ACCOUNTING AND FINANCE

AcF 213

MANAGEMENT ACCOUNTING FOR BUSINESS DECISIONS

管理会计代写 This exam is open-book. However, all questions should be answered using your own words. Copying from unacknowledged sources…

Answer either question 1 or question 2 from section A AND either question 3 or question 4 from section B.

All questions carry equal marks.

Show all of your workings.

This exam is open-book. However, all questions should be answered using your own words. Copying from unacknowledged sources, including lecture slides and internet pages, will constitute an academic offence as will colluding with others. All work submitted must be your own work. Word limits apply to written elements in each question.

SECTION A

ANSWER EITHER QUESTION ONE OR QUESTION TWO FROM THIS SECTION: YOU MUST ANSWER ALL PARTS OF THE QUESTION SELECTED

QUESTION 1 管理会计代写

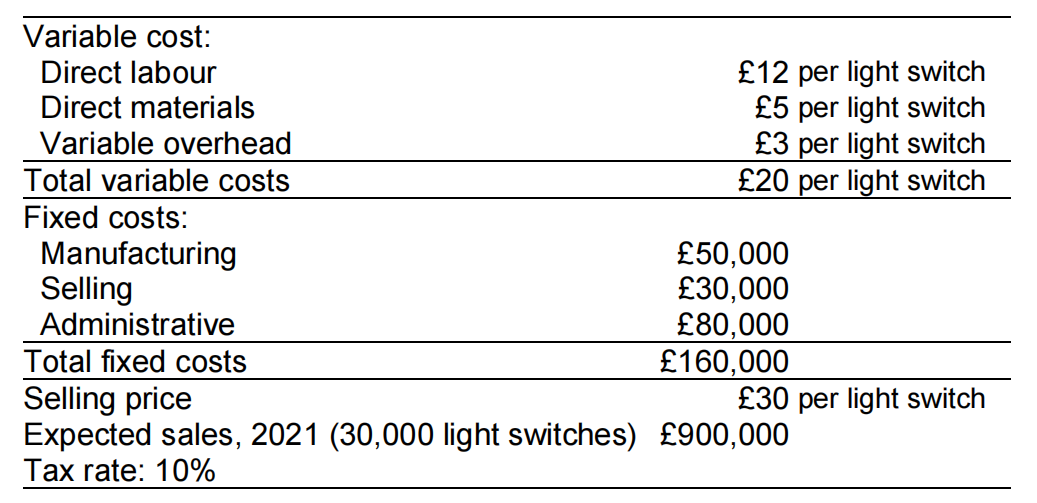

ABC Ltd., a maker of light switches, has experienced a steady growth in sales for the past three years. The company’s management accountant has prepared the following data for the current year, 2021:

REQUIRED:

Please note: a maximum word count applies to some parts of this question.

(a) Using the information provided above:

(i) Calculate the projected after-tax profit for 2021.

(5 marks)

(ii) Calculate the after-tax break-even point in units and sales revenue for 2021.

(4 marks)

(b) ABC Ltd. has set the sales target for 2022 at a level of £1,200,000 (or 40,000 light switches). To attain this target, the company plans to spend an additional selling expense of £50,000 for advertising, with all other costs and tax rate remaining constant.

(i) Calculate the after-tax profit for 2022.

(5 marks)

(ii) Calculate the after-tax break-even point in units and sales revenue for 2022.

(4 marks)

(iii) For 2022, calculate the sales level in units and sales revenue required to generate the same after-tax profit as for 2021.

(5 marks)

Define operating leverage in words without using the formula and explain how the advertising campaign affects the operating leverage and profit of this company. 管理会计代写

(6 marks; max 210 words)

(iv) Calculate the maximum amount the company can spend on the advertising campaign in 2022 to earn an after-tax profit of £90,000. Assume a sales level of 40,000 light switches.

(6 marks)

(c) The cost structure of service industries is different from that of manufacturing. Compare the costs of transporting the first passenger and the incremental costs of transporting another passenger in an airline.

(4 marks; max 140 words)

Explain how high operating leverage has affected the airline industry during this

pandemic. Ensure you provide an airline example.

(8 marks; max 280 words)

Regardless of industry, explain why raising selling prices may not be a feasible

option in many cases.

(3 marks; max 105 words)

(Total marks for question 1: 50 marks)

