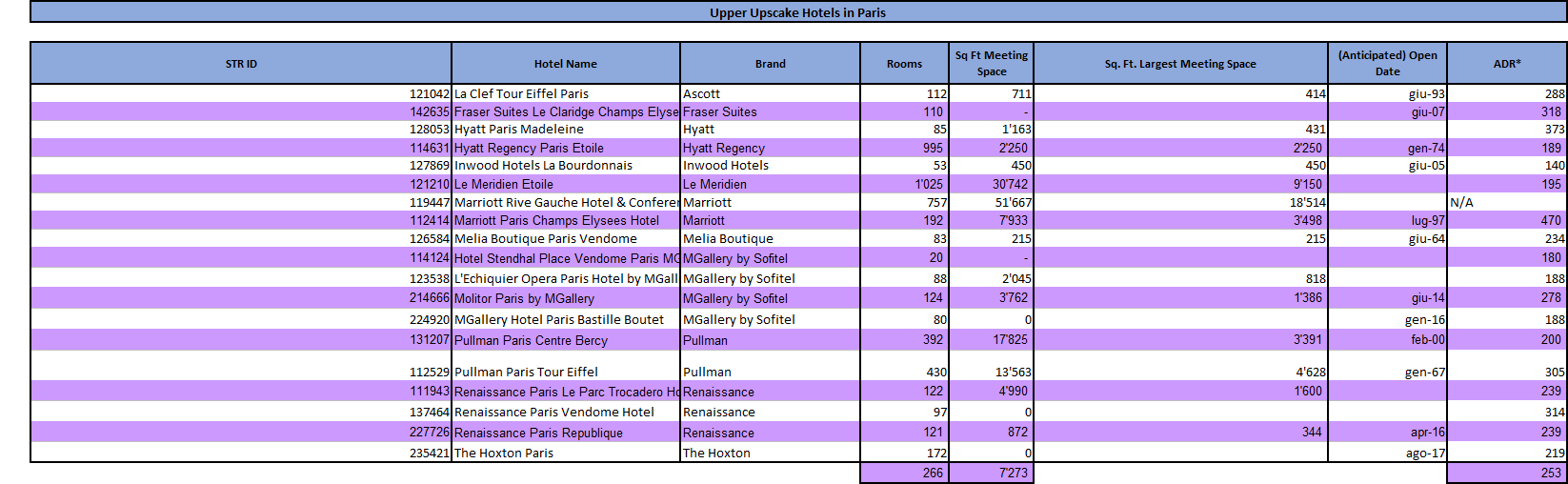

Example 1

投资报告代写 This report provides a market valuation and investment analysis of the Pullman Paris Centre Bercy on behalf of an Open-Ended Real Estate Fund.

EXECUTIVE SUMMARY

This report provides a market valuation and investment analysis of the Pullman Paris Centre Bercy on behalf of an Open-Ended Real Estate Fund. The target property is a 392 upper-upscale hotel, opened in February 2000 and located in Paris’s Bercy neighborhood. The hotel offers a wide selection of services, including a Spa, a fitness center. A swimming pool, a lounge bar, a restaurant, a co-working space, a banquet room. And 17’825 square feet of meeting space. However, the property is part of a highly competitive market. Which has been strongly hit by the COVID-19 pandemic. With the market demand for upper-upscale properties dropping by 77.9% in one year (Appendix 1). The valuation and investment analysis was therefore based on the current economic situation.

The report firstly presents a 2-stage discounted cash flow valuation of the property. Assuming an initial phase of recovery, followed by a growth phase at a constant ADR growth. The outcome of our valuation is a market value of 109’100’000€ which, taking into consideration a 10% purchase discount, leads to a likely purchase price of 98’190’000€. However. As the information about the property and market in our possession was limited. We had to base our market valuation on multiple assumptions, presented in the following sections of the report. Hence, this could have led to overvaluation or undervaluation of the property. 投资报告代写

The second part of the report includes a detailed investment analysis for this project, considering multiple scenarios with different sources of financing.

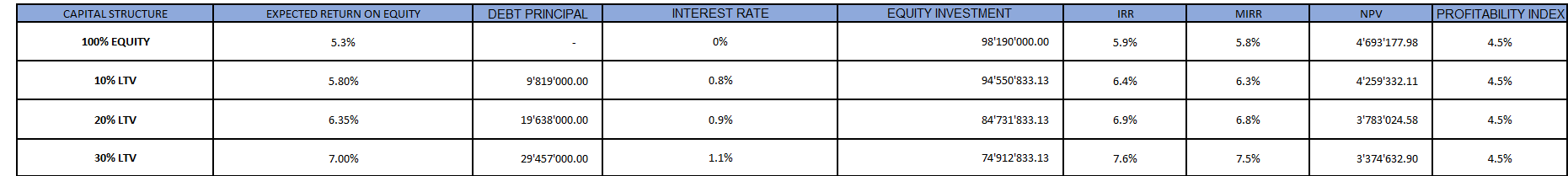

Our analysis concludes that the property results to be a suitable and profitable investment for your fund. As all the metrics we employed prove the investment to create value for your fund and to return a premium to investors. Our report suggests financing this investment with 30% of funds originated from an interest-only loan requiring an interest rate of around 1.1%. And the remaining part with the fund’s equity. This particular capital structure would allow the investment vehicle to generate an expected 7.0% return on equity, IRR and MIRR of 7.6% and 7.5%, respectively. And a net present value of the project of 3’374’633€ which. Considering the initial equity investment required, translates into a 4.5% profitability index.

The report concludes that Pullman Paris Centre Bercy represents a great investment opportunity for your fund. Through this acquisition, you could take advantage of the current market instability. And low interest rate environment and purchase a great property at a fair market value. Furthermore, with an investment horizon of 10 years. This property could lead to great excess returns for your investors. While allowing the fund to be exposed to an appropriate amount of risk since our proposition does not exceed the maximum LTV of 30%.

