ACCOUNTING AND FINANCE

Ac.F 212

PRINCIPLES OF FINANCIAL ACCOUNTING

财务报告代写 Analyse the reasons why financial reporting practices have differed between countries. In doing so, explain why each of the reasons…

QUESTION 1

ANSWER BOTH PARTS OF THIS QUESTION

a) Analyse the reasons why financial reporting practices have differed between countries. In doing so, explain why each of the reasons that you give causes such differences?

[12 marks]

b) Explain why it is thought to be a good idea to have one worldwide set of international accounting / financial reporting standards. Who supports the creation of such international standards and why?

[13 marks]

TOTAL 25 MARKS

QUESTION 2 财务报告代写

ANSWER ALL PARTS OF THIS QUESTION

a.The IASB’s CF designates a number of ideas as ‘qualitative characteristics’ (QCs). What is the purpose of these QCs?

[3 marks]

b.Amongst the QCs, some are termed ‘fundamental’. Identify these and explain by use of suitable examples what impact they can have on financial reporting and its users. Include in your answer consideration of the component parts (sub-characteristics) of the fundamental QCs.

[14 marks]

c.In addition to the fundamental QCs, a number of ‘enhancing’ QCs are specified. Again using suitable examples, explain what impact these QCs can have on financial reporting and its users.

[8 marks]

TOTAL 25 MARKS

QUESTION 3

ANSWER ALL PARTS OF THIS QUESTION

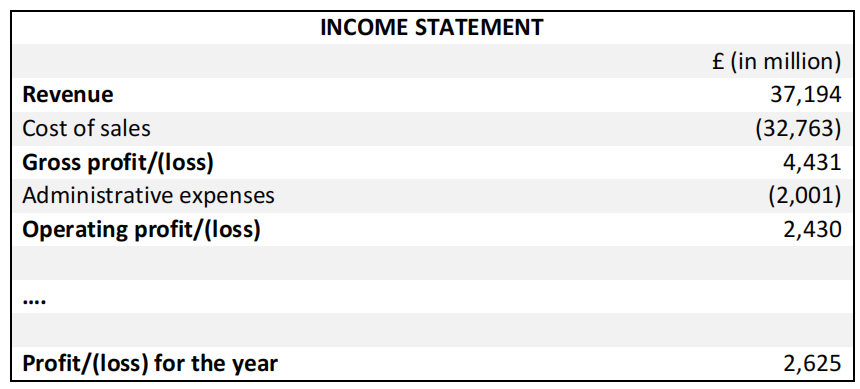

a) The following is an extract from the income statement of CYN plc, a company in the utility industry, for the fiscal year ended 31 December 2020:

INCOME STATEMENT

REQUIRED:

i) CYN plc presents its expenses according to a specific classification. Explain how this classification and an alternative classification categorise expenses.

ii) CYN plc presents its income statement as a separate statement. Explain whether CYN is allowed to follow an alternative presentation format.

iii) A journalist requests information on the financial performance of CYN plc in fiscal year 2020. The CEO of CYN refers the journalist to the income statement. Explain whether the income statement answers the journalist’s question. 财务报告代写

[10 marks]

b) The regulator of the utility industry considers awarding subsidies to domestic utility firms because it has received evidence suggesting unfair competition from foreign firms. To verify this evidence, the regulator will assess whether the profits of domestic utility firms are lower than the profits of the foreign competitors. This assessment will be based on income statement information for fiscal year 2021. If the regulator decides to award subsidies, CYN plc will be one of the beneficiaries. At the end of fiscal year 2021, the CEO of CYN has to decide on two issues:

- At the beginning of fiscal year 2021, CYN plc acquired financial instruments. At the end of fiscal year 2021, the value of these financial instruments has decreased. The CEO has to decide whether to classify them as fair value through other comprehensive income (FVOCI) or fair value through profit or loss (FVPL).

- Impairment tests for some of CYN’s intangible assets require a substantial number of assumptions. The accounting department of CYN believes that it can justify different assumptions that result in either the impairment of the intangibles or no impairment. The CEO has to decide which assumptions to apply in the financial statements for fiscal year 2021.

REQUIRED: 财务报告代写

i) Explain how the assessment of the regulator creates incentives for earnings management and how, given the regulator’s assessment, you expect the CEO to decide on issues 1. and 2.

ii) Assume that the compensation of the CEO is increasing in profit/loss from the income statement. Explain how this compensation contract creates incentives for earnings management and how, given this compensation contract, you expect the CEO to decide on issues 1. and 2.

iii) Explain whether and, if so, how the assessment of the regulator and the compen sation contract of the CEO jointly create incentives for earnings management. If applicable, explain how you expect the CEO to decide on issues 1. and 2. You can refer to your answers for i) and ii).

