Are Global Trade Patterns Consistent with economic theory?

经济学essay代写 Specifically talking about trade or as the era of globalization suggests . International trade we mainly refer to···

Specifically talking about trade or as the era of globalization suggests . International trade we mainly refer to the exchange of goods and services taking place between countries under certain conditions. Another important aspect of globalization has been that almost all countries or economies today are open economies . Which mean they are involved in international trade where import and export of goods always take place.

Now the biggest question that may arise in an individual mind is- why do countries’ trade or integrate their domestic markets with the world market? The most reliable explanation can be given as the gains from trade. If relative commodity prices differ between countries in the absence of trade . Both countries can gain by exchanging commodities at any intermediate price ratio. Such benefits or gains can be explained elaborately through certain theoretical explanations or traditional economic theories of trade –

Economic theories of Trade 经济学essay代写

Model 1: Trade benefits both countries

For simplicity here we consider a two country model , i.e. we show that . Two countries are indulged in international trade and as per the theory they are mutually benefitted through such trade. Countries’ welfare has been demonstrated through indifference curve . Which also show the bundle of goods the country can afford – under no trade situation and under international trade (Freeman, 2004). The concept of budget line and relative prices(terms of trade) has also been used for this theoretical explanation. For using this concept we further assume that two commodities are being traded – X and Y.

Here we denote one country as the Home Country and the other one as the Foreign Country.经济学essay代写

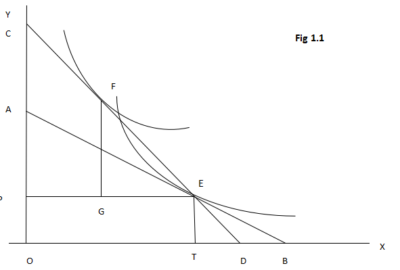

Figure 1.1

reflects the benefits or gains that the home country receives from international trade. The two budget lines CED and AEB have been drawn. These budget lines also represent different set of relative prices for the country. Trade triangle is denoted by EFG where FG shows the amount of imports and GE shows the amount of imports.

Without trade the country had to be content with the consumption bundle they were receiving at point E. it is only due to trade with the other nation that the country is allowed to reach the consumption bundle at point F. F is also regarded as the best consumption point along the budget line. Thus it is obvious that the Home Country benefits from international trade. The same can be proved for the Foreign Country as well as shown in the figure below-

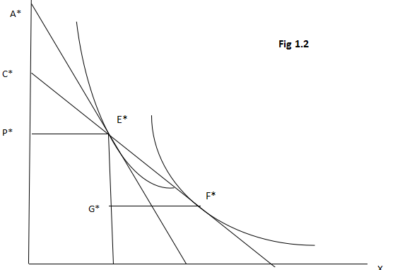

Figure 1.2 经济学essay代写

reflects the benefits or gains that the Foreign Country receives from international trade. The budget lines are given by A*E*B* and C*E*D* which also represents the relative prices. The trade triangle is given as E*F*G*, where E*G* shows the amount of exports and G*F* shows the amount of imports. Without trade the country would have valued both the goods at the point E*, but the situation in the Foreign Country has changed due to trade.

The intermediate price ration is noticeable here with the low price of X in the Home Country and the high price of X in the Foreign Country. Thus it is evident that the foreign country also benefits from international trade (Glyn, 2004).

Thus from the above theoretical model it may be concluded that . A divergence in the relative price of commodities in the two countries before trade indicates a mutual potential gain from trade for both countries at a common intermediate price ratio.

Besides exchanging both the goods it should be noted that the two countries – Home Country and Foreign Country can also derive further gains from intra- industry trade as well as inter industry trade (Krueger, 1998).

Model 2: Comparative advantage and Trade 经济学essay代写

While discussing the economic theories of trade . It is also important to mention about the concept of comparative advantage situation which actually allows the trade to happen. In fact it is due to the comparative advantage situation that . The countries pour out of their local markets and channelize its resources in a more proper manner at the given world market prices.