MARKET VALUATION 投资报告代写

Given the current market outlook, still highly influenced by the COVID-19 pandemic. We separated our subject property’s expected performance into two phases: the first phase, starting on the 1st of June 2021. And ending on the 31st of May 2024, will be a recovery phase. In which our target property will return to pre-pandemic financial results; the second phase, instead, will be a growth phase, in which the hotel will maintain a constant ADR growth rate, that we will determine later. When estimating the duration of the recovery phase for our target hotel. We considered that the average accommodation GDP is expected to go back to pre-pandemic levels in Q1 2022 (Riaz & Tress, 2021).

However, the Pullman Paris Centre Bercy is more vulnerable to COVID-19 effects compared to the average property since it is a full-service property in a primary urban market. Has a large portion of foreign guests, belongs to the upper-upscale category. And attracts many conference and groups clients (Riaz & Tress, 2021). Therefore, we expect its recovery phase to be much longer than for the average hospitality business. In particular, we expect the hotel to generate pre-pandemic RevPAR at the end of fiscal year 3 (end of May 2024).

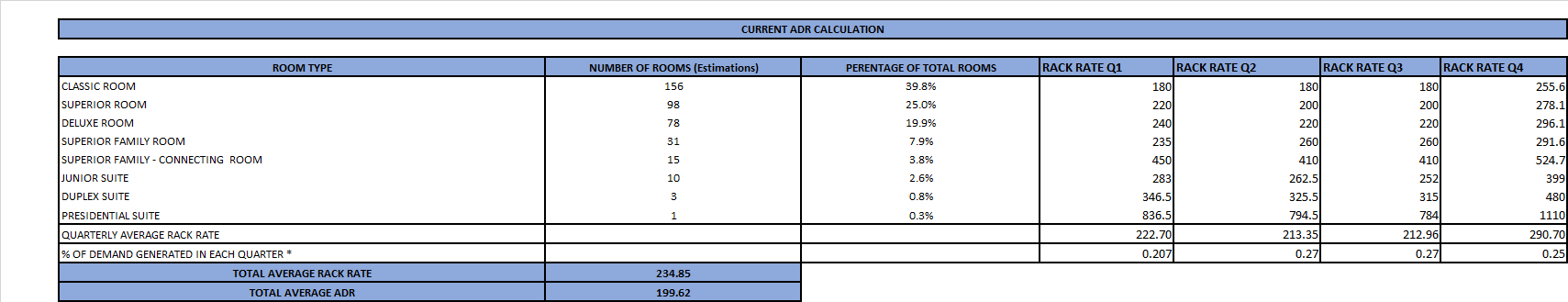

Regarding the ADR growth in the first phase, we have to consider that this KPI dropped by 10% in 2020 (Appendix 3); therefore. We predict ADR to grow by 11.11% in the next three years (CAGR in ADR of 3.56%). As we did not know the ADR of our target hotel in 2019 and 2020. We first gathered from the hotel website (https://www.pullmanpariscentrebercy.com/en/) the rack rates for a 1-night stay in each type of guest room.

In order to account for seasonality, we repeated this process for the months of February, May, August, November (one month per quarter).

After having estimated the number of rooms for each room category, we calculated the average rack rate per quarter (Appendix 8). Consequently, with the percentage of hotel demand generated per quarter in 2019 (Appendix 15). We calculated the weighted average yearly rack rate (we employed 2019 demand as 2020 data were distorted, due to COVID-19). Finally, we calculated the estimated yearly ADR by discounting the rack rate by 15%. As suggested in the case study instructions, leading to an estimated value of 199.62€. Since we expect the recovery from the pandemic to be relatively slow, we assumed the ADR we calculated with current rates still reflects the prices of 2020. Hence, as stated previously, we expect this KPI to grow at a yearly 3.56% in the first three years, leading to an ADR of 221.71€ at the end of year 3. 投资报告代写

To estimate the ADR growth rate for the second phase. We first calculated that the ADR CAGR experienced by upper-upscale hotels in Paris between 2000 and 2019 was 1.75% (data from Appendix 14). However, even if the harmful effects of the pandemic have been significantly higher on market demand, compared to market supply (Appendices 1 and 2). We expect market demand to recover way more rapidly in the next years. Hence, we have reason to believe that this will lead to excess demand in the market, resulting in a higher-than-average ADR increase after 2023. Consequently, we applied a 0.35% premium to the historical ADR growth rate.

To find an estimation of the depreciation rate for upper-upscale hotels in the Paris area. We run a regression using the age of the hotels in the sample as the independent variable, and their ADR as dependent variable.

However, we decided to ignore the regression’s results since its R squared was extremely low (1.77%). And our x variable had a p-value above 5% (69.6%), meaning that our regression was not statistically significant. Hence, we decided to base our depreciation calculation on the benchmark we studied in class of 1%. But we applied a 20% discount to this average. As our subject property is among the most recently opened (Appendix 4), leading to a forecasted depreciation of 0.8% per year. Concerning the historical and expected future inflation rates, we utilized the benchmarks studied in class of 2.2% and 2.3%, respectively. In conclusion, our estimated yearly ADR growth rate from year 4 will be 1.4% (Appendix 17).