[15 marks]

TOTAL 25 MARKS

QUESTION 4

ANSWER ALL PARTS OF THIS QUESTION

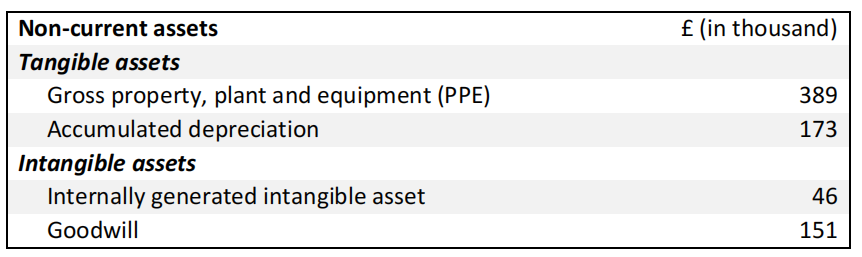

a) The following is an extract from the balance sheet of PHI plc for the fiscal year ended 31 December 2020:

REQUIRED:

Based on the above extract, what can you infer from the fact that

i) an internally generated intangible asset

ii) goodwill

is recognised on the balance sheet? You will not receive marks for merely copying the recognition criteria from the IFRS. Instead, you are required to summarise central aspects in your own words.

[5 marks]

b) On 1 April 2021, PHI plc acquired a new machine for a price of £25,000. On the same day, PHI paid £5,000 for a staff training session on how to operate the machine. For the subsequent measurement of the machine, PHI chose the revaluation model and the diminishing balance method with an annual rate of 30%. PHI expects to use the machine for 10 years and to dispose of it at the end of these 10 years (residual value of £0). On 31 December 2021, the machine has a fair value of £23,000; on 31 December 2022, the machine has a fair value of £12,000. PHI has a fiscal year ending 31 December.

REQUIRED: 财务报告代写

i) Explain what the subsequent measurement of the machine tells you about the subsequent measurement of other items of property, plant and equipment (PPE).

ii) Calculate the relevant amounts and prepare the journal entries for the initial recognition and subsequent measurement of the machine in fiscal years 2021 and 2022 Explain each of your steps.

iii) On 31 December 2021, annual depreciation for PPE items other than the machine amounts to £37,000. Based on the balance sheet extract in a), derive the value of accumulated depreciation on 31 December 2021. Explain your steps.

[20 marks]

TOTAL 25 MARKS

QUESTION 5 财务报告代写

ANSWER ALL PARTS OF THIS QUESTION

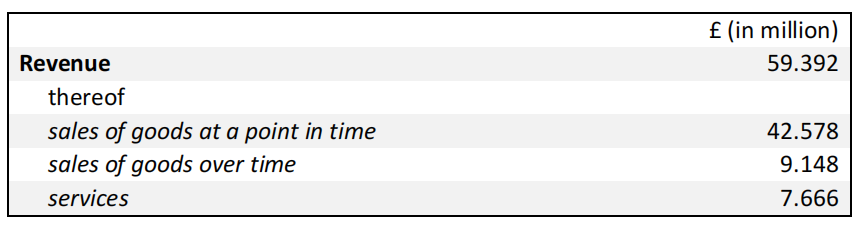

a) BAR plc is a ship building company that focuses on the construction and maintenance of ships. The following is an extract from the notes to the financial statements of BAR plc for fiscal year 2020:

REQUIRED: 财务报告代写

Based on the above extract and BAR plc’ business activities, think of transactions that could result in the recognition of revenue for BAR plc. Provide one specific example for each of the three revenue categories (sales of goods at a point in time, sales of goods over time and services) and explain why your examples would fall into the respective categories. Do not use the contract from b).