This comparative advantage only has laid out the concept of globalization, i.e. integration of the domestic markets with the foreign markets or the world market overall. We now involve production possibilities schedule . And the assumption of two country and two goods in the model at the backdrop of comparative advantage to show the gains from trade for the Home Country and Foreign Country. The theoretical explanation is given along with the diagrams below-

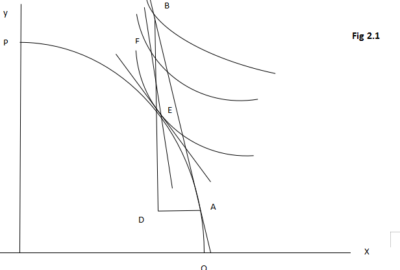

Figure 2.1 经济学essay代写

shows the gains from trade in the Home Country through the production possibilities curve as a result of comparative advantage. The trade triangle is given as BAD, where the country exports DA amount of X and imports BD amount of Y. If the country is not allowed to trade the production . And consumption possibilities will be restricted to PQ with E being the best consumption point.

It also shows the pre trade relative price. The post trade world prices are shown by AB. This line also shows the increase in consumption possibilities through the new expanded locus . And B is considered to be the desired consumption point. Thus there is an increase in consumption as well as increase in production resulting in the increase in real income for the Home Country.

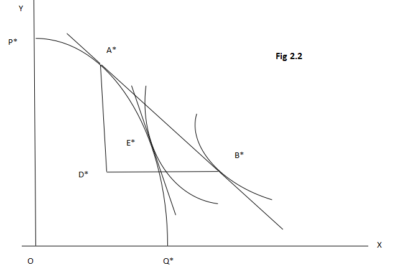

Figure 2.2 经济学essay代写

shows the gains from trade for the Foreign Country as a result of comparative advantage. The trade triange is given B*A*D*,where B*D* being the amount of imports and A*D* being the exports. The Foreign Country also gains from trade as consumption rises from E* to B* and ultimately a rise in real income as well (Rodrik, 1998).

The flatter production possibilities curve for the Home Country as compared to that of the Foreign Country is noticeable . Because it shows the comparative advantage of the Home Country in producing X . And has a lower relative price for X than the Foreign Country. Here the object of comparison which determines the comparative advantage is the pre trade cost ratio of one country as opposed to that of another country. Thus it may be concluded that the world market trading benefits both the countries . As the production possibilities curve itself expands due to global trade.

Model 3: Global Trade and Inequality of Nations 经济学essay代写

As per the eminent economist Paul Krugman, international trade has been the driving factor behind inequality of wages (Krugman, 1993). But this is due to the combined effect of both technology and trade upon the factor prices. But Krugman has also claimed that globalization has been the main reason behind the inequality of nations.

To prove this claim, he has presented a model for a small open economy . With the focus upon the manufacturing sectors. He considered a small manufacturing sector under imperfect competitive structure. This sectors produce both intermediate as well as finished goods. These intermediate goods create demand linkages between . And they show a tendency towards manufacturing agglomeration.

We assume same manufacturing industry for all economies at high transport cost. But as transport cost tends to fall below a critical value . All nations which find themselves in the core periphery suffer a decline in real income. With continuation in fall of transport cost a state of convergence takes place gradually with respect to real income . Where peripheral nations gain and the core nations loose.

It is seen that rise in international trade or trade liberalization creates a strong incentive . For those imperfectly competitive industries to concentrate in the central region for those large markets. Thus we have lower wages in the periphery as compared to the center. Relative wages and periphery do diverge in the early stages of trade. This leads to inequality between nations as a result of global trade (Krugman, Trade and wages, reconsidered, 2008).

Real life examples: Case Examples 经济学essay代写

We now consider some real life case examples to show the consistency of the global trade patterns with the above discussed economic theories of trade. The case examples of both developed and underdeveloped countries have been taken into consideration.

Case Example 1: Comparative Advantage 经济学essay代写

For instance, we can point out the real life examples of some of the developed countries like Japan which exports automobiles and other consumer durables to a large extent to meet up its expenses for oil and other raw materials in the world markets (KUBOTA & PFANNER, 2015). Even for developed countries like United States which has more or less a balanced productive structure relies on export trade for some of its sectors.