QUESTION 2 管理会计代写

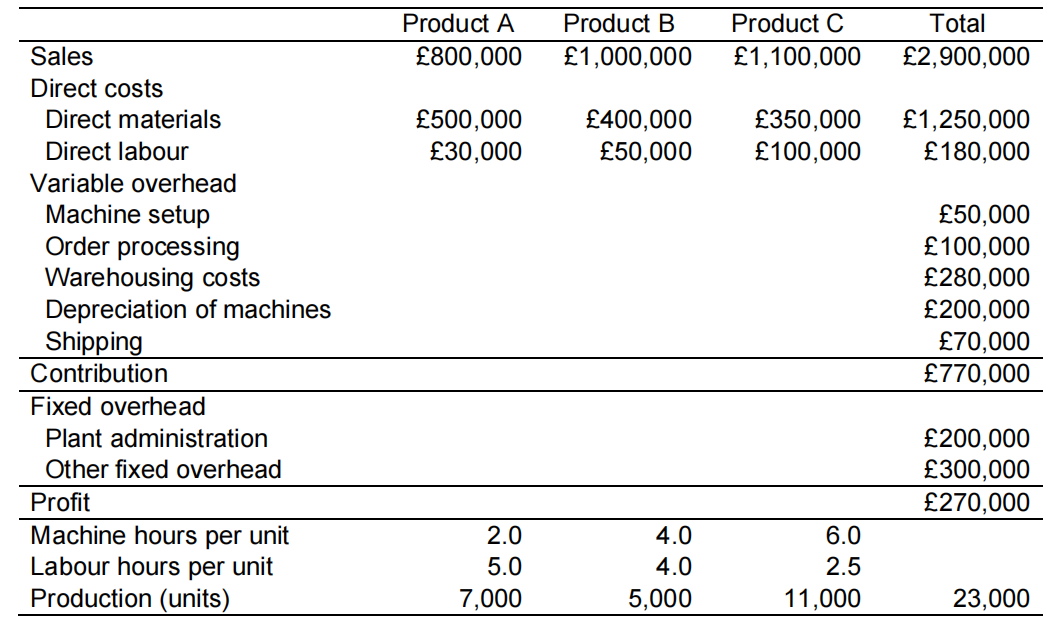

XYZ Ltd. manufactures three products A, B, and C, and has experienced a decrease in profits despite increasing sales. The company has allocated overhead using machine hours but is currently considering introducing activity-based costing (ABC). In 2020, the company had the following revenues and expenses.

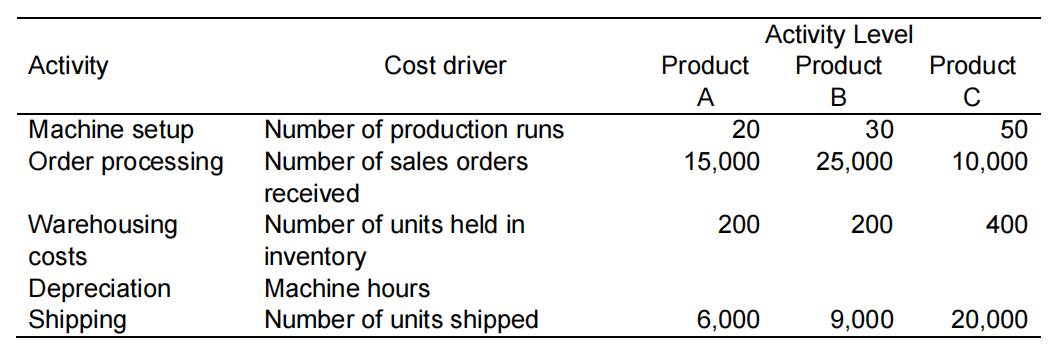

Overheads have been analysed into different activities, and the following costs and relevant cost drivers have been identified by activity. Regardless of the cost allocation method, plant administration and other fixed overhead costs are not allocated to products.

REQUIRED:

Please note: a maximum word count applies to some parts of this question.

(a) Using examples, describe two potential benefits and one cost factor of adopting ABC.

(6 marks; max 210 words)

What would be the benefits of ABC for this company in particular? Ensure that you explain the benefits based on how high-volume products “subsidise” low-volume products under the traditional absorption costing and how ABC considers complexity in the operation.

(6 marks; max 210 words)

(b) Using the information provided above:

(i) Complete the income statement using machine hours to allocate variable overhead. Ensure that you explicitly show the absorption overhead rate in

your working.

(6 marks)

(ii) Complete the income statement using the activity cost drivers analysed above. Ensure that you explicitly show the activity overhead rates in your

working. 管理会计代写

(20 marks)

(c) The company does not allocate plant administration and other fixed overhead costs to products. Discuss whether you agree to this practice in terms of establishing “fair” product cost to cover all costs.

(4 marks; max 140 words)

Discuss whether the introduction of ABC would lead to a better pricing decision for this company.

(2 marks; max 70 words)

(d) Discuss the corporate culture that is best suited to implement ABC and the corporate culture that is not.

(3 marks; max 105 words)

Discuss whether and how the introduction of ABC will add value to shareholders.

