHX |

5-Mar-12 |

1.00 | 1.00 | 1.00 | 1.10 | 0.97 | 1.01 |

| 12-Mar-12 | 0.99 | 1.00 | 1.00 | 1.04 | 1.06 | 1.02 |

| 19-Mar-12 | 1.04 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| 26-Mar-12 | 0.98 | 1.00 | 1.05 | 1.03 | 1.02 | 1.00 |

| 2-Apr-12 | 1.00 | 1.00 | 1.00 | 1.04 | 0.97 | 0.99 |

| 9-Apr-12 | 0.99 | 1.00 | 1.00 | 0.95 | 1.01 | 1.02 |

16-Apr-12 |

1.01 | 1.00 | 0.91 | 0.98 | 1.00 | 0.94 |

| 23-Apr-12 | 0.97 | 1.00 | 1.10 | 0.97 | 1.00 | 1.01 |

| 30-Apr-12 | 1.04 | 1.00 | 1.09 | 0.91 | 1.01 | 1.00 |

| 7-May-12 | 0.97 | 0.80 | 0.96 | 1.08 | 1.01 | 0.98 |

| 14-May-12 | 0.91 | 1.00 | 1.04 | 0.95 | 0.96 | 0.97 |

| 21-May-12 | 1.08 | 1.00 | 0.92 | 1.08 | 1.01 | 1.04 |

| 28-May-12 | 0.97 | 1.00 | 1.13 | 1.08 | 1.00 | 0.99 |

| 4-Jun-12 | 0.98 | 0.75 | 1.00 | 1.03 | 1.07 | 1.02 |

| 11-Jun-12 | 0.98 | 1.00 | 0.92 | 1.04 | 0.98 | 1.03 |

15-Jun-12 |

1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| 18-Jun-12 | 1.00 | 0.67 | 1.21 | 0.98 | 1.04 | 0.99 |