In this context of real life examples we can say that the economic theory of comparative advantage is quiet consistent with the global pattern of trade. Some of the Asian countries which have similar patterns of comparative advantage have achieved remarkable success in export oriented development after ASEAN 4 agreed to a free trade area in 1994.

Trade also helped to achieve full employment in some of the newly emerged superpowers like Hong Kong and Singapore after an integration of US-Mexico border type. These countries also have been subcontracting their production to other parts like Indonesia and Malaysia.

Case example 2: Manufacturing sector 经济学essay代写

The recent global trade patterns have shown a decline in trade for manufactured goods for many developed economies and UK stands out to be one of them. As per the recent reports UK trades more in commercial and financial services as compared to manufactured goods in recent times. In fact less national output is also being generated from the manufacturing sector.

As per the share of manufactured goods in world trade, share of US has fallen to 15% recently. Some countries like Russia are reportedly suffering in the world market due to the quality of their manufactured goods and the pressure of international competition. The recent data also indicates that as a percentage of world GDP, international trade has increased to 60% by 2014.

The projections till 2020 shows more dramatic changes in world trading patterns especially for the European member countries and it is expected that global organizations like IMF, World Bank G7 and G20 will adapt themselves considerable to remain legitimate representatives of the world (European Central Bank (ECB), 2008).

Case Example 3: Gains from Trade 经济学essay代写

All participants of free trade- whether developed or underdeveloped countries have gained in ones respect, i.e. access to larger international markets. The economies become more competitive due to integration of the world markets with the domestic ones as well as it give the economies more opportunities for international division of labor.

Efficiency thus increases due to international specialization a foreign competition. In fact international trade is also the main ingredient the rising trend of urbanization observed throughout the world. Although developed countries still prefer to trade among themselves, their share of exports has increased in recent times.

Diversification in the export structure particularly among the developed countries is a striking feature of the emerging global trade patterns. Low cost, Labor intensive imports from the developing countries have pushed the wage gap between skilled and unskilled laborers for developed countries like United Kingdom and United States (Slaughter, 1999).

East Asian Economies or the Chinese economies like Hong Kong 经济学essay代写

And Singapore has been the chief gainers from international trade emerging as the new superpower and rising economies whereas trade has not significantly benefitted the Sub Saharan African regions whose share in world trade has been continuously declining since the 1990s.

The emerging global trade pattern has also led the international organizations like WTO and GATT to advocate for free trade in recent times rather than adopting protectionism (O’Neill & Terzi, 2014). However Japan’s export growth is likely to slow down in the upcoming years . As the country’s recent export volume has exceeded her domestic production.

However the recent global trade pattern has also led to emergence of regional trading blocs. Some examples of these trading blocs are NAFTA . European Union etc. the demerit of such creation of regional trading blocs has been that . It has led to trade creation between member countries . While the countries remaining outside these trading blocs have suffered from trade diversion.

全球贸易模式是否与经济理论相符?

具体讲贸易或正如全球化时代所暗示的那样,国际贸易我们主要是指在一定条件下国家之间进行的商品和服务的交换。全球化的另一个重要方面是,当今几乎所有国家或地区都是开放经济体,这意味着它们参与了总是进行货物进出口的国际贸易。现在,一个人可能会想到的最大问题是:为什么国家进行贸易或将其国内市场与世界市场整合?可以将最可靠的解释作为贸易收益。如果在没有贸易的情况下国家之间相对商品价格有所不同,则两国可以通过以任何中间价格比率交换商品来获得收益。这些收益或收益可以通过某些理论解释或传统的贸易经济理论来详尽地解释-

贸易经济学理论

模式1:两国的贸易利益

为了简单起见,在这里我们考虑一个两国模型,即,我们表明两个国家都沉迷于国际贸易,并且根据理论,它们通过这种贸易互惠互利。国家的福利已通过冷漠曲线得到了证明,该曲线也显示了该国在无贸易状况和国际贸易下可以买得起的商品捆绑(弗里曼,2004年)。预算线和相对价格(贸易条件)的概念也已用于此理论解释。为了使用这个概念,我们进一步假设正在交易两种商品-X和Y。