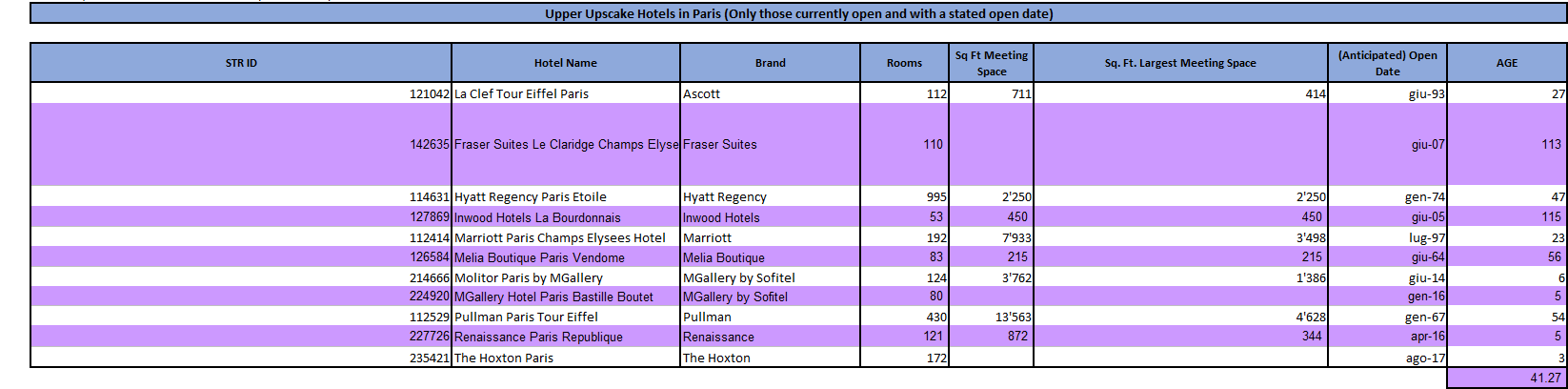

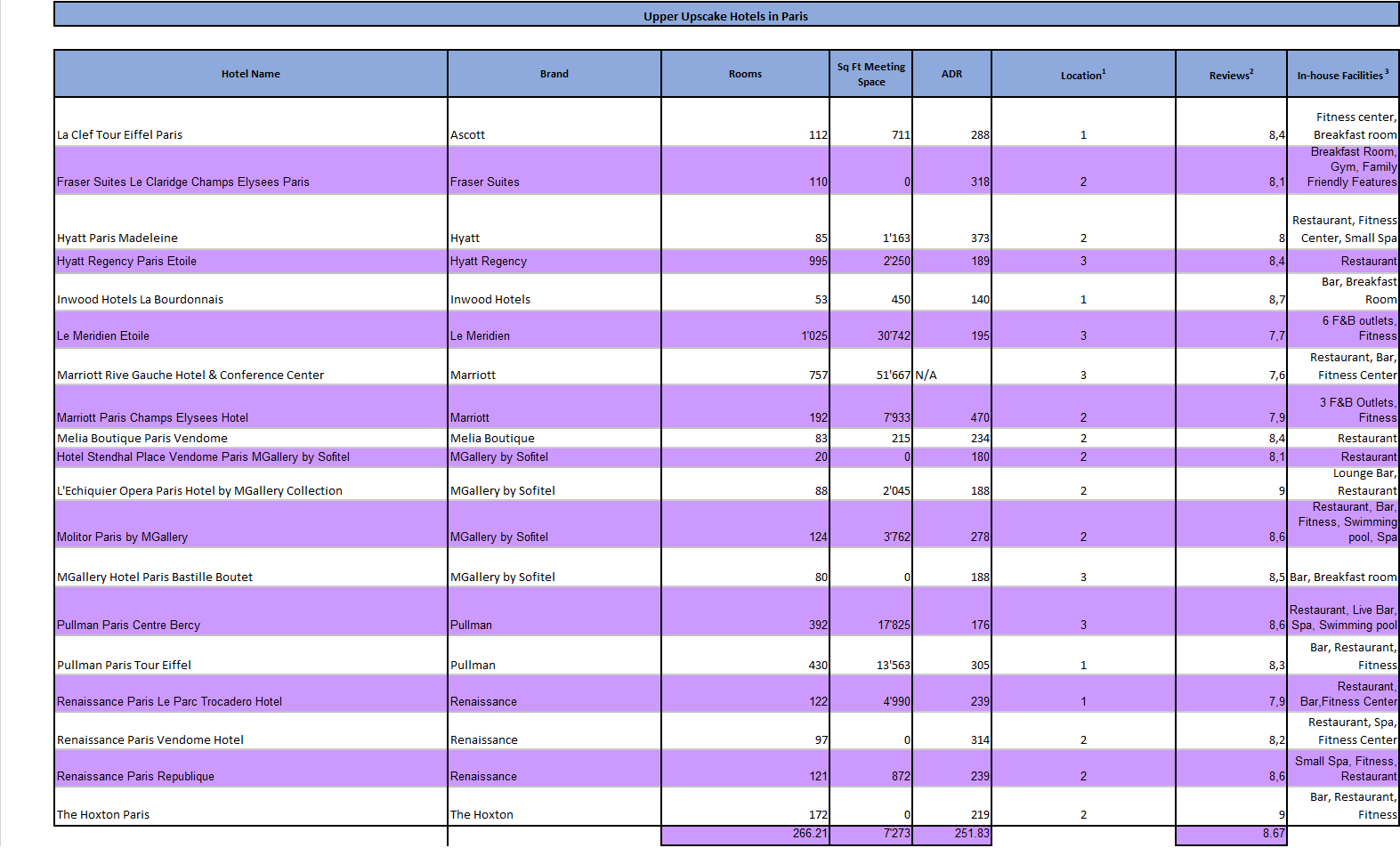

Since we were not provided with our target hotel’s historical occupancy. We compared the hotel with its competitors to find potential differences affecting occupancy. Thus, we assumed demand to be driven by four main factors in Paris: the property’s location, online reviews. The facilities available in-house, and the dimension of meeting space. For the valuation of the properties’ location. We attributed each hotel in the market a grade between one and three, one being a top location, on a relative basis. Even if we assigned a grade of three to our target property, from a guest reviews perspective the hotel is in line with the market average and, concerning the facilities. It is among the only three hotels offering a complete Spa facility and at least two F&B services.