| 25-Jun-12 | 0.98 | 1.00 | 0.90 | 1.02 | 1.04 | 1.05 |

| 2-Jul-12 | 1.10 | 1.50 | 1.31 | 1.01 | 1.00 | 0.99 |

| 9-Jul-12 | 0.95 | 0.67 | 0.85 | 0.97 | 1.03 | 1.02 |

| 16-Jul-12 | 1.01 | 1.00 | 1.00 | 1.03 | 1.05 | 1.03 |

| 23-Jul-12 | 1.02 | 1.00 | 1.00 | 1.03 | 1.05 | 1.01 |

| 30-Jul-12 | 1.03 | 1.00 | 0.93 | 0.99 | 1.03 | 1.00 |

| 6-Aug-12 | 1.02 | 1.00 | 0.96 | 1.02 | 0.99 | 0.99 |

| 13-Aug-12 | 1.06 | 1.00 | 1.00 | 1.02 | 1.13 | 0.97 |

| 20-Aug-12 | 1.04 | 0.50 | 0.96 | 1.09 | 1.02 | 1.02 |

| 27-Aug-12 | 1.06 | 1.00 | 1.16 | 1.00 | 0.99 | 1.02 |

3-Sep-12 |

0.98 | 2.00 | 1.03 | 1.00 | 1.00 | 1.03 |

| 10-Sep-12 | 1.08 | 1.00 | 0.87 | 0.97 | 0.98 | 1.03 |

| 17-Sep-12 | 1.00 | 1.00 | 1.19 | 1.09 | 0.96 | 0.98 |

| 24-Sep-12 | 1.00 | 0.50 | 0.90 | 1.02 | 1.01 | 1.00 |

| 1-Oct-12 | 1.08 | 1.00 | 0.96 | 1.01 | 1.04 | 1.05 |

| 8-Oct-12 | 1.07 | 2.00 | 0.81 | 0.97 | 1.01 | 0.97 |

| 15-Oct-12 | 1.05 | 1.00 | 1.00 | 1.00 | 1.04 | 1.05 |

| 22-Oct-12 | 0.94 | 1.00 | 1.09 | 1.13 | 1.08 | 0.96 |

| 29-Oct-12 | 1.03 | 1.00 | 1.13 | 1.00 | 1.00 | 1.03 |

5-Nov-12 |

0.99 | 1.00 | 1.00 | 0.98 | 1.06 | 1.01 |

| 12-Nov-12 | 0.98 | 0.50 | 1.00 | 0.99 | 0.99 | 0.92 |

| 19-Nov-12 | 1.01 | 1.00 | 1.00 | 1.02 | 0.94 | 1.01 |

| 26-Nov-12 | 1.09 | 1.00 | 1.11 | 1.00 | 1.03 | 1.03 |

| 3-Dec-12 | 1.00 | 44.00 | 1.03 | 0.96 | 0.99 | 1.04 |

| 10-Dec-12 | 1.04 | 0.95 | 1.00 | 1.04 | 1.03 | 0.95 |

| 17-Dec-12 | 0.99 | 0.93 | 1.00 | 1.04 | 0.92 | 1.01 |

| 24-Dec-12 | 0.96 | 1.03 | 0.94 | 1.03 | 1.03 | 1.01 |

| 31-Dec-12 | 1.05 | 0.93 | 1.14 | 1.03 | 1.05 | 1.01 |

| 7-Jan-13 | 1.03 | 1.00 | 0.97 | 1.00 | 0.95 | 1.00 |

| 14-Jan-13 | 1.01 | 0.97 | 0.97 | 1.02 | 0.97 | 1.04 |

| 21-Jan-13 | 1.00 | 1.11 | 1.10 | 1.01 | 1.08 | 1.01 |

| 28-Jan-13 | 1.04 | 0.88 | 1.06 | 1.07 | 1.05 | 1.03 |

| 4-Feb-13 | 0.97 | 1.03 | 1.03 | 0.97 | 1.00 | 0.97 |

11-Feb-13 |

1.10 | 1.03 | 1.00 | 1.01 | 1.01 | 0.98 |

| 18-Feb-13 | 0.90 | 0.95 | 0.97 | 1.04 | 1.02 | 1.01 |

| 25-Feb-13 | 1.19 | 1.06 | 1.11 | 0.98 | 0.96 | 0.99 |

| 4-Mar-13 | 0.98 | 1.19 | 1.05 | 1.06 | 1.04 | 1.05 |

| 11-Mar-13 | 0.97 | 1.20 | 1.05 | 1.12 | 1.02 | 1.01 |

| 18-Mar-13 | 1.00 | 1.17 | 1.05 | 0.99 | 0.96 | 0.95 |

| 25-Mar-13 | 1.04 | 0.98 | 1.02 | 1.01 | 1.01 | 1.03 |

| 1-Apr-13 | 1.00 | 1.34 | 0.96 | 0.94 | 0.97 | 0.98 |

| 8-Apr-13 | 1.01 | 1.04 | 1.00 | 1.05 | 1.03 | 1.01 |

| 15-Apr-13 | 1.00 | 1.00 | 0.96 | 0.97 | 0.96 | 0.94 |

| 22-Apr-13 | 1.03 | 0.93 | 0.93 | 1.13 | 1.06 | 1.07 |

29-Apr-13 |

1.01 | 1.08 | 1.08 | 1.03 | 1.01 | 1.00 |

| 6-May-13 | 0.98 | 0.96 | 0.93 | 1.03 | 1.11 | 1.06 |

| 13-May-13 | 1.06 | 0.96 | 1.10 | 0.97 | 1.03 | 1.01 |

| 20-May-13 | 0.86 | 1.00 | 0.98 | 0.92 | 0.95 | 0.92 |

| 27-May-13 | 1.11 | 0.99 | 0.95 | 1.01 | 1.01 | 1.00 |

| 3-Jun-13 | 0.81 | 0.96 | 1.05 | 0.99 | 0.95 | 0.97 |

| 10-Jun-13 | 1.02 | 0.99 | 0.98 | 1.00 | 1.03 | 0.98 |

| 17-Jun-13 | 1.05 | 0.99 | 0.98 | 1.06 | 1.00 | 0.99 |

| 24-Jun-13 | 0.99 | 1.03 | 1.02 | 0.96 | 0.99 | 0.99 |

1-Jul-13 |

1.02 | 1.03 | 1.12 | 1.08 | 1.04 | 1.04 |

| 8-Jul-13 | 1.09 | 1.00 | 1.09 | 1.05 | 1.03 | 1.01 |

| 15-Jul-13 | 0.96 | 1.10 | 0.98 | 1.02 | 0.97 | 0.97 |

| 22-Jul-13 | 1.02 | 1.07 | 1.06 | 1.02 | 1.00 | 0.96 |

| 29-Jul-13 | 1.04 | 1.10 | 1.08 | 1.00 | 1.04 | 1.01 |

| 5-Aug-13 | 1.00 | 1.02 | 0.98 | 0.94 | 0.93 | 1.00 |

| 12-Aug-13 | 0.97 | 1.17 | 1.02 | 1.03 | 1.02 | 1.07 |

| 19-Aug-13 | 0.97 | 1.03 | 0.95 | 0.98 | 0.99 | 1.00 |

| 26-Aug-13 | 1.00 | 1.07 | 1.00 | 1.05 | 1.00 | 0.99 |

| 2-Sep-13 | 1.00 | 0.96 | 1.04 | 1.07 | 1.00 | 0.97 |

| 9-Sep-13 | 1.05 | 1.16 | 1.04 | 1.00 | 0.96 | 1.06 |

| 16-Sep-13 | 1.05 | 0.97 | 1.10 | 1.02 | 1.00 | 1.05 |

| 20-Sep-13 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| 23-Sep-13 | 0.97 | 1.01 | 0.95 | 1.00 | 1.03 | 1.03 |