在这里,我们将一个国家称为本国,将另一个国家称为外国。图1.1反映了母国从国际贸易中获得的收益或收益。划出了CED和AEB的两个预算项目。这些预算项目还代表了该国家的不同相对价格集。贸易三角形用EFG表示,其中FG显示进口量,GE显示进口量。没有贸易,该国必须满足他们在E点收到的消费束。仅由于与另一个国家的贸易,该国才可以在F点达到消费束。F也被认为是最好的预算线的消费点。因此很明显,母国从国际贸易中受益。如下图所示,对于国外也可以证明这一点:

图1.2反映了外国从国际贸易中获得的收益或收益。预算线由A * E * B *和C * E * D *给出,它们也代表相对价格。贸易三角形的形式为E * F * G *,其中E * G *显示出口量,G * F *显示进口量。没有贸易,该国将在E *点对这两种商品进行估值,但是由于贸易,国外的情况已经改变。这里的中间价格比很明显,在本国X的价格低,而在国外X的价格高。因此很明显,外国也从国际贸易中受益(Glyn,2004)。

因此,从以上理论模型可以得出结论,在贸易之前两国商品相对价格的差异表明,在共同的中间价格比率下,两国贸易互有潜在收益。

除了交换两种商品外,还应注意,本国和外国这两个国家也可以从产业内贸易和产业间贸易中获得更多收益(Krueger,1998)。

模式2:比较优势与贸易

在讨论贸易的经济理论时,重要的是要提到实际上使贸易发生的比较优势情况的概念。实际上,由于比较优势的情况,这些国家从当地市场大量涌入,并以给定的世界市场价格以更适当的方式分配其资源。这种比较优势仅提出了全球化的概念,即将国内市场与国外市场或整个世界市场进行整合。在比较优势的背景下,我们现在在模型中涉及生产可能性计划以及两个国家和两种商品的假设,以显示本国和外国从贸易中获得的收益。给出了理论上的解释,并附带下面的图表:

图2.1显示了由于具有比较优势而通过生产可能性曲线从母国获得的贸易收益。贸易三角为BAD,该国出口DA的数量为X,进口BD的数量为Y。如果不允许该国家进行贸易,则生产和消费的可能性将受到限制。

o以E为最佳消耗点的PQ。它还显示了交易前的相对价格。交易后世界价格由AB显示。这条线还显示了通过新扩展的基因座增加的消费可能性,并且B被认为是所需的消费点。因此,消费增加以及产量增加,导致母国的实际收入增加。

图2.2显示了比较优势带来的外国贸易收益。贸易三角的给定为B * A * D *,其中B * D *为进口量,A * D *为出口。随着消费从E *增长到B *,并最终也增加了实际收入,外国也从贸易中受益(Rodrik,1998)。

值得注意的是,与外国相比,母国的生产可能性曲线较为平坦,因为它显示了母国在生产X方面的比较优势,并且X的相对价格低于外国。在这里,确定比较优势的比较对象是一个国家相对于另一个国家的贸易前成本比率。因此可以得出结论,由于全球贸易使生产可能性曲线本身扩大,因此世界市场贸易对两国都有利。

模式3:全球贸易与国家不平等

根据著名的经济学家保罗·克鲁格曼(Paul Krugman)的说法,国际贸易一直是导致工资不平等的驱动因素(克鲁格曼,1993)。但这是由于技术和贸易对要素价格的综合影响。但是克鲁格曼还声称,全球化一直是国家不平等背后的主要原因。为了证明这一主张,他提出了一个针对小型开放经济的模型,重点是制造业。他认为竞争结构不完善的小型制造业。该部门既生产中间产品,也生产成品。这些中间产品在它们之间建立了需求联系,并且它们显示出制造集聚的趋势。我们假设所有经济体的制造业都是相同的,运输成本很高。但是,由于运输成本趋于低于临界值,所有处于核心边缘的国家的实际收入都会下降。随着运输成本的持续下降,外围国家的收益逐渐增加,而核心国家的宽松则使实际收入逐渐趋于收敛。可以看出,国际贸易的增长或贸易自由化为那些竞争能力不强的行业集中到那些大型市场的中部地区提供了强大的动力。因此,与中心地区相比,我们在外围地区的工资较低。相对的工资和外围在贸易的早期阶段确实存在分歧。由于全球贸易,这导致国家之间的不平等(克鲁格曼,《贸易与工资》,重新考虑,2008年)。