Finally, our target hotel’s meeting spaces are larger than the average (Appendix 7). In conclusion, the benefits brought by a better-than-average facility proposition and by the larger-than-average meeting space are offset by the non-optimal location; hence we expect our target property’s 2019 occupancy to be in line with the market (71,47% ).

We then tried to estimate whether COVID-19’s effects on occupancy could be different on our target property, compared to the market average. 投资报告代写

Since our property’s meeting spaces are considerably higher than competitors’ (Appendix 5). We assume the hotel generates high revenues from groups and corporate guests. Which enhances the negative effects of COVID-19 on occupancy (Riaz & Tress, 2021). At the same time, our target hotel’s ADR falls way below the competitors’ average (Appendix 5), meaning we can forecast a lower impact of COVID-19 on occupancy (Riaz & Tress, 2021). To conclude, we forecasted that these two opposite effects offset each other. And we predicted our target hotel’s occupancy rate to be equal to the market average also in 2020 (25,16%). Therefore, as we expect the hotel’s occupancy to return to pre-pandemic levels in fiscal year 3. We calculated that occupancy will grow by 41.62% per year in the first three years.

In order to estimate the expected occupancy growth after year 3. We started by analyzing the market’s historical benchmark: yearly occupancy has not experienced a clear trend in the last 20 years but has mainly followed macroeconomic business cycles, showing an average of 72.6% (Appendix 6). Since, as seen before, we expect our target hotel’s occupancy to be in line with the market. We forecasted an occupancy of 72.6% starting from year 4. And we expect this percentage to remain fixed until year 10 since, as explained before. It is hard to find a clear trend in the market occupancy. After having calculated ADR and occupancy for the whole 10-year period. We calculated yearly room revenues by multiplying the yearly RevPAR times the number of available rooms in each year. 投资报告代写

Concerning the Going-in Cap rate, we used, as base for our calculation, the 2020 cap rate of prime hotels in the city of Paris of 3.6% (Source: Knight Frank).

Then, using data from the CBRE North America Cap Rate survey, we calculated the Cap rate discounts for CBD properties (4.72%) and for full-service hotels (3.41%) over the average hotel. We then estimated a Cap rate premium of 0.7% due to our target property’s sub-optimal location. And a 0.5% Cap rate discount because the hotel’s building is younger than the market’s average. We did not apply any premium for the hotel’s positioning in the competitive set as we did not want to double-count factors we already considered. And did not find any other element with a relevant influence on the property’s risk. We finally added a 1.5% risk premium for COVID-19 related risks, leading to a going-in CAP rate of 5.01%.

Since we expect the COVID-19 risk premium to drop substantially from 2021 to 2024 (from 1.5% to 0.5%). 投资报告代写

We estimated a different cap rate for the growth phase after year 4 (4.01%). Subsequently. Since these Cap rates are based on NOI, we then multiplied the going-in cap rate times the PBTCF to NOI ratio in year 1 (73.35%). And the NOI-based cap rate in year 4 times the PBTCF to NOI ratio in the same year (73.74%), resulting in adjusted Cap rates of 3.65% and 2.96%.

Therefore, with the ADR growth rates we calculated previously. We are able to infer that our estimated discount rate for the recovery phase is 7.24%, and the discount rate for the growth phase will be 4.36%. For the going-out cap rate calculation. We decided to add the benchmark of 0.5% studied in class to the cap rate of year 4. We did not base our going-out cap rate on the going-in cap rate because it would have led to an overestimation of the former since it would have included a 1.5% COVID-19 risk premium.

For the estimation of the F&B revenue, we made the following considerations: since most of our target hotel’s competitors have a better location, they can attract more external guests and tempt more in-house clients to dine in-house.

On the other hand, our target property’s higher-than-average meeting space surface. And banquet room will generate larger Conference. And Banqueting F&B Revenues. In conclusion, we estimated that these two elements offset each other; hence our hotel will follow the average benchmark from 2015 to 2019 for what concerns the amount of F&B revenues over room revenues (37.7%). Regarding the estimation of Other Operated Departments Revenues as a percentage of room revenues. We applied a 5 percentage points premium to the market average of 2.14% since the Pullman Paris Center Bercy, as seen before, will generate higher meeting spaces rental revenue and Spa revenues, compared to the average competitor. These assumptions led to OOD revenues of 752’545.27€ in year 1. 投资报告代写

For the Miscellaneous Income as a percentage of room revenues, we believe our target hotel will be in line with the market benchmark (3.06%). We then estimated that F&B Revenues, OOD Revenues. And Miscellaneous Income will remain constant as a % of rooms revenues for the first three years and will then grow by a yearly 2.3% (inflation rate) from year 4. We decided to keep these revenues constant in percentage in the recovery phase because, in this phase, we expect room revenues to grow at a very paced speed. Consequently, we also think that other departmental revenues will follow the same growth.