30-Sep-13 |

0.98 | 0.99 | 1.07 | 1.06 | 1.02 | 0.97 |

| 7-Oct-13 | 1.04 | 1.04 | 1.02 | 1.05 | 1.00 | 0.99 |

| 14-Oct-13 | 1.10 | 1.01 | 1.02 | 1.00 | 1.02 | 1.02 |

| 21-Oct-13 | 0.98 | 0.98 | 1.01 | 0.97 | 1.08 | 0.99 |

| 28-Oct-13 | 1.06 | 0.95 | 1.06 | 1.00 | 0.97 | 1.01 |

| 4-Nov-13 | 0.97 | 1.05 | 1.06 | 1.01 | 0.97 | 1.00 |

| 11-Nov-13 | 0.97 | 0.94 | 0.91 | 0.90 | 1.01 | 1.13 |

| 18-Nov-13 | 1.17 | 0.96 | 1.01 | 1.19 | 1.00 | 0.99 |

| 25-Nov-13 | 0.98 | 1.02 | 1.04 | 1.02 | 0.96 | 1.04 |

| 2-Dec-13 | 0.95 | 0.92 | 0.92 | 1.05 | 0.96 | 0.95 |

| 9-Dec-13 | 0.98 | 0.98 | 0.99 | 0.98 | 1.00 | 1.00 |

| 16-Dec-13 | 1.02 | 1.00 | 0.98 | 1.03 | 1.02 | 1.06 |

23-Dec-13 |

1.00 | 1.01 | 1.05 | 1.11 | 1.01 | 1.00 |

| 30-Dec-13 | 0.99 | 1.03 | 1.01 | 1.00 | 1.00 | 1.02 |

| 6-Jan-14 | 1.05 | 1.06 | 0.97 | 0.95 | 0.98 | 1.02 |

| 13-Jan-14 | 1.00 | 0.96 | 1.00 | 1.02 | 0.97 | 1.00 |

| 20-Jan-14 | 0.92 | 1.01 | 1.10 | 1.04 | 0.96 | 1.00 |

| 27-Jan-14 | 1.02 | 0.98 | 0.96 | 0.99 | 1.01 | 0.98 |

| 3-Feb-14 | 0.98 | 0.93 | 1.13 | 1.02 | 1.01 | 1.03 |

| 10-Feb-14 | 1.03 | 1.01 | 1.05 | 0.90 | 0.99 | 1.01 |

| 17-Feb-14 | 0.99 | 0.92 | 1.05 | 1.05 | 1.02 | 1.03 |

| 24-Feb-14 | 1.04 | 0.97 | 1.02 | 0.97 | 0.93 | 1.04 |

| 3-Mar-14 | 1.06 | 0.95 | 1.06 | 1.00 | 0.99 | 1.05 |

| 10-Mar-14 | 1.02 | 1.01 | 1.00 | 1.00 | 0.95 | 0.94 |

17-Mar-14 |

1.06 | 0.91 | 1.03 | 0.97 | 0.98 | 0.98 |

| 24-Mar-14 | 0.99 | 1.00 | 0.95 | 1.06 | 1.01 | 1.01 |

| 31-Mar-14 | 0.99 | 0.96 | 1.00 | 0.99 | 1.00 | 1.00 |

| 7-Apr-14 | 1.04 | 1.00 | 0.89 | 0.97 | 1.04 | 0.97 |

| 14-Apr-14 | 0.98 | 0.97 | 1.05 | 0.99 | 1.00 | 1.00 |

| 21-Apr-14 | 1.00 | 0.92 | 0.97 | 0.99 | 1.02 | 1.00 |

| 28-Apr-14 | 0.97 | 1.06 | 0.98 | 1.04 | 1.00 | 1.01 |

| 5-May-14 | 0.93 | 0.96 | 1.02 | 0.99 | 0.95 | 0.99 |

| 12-May-14 | 1.01 | 0.96 | 1.02 | 1.06 | 1.01 | 1.00 |

| 19-May-14 | 0.97 | 1.08 | 1.06 | 1.02 | 0.92 | 1.03 |

26-May-14 |

1.07 | 1.04 | 0.99 | 1.11 | 1.02 | 1.02 |

| 2-Jun-14 | 0.97 | 1.00 | 0.99 | 0.99 | 1.01 | 1.01 |

| 9-Jun-14 | 1.03 | 1.00 | 0.94 | 0.98 | 0.94 | 0.95 |

| 16-Jun-14 | 1.04 | 1.00 | 1.00 | 1.07 | 0.96 | 1.00 |

| 23-Jun-14 | 1.00 | 0.97 | 0.99 | 0.99 | 1.02 | 1.01 |

| 30-Jun-14 | 1.03 | 1.00 | 1.04 | 0.99 | 1.02 | 1.02 |

| 7-Jul-14 | 0.99 | 1.00 | 0.97 | 1.01 | 0.99 | 0.97 |

| 14-Jul-14 | 1.00 | 0.99 | 1.02 | 1.02 | 1.13 | 0.97 |

| 21-Jul-14 | 0.98 | 1.15 | 1.00 | 1.05 | 1.03 | 0.98 |

| 28-Jul-14 | 1.02 | 1.02 | 0.98 | 1.01 | 1.00 | 1.02 |

4-Aug-14 |

0.99 | 0.97 | 0.99 | 0.96 | 0.98 | 1.03 |

| 11-Aug-14 | 1.07 | 1.05 | 0.99 | 1.04 | 1.03 | 0.94 |

| 18-Aug-14 | 1.01 | 1.18 | 0.96 | 1.04 | 0.99 | 1.01 |

| 25-Aug-14 | 1.06 | 0.97 | 0.99 | 0.95 | 1.04 | 0.97 |

| 1-Sep-14 | 1.00 | 0.96 | 0.94 | 1.02 | 1.01 | 1.01 |

| 8-Sep-14 | 1.01 | 0.98 | 1.01 | 1.00 | 0.94 | 0.98 |

| 15-Sep-14 | 0.97 | 0.98 | 1.00 | 0.99 | 0.94 | 0.97 |

| 22-Sep-14 | 1.02 | 0.92 | 1.00 | 0.99 | 0.99 | 0.96 |

29-Sep-14 |

1.01 | 1.00 | 1.05 | 0.97 | 0.97 | 1.00 |

| 6-Oct-14 | 1.03 | 1.02 | 0.95 | 0.98 | 0.99 | 0.96 |

| 13-Oct-14 | 1.01 | 0.95 | 0.99 | 0.98 | 1.02 | 1.01 |

| 20-Oct-14 | 1.10 | 1.04 | 1.03 | 0.97 | 1.03 | 1.05 |

| 27-Oct-14 | 1.05 | 1.01 | 1.00 | 0.96 | 1.01 | 1.00 |

| 3-Nov-14 | 1.04 | 0.98 | 0.99 | 0.98 | 0.99 | 1.02 |

| 10-Nov-14 | 1.04 | 1.03 | 1.00 | 1.01 | 0.98 | 1.01 |

| 17-Nov-14 | 1.02 | 0.94 | 1.00 | 0.92 | 0.91 | 0.98 |

| 24-Nov-14 | 0.98 | 1.05 | 0.86 | 1.07 | 0.97 | 0.99 |

1-Dec-14 |

1.03 | 0.99 | 0.95 | 0.96 | 1.03 | 1.04 |

| 8-Dec-14 | 0.93 | 0.94 | 0.97 | 0.94 | 0.93 | 0.98 |

| 15-Dec-14 | 1.00 | 0.93 | 1.09 | 1.03 | 1.00 | 1.06 |

| 22-Dec-14 | 1.03 | 1.06 | 0.98 | 1.00 | 1.01 | 1.01 |

| 26-Dec-14 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| 29-Dec-14 | 1.01 | 1.07 | 1.03 | 1.04 | 1.05 | 1.02 |

