Report on Portfolio Analysis

Portfolio Analysis代写 Portfolio analysis has always been an interesting and absorbing topic in the study of Finance.Capital Asset Pricing Model (CAPM)

Introduction Portfolio Analysis代写

Portfolio analysis has always been an interesting and absorbing topic in the study of Finance. One of the fundamental question in Finance is how to tradeoff between profit and risk. Markowitz (1952) provides the first systematic method for solving the problem, which revolutionize the study of Finance. In his paper, he proposes a mean-variance approach to set up a model that are both general enough for practical situations and simple enough to be numerically solved, which serves as a classic framework for the study of portfolio analysis. Another fundamental question in Finance is to price assets under uncertainty.

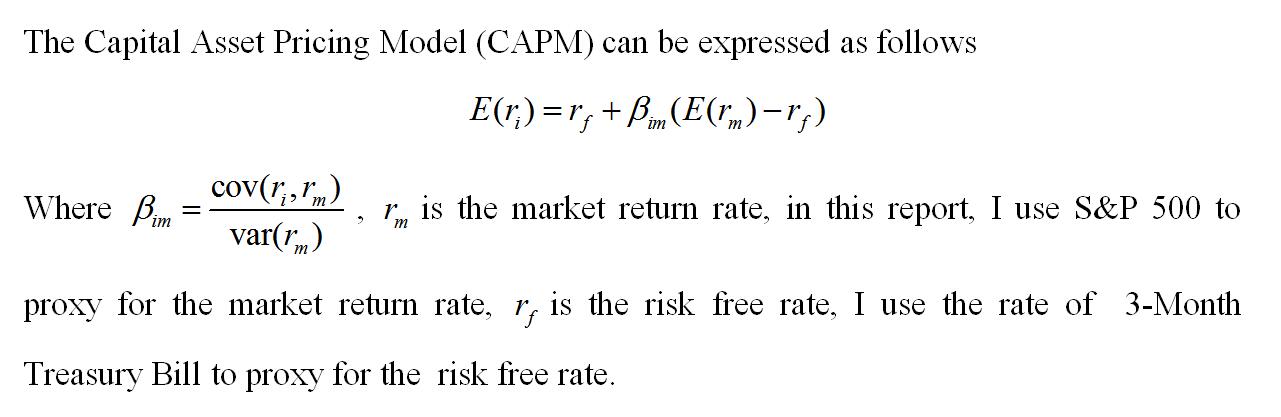

The Capital Asset Pricing Model (CAPM) proposed by Sharpe (1964) and Lintner (1965) provides a start point and a benchmark in answering this question. About fifty years later, Capital Asset Pricing Model (CAPM) is still widely used both theoretically and practically. When evaluating the performance of portfolios, Capital Asset Pricing Model (CAPM) still provides one of the most useful framework.

In this report, I will conduct a portfolio analysis from two parts.

In the first part, I will construct stock portfolios and compare their performance within the framework of Capital Asset Pricing Model (CAPM). In the second part, I will propose a trading strategy and evaluate its performance on the market.

The Construction of Portfolios Portfolio Analysis代写

In this section, I will construct two portfolios of stocks and compare their performance.

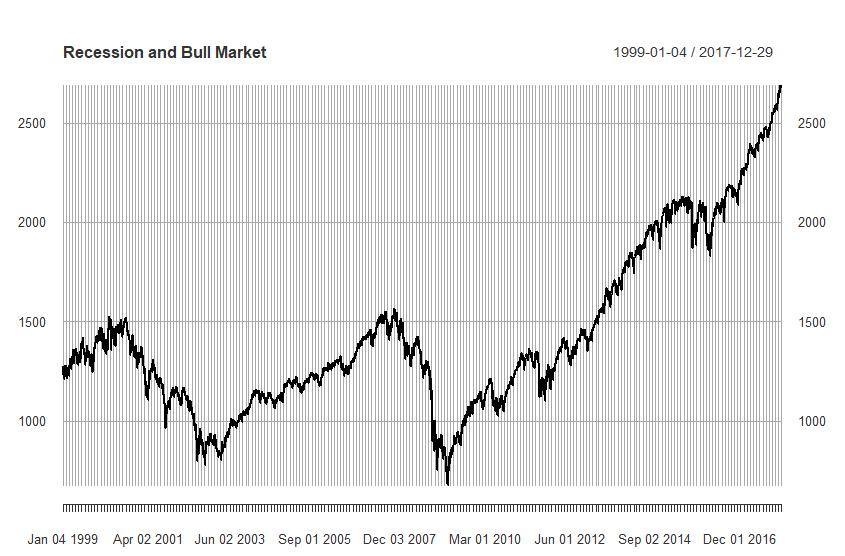

The data I use is from January 2001 to January 2018, which cover the periods of recession and bull market. Here I use the return of S&P500 as an indicator for recession and bull market. When the yearly return of S&P500 is greater than 20%, I define the year as bull market year. When the yearly return of S&P500 is less than -20%, I define the year as recession year. Based on this criterion, year 2002 and year 2008 are the recession year.

