Key steps in CW1

stocks代写 In the bullish market, we can examine which hedging strategy may make less loss to the portfolio, given the short positions in futures contracts.

1)Construction of your portfolio stocks代写

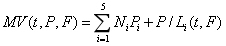

Suppose that on 11/01/2017, you split $10m into 5 stocks, $2m/each stock.

a)Given the stock prices on that day, you can figure out the number of each stock in your portfolio; stocks代写

b)Keep the number of each stock in your portfolio unchanged over the period from 11/01/2017 to 10/12/2018

c)In each day, the value of your portfolio P:

![]()

d)So that you can construct the time series of MV(t,P), and the daily return of the portfolio P:

![]()

and the daily return of the index futures is

![]()

While the daily change of the portfolio value is equal to stocks代写

![]()

And the daily change of the S&P500 index futures is equal to

![]()

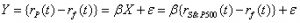

e)Estimate the beta of your portfolio P by running the following regression

This method can be applied to all the individual stocks. stocks代写

The expected returns of the portfolio P in the in-sample period from 11/01/2017 to 5/31/2018 is :

![]()

M is the total number of daily returns over this period. The expected returns of others, including individual stocks and market index S&P500 can be calculated similarly.

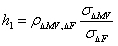

2)Suppose now you have estimated all betas. We have two ways to obtain the optimal hedging ratio h: stocks代写

In both ratios, all the estimates are obtained based on the information from 11/01/2017 to 5/31/2018 is

![]()

On May 31, 2018, we now construct your hedging strategy stocks代写

for i=1,2

Which is required in e) and f). stocks代写

In g), based on the information on May 31, 2018, we make expectations about the terminal levels of the S&P500 index and futures (![]() and

and![]() ) in five scenarios (see the details in g).

) in five scenarios (see the details in g).

In each scenario, we can figure out the expected return of the S&P500 index from May 31, 2018 to October 12, 2018:

![]()

And work out the expected return of your portfolio via CAPM:

![]()

And work out the expected value of your portfolio on October 12, 2018:

For the index futures, the expected P/L is equal to stocks代写

![]()

So the total value of hedged portfolio in each scenario is equal to stocks代写

The process above can be done in all five scenario for each hedging strategy. Note that all the obtained results are not real, just your expectations made on May 31, 2018.

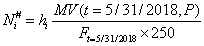

In h), For each of your hedging strategies, the marking-to-market practice in the real market is done in a daily basis over the period of May 31, 2018 to October 12, 2018:

![]() , for i=1 or 2

, for i=1 or 2

for short positions in futures contracts. This presents the dynamics of profit/loss in your futures trading position. Note that (-1)*(Ft-FMay 31, 2018)*250*Ni measures the total profit/loss in the futures position over the period from May 31, 2018 to time t. stocks代写

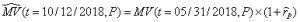

In i) the market value of your portfolio P over the period of May 31, 2018 to October 12, 2018:

![]() , for all t in this period

, for all t in this period

So in each day t over the period of May 31, 2018 to October 12, 2018, the total value of hedged portfolio is equal to stocks代写

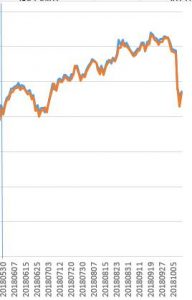

This then presents the dynamics of the total value of hedged portfolio at each time point during the period of May 31, 2018 to October 12, 2018.

3)Comments: stocks代写

1) comment the difference in the construction of two hedging strategies (one with minimal variance and the other estimated from beta)

Main difference is rooted in the way of estimating the optimal hedging ratio h. stocks代写

2) On the one hand, stocks代写

on May 31, 2018, you made the expectation about the terminal value of your hedged portfolio across a range of scenarios on October 12, 2018. This is just your expectation based on scenario analysis. On the other hand, you do know the terminal value of the hedged portfolio on October 12, 2018, given the real data. So there is a gap between your expectation and real results you get on October 12, 2018. Make comments on this gap.

On the one hand, the expectation about the performance of the portfolio and hedging strategies is made on May 31, 2018 in g).

On the other hand, you work out the time series of the total value of hedged portfolio over the period of May 31, 2018 to October 12, 2018 by using real data. This is done in i) and h).

Now to check out whether the realized value in i) and h) on October 12, 2018 is consistent with the expectation made on May 31 2018.

3) During the period from May 31 to October 12, 2018, stocks代写

your hedging strategies may present different performances. For example, in the bearish market (e.g., market declines), which one performs better? In the bullish (e.g. the market grows), which one performs better? Remember that the hedging strategies are used to provide protections on your portfolio, e.g., to offset the loss of your portfolio in the bearish market, and to minimize the impact on your portfolio in the bullish market.

On October 12, 2018,we have the time series of MV(t,P) and MV(t,P,F) over the period of May 31, 2018 to October 12, 2018. Roughly speaking, there are two bearish periods and two bullish periods in this full period. Now to check out the difference between the dynamics of portfolio P without hedging and the dynamics of hedged portfolio with futures.

In the bearish markets, we can examine which hedging strategy can provide a better protection. stocks代写

In the bullish market, we can examine which hedging strategy may make less loss to the portfolio, given the short positions in futures contracts.

更多其他: Assignment代写 商科论文代写 Essay代写 论文代写 心理学论文代写 哲学论文代写 计算机论文代写

您必须登录才能发表评论。