| 5-Jan-15 | 1.06 | 0.91 | 1.03 | 0.99 | 0.97 | 0.99 |

| 12-Jan-15 | 0.96 | 0.97 | 0.94 | 1.03 | 0.91 | 0.90 |

| 19-Jan-15 | 1.00 | 1.05 | 0.97 | 1.05 | 1.06 | 1.07 |

| 26-Jan-15 | 0.98 | 0.99 | 1.02 | 1.03 | 1.03 | 1.03 |

| 2-Feb-15 | 1.04 | 1.02 | 1.11 | 0.97 | 1.13 | 1.06 |

| 9-Feb-15 | 1.13 | 1.00 | 1.26 | 0.97 | 1.04 | 1.00 |

| 16-Feb-15 | 1.03 | 1.02 | 0.98 | 1.01 | 1.02 | 1.04 |

23-Feb-15 |

1.11 | 1.20 | 1.11 | 1.11 | 0.99 | 1.06 |

| 2-Mar-15 | 0.94 | 1.07 | 1.04 | 0.94 | 1.06 | 1.00 |

| 9-Mar-15 | 1.00 | 0.95 | 0.97 | 1.00 | 0.94 | 0.99 |

| 16-Mar-15 | 1.00 | 1.08 | 1.02 | 1.01 | 1.03 | 1.03 |

| 23-Mar-15 | 0.95 | 0.98 | 1.00 | 0.93 | 0.99 | 1.02 |

| 30-Mar-15 | 1.03 | 0.97 | 1.04 | 0.93 | 1.00 | 1.00 |

| 6-Apr-15 | 0.97 | 1.03 | 1.06 | 0.99 | 0.99 | 1.02 |

| 13-Apr-15 | 0.94 | 0.97 | 0.98 | 0.94 | 0.97 | 1.01 |

| 20-Apr-15 | 1.02 | 1.00 | 1.00 | 0.97 | 1.00 | 0.99 |

| 27-Apr-15 | 0.95 | 1.00 | 1.07 | 0.95 | 1.01 | 0.94 |

| 4-May-15 | 1.01 | 0.97 | 1.11 | 0.99 | 0.97 | 1.01 |

| 11-May-15 | 1.12 | 0.98 | 0.93 | 1.03 | 1.10 | 1.05 |

| 18-May-15 | 1.02 | 0.93 | 1.02 | 1.01 | 0.98 | 1.08 |

25-May-15 |

1.02 | 1.10 | 0.97 | 0.97 | 1.00 | 1.05 |

| 1-Jun-15 | 0.92 | 1.05 | 0.91 | 0.96 | 0.93 | 0.95 |

| 8-Jun-15 | 0.98 | 1.05 | 0.98 | 0.96 | 0.99 | 1.03 |

| 15-Jun-15 | 1.00 | 0.98 | 1.04 | 0.99 | 1.03 | 1.04 |

| 22-Jun-15 | 0.98 | 1.00 | 0.94 | 0.97 | 0.87 | 0.99 |

| 29-Jun-15 | 1.01 | 0.97 | 1.01 | 0.95 | 1.00 | 1.00 |

| 6-Jul-15 | 0.97 | 1.19 | 1.10 | 0.92 | 1.00 | 1.00 |

| 13-Jul-15 | 1.03 | 1.14 | 1.03 | 1.12 | 1.00 | 1.06 |

| 20-Jul-15 | 0.97 | 0.95 | 0.97 | 1.00 | 1.00 | 0.99 |

27-Jul-15 |

1.01 | 1.04 | 1.06 | 1.05 | 1.01 | 1.03 |

| 3-Aug-15 | 1.01 | 1.03 | 0.99 | 0.95 | 0.98 | 0.96 |

| 10-Aug-15 | 0.97 | 1.06 | 0.98 | 1.24 | 0.85 | 0.99 |

| 17-Aug-15 | 1.00 | 0.98 | 0.96 | 0.99 | 1.07 | 0.97 |

| 24-Aug-15 | 1.04 | 1.04 | 1.05 | 0.83 | 1.05 | 1.02 |

| 31-Aug-15 | 0.95 | 1.20 | 0.90 | 0.97 | 0.90 | 0.98 |

| 7-Sep-15 | 0.99 | 1.00 | 0.96 | 1.11 | 0.98 | 1.04 |

| 14-Sep-15 | 1.02 | 0.98 | 1.07 | 0.99 | 1.01 | 0.98 |

21-Sep-15 |

0.88 | 1.19 | 0.96 | 1.04 | 0.95 | 0.98 |

| 28-Sep-15 | 1.09 | 0.94 | 1.01 | 1.01 | 1.03 | 0.99 |

| 5-Oct-15 | 1.07 | 1.15 | 1.00 | 1.00 | 1.03 | 1.01 |

| 12-Oct-15 | 1.01 | 1.01 | 0.97 | 0.99 | 1.01 | 1.00 |

| 19-Oct-15 | 1.04 | 1.01 | 1.03 | 0.96 | 1.00 | 1.04 |

| 26-Oct-15 | 1.01 | 1.10 | 0.99 | 1.00 | 1.22 | 1.00 |

| 2-Nov-15 | 1.03 | 1.03 | 1.09 | 1.01 | 0.98 | 0.98 |

| 9-Nov-15 | 0.97 | 0.96 | 0.95 | 0.93 | 0.91 | 0.95 |

| 16-Nov-15 | 1.02 | 1.19 | 1.14 | 1.09 | 1.04 | 0.97 |

23-Nov-15 |

0.98 | 0.97 | 1.08 | 0.96 | 0.97 | 0.98 |

| 30-Nov-15 | 0.95 | 1.02 | 1.04 | 0.84 | 1.00 | 1.01 |

| 7-Dec-15 | 1.00 | 1.08 | 0.97 | 0.92 | 1.00 | 0.94 |

| 14-Dec-15 | 1.14 | 1.00 | 1.09 | 1.38 | 1.06 | 1.08 |

| 21-Dec-15 | 1.04 | 1.19 | 0.96 | 1.02 | 0.99 | 1.02 |

| 28-Dec-15 | 1.04 | 1.01 | 1.02 | 1.02 | 1.04 | 1.03 |

| 4-Jan-16 | 0.96 | 0.97 | 0.93 | 0.97 | 0.88 | 0.93 |

| 11-Jan-16 | 0.98 | 0.97 | 0.93 | 1.02 | 0.95 | 0.95 |

| 18-Jan-16 | 1.00 | 0.95 | 0.97 | 1.00 | 1.07 | 1.02 |

| 25-Jan-16 | 0.97 | 0.98 | 1.11 | 1.08 | 1.04 | 1.01 |

| 1-Feb-16 | 0.96 | 1.06 | 0.94 | 0.88 | 0.99 | 1.02 |

8-Feb-16 |

0.96 | 0.95 | 0.93 | 1.01 | 0.86 | 0.97 |

| 15-Feb-16 | 1.06 | 1.03 | 1.09 | 1.12 | 0.93 | 1.08 |

| 22-Feb-16 | 1.05 | 1.00 | 0.99 | 1.02 | 1.05 | 1.03 |

| 29-Feb-16 | 1.07 | 0.96 | 1.16 | 1.05 | 1.03 | 1.04 |

| 7-Mar-16 | 1.01 | 1.00 | 0.98 | 0.98 | 0.98 | 0.99 |