In year 2002, the bubble of Internet company bursts, which leads to a great decrease in stock market. In year 2008, the great recession begins, which causes a huge plunge in stock market. In year 2003, year 2009, year 2013, the stock market begins to recover and the yearly returns of S&P500 are greater than 20%, suggests a bull market starts to form. The returns of S&P 500 are depicted in the following figure.Portfolio Analysis代写

To construct the portfolio, I choose the firms which have a relatively long history of data.

That is, I will focus on the firms who have the data at least cover the period of January 2001 to January 2018. In this report, I will construct two main portfolios. The first portfolio is comprised of the most prestigious firms of various traditional industries. To be specific, I choose the stocks of five traditional companies that comes from different industries in the first portfolio, they are Coca-Cola Company, AT&T company, Walmart company, Ford company and CVS company.

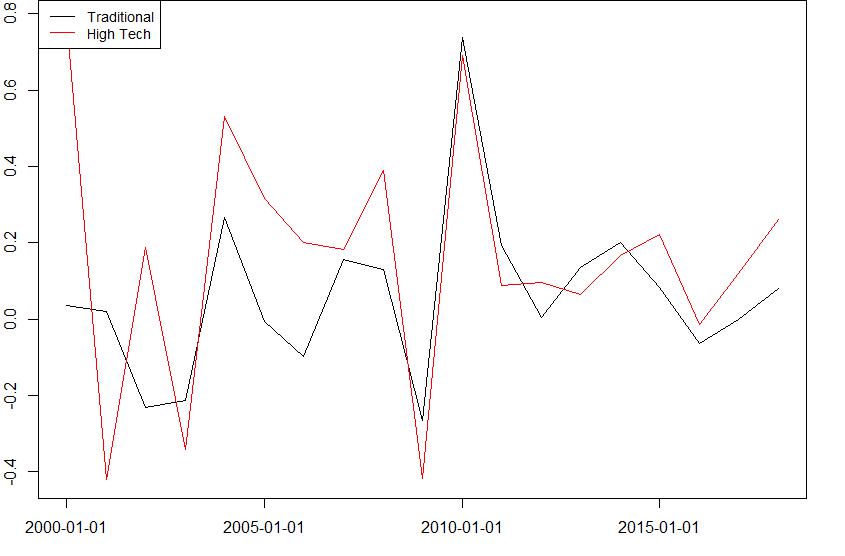

The second portfolio is comprised of the most prestigious firms of high technology. To be specific, I choose the stocks of five high technology companies in the second portfolio, they are Apple company, IBM company, Microsoft company, Intel company and CISCO company. A simple and natural way to construct the portfolios is to set weights to be the equal for all the companies in the two portfolios. The yearly return of the two portfolios are as follows

We can see the high technology portfolio generally has a higher return and higher volatility than traditional portfolio.

Evaluation under CAPM Portfolio Analysis代写

After constructing the portfolios, we can evaluate their performance under the framework

of Capital Asset Pricing Model (CAPM).

After calculating in R, we get the beta for the traditional portfolio is 0.9689, the beta for the high technology portfolio is 1.4215. These results suggest that the traditional portfolio we choose is quite close to the S&P 500 and the high technology portfolio is more aggressive than the traditional portfolio.Portfolio Analysis代写

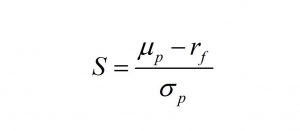

A good measure for the performance of portfolios is Sharpe Ratio, which measures the average excess return to the risk per unit. Sharpe Ratio is expressed as

After calculating in R, we get the Sharpe Ratio for the traditional portfolio is 0.1348, the Sharpe Ratio for the high technology portfolio is 0.4090. These results suggest that the high technology portfolio has a much higher risk-adjusted excess return than that of traditional portfolio.