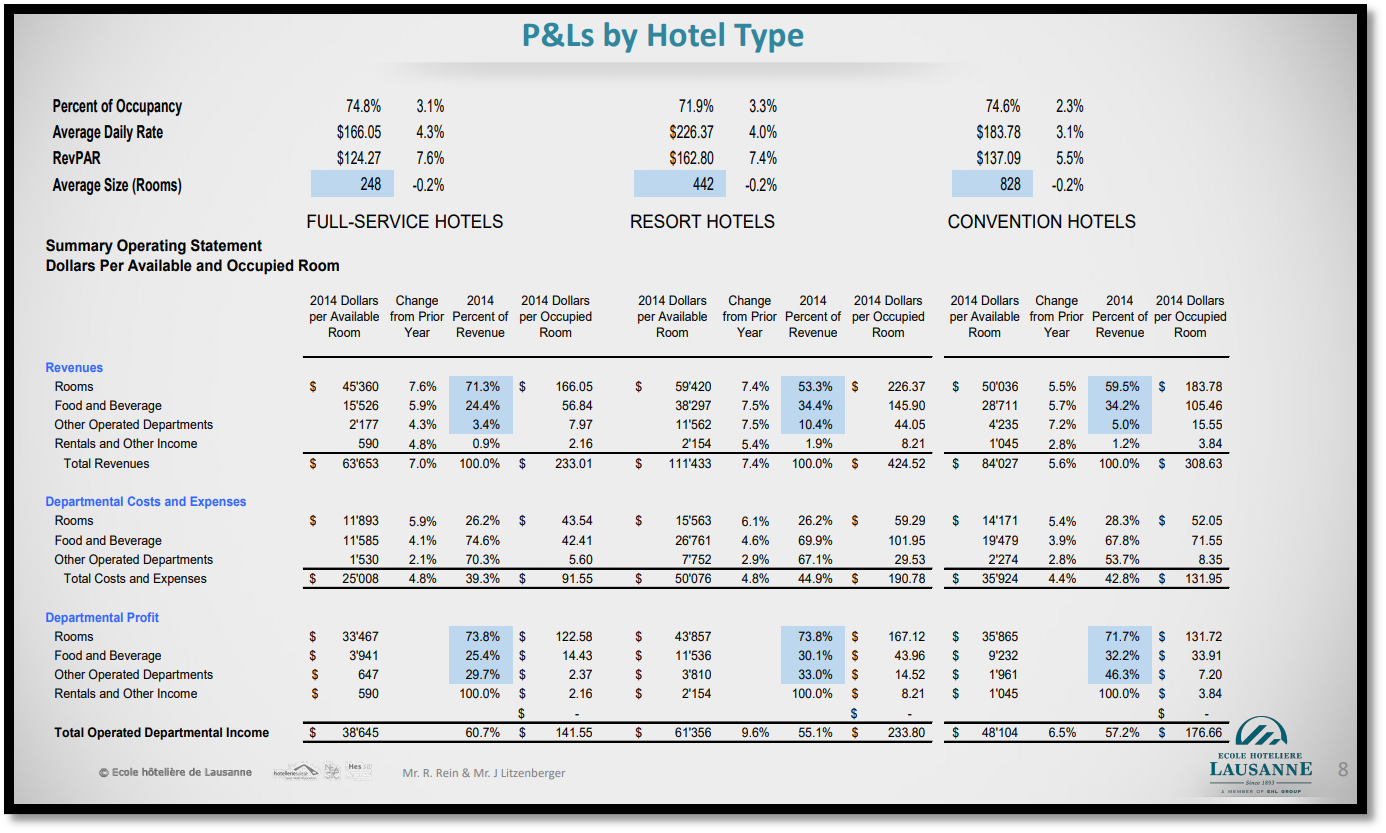

Regarding the F&B departmental expenses, the market average from 2015 to 2019 has been 95.48% of F&B Revenues. However, we assume that our target property will benefit from having a relevant portion of F&B Revenues coming from banquets and conventions. In fact, on average, convention hotels have a lower percentage of F&B espenses (Appendix 9).

Consequently, we decided to apply a 10 percentage points discount to the market average of F&B expenses as a percentage of F&B revenues. 投资报告代写

In addition, we expect the market OOD expenses as a percentage of OOD Revenues (90.3%) to be 10 percentage points higher than the same metric for our target property since the rental of our meeting spaces generate OOD revenue with very low departmental expenses. Concerning the percentages of Room Expenses and Undistributed Expenses. We expect our hotel to follow the market averages, as we do not have relevant information that leads us to a different estimation. Moreover, we forecast that in the first 3 years, all departmental expenses will remain fixed as a percentage of the related department’s revenues. And that all undistributed expenses will remain fixed as a percentage of total revenues, for the reason explained before. All these expenses accounts will then grow by a yearly 2.3% (inflation rate) from year 4.

Concerning the estimation of franchise and management fees, from Accor’s website (https://group.accor.com/en/hotel-development/brands/Pullman). We have assumed that our subject property has a management agreement and a franchise agreement with Pullman. Hence, we expect the property to pay a franchise fee (part of S&M expenses), a base management fee. And an incentive management fee to Pullman. As we could not retrieve any specific information about Pullman’s fees. We estimated that all these costs, in percentage points, will be equal to the market averages.

In regards to the Non-operating income and expenses, we expect our property to match the market benchmark of costs as a percentage of total revenues. 投资报告代写

Concerning the replacement reserve, the average market value as a percentage of total revenues over the 5 years (2.8%) is significantly lower than the benchmark for full-service hotels seen in class (8.1%). Therefore, we calculated the replacement reserve for our target hotel as the average of the market benchmark. And the metric seen in class, leading to a result of 5.45%. We expect the replacement reserve and the non-operating expenses to remain fixed as a percentage of total revenues in the first three years and to grow at the inflation rate from year 4. (All revenues and expenses benchmarks mentioned in this paragraph were retrieved from the STR Profitability Report Paris – All segments).

After having calculated the PBTCFs for each of the next ten years and the discount rates for the two different growth phases. We estimated the transaction costs for a hotel purchase in France. 投资报告代写

According to the CMS guide to hotel real estate transaction costs in Europe (CMS, 2013). A hotel buyer in France must pay a 5.09% fee for the transfer of duty, a 0.1% fee for the land registration, a 0.83% of notary fee (plus a 19% VAT on this fee). And a legal fee that we estimated to be 0.1% of property sales, plus the correspondent VAT. Insteas, seller’s costs are, on average, inferior to buyers’ costs concerning real estate transactions in France, averaging between 1.8% and 6% (Source: www.globalpropertyguide.com). To account for the likelihood that hotels could require higher costs than the average real estate property, we chose the higher range of the seller’s costs.