| 14-Mar-16 | 1.02 | 1.07 | 1.06 | 0.98 | 1.07 | 1.00 |

| 21-Mar-16 | 0.99 | 0.99 | 0.98 | 1.01 | 0.98 | 0.99 |

| 28-Mar-16 | 1.01 | 1.00 | 1.04 | 1.01 | 1.00 | 1.00 |

APPENDIX-Ⅴ

Table ASX200 monthly

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

APPENDIX-Ⅵ Investment and Portfolio Management代写

Table All Ordinaries monthly

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Table ASX200 HPR monthly

|

Table All Ordinaries HPR monthly

|

Table All Ordinaries HPR annual

|

Table ASX200 HPR annual Investment and Portfolio Management代写

|

APPENDIX-VII

Table The closing price

| Date | CTD | HUB | MYX | GXL | JHX | FXL |

| 28-Feb-12 | 2.1 | 0.05 | 0.22 | 1.8 | 7.43 | 2.29 |

| 5-Mar-12 | 2.1 | 0.05 | 0.22 | 1.98 | 7.51 | 2.32 |

| 12-Mar-12 | 2.08 | 0.05 | 0.22 | 2.05 | 7.67 | 2.38 |

| 19-Mar-12 | 2.16 | 0.05 | 0.22 | 2.05 | 7.67 | 2.39 |

| 26-Mar-12 | 2.12 | 0.05 | 0.23 | 2.11 | 7.68 | 2.41 |

| 2-Apr-12 | 2.13 | 0.05 | 0.23 | 2.19 | 7.63 | 2.40 |

| 9-Apr-12 | 2.11 | 0.05 | 0.23 | 2.09 | 7.76 | 2.41 |

| 16-Apr-12 | 2.13 | 0.05 | 0.21 | 2.04 | 7.32 | 2.33 |

| 23-Apr-12 | 2.07 | 0.05 | 0.23 | 1.97 | 7.39 | 2.32 |

| 30-Apr-12 | 2.16 | 0.05 | 0.25 | 1.79 | 7.41 | 2.32 |

| 7-May-12 | 2.09 | 0.04 | 0.24 | 1.93 | 7.25 | 2.31 |

14-May-12 |

1.9 | 0.04 | 0.25 | 1.84 | 7.05 | 2.21 |

| 21-May-12 | 2.05 | 0.04 | 0.23 | 1.99 | 7.36 | 2.32 |

| 28-May-12 | 1.99 | 0.04 | 0.26 | 2.14 | 7.25 | 2.32 |

| 4-Jun-12 | 1.96 | 0.03 | 0.26 | 2.2 | 7.4 | 2.37 |

| 11-Jun-12 | 1.92 | 0.03 | 0.24 | 2.29 | 7.61 | 2.41 |

| 15-Jun-12 | 1.92 | 0.03 | 0.24 | 2.29 | 7.61 | 2.41 |

| 18-Jun-12 | 1.92 | 0.02 | 0.29 | 2.24 | 7.57 | 2.41 |

| 25-Jun-12 | 1.88 | 0.02 | 0.26 | 2.29 | 7.96 | 2.49 |

2-Jul-12 |

2.06 | 0.03 | 0.34 | 2.31 | 7.88 | 2.53 |

| 9-Jul-12 | 1.96 | 0.02 | 0.29 | 2.25 | 8.05 | 2.53 |

| 16-Jul-12 | 1.98 | 0.02 | 0.29 | 2.31 | 8.32 | 2.61 |

| 23-Jul-12 | 2.01 | 0.02 | 0.29 | 2.39 | 8.37 | 2.66 |

| 30-Jul-12 | 2.08 | 0.02 | 0.27 | 2.37 | 8.33 | 2.67 |

| 6-Aug-12 | 2.13 | 0.02 | 0.26 | 2.41 | 8.27 | 2.67 |

| 13-Aug-12 | 2.26 | 0.02 | 0.26 | 2.46 | 8.03 | 2.72 |

| 20-Aug-12 | 2.36 | 0.01 | 0.25 | 2.67 | 8.23 | 2.81 |

| 27-Aug-12 | 2.51 | 0.01 | 0.29 | 2.68 | 8.38 | 2.86 |

| 3-Sep-12 | 2.46 | 0.02 | 0.3 | 2.69 | 8.65 | 2.90 |

| 10-Sep-12 | 2.66 | 0.02 | 0.26 | 2.6 | 8.95 | 2.96 |

| 17-Sep-12 | 2.67 | 0.02 | 0.31 | 2.83 | 8.74 | 2.95 |

| 24-Sep-12 | 2.68 | 0.01 | 0.28 | 2.89 | 8.7 | 2.95 |

| 1-Oct-12 | 2.9 | 0.01 | 0.27 | 2.93 | 9.14 | 3.09 |

| 8-Oct-12 | 3.1 | 0.02 | 0.22 | 2.85 | 8.91 | 3.07 |

| 15-Oct-12 | 3.26 | 0.02 | 0.22 | 2.86 | 9.4 | 3.20 |

22-Oct-12 |

3.07 | 0.02 | 0.24 | 3.22 | 8.98 | 3.21 |

| 29-Oct-12 | 3.17 | 0.02 | 0.27 | 3.22 | 9.26 | 3.27 |

| 5-Nov-12 | 3.15 | 0.02 | 0.27 | 3.15 | 9.39 | 3.32 |

| 12-Nov-12 | 3.1 | 0.01 | 0.27 | 3.12 | 8.68 | 3.17 |

| 19-Nov-12 | 3.14 | 0.01 | 0.27 | 3.19 | 8.8 | 3.17 |

| 26-Nov-12 | 3.43 | 0.01 | 0.3 | 3.19 | 9.09 | 3.29 |

| 3-Dec-12 | 3.44 | 0.44 | 0.31 | 3.07 | 9.44 | 3.40 |

| 10-Dec-12 | 3.58 | 0.42 | 0.31 | 3.19 | 9 | 3.38 |

| 17-Dec-12 | 3.54 | 0.39 | 0.31 | 3.33 | 9.1 | 3.36 |

| 24-Dec-12 | 3.4 | 0.4 | 0.29 | 3.42 | 9.18 | 3.38 |

| 31-Dec-12 | 3.58 | 0.37 | 0.33 | 3.51 | 9.27 | 3.47 |

| 7-Jan-13 | 3.7 | 0.37 | 0.32 | 3.51 | 9.27 | 3.46 |

14-Jan-13 |

3.73 | 0.36 | 0.31 | 3.58 | 9.6 | 3.51 |

| 21-Jan-13 | 3.73 | 0.4 | 0.34 | 3.63 | 9.72 | 3.59 |

| 28-Jan-13 | 3.87 | 0.35 | 0.36 | 3.88 | 10.03 | 3.73 |

| 4-Feb-13 | 3.77 | 0.36 | 0.37 | 3.78 | 9.76 | 3.66 |

