China Fiscal Regime for Petroleum Exploration and Development

Fiscal Regime代写 China Fiscal Regime for Petroleum Exploration and Development:China is one of the world-leading oil and gas producers and consumers.

China is one of the world-leading oil and gas producers and consumers. The term “fiscal regime” is used to refer to quantifiable forms of government participation in oil and gas exploration and development including participation, royalty, taxation and profits. Production sharing contract (PSC) is the common type of contract that the Chinese government use to govern partnership with local and foreign companies in oil and gas exploration. In this regard, this study explains and analyze one-year PSC terms in petroleum development.

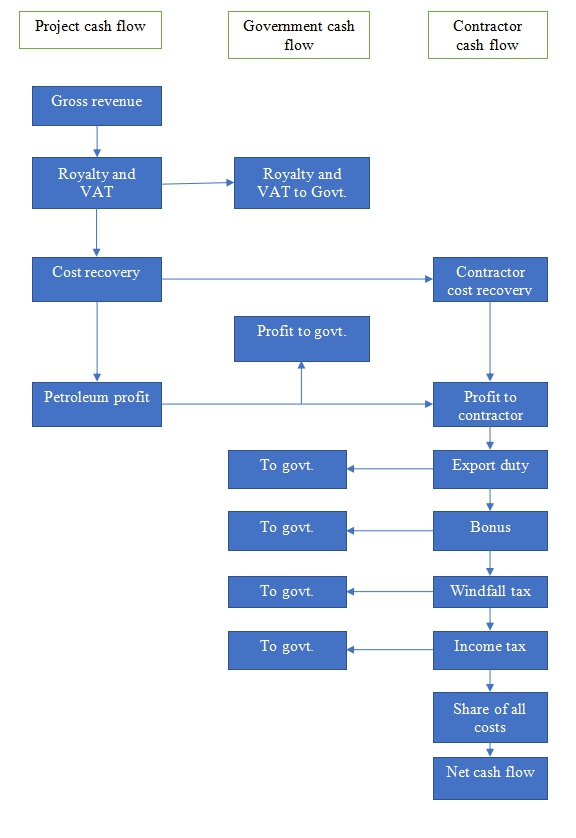

The figure 1 below shows a typical structure of Chinese PSC term as a flow chart. Fiscal Regime代写

It is an illustration of how contractors derive after-tax net cash flow using PSC terms. There are three main components including project cash flow, government cash flow and contractor cash flow. At the top is the gross revenue from the sales of petroleum. Royalty and VAT are deducted as percentage of the total revenue. Typically, in Chinese PSC, VAT is fixed while Royalty rate is incremental depending on production rate. After these deductions, subject to Cost Recovery, the contractor deducts the costs of production. The remainder is shared between the government and the contractor depending on the production level.

When the profits are allocated, the contractor is entitled to pay a bonus, export duty, revenue windfall tax. Fiscal Regime代写

There are many bonuses paid by the contractor from their gross profit. However, in this analysis, I will assume that the contractor exports all the shares so that the company pays export duty for its revenues. Revenue windfall tax is applied when the price of crude oil is more than $40 per barrel. The final tax applicable to contractors is income tax. Taxable income is the total cost recovery and share of revenue less operating and capital depreciation costs.

In reference to figure 1, the total revenue that accrues to the contractor is equal to total cost recovery and petroleum profit shared. The deductions include income tax, bonus, and operating costs. The net cash flow is indicated at the bottom right-hand side as the remaining revenue.

