Critical Analysis of Tradeoff Theory

By

Institution

Instructor

Course

Location

Date

Critical Analysis of Tradeoff Theory

Tradeoff Theory代写 Tradeoff theory state that “the optimal capital structure is a trade-off between interest tax shields and the cost of financial distress”

Capital structure is a pertinent decision that companies must make.

Business owners and managers seek to have the optimal and sustainable capital mix that ensures business goals attainment. Investors look for a strong balance sheet that indicates the health status of the business. Capital structure is a permanent way of financing the company’s investments. Business owners and managers use theories to guide them on the optimal capital mix that will provide the highest benefits to the stakeholders. Tradeoff theory is one of these theories. Nonetheless, critical analysis of the tradeoff theory is essential before its application and implementation in determining the capital structure. Tradeoff Theory代写**成品

Tradeoff theory state that “the optimal capital structure is a trade-off between interest tax shields and the cost of financial distress” Tradeoff Theory代写

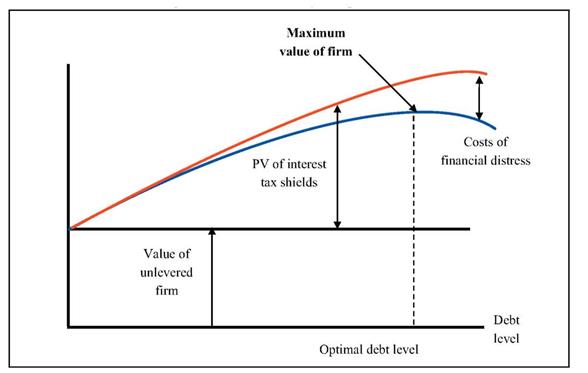

(Ahmadimousaabad, Bajuri, Jahanzeb, Karami, and Rehman, 2013, p. 11). The theory can be summarized graphically as shown in figure 1 below. The horizontal line is the starting point of all equity financed businesses. The red line is added to represent the present value of tax shields. Notably, tax shields increase initially as the firm borrows more. It then reaches a point where additional borrowing will only increase the rate of financial distress. Also, it is not certain that the firm will get a tax shield for excessive borrowing to save on the corporate tax. Financial distress increases as debt level increases. Tradeoff Theory代写**成品

Figure 1

The key essence of the trade-off theory is to explain the forms that the company capital takes, that is, debt and partly equity. Tradeoff Theory代写

(Oolderink, 2013, p. 6) The theory explains the advantage of debt financing especially the reduction in the amount of tax. According to Ghazouani (2013, p. 626), it informs on the cost of debt financing which mainly is financial distress such as bankruptcy costs and non-bankruptcy including low staff morale, and delayed payments. Most small firms rely on the theory to determine the balance between debt and equity that earns the highest return. The theory states that the marginal benefits of tax shields decrease as the firm borrows more and more capital. Tradeoff Theory代写**成品

However, there conflicting findings on the ability of the tradeoff theory to explain how firms make financing decisions. Tradeoff Theory代写

Nonetheless, the theory significantly contributes to the understanding of capital structure. Unlike the Pecking order theory, the trade-off theory does not recognize that firms can leverage their size and assets to finance investments (Shahar et al., 2015, p. 978). Thus, large and profitable firms can finance their investments by raising capital internally through retained earnings. Internal sourcing offers higher creditors protections and confidence and hence lowers the agency costs and increases the availability of debt capital. Besides, the theory fails to provide for business preferences for the most optimal source of financing. Thus, it is not the most preferred theory for application in large firms. Tradeoff Theory代写**成品

Tradeoff theory is pivotal in the understanding of a small firm’s capital structure. Tradeoff Theory代写

The theory considerations help companies to determine their debt capacity. It is supplemented by the Pecking order theory on deciding the preference between equity and debt financing. Managers should use the capital mix that brings the highest benefits to the company.

References Tradeoff Theory代写

Ahmadimousaabad, A., Bajuri, N., Jahanzeb, A., Karami, M. and Rehman, S., 2013. Trade-off theory, pecking order theory and market timing theory: a comprehensive review of capital structure theories. International Journal of Management and Commerce Innovations, 1(1), pp.11-18.

Oolderink, P., 2013. Determinants of capital structure: static trade-off theory vs. pecking-order theory: evidence from Dutch listed firms (Bachelor’s thesis, University of Twente).

Ghazouani, T., 2013. The capital structure through the trade-off theory: Evidence from Tunisian firm. International Journal of Economics and Financial Issues, 3(3), pp.625-636.

Shahar, W.S.S., Shahar, W.S.S., Bahari, N.F., Ahmad, N.W., Fisal, S. and Rafdi, N.J., 2015. A review of capital structure theories: Trade-off theory, pecking order theory, and market timing theory. pp. 240-247.

更多其他:Assignment代写 网课代修 Review代写 研究论文代写 文学论文代写 Report代写 数据分析代写 代写案例 润色修改 Case study代写 Proposal代写 Essay代写 数据分析代写 Academic代写

您必须登录才能发表评论。