[5 marks]

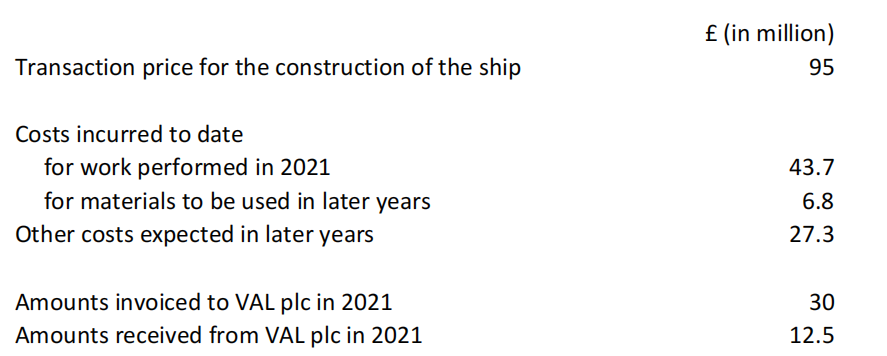

b) At the beginning of fiscal year 2021, BAR plc entered into a contract with VAL plc to build a ship and to subsequently provide an annual maintenance service for the ship over a period of five years. The contract includes a fixed price for both the construction of the ship and the provision of the maintenance service of £120 million. VAL plc requested that the ship has specific features and BAR plc agreed to customise the ship. However, BAR plc considered it unnecessary to customise the maintenance service, since the maintenance service is regularly provided for different types of ships, including ships not built by BAR plc. BAR plc classifies the construction of the ship and the provision of the annual maintenance service as two separate performance obligations. BAR plc started with the construction of the ship in fiscal year 2021 and expects its completion in fiscal year 2023. Below are the details to account for the construction of the ship at the end of fiscal year 2021:

For the construction of the ship, BAR plc recognises revenue over time and measures progress using an input method based on the costs incurred to date relative to total expected costs.

REQUIRED: 财务报告代写

i) BAR plc classifies the construction of the ship and the provision of the maintenance service as two separate performance obligations. Explain why this classification appears correct.

ii) Show how the construction of the ship should be treated in BAR plc’s financial statements for fiscal year 2021. Calculate the relevant amounts, prepare the journal entries and explain your steps.

iii) Assume that, in fiscal year 2022, BAR plc increases its estimate of total expected costs for the construction of the ship by an amount of £20 million. Calculate the resulting loss from the construction of the ship and specify in which fiscal year BAR plc has to recognise this loss in its financial statements.

iv) Calculate the revenue attributable to the provision of the annual maintenance ser vice and explain how BAR plc should recognise this revenue. You can, but do not have to, prepare journal entries.

[20 marks]

TOTAL 25 MARKS

QUESTION 6

ANSWER ALL PARTS OF THIS QUESTION 财务报告代写

a) Explain the purpose of consolidated financial statements.

[2 marks]

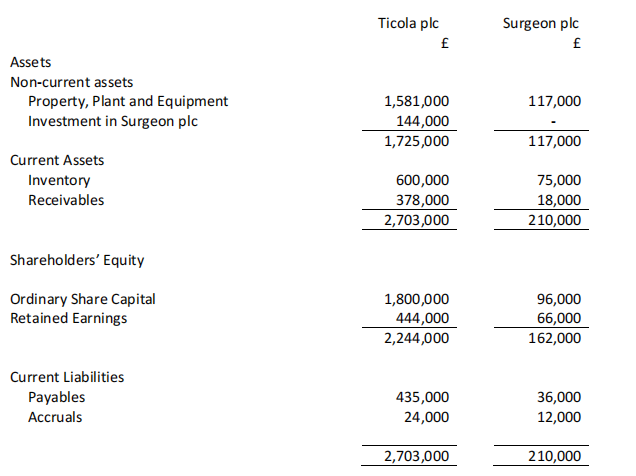

b) As at 30 September 2020, the Statements of Financial Position of the two companies in ‘The Laughing Doctor group’, Ticola plc and Surgeon plc, were as given below.

Other information

- Ticola plc had paid £144,000 on 1 October 2017 to buy 70% of the ordinary share capital of Surgeon plc. At that date, the retained earnings of Surgeon plc were £30,000.

- Also on 1 October 2017, the fair value of Surgeon plc’s non-current assets was £24,000 in excess of their book value. This valuation difference has not been reflected in the books of Surgeon plc. (Any depreciation consequences arising from re lated adjustments may be ignored.• Since being acquired by Ticola plc, Surgeon plc has not issued any shares.

- There has been an impairment of the goodwill arising on consolidation of 40% since acquisition.

REQUIRED: 财务报告代写

Prepare a consolidated Statement of Financial Position for the Ticola plc group as at 30 September 2020. In producing the Statement, provide clear, detailed workings and explain carefully the purpose of each calculation undertaken and why you have used each of the figures in the calculation.

[23 marks]

TOTAL 25 MARKS

END OF PAPER