| 11-Feb-13 | 4.14 | 0.37 | 0.37 | 3.81 | 9.6 | 3.71 |

| 18-Feb-13 | 3.72 | 0.35 | 0.36 | 3.98 | 9.7 | 3.69 |

| 25-Feb-13 | 4.41 | 0.37 | 0.4 | 3.89 | 9.65 | 3.76 |

| 4-Mar-13 | 4.32 | 0.44 | 0.42 | 4.11 | 10.09 | 3.90 |

| 11-Mar-13 | 4.19 | 0.53 | 0.44 | 4.59 | 10.2 | 4.00 |

| 18-Mar-13 | 4.21 | 0.62 | 0.46 | 4.53 | 9.74 | 3.91 |

| 25-Mar-13 | 4.39 | 0.61 | 0.47 | 4.57 | 10.01 | 4.00 |

| 1-Apr-13 | 4.41 | 0.82 | 0.45 | 4.28 | 9.78 | 3.92 |

| 8-Apr-13 | 4.44 | 0.85 | 0.45 | 4.5 | 9.89 | 4.01 |

15-Apr-13 |

4.45 | 0.85 | 0.43 | 4.37 | 9.34 | 3.87 |

| 22-Apr-13 | 4.57 | 0.79 | 0.4 | 4.93 | 10.02 | 4.12 |

| 29-Apr-13 | 4.6 | 0.85 | 0.43 | 5.1 | 10.05 | 4.17 |

| 6-May-13 | 4.53 | 0.82 | 0.4 | 5.23 | 10.68 | 4.35 |

| 13-May-13 | 4.82 | 0.79 | 0.44 | 5.06 | 10.83 | 4.42 |

| 20-May-13 | 4.16 | 0.79 | 0.43 | 4.63 | 9.97 | 4.06 |

| 27-May-13 | 4.63 | 0.78 | 0.41 | 4.68 | 9.96 | 4.14 |

| 3-Jun-13 | 3.77 | 0.75 | 0.43 | 4.61 | 9.69 | 3.91 |

| 10-Jun-13 | 3.83 | 0.74 | 0.42 | 4.63 | 9.54 | 3.91 |

| 17-Jun-13 | 4.01 | 0.73 | 0.41 | 4.93 | 9.49 | 3.98 |

| 24-Jun-13 | 3.97 | 0.75 | 0.42 | 4.73 | 9.39 | 3.92 |

| 1-Jul-13 | 4.04 | 0.77 | 0.47 | 5.13 | 9.76 | 4.10 |

| 8-Jul-13 | 4.4 | 0.77 | 0.51 | 5.41 | 9.86 | 4.25 |

| 15-Jul-13 | 4.24 | 0.85 | 0.5 | 5.52 | 9.59 | 4.19 |

| 22-Jul-13 | 4.33 | 0.91 | 0.53 | 5.64 | 9.2 | 4.17 |

29-Jul-13 |

4.52 | 1 | 0.57 | 5.66 | 9.3 | 4.27 |

| 5-Aug-13 | 4.51 | 1.02 | 0.56 | 5.3 | 9.28 | 4.15 |

| 12-Aug-13 | 4.39 | 1.19 | 0.57 | 5.44 | 9.9 | 4.30 |

| 19-Aug-13 | 4.26 | 1.23 | 0.54 | 5.33 | 9.89 | 4.26 |

| 26-Aug-13 | 4.25 | 1.32 | 0.54 | 5.57 | 9.81 | 4.30 |

| 2-Sep-13 | 4.26 | 1.27 | 0.56 | 5.97 | 9.53 | 4.31 |

| 9-Sep-13 | 4.46 | 1.47 | 0.58 | 5.99 | 10.07 | 4.44 |

| 16-Sep-13 | 4.69 | 1.42 | 0.64 | 6.12 | 10.62 | 4.60 |

| 20-Sep-13 | 4.69 | 1.42 | 0.64 | 6.12 | 10.62 | 4.60 |

| 23-Sep-13 | 4.56 | 1.43 | 0.61 | 6.1 | 10.91 | 4.64 |

30-Sep-13 |

4.48 | 1.42 | 0.65 | 6.45 | 10.56 | 4.65 |

| 7-Oct-13 | 4.64 | 1.47 | 0.66 | 6.78 | 10.5 | 4.73 |

| 14-Oct-13 | 5.11 | 1.48 | 0.67 | 6.81 | 10.76 | 4.87 |

| 21-Oct-13 | 5.03 | 1.45 | 0.68 | 6.58 | 10.62 | 4.85 |

| 28-Oct-13 | 5.32 | 1.38 | 0.72 | 6.55 | 10.77 | 4.89 |

| 4-Nov-13 | 5.18 | 1.45 | 0.76 | 6.6 | 10.75 | 4.87 |

| 11-Nov-13 | 5.01 | 1.36 | 0.69 | 5.92 | 12.17 | 4.94 |

| 18-Nov-13 | 5.85 | 1.31 | 0.7 | 7.02 | 12.03 | 5.24 |

25-Nov-13 |

5.73 | 1.34 | 0.73 | 7.19 | 12.54 | 5.31 |

| 2-Dec-13 | 5.43 | 1.23 | 0.67 | 7.57 | 11.86 | 5.15 |

| 9-Dec-13 | 5.3 | 1.2 | 0.66 | 7.42 | 11.89 | 5.10 |

| 16-Dec-13 | 5.42 | 1.2 | 0.65 | 7.65 | 12.56 | 5.28 |

| 23-Dec-13 | 5.41 | 1.21 | 0.68 | 8.46 | 12.58 | 5.43 |

| 30-Dec-13 | 5.38 | 1.25 | 0.69 | 8.45 | 12.85 | 5.48 |

| 6-Jan-14 | 5.64 | 1.32 | 0.67 | 8.06 | 13.13 | 5.50 |

| 13-Jan-14 | 5.64 | 1.27 | 0.67 | 8.21 | 13.17 | 5.50 |

| 20-Jan-14 | 5.21 | 1.28 | 0.74 | 8.5 | 13.18 | 5.47 |

| 27-Jan-14 | 5.32 | 1.25 | 0.71 | 8.44 | 12.9 | 5.43 |

| 3-Feb-14 | 5.21 | 1.16 | 0.8 | 8.57 | 13.33 | 5.51 |

| 10-Feb-14 | 5.39 | 1.17 | 0.84 | 7.73 | 13.5 | 5.43 |

17-Feb-14 |

5.36 | 1.08 | 0.88 | 8.12 | 13.96 | 5.58 |

| 24-Feb-14 | 5.6 | 1.05 | 0.9 | 7.86 | 14.5 | 5.61 |

| 3-Mar-14 | 5.95 | 1 | 0.95 | 7.84 | 15.29 | 5.79 |

| 10-Mar-14 | 6.06 | 1.01 | 0.95 | 7.84 | 14.44 | 5.64 |

| 17-Mar-14 | 6.41 | 0.92 | 0.98 | 7.61 | 14.1 | 5.58 |

| 24-Mar-14 | 6.32 | 0.92 | 0.93 | 8.07 | 14.23 | 5.66 |

| 31-Mar-14 | 6.23 | 0.88 | 0.93 | 7.97 | 14.17 | 5.61 |

| 7-Apr-14 | 6.5 | 0.88 | 0.83 | 7.76 | 13.69 | 5.55 |