(3 marks; max 105 words)

(Total marks for question 2: 50 marks)

SECTION B

ANSWER EITHER QUESTION THREE OR QUESTION FOUR FROM THIS SECTION:

YOU MUST ANSWER ALL PARTS OF THE QUESTION SELECTED

QUESTION 3 管理会计代写

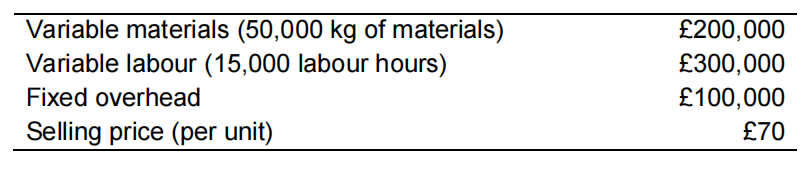

ABC Ltd. manufactures chairs and sells them through several retail chains. Early in August, senior managers at this company received a variance analysis report identifying the deviation of its performance for the first half of the year from its budget. The president is concerned that their actual profit is lower than expected despite unit sales being higher than budget. In the first six months, the cost of manufacturing and marketing at the company’s forecasted volume of 10,000 units PER MONTH was as follows:

REQUIRED:

Please note: a maximum word count applies to some parts of this question.

(a) Explain why the variances for fixed costs are generally different from the variances for variable costs. Use an example to support your explanation.

(5 marks; max 175 words)

In particular, for control purposes, why is an efficiency (i.e., quantity or volume) variance not calculated for fixed manufacturing overhead?

(3 marks; max 105 words)

(b) Using the information provided above:

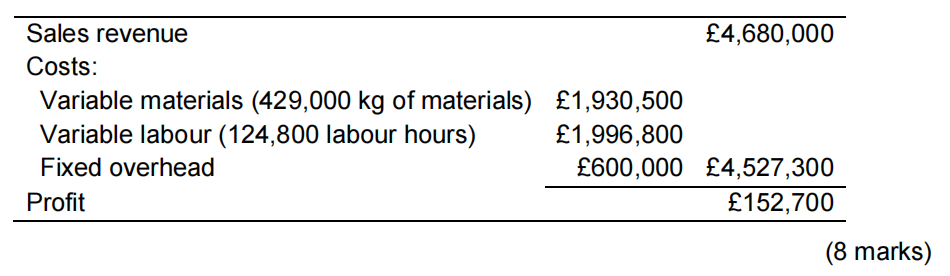

(i) Construct the master and flexible budgets to compare them with the actual performance: The actual income statement in the first six months was as follows at the volume of 78,000 units.

(ii) Calculate a series of variances to reconcile the budgeted and actual profits (i.e., total, sales, materials, labour, and fixed overhead variances). Ensure

that you show both the price and quantity variances for sales, materials, and labour. The company’s budgeted and actual profits should be reconciled at the end of your answer to confirm that your analyses were correct. 管理会计代写

(13 marks)

(iii) Suggest who is potentially responsible for the sales, materials, and labour variances calculated in (b) (ii) and explain why.

(12 marks; max 420 words)

(c) Explain whether and why some responsibility centres are responsible only for costs, some only for revenue, and some for both. Provide an example for each case.

(9 marks; max 315 words)

(Total marks for question 3: 50 marks)

QUESTION 4 管理会计代写

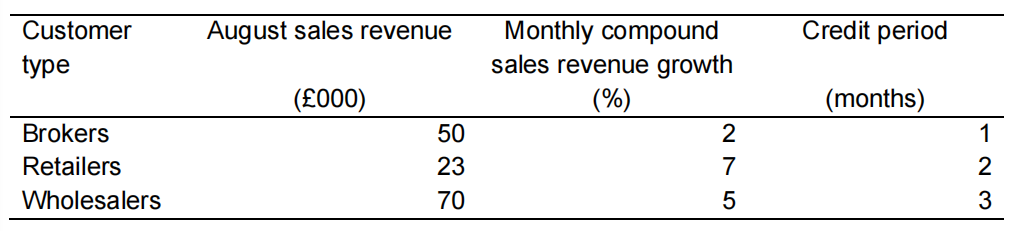

XYZ Ltd. is planning to introduce a new hybrid car to enter the expanding market. The new car will be launched in August and supplied to three distinct customer types: Brokers, retailers, and wholesalers. The sales for August and growth in sales for subsequent months are estimated as follows:

The company is concerned about launching the new product in terms of financing, liquidity, and credit control of receivables. In particular, credit control is most likely challenging because the market is new to the company.

REQUIRED:

Please note: a maximum word count applies to some parts of this question.

(a) Using examples, explain three main factors that may influence the level of cash holdings in a business.

(6 marks; max 210 words)

Discuss why companies hold more or less inventory.

(3 marks; max 105 words)

(b) Using the information provided above:

(i) Prepare an ageing schedule of receivables for each of the first four months of selling this new product (i.e., August – November). Your schedule should analyse the expected receivables outstanding according to customer type. It should also indicate, for each customer type and month, the percentage of total receivables outstanding. 管理会计代写

(20 marks)

(ii) Interpret the results in (b) (i) based on the “five Cs of credit.” Ensure that you explain the proportion of the receivables of each customer type in November.

(9 marks; max 315 words)

(c) Explain the cost of holding too little and too much cash. For each case, provide an example relevant to the current pandemic.

(i) Too little cash.

(6 marks; max 210 words)

(ii)Too much cash.

(6 marks; max 210 words)

END OF PAPER