In our discounted cash flow valuation. We first calculated the terminal value of our property in year 10, using the direct capitalization method. We then employed a two-stage discounted cash flow method since we are employing two different discount rates for the two growth phases. Therefore, we first discounted all the cashflows after year 4 (including the terminal value) to year 3. Using the discount rate of the second phase (4.36%). Secondly, we discounted the first three years’ cashflows (including the value of the cashflows after year 4, discounted to year 3) to year 0. Using the discount rate for the recovery phase (7.24%). In the end, we obtain a property market value of 109’100’000€ which. Accounting for a 10% sales discount, leads to a purchase price of 98’190’000€.

INVESTMENT VALUATION 投资报告代写

The first step in our leveraged investment valuation was to find the discount rate. And the cost of debt to utilize in the expected return on equity calculation. Since, in the market valuation, we found two different discount rates (one for the recovery phase and one for the growth phase). We now needed to calculate a property discount rate that could include both of them. For this purpose, we concluded that the average discount rate we utilized in the market valuation is equal to the rate of return that makes the NPV of our investment equal to zero. Considering the market value to be the initial investment. Consequently, to find the average discount rate of our property. We made an IRR calculation, resulting in a total discount rate of 5.33% (Appendix 16).

Regarding the cost of debt calculation. We utilized a simple regression to estimate how the interest rates change at different LTV ratios. Using sample of REITs and REOCs retrieved from www.snl.com. These calculations can be found in the “Cost of Debt Analysis” tab of the MS Excel file and led to an estimated interest rate of 0.79% with a 10% LTV, of 0.93% when the LTV is 20%, and 1.07% when the LTV is 30%.

In the investment valuation, we first analyzed the scenario with 100% equity financing: we calculated the unleveraged IRR, NPV. And MIRR of the project, assuming a reinvestment rate equal to the WACC and an unknown financing rate. All these metrics show the investment is creating value: the NPV is widely above zero (4’693’178€). And both the IRR (5.9%) and the MIRR (5.8%) are higher than both the cost of capital (5.3%) and the minimum required return of our investment vehicle (3%).

Then, we conducted the investment valuation for the three different levels of LTV required from our real estate investment vehicle (10%, 20%, and 30%) separately. 投资报告代写

We first analyzed an investment funded with a 10% LTV. The resulting loan principal is 9’819’000€. Which, with an estimated interest rate of 0.8%, leads to a 77’849€ yearly interest payment. The expected return on equity, in this scenario, would be 5.8%, while the leveraged IRR would be 6.4%, representing a positive return for equity investors. Also significantly higher than the minimum required rate of return of 3%. The NPV calculation for the project with a 10% LTV also shows value creation, with an NPV of 4,26 million euros. Finally, the MIRR for this investment is 6.3%, assuming a reinvestment rate equal to the expected return on equity. And an unknown financing rate. Secondly, we calculated the same investment metrics considering a 20% LTV.

This assumption leads to a 19’638’000€ loan principle, 182’825€ yearly interest payments. And 6.35% expected return on equity, which is still more than twice the minimum required rate of return and has also increased from the previous scenario. The leveraged IRR is higher than both the scenario with 0% and with 10% LTV, reaching the value of 6.91%. And is 57 basis points higher than the estimated cost of equity, showing strong value creation. The MIRR has grown from the previous scenario, too, again considering a reinvestment rate equal to the expected return on equity. Finally, the newly calculated NPV experiences a slight drop from the previous analysis. Thirdly, in the scenario with a 30% LTV, the expected return on equity increases even more (7.00%). And the same do the leveraged IRR (7.58%) and the MIRR (7.48%). The only value that keeps on decreasing is the NPV.

Therefore, from this analysis, we can conclude that this investment would lead to value creation, regardless of whether the company decides a 10%, 20%, or 30% LTV. Therefore, we would definitely encourage the fund to invest in this project.

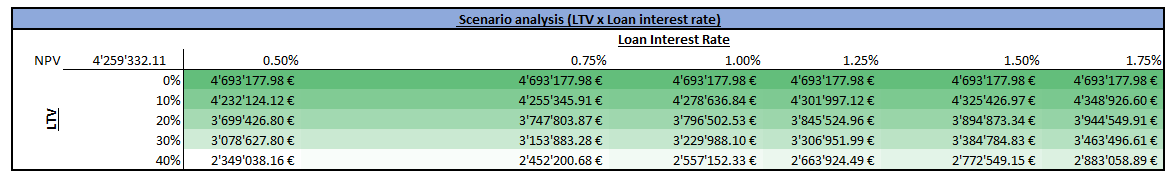

Regarding the best source of financing, we can see contrasting results from the metrics we calculated: with a higher LTV ratio. The expected return on equity, the IRR. And the MIRR show an increasing return for equity investors, concluding that a 30% LTV ratio would be the optimal level of leverage; however, the NPV shows the investment without leverage to be the most profitable (Appendix 10). The fact of having an NPV contrasting with all the other investment metrics was, in our opinion, unusual and counter-intuitive.

Moreover, in the case of mutually exclusive projects. We know that the NPV is one of the best metrics to chose the optimal investment; therefore, we chose to investigate more profoundly the contrarian behavior of NPV. In particular, we concluded that one of the main reasons for an NPV having an inverse relationship with the LTV (in the 10%-30% LTV range) is the environment of low interest rates.

If we go back to the expected return on equity calculation (Rp + D/E(Rp- Rd)). 投资报告代写

We can see that, in a scenario of low interest rates, the premium of the property return over the cost of debt is very high. Hence, even a very slight increase in the debt-equity ratio leads to a massive increase in the expected return of equity.

This causes the expected return on equity to grow faster than the present value of future cash flows, which leads to a decreasing NPV. In order to check whether our assumptions were correct. We conducted further scenario analysis. Appendices 12 and 13 show that. With interest rates higher than 5%, the NPV increases when the LTV ratio grows from 10% to 30%. This study enforces our opinion that the negative relationship between NPV. And LTV ratio (considering, again, the 10%-30% LTV range) is mainly caused by the low interest rates environment.