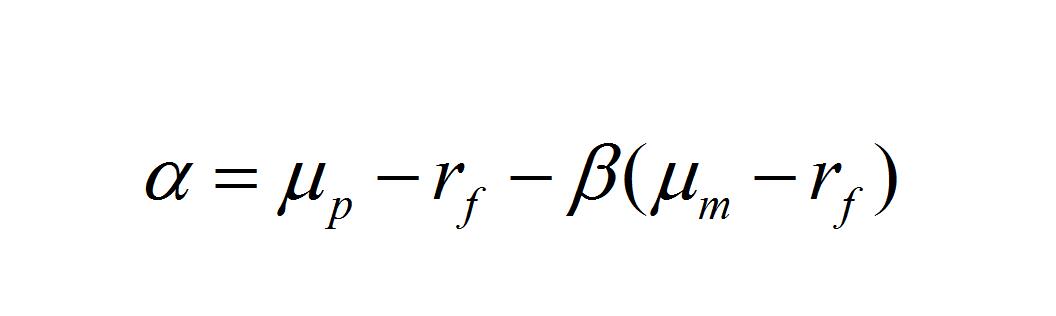

Another index which is useful for evaluating the performance of portfolios is Jensen’s alpha, which is used to measure the abnormal return of a portfolio over the theoretical expected return. Jensen’s alpha is expressed as follows.

After calculating in R, we get the Jensen’s alpha for the traditional portfolio is 0.0046, the Jensen’s alpha for the high technology portfolio is 0.0953. These suggest that the high technology portfolio has a much higher abnormal return than traditional portfolio.

Therefore, based on the CAPM framework, the high technology portfolio has a better performance than traditional portfolio. Note that we may assign weights based on previous information for the portfolios to improve their performance. This is can be further studied in the future.

Trading Strategy Portfolio Analysis代写

In this section, I will propose a trading strategy and evaluate its performance on the stock market. Technical analysis method is used on constructing the trading strategies.

Here I will use the stock of Apple company as an example for the trading strategies.

The strategies we use are mainly based on the indicator of Moving Average Convergence Divergence (MACD) and Bollinger bands (BB). I will propose two trading strategy based on these two indicators. I choose closing price of the stock of Apple to calculate the averages. The trading strategy is simulated on the data between January 2016 to December 2017. Note that technical trading strategies only use past trading information on the analysis and the information is known when we make transactions based on the t technical trading strategies. It is not so necessary to leave some data out of sample. So, we do the simulation with the data of most recent two years.Portfolio Analysis代写

In the trading strategy based on Moving Average Convergence Divergence (MACD), two averages of closed prices are computed at first: a slow-moving average and a fast-moving average. The difference between the them is called MACD line. We also need to calculate the third average: a 9-day exponential moving average of MACD, this third average is used as MACD signal line. If the MACD line crosses above the signal line then it is a buying sign and we buy the stock. If the MACD line crosses below the signal line then it is a selling sign and we sell the stock.

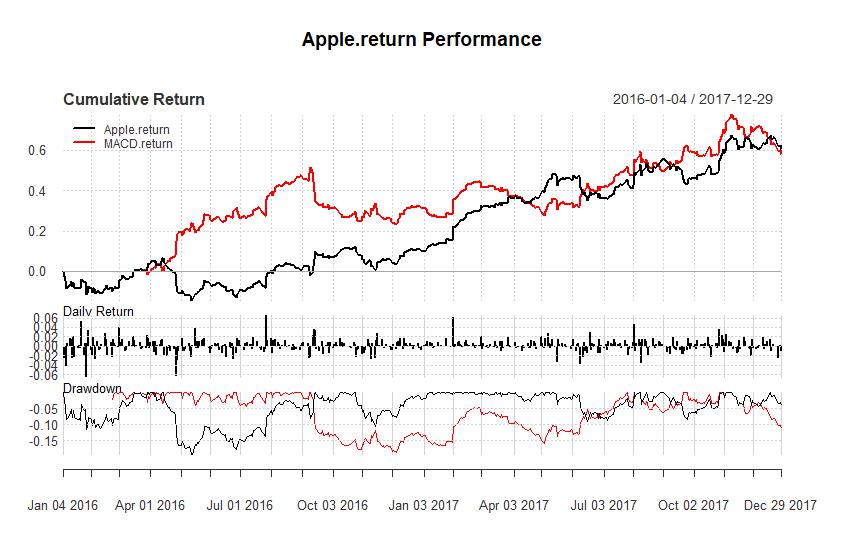

To be specific, my Moving Average Convergence Divergence (MACD) trading strategy is to buy 1 share of Apple stock if yesterday’s closed is higher than the signal line and sell it at the end of the day, and to sell 1 share of Apple stock if yesterday’s closed is lower than the signal line and close the short position at the end of the day. Assuming no transaction cost, the result of the trading strategy is as follows

From the result, we can see that our trading strategy provides a cumulative return tends to be even better than the cumulative return of Apple stock.

