Name

Instructor

Course

Date

Minimum Wage and Tax Policy as Solutions to Income Inequality

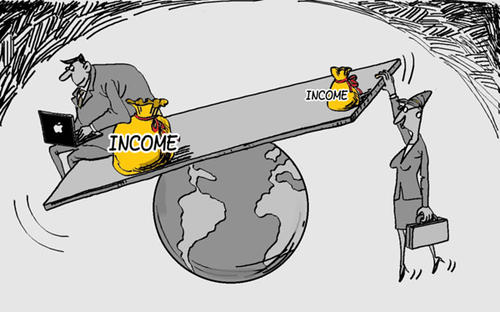

Income Inequality代写 In this regard, there is needed to interrogate minimum wage and tax policies as solutions to the problem of income inequality.

Poverty reduction has become a watchword by the development agencies, international monetary and lending organizations and development economists. The discussion on poverty reduction has reached high ends by it being articulated in the Millennium Development Goals (MDGs) and extensive analysis of the accomplishments of MDGs. Nevertheless, poverty reduction through income equality is low in the United States which has either ignored the issue of income distribution or tend to view income distribution in terms of economic growth. In this regard, there is needed to interrogate minimum wage and tax policies as solutions to the problem of income inequality.

Background Information Income Inequality代写

Income inequality has continued to rise in the United States. Quarter of Americas earn $10 per hour or less which is below the federal poverty level (Inequality.org). The broad facts can be derived to show a clear picture of the historical income distribution in America for the last six decades. Beginning the end of World War II, America showed economic growth with shared prosperity. As such, income proliferated and at the same rates across all the economic levels. The income inequality between the top earners and low earners did not change much or substantially remained the same during this period.

At the beginning of the 1970s, there was slow economic growth and widening of the income gap (Inequality.org). Income Inequality代写

There was a reduction in income of the households in both the middle and lower levels while that of the top earners continue to grow. Income distribution in this era slowed tremendously. Most incomes in the economy were concentrated at the very top of the income ladder. These minorities of high income formed 1 percent of the American population with their wealth aggregated 30 percent in 1989 and has grown to 39 percent in 2016, of the economy while that of lower earners has been falling from 33 percent to 23 percent in the same period.

Moreover, after 2008 financial crisis, the rich have continued to get richer. According to Saez, in 2012, the top 10 percent have cumulative income of more than 50 percent to the total income in the U.S (p. 3). Also, in the same year, they found that the top 1 percent earner accumulate 20 percent of the total income. Besides, the top 10 percent account to nine times more income than bottom earners who are 90 percent of the total earners. Worse still, the top 1 percent average forty times more income than 90 percent lower earners. These data show the disparity in income distribution has continued to grow over the decades in the United States.

The statement of the Problem Income Inequality代写

Policies and economic development agendas should focus on reduction in income inequality through minimum wage coupled with appropriate taxation policy. Reducing income inequality is a way of lowering poverty levels in the country. Although a lot of research have proposed solutions to this menace in society, proactive measures need to be taken into consideration. Increase in income inequality has not only increased the level of poverty but undermined societal harmony. In this regard, there is a need for research how minimum wage and appropriate taxation policies are the most appropriate ones to solve the problem of income inequality and rebuild a more collaborative, a more socially equal and humane society.

Objectives Income Inequality代写

This research proposal seeks to propose a solution to reduce the problem of income inequality in the U.S. The proposal will interrogate:

i. The case of income inequality in the United States.

ii. The solutions which are available for income inequality, and

iii. Explore how minimum wage and tax policies can reduce income inequality.

iv. Find a solution that offers a more collaborative, more socially and humane society.

Research Question Income Inequality代写

This research proposal will seek to answer the question:

What can be done to solve the problem of income inequality and to rebuild a more collaborative, a more socially equal and humane society?

Methodology

A systematic review of the existing literature will be used to interrogate the type of solution required in income inequality. The solutions provided by various literature will offer better insight into the proposed solution in this research.

Literature Review Income Inequality代写

In their paper, Shapira, Meschede, and Osoro observed that there is a widening gap in racial wealth gap (p. 1).

The article explores income inequalities in African-American and white communities. They identified the major contributors of widening racial wealth gaps to include homeownership, household income, unemployment, education, and inheritance. The author acknowledged that inequality in wealth distribution not only affect economic growth but social stability. They observed that there exist racial wealth inequality which has continued to widen and hence a challenge to social harmony and equity.