After having explained the behavior of NPV, we made an even stronger reasoning against the reliability of NPV in our analysis.

This ratio, in fact, provides a result in euro amounts, meaning it ignores the amount of money invested to obtain those returns. Hence, in order to have an even better perspective on NPV. We calculated, for each of the scenarios under scrutiny. The Profitability ratio, meaning the NPV divided by the initial investment (Appendix 10). The results show that this ratio remains relatively stable at 4.5% in all the scenarios, thus supports the conclusion the Pullman Paris Centre Bercy hotel represents a solid investment. And shows that, according to the relationship between the initial equity investment and the NPV produced by the project. The choice of different sources of financing does not change the return of equity investors.

To conclude, we think it is reasonable to ignore the results of NPV when choosing the optimal capital allocation for our investment vehicle. Therefore, we believe the hotel should adopt a 30% LTV investment strategy. Taking a 29’457’000 interest-only loan at a 1.1% yearly interest rate. This enables the investors to receive an expected return on equity of 7.00%, an IRR of 7.6%. And a MIRR of 7.5%, which all exceed the 3% required rate of return by more than 100%. In addition, this investment does not expose your fund to an excessive amount of risk. As we did not surpass the maximum amount of debt financing of 30% of the asset value.

APPENDICES: 投资报告代写

Appendix 1

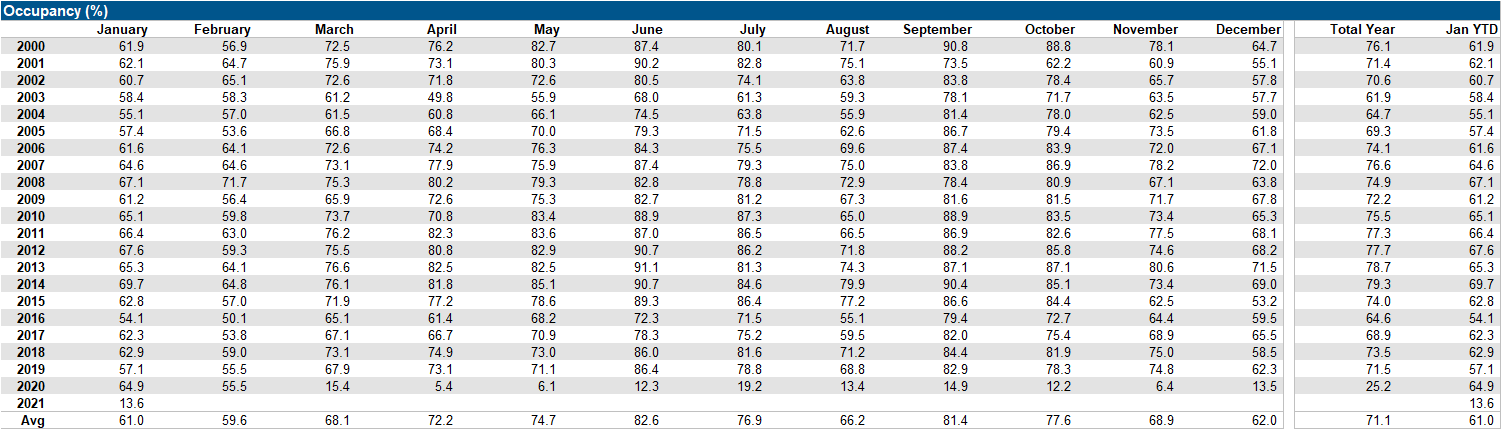

(Retrieved from the STR Trend Report Paris – Luxury Upper Upscale)

Appendix 2

(Retrieved from the STR Trend Report Paris – Luxury Upper Upscale)