| 14-Apr-14 | 6.37 | 0.85 | 0.87 | 7.72 | 13.63 | 5.51 |

| 21-Apr-14 | 6.34 | 0.78 | 0.84 | 7.65 | 13.68 | 5.50 |

| 28-Apr-14 | 6.17 | 0.83 | 0.82 | 7.94 | 13.82 | 5.55 |

| 5-May-14 | 5.75 | 0.8 | 0.84 | 7.83 | 13.63 | 5.40 |

| 12-May-14 | 5.83 | 0.77 | 0.86 | 8.28 | 13.64 | 5.49 |

| 19-May-14 | 5.66 | 0.83 | 0.91 | 8.42 | 14.01 | 5.52 |

26-May-14 |

6.06 | 0.86 | 0.9 | 9.36 | 14.33 | 5.81 |

| 2-Jun-14 | 5.9 | 0.86 | 0.89 | 9.22 | 14.48 | 5.79 |

| 9-Jun-14 | 6.07 | 0.86 | 0.84 | 9.08 | 13.73 | 5.63 |

| 16-Jun-14 | 6.34 | 0.86 | 0.84 | 9.68 | 13.77 | 5.75 |

| 23-Jun-14 | 6.35 | 0.83 | 0.83 | 9.55 | 13.95 | 5.77 |

| 30-Jun-14 | 6.55 | 0.83 | 0.86 | 9.41 | 14.25 | 5.85 |

| 7-Jul-14 | 6.5 | 0.83 | 0.83 | 9.46 | 13.8 | 5.76 |

| 14-Jul-14 | 6.48 | 0.82 | 0.85 | 9.66 | 13.45 | 5.81 |

| 21-Jul-14 | 6.38 | 0.94 | 0.85 | 10.11 | 13.2 | 5.86 |

| 28-Jul-14 | 6.49 | 0.96 | 0.83 | 10.21 | 13.48 | 5.94 |

| 4-Aug-14 | 6.45 | 0.93 | 0.82 | 9.77 | 13.88 | 5.91 |

| 11-Aug-14 | 6.92 | 0.98 | 0.81 | 10.16 | 12.99 | 5.93 |

18-Aug-14 |

7.02 | 1.16 | 0.78 | 10.53 | 13.17 | 6.06 |

| 25-Aug-14 | 7.44 | 1.13 | 0.77 | 10 | 12.81 | 6.00 |

| 1-Sep-14 | 7.44 | 1.09 | 0.72 | 10.17 | 13 | 6.05 |

| 8-Sep-14 | 7.5 | 1.07 | 0.73 | 10.15 | 12.79 | 5.98 |

| 15-Sep-14 | 7.26 | 1.05 | 0.73 | 10 | 12.43 | 5.82 |

| 22-Sep-14 | 7.4 | 0.97 | 0.73 | 9.85 | 11.92 | 5.71 |

| 29-Sep-14 | 7.5 | 0.97 | 0.77 | 9.57 | 11.95 | 5.68 |

| 6-Oct-14 | 7.71 | 0.99 | 0.73 | 9.37 | 11.44 | 5.59 |

| 13-Oct-14 | 7.81 | 0.94 | 0.72 | 9.2 | 11.54 | 5.59 |

| 20-Oct-14 | 8.56 | 0.98 | 0.74 | 8.93 | 12.07 | 5.79 |

| 27-Oct-14 | 8.96 | 0.99 | 0.74 | 8.6 | 12.02 | 5.80 |

| 3-Nov-14 | 9.35 | 0.97 | 0.73 | 8.43 | 12.26 | 5.86 |

| 10-Nov-14 | 9.72 | 1 | 0.73 | 8.5 | 12.4 | 5.95 |

17-Nov-14 |

9.93 | 0.94 | 0.73 | 7.79 | 12.2 | 5.78 |

| 24-Nov-14 | 9.73 | 0.99 | 0.63 | 8.3 | 12.1 | 5.79 |

| 1-Dec-14 | 10 | 0.98 | 0.6 | 7.99 | 12.54 | 5.86 |

| 8-Dec-14 | 9.34 | 0.92 | 0.58 | 7.48 | 12.33 | 5.58 |

| 15-Dec-14 | 9.35 | 0.86 | 0.63 | 7.73 | 13.01 | 5.74 |

| 22-Dec-14 | 9.67 | 0.91 | 0.62 | 7.75 | 13.1 | 5.82 |

| 26-Dec-14 | 9.67 | 0.91 | 0.62 | 7.75 | 13.1 | 5.82 |

| 29-Dec-14 | 9.79 | 0.97 | 0.64 | 8.07 | 13.3 | 5.96 |

| 5-Jan-15 | 10.35 | 0.88 | 0.66 | 7.96 | 13.23 | 6.00 |

| 12-Jan-15 | 9.95 | 0.85 | 0.62 | 8.17 | 11.85 | 5.68 |

| 19-Jan-15 | 9.97 | 0.89 | 0.6 | 8.6 | 12.64 | 5.92 |

| 26-Jan-15 | 9.76 | 0.88 | 0.61 | 8.9 | 13.02 | 6.01 |

2-Feb-15 |

10.16 | 0.9 | 0.68 | 8.63 | 13.78 | 6.23 |

| 9-Feb-15 | 11.45 | 0.9 | 0.86 | 8.38 | 13.78 | 6.46 |

| 16-Feb-15 | 11.76 | 0.92 | 0.84 | 8.46 | 14.35 | 6.63 |

| 23-Feb-15 | 13 | 1.1 | 0.93 | 9.4 | 15.14 | 7.17 |

| 2-Mar-15 | 12.26 | 1.18 | 0.97 | 8.81 | 15.07 | 6.99 |

| 9-Mar-15 | 12.25 | 1.12 | 0.94 | 8.85 | 14.85 | 6.91 |

| 16-Mar-15 | 12.3 | 1.21 | 0.96 | 8.95 | 15.24 | 7.03 |

| 23-Mar-15 | 11.64 | 1.18 | 0.96 | 8.29 | 15.48 | 6.84 |

| 30-Mar-15 | 12 | 1.15 | 1 | 7.7 | 15.43 | 6.79 |

| 6-Apr-15 | 11.58 | 1.18 | 1.06 | 7.66 | 15.78 | 6.78 |

| 13-Apr-15 | 10.87 | 1.15 | 1.04 | 7.2 | 15.89 | 6.58 |

| 20-Apr-15 | 11.04 | 1.15 | 1.04 | 7 | 15.69 | 6.54 |

| 27-Apr-15 | 10.49 | 1.15 | 1.11 | 6.68 | 14.74 | 6.25 |

| 4-May-15 | 10.55 | 1.12 | 1.23 | 6.6 | 14.93 | 6.28 |

| 11-May-15 | 11.8 | 1.1 | 1.15 | 6.81 | 15.63 | 6.68 |

| 18-May-15 | 11.99 | 1.02 | 1.17 | 6.91 | 16.84 | 6.91 |

25-May-15 |

12.23 | 1.12 | 1.13 | 6.69 | 17.66 | 7.06 |

| 1-Jun-15 | 11.25 | 1.18 | 1.03 | 6.4 | 16.75 | 6.65 |

| 8-Jun-15 | 10.97 | 1.24 | 1.01 | 6.14 | 17.29 | 6.65 |