This is regardless of the equal opportunity policies that have been established in American society. The authors proposed several measures and policies to close the gap in racial wealth disparities (p. 6). First, they proposed enforcement and strengthening of mortgage, lending and housing policies. The solution will reduce the residential segregation which has taken root in America and has given white advantage in home ownership than African-American.

Secondly, Shapira, Meschede, and Osoro also suggested the implementation of national and states level policies and measures that will raise the minimum wage, ensure equal pay provision, and strengthen employment-based benefits. Besides, they noted the correlation between low access to education and income disparities. The proposed investment in affordable education and early childhood education that is quality and equal. According to them, when these issues in society are addressed, the racial gap in wealth acquisition will reduce and hence improve economic development and social harmony.

Tax rates and policies and be a great irony when dealing with income redistribution in society. Income Inequality代写

The U.S. government has enacted wrong tax policy which has special privileges for capital gains. As a result, investments have become more valuable than the actual work. Oishi, Kushlev, and Schimmack observed that progressive taxation in an appropriate solution to income inequality and way to happiness. They also noted that between 1962 and 2014 when the tax system was progressive the income inequality was lower (p. 158). The use of progressive taxation takes more from the top earner and less from the bottom earners.

Over the years when the system was being applied, the level of income inequality had continued to lower while the bottom earners who made about 40 percent of the total earners were happier (p. 165). As such, the happiness of the lower income earners can be explained with lower income inequality. The findings are essential in measuring the satisfaction level of the majority in the society who represent about 70 percent of all earners. The satisfaction of the citizens as a result of reduced income inequality is a pathway towards achieving a more socially equal society.

According to Mishel, Gould, and Bivens, the wage has been in stagnation particularly for the middle and bottom level. Income Inequality代写

They observed that hourly compensation has been maintaining low and stagnant as productivity increases (p. 4). While wages for the top 1 percent has been increasing, that of the bottom has been stagnant. Comparing the wages across all levels, that of the top has been rising, the middle has been stagnant and that of the bottom declining (p. 6). The solution to this problem is policy review which will align economic changes with the wages. For instance, since productivity has been rising, the minimum wage should be increased to reflect changes in production.

Also, the government can regulate how top CEOs are remunerated as most of the wealth generated by the working class goes to them. Besides, the empowerment of collective bargaining power will ensure a union for better wages for workers.

Moreover, Atkinson et al. focused on the use of tax-benefits reform and minimum wage to reduce poverty and income inequality. Income Inequality代写

The authors supported the used of the progressive tax system on income and an increase in minimum wages. Also, they stressed on the need to have minimum wage as a reflection of the living standard in the form of a living wage and other social transfers (p. 308). Minimum wage increases the income of the bottom earners. When it is coupled with a progressive tax system, and re-distribution of tax income inform of social benefits, the gap between the top and bottom is reduced.

Conclusion

The findings from the various literature suggest that an increase in minimum wages and progressive tax policies are the solution to income inequality. The U.S. government will need to implement, strengthen and adjust minimum wages and tax systems to reduce the widening gaps between the top earners and the lower earners. The reduction in income inequality will increase the collaboration among the various levels in the society, increase social equity and build a humane society.

Work Cited Income Inequality代写

Atkinson, Anthony B., et al. “Reducing poverty and inequality through tax-benefit reform and the minimum wage: the UK as a case study.” The Journal of Economic Inequality 15.4 (2017): pp. 303-323.

Inequality.org. “Income Inequality – Inequality.Org”. Inequality.Org, https://inequality.org/facts/income-inequality/. Accessed 9 May 2019.

Mishel, Lawrence, Elise Gould, and Josh Bivens. “Wage stagnation in nine charts.” Economic Policy Institute 6 (2015): pp. 1-13.

Oishi, Shigehiro, Kostadin Kushlev, and Ulrich Schimmack. “Progressive taxation, income inequality, and happiness.” American Psychologist 73.2 (2018): pp. 157-168

Saez, Emmanuel. “Striking it Richer: The Evolution of Top Incomes in the United States (Updated with 2012 preliminary estimates) UC Berkeley, September 3, 2013.” (2013).

Shapiro, Thomas, Tatjana Meschede, and Sam Osoro. “The roots of the widening racial wealth gap: Explaining the black-white economic divide.” Research and policy brief (2013), pp. 1-8.