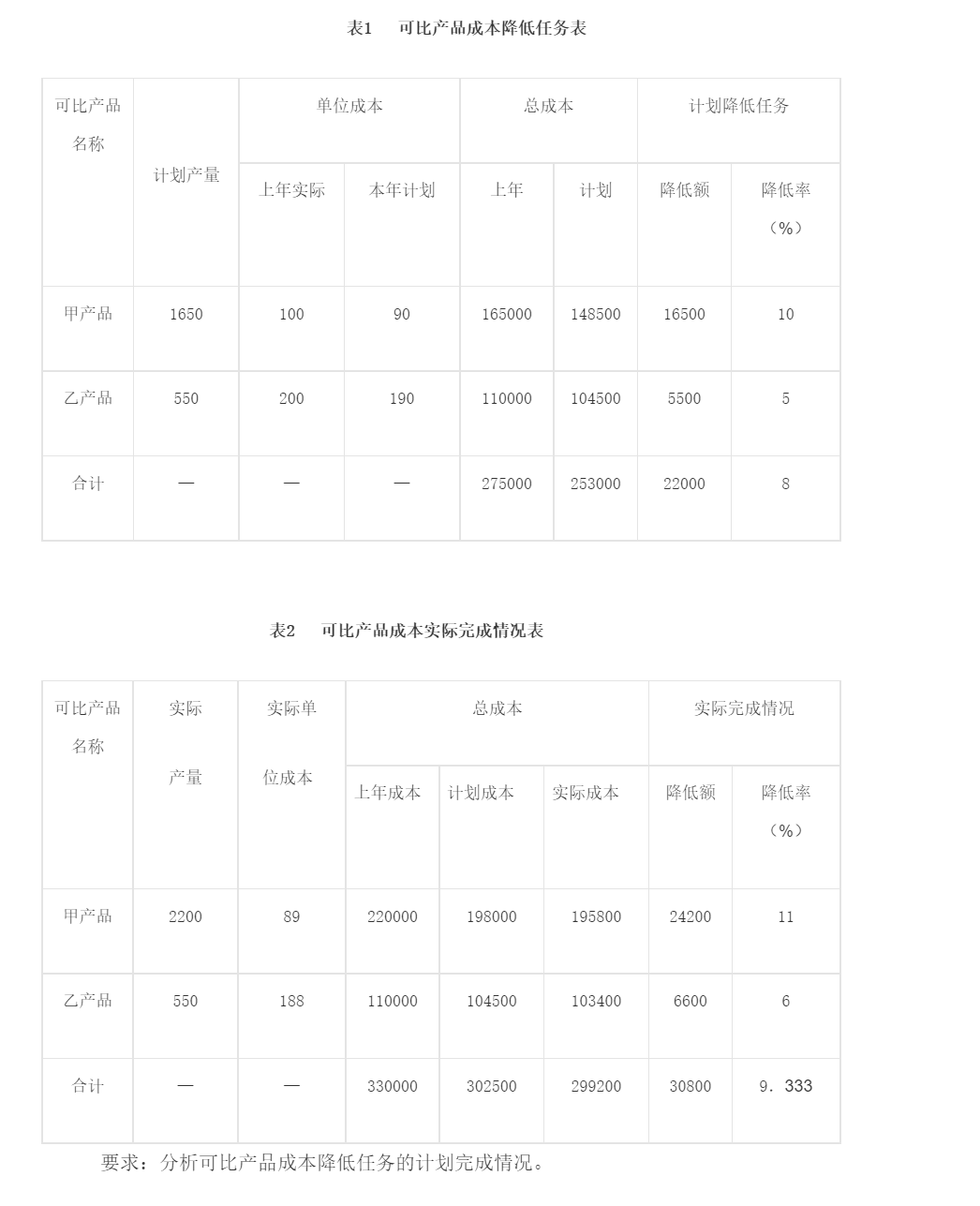

Appendix 3

(Retrieved from the STR Trend Report Paris – Luxury Upper Upscale)

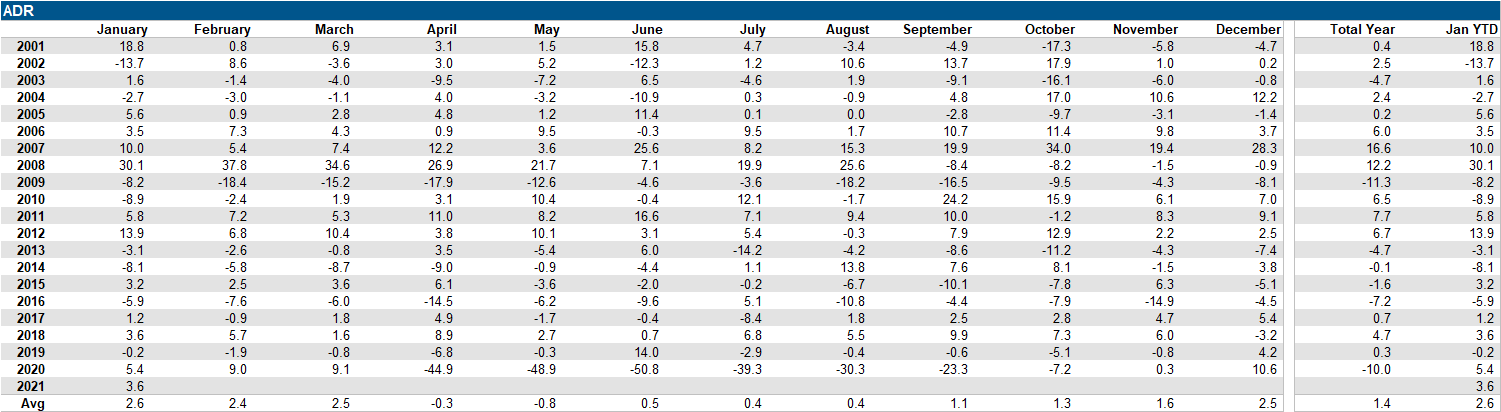

Appendix 4

(Data retrieved from the STR Pipeline Paris report)

Appendix 5

(Data retrieved from the STR Pipeline Paris report and from our calculations)

(*data retrieved from Booking.com and hrs.com)

Appendix 6

(Retrieved from the STR Trend Report Paris – Luxury Upper Upscale)

Appendix 7

(Data retrieved from the STR Pipeline Paris report, from Booking.com, and from each hotel’s website)

Appendix 8

(*Calculations based on data from the STR Trend Report Paris – Luxury Upper Upscale)

Appendix 9

(Image retrieved from slide 6 of Professor John Litzenberger’s Power Point Presentation: “Session 5 – Rooms dept – pre”)

Appendix 10

Appendix 11

Appendix 12

Appendix 13

Appendix 14

(Retrieved from the STR Trend Report Paris – Luxury Upper Upscale)

Appendix 15

(Retrieved from the STR Trend Report Paris – Luxury Upper Upscale)

Appendix 16

Appendix 17

REFERENCES: 投资报告代写

CMS (2013). CMS Guide to Hotel Real Estate Transaction Costs in Europe

Global Data (2020, December 17) Tourism Destination Market Insights: Western Europe (2020) https://tourism.globaldata.com/Analysis/details/tourism-destination-market-insights-western-europe-2020

Global Property Guide (2015, January 19). Transaction costs are moderate to high in France. https://www.globalpropertyguide.com/Europe/France/Buying-Guide

Riaz, U. and Tress, B (2021, March 8). How to better forecast recovery in the hospitality industry Ernst and Young. https://www.ey.com/en_us/real-estate-hospitality-construction/how-to-better-forecast-recovery-in-the-hotel-industry

STR Pipeline Paris Report

STR Profitability Report Paris – All Segments

STR Trend Report Paris – Luxury Upper Upscale