| 15-Jun-15 | 11.01 | 1.22 | 1.05 | 6.1 | 17.95 | 6.78 |

| 22-Jun-15 | 10.74 | 1.22 | 0.99 | 5.94 | 17.79 | 6.60 |

| 29-Jun-15 | 10.87 | 1.18 | 1 | 5.62 | 17.83 | 6.57 |

| 6-Jul-15 | 10.59 | 1.4 | 1.1 | 5.15 | 17.78 | 6.49 |

| 13-Jul-15 | 10.89 | 1.59 | 1.13 | 5.76 | 18.78 | 6.84 |

| 20-Jul-15 | 10.6 | 1.51 | 1.1 | 5.77 | 18.5 | 6.73 |

| 27-Jul-15 | 10.71 | 1.57 | 1.17 | 6.05 | 18.99 | 6.91 |

| 3-Aug-15 | 10.84 | 1.62 | 1.16 | 5.76 | 18.2 | 6.75 |

| 10-Aug-15 | 10.49 | 1.71 | 1.14 | 7.13 | 17.95 | 6.82 |

| 17-Aug-15 | 10.52 | 1.68 | 1.09 | 7.04 | 17.47 | 6.74 |

| 24-Aug-15 | 10.9 | 1.75 | 1.14 | 5.87 | 17.88 | 6.72 |

| 31-Aug-15 | 10.39 | 2.1 | 1.03 | 5.68 | 17.49 | 6.53 |

7-Sep-15 |

10.25 | 2.1 | 0.99 | 6.3 | 18.17 | 6.71 |

| 14-Sep-15 | 10.47 | 2.05 | 1.06 | 6.25 | 17.74 | 6.67 |

| 21-Sep-15 | 9.18 | 2.44 | 1.02 | 6.53 | 17.43 | 6.49 |

| 28-Sep-15 | 10.02 | 2.3 | 1.03 | 6.57 | 17.24 | 6.59 |

| 5-Oct-15 | 10.7 | 2.65 | 1.03 | 6.57 | 17.46 | 6.81 |

| 12-Oct-15 | 10.78 | 2.67 | 1 | 6.52 | 17.53 | 6.83 |

| 19-Oct-15 | 11.17 | 2.7 | 1.03 | 6.24 | 18.3 | 6.99 |

| 26-Oct-15 | 11.27 | 2.96 | 1.02 | 6.26 | 18.3 | 7.15 |

| 2-Nov-15 | 11.6 | 3.04 | 1.11 | 6.31 | 18.01 | 7.18 |

9-Nov-15 |

11.28 | 2.93 | 1.06 | 5.85 | 17.15 | 6.84 |

| 16-Nov-15 | 11.47 | 3.49 | 1.21 | 6.35 | 16.69 | 7.01 |

| 23-Nov-15 | 11.27 | 3.39 | 1.31 | 6.11 | 16.36 | 6.87 |

| 30-Nov-15 | 10.66 | 3.46 | 1.36 | 5.11 | 16.5 | 6.65 |

| 7-Dec-15 | 10.69 | 3.73 | 1.32 | 4.69 | 15.46 | 6.44 |

| 14-Dec-15 | 12.22 | 3.74 | 1.44 | 6.48 | 16.68 | 7.25 |

| 21-Dec-15 | 12.65 | 4.45 | 1.38 | 6.6 | 16.97 | 7.49 |

| 28-Dec-15 | 13.13 | 4.51 | 1.41 | 6.7 | 17.47 | 7.71 |

| 4-Jan-16 | 12.6 | 4.37 | 1.31 | 6.5 | 16.19 | 7.27 |

| 11-Jan-16 | 12.33 | 4.22 | 1.22 | 6.64 | 15.44 | 7.06 |

| 18-Jan-16 | 12.28 | 4 | 1.18 | 6.65 | 15.78 | 7.10 |

| 25-Jan-16 | 11.9 | 3.9 | 1.31 | 7.15 | 15.99 | 7.18 |

| 1-Feb-16 | 11.45 | 4.15 | 1.23 | 6.32 | 16.37 | 7.05 |

| 8-Feb-16 | 10.97 | 3.95 | 1.14 | 6.39 | 15.92 | 6.79 |

| 15-Feb-16 | 11.68 | 4.07 | 1.24 | 7.15 | 17.14 | 7.25 |

| 22-Feb-16 | 12.22 | 4.06 | 1.23 | 7.28 | 17.64 | 7.46 |

| 29-Feb-16 | 13.08 | 3.9 | 1.43 | 7.65 | 18.26 | 7.79 |

| 7-Mar-16 | 13.21 | 3.89 | 1.4 | 7.47 | 18.02 | 7.72 |

| 14-Mar-16 | 13.45 | 4.18 | 1.48 | 7.34 | 18 | 7.83 |

| 21-Mar-16 | 13.32 | 4.12 | 1.45 | 7.42 | 17.79 | 7.76 |

| 28-Mar-16 | 13.41 | 4.12 | 1.51 | 7.49 | 17.79 | 7.80 |

Table Dividends

CTD:

|

JHX:

| Dec 21, 2015 | 0.0994 Dividend |

| Jun 9, 2015 | 0.3476 Dividend |

| Dec 19, 2014 | 0.0987 Dividend |

| Jun 10, 2014 | 0.3429 Dividend |

| Dec 13, 2013 | 0.087585 Dividend |

| Jun 24, 2013 | 0.135219 Dividend |

| Dec 12, 2012 | 0.047746 Dividend |

| Jun 25, 2012 | 0.37449 Dividend |

GXL:

| Feb 24, 2016 | 0.1286 Dividend |

| Aug 17, 2015 | 0.128571 Dividend |

| Mar 3, 2015 | 0.114286 Dividend |

| Sep 4, 2014 | 0.10 Dividend |

| Feb 17, 2014 | 0.078571 Dividend |

| Sep 6, 2013 | 0.071429 Dividend |

| Mar 8, 2013 | 0.05 Dividend |

| Aug 27, 2012 | 0.057143 Dividend |

| Mar 9, 2012 | 0.057143 Dividend |

FXL:

| Mar 10, 2016 | 0.1036 Dividend |

| Sep 9, 2015 | 0.128571 Dividend |

| Mar 11, 2015 | 0.125 Dividend |

| Sep 10, 2014 | 0.121429 Dividend |

| Mar 7, 2014 | 0.114286 Dividend |

| Sep 9, 2013 | 0.107143 Dividend |

| Mar 8, 2013 | 0.10 Dividend |

| Sep 10, 2012 | 0.092857 Dividend |

| Mar 9, 2012 | 0.085714 Dividend |

更多其他:prensentation代写 文学论文代写 商科论文代写 艺术论文代写 代写案例 Assignment代写 Proposal代写 Capstone Projects

您必须登录才能发表评论。