Note that Apple stock gives a return of about 10% in 2016, but with my trading strategy, the return is about 30%. In most of the time, the return of this trading strategy provides a return even higher than Apple stock. With this trading strategy, the cumulative return is about 60% for just two years, which is quite high.Portfolio Analysis代写

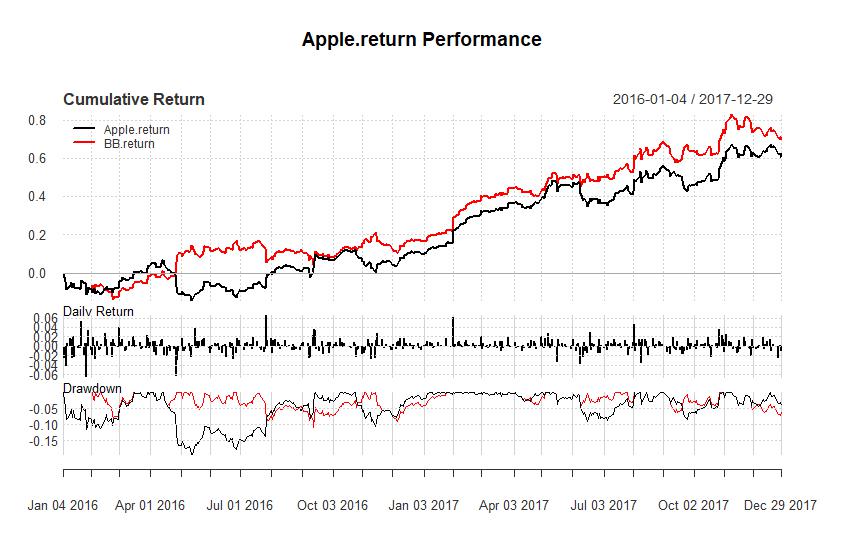

Bollinger bands (BB) analyzes the band around the price movements of an asset. The band is based on standard deviations and a moving average. Bollinger bands have three lines, upper, middle and lower. The middle line is a moving average of prices. Bollinger bands help analyze how strongly the price is rising, and when the stock is potentially losing strength or reversing the trend. My Bollinger bands (BB) trading strategy is to buy 1 share of Apple stock if yesterday’s closed is higher than the middle line and sell it at the end of the day, and to sell 1 share of Apple stock if yesterday’s closed is lower than the middle line and close the short position at the end of the day. Assuming no transaction cost, the result of the trading strategy is as follows

We can see that the Bollinger bands (BB) trading strategy provides a return which is almost consistently higher than the return of Apple stock. With this trading strategy, the cumulative return is about 70% for just two years, which is even higher than the Moving Average Convergence Divergence (MACD) trading strategy. The volatility of the returns from Bollinger bands (BB) trading strategy tends also to be lower than that of Moving Average Convergence Divergence (MACD) trading strategy.

Conclusion Portfolio Analysis代写

In this report, I first use the framework of Capital Asset Pricing Model (CAPM) to evaluate the performance of two portfolio: one is comprised of traditional firms, the other is comprised of high technology firms. The result shows that high technology portfolio tends to have better performance than traditional portfolio under the framework of Capital Asset Pricing Model (CAPM) in the sense that it has a higher Sharpe Ratio and higher Jensen’s Alpha.

Then I propose two trading strategies based on Moving Average Convergence Divergence (MACD) and Bollinger bands (BB). The simulation results show that the two trading strategies tend to have better performance than the return of Apple stock. But, we may need to note that the performance of short term trading strategy may depend on the stock it chooses and the condition of market. For more general trading strategies, further researches may be needed.

Reference

Lintner, J. (1965). Security prices, risk, and maximal gains from diversification. The journal of finance, 20(4), 587-615.

Markowitz, H. (1952). Portfolio selection. The journal of finance, 7(1), 77-91.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The journal of finance, 19(3), 425-442.

更多其他: Report代写 文学论文代写 商科论文代写 艺术论文代写 人文代写 数据分析代写 代写案例 Assignment代写 Case study代写

您必须登录才能发表评论。