现实生活中的例子:案例

现在,我们考虑一些现实生活中的案例,以显示全球贸易模式与以上讨论的贸易经济理论的一致性。已经考虑了发达国家和不发达国家的案例。

案例1:比较优势

例如,我们可以指出一些发达国家的现实生活中的例子,例如日本,它们在很大程度上出口汽车和其他耐用消费品,以支付其在世界市场上购买石油和其他原材料的费用(久保田&PFANNER, 2015)。即使对于像美国这样的发达国家而言,其生产结构或多或少都具有均衡性,其某些部门也依赖出口贸易。在现实生活中,我们可以说比较优势的经济学理论与全球贸易格局相吻合。 1994年东盟4同意建立自由贸易区后,一些具有类似比较优势模式的亚洲国家在出口导向型发展方面取得了显著成就。贸易还有助于在一些新兴的超级大国中实现充分就业,例如香港和新加坡。整合美墨边境类型后的新加坡。这些国家还一直将其生产分包给印度尼西亚和马来西亚等其他地区。

案例2:制造业

最近的全球贸易格局表明,许多发达经济体的制成品贸易均下降,英国是其中之一。根据最近的报道,与制成品相比,英国在商业和金融服务方面的交易更多。实际上,制造业的国家产出也较少。按照制成品在世界贸易中的比重,最近美国的比重已降至15%。据报道,像俄罗斯这样的一些国家由于其制造质量而在世界市场上遭受苦难

货物和国际竞争的压力。最近的数据还表明,到2014年,国际贸易占世界GDP的比重已增加到60%。到2020年的预测显示,世界贸易格局将发生更为戏剧性的变化,尤其是对于欧洲成员国,并且预计像IMF这样的全球性组织,世行七国集团和二十国集团将作出重大调整以保持世界合法代表地位(欧洲中央银行(ECB),2008)。

案例3:贸易收益

自由贸易的所有参与者,无论是发达国家还是不发达国家,都获得了尊重,即进入了更大的国际市场。由于世界市场与国内市场的融合,经济体变得更具竞争力,同时也为经济体提供了更多的国际分工机会。因此,由于国际专业化和国外竞争,效率提高了。实际上,国际贸易也是全世界观察到的城市化趋势的主要组成部分。尽管发达国家仍然喜欢相互之间进行贸易,但它们在出口中所占的份额最近有所增加。出口结构的多样化,特别是发达国家之间的多样化,是新兴的全球贸易格局的显着特征。来自发展中国家的低成本,劳动密集型进口产品推高了英国和美国等发达国家的技术工人与非技术工人之间的工资差距(Slaughter,1999)。东亚经济体或香港和新加坡等中国经济体已成为新兴的超级大国和崛起的经济体中国际贸易的主要受益者,而贸易却并未使撒哈拉以南非洲地区受益匪浅,自撒哈拉以南非洲地区以来,该地区在世界贸易中的份额一直在持续下降。 1990年代。新兴的全球贸易格局也导致WTO和GATT等国际组织在近期倡导自由贸易,而不是采用贸易保护主义(O’Neill&Terzi,2014)。但是,由于日本最近的出口量已超过其国内产量,因此未来几年日本的出口增长可能会放缓。

但是,最近的全球贸易格局也导致了区域贸易集团的出现。这些贸易集团的一些例子是北美自由贸易协定,欧洲联盟等。建立这种区域贸易集团的弊端在于它导致了成员国之间的贸易创造,而留在这些贸易集团之外的国家则遭受了贸易转移的影响。