Figure 1: Structure of Chinese PSC term

Components of Chinese PSC Fiscal Regime代写

a. Royalty: The rate is calculated on an incremental sliding scale for foreign PSCs. The rate is calculated according to oil and gas production in the contract area and appropriate sliding scale is applied.

b. Value-added tax: It is based on the gross revenue and charged at the rate of 5 percent.

c. Cost recovery: The contractor is allowed to recover the cost of exploration, development and operations of a contract area. It is charged after deducting Royalty. However, the cost recovery has a limit on a sliding scale and vary for both offshore and onshore contractors. It ranges from 50% to 62.5% for offshore contractors. The cost recovery for natural gas is 70 percent.

d. Profit-sharing: The profit after deducting royalty, VAT and cost recovery is allocated between the government and the contractor. Profit-sharing is negotiated in PSCs and ranges from 0% to 40% for the government.

e. State participation: The remaining allocable oil profit is shared with respect to the proportion of participants in the project.

f. Bonus and fee: There is a signature bonus of $1 million that is not recoverable. A non-refundable submission fee of between $10,000 to $40,000 is paid.

g. Export duty: It is set at 5 percent of the contractor revenue.

h. Revenue windfall tax: Applicable to both onshore and offshore contractors. It is charged on a weighted average price of crude oil for revenue exceeding $40 per barrel. The tax is incremental from 20 percent by 5 percent for every additional $5 per barrel until 40 percent ceiling.

i. Income tax: A 25 percent corporate tax is levied to all oil contractors.

Hypothetical numerical example analysis Fiscal Regime代写

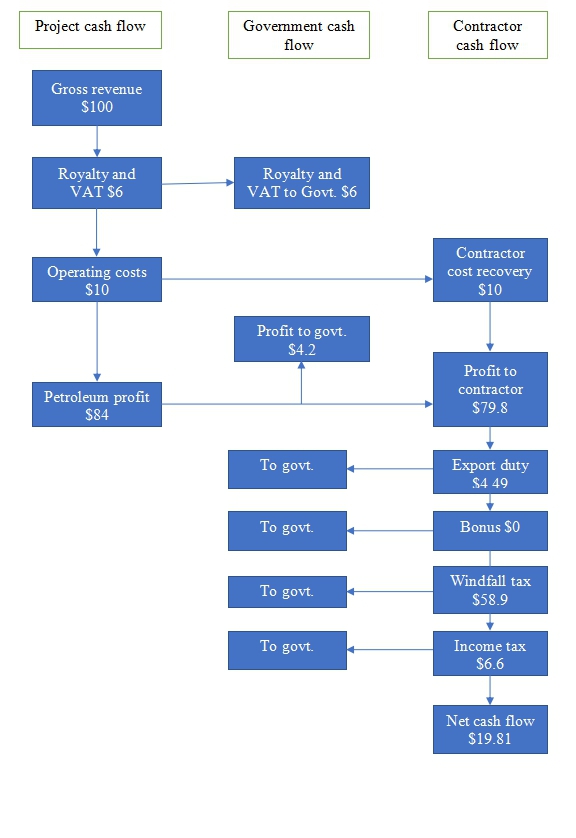

Figure 2 below shows the numerical cash flow analysis using a Chinese offshore contractor of a single year. also, it a simple illustration of PSC flow chart indicating project, government, and contractor cash flows. Nonetheless, there are underlying assumptions as indicated below:

a. Operating costs are for the years of study

b. 5% cost recovery

c. 95% contractor profit share

d. 5% export duty

e. $0 bonus for the year of study

f. 25% income tax

Gross revenue Fiscal Regime代写

At the left-hand side of figure 2 is gross revenue from oil sales. The gross revenue is assumed to be $100 million. The 6% of total revenue is deducted as VAT and royalty remaining {100 – (100*6/100)} = $94 million as the gross revenue.

Cost recovery

Costs are recovered after royalty deductions. Cost recovery ceiling is 58.5 percent. The cost to be recovered in this case is operating costs assumed at $10 million.

Profit-sharing Fiscal Regime代写

The remaining revenue is calculated by deducting royalty, VAT, and cost recovery. That is, {100 – (6 + 10)} = $84 million. The contractor gets 95 percent of the oil profit and the government to receive the remainder. That is, (95% * 84) = $79.8 million will go the contractor and (84 – 79.8) = $4.2 million go to the Chinese government.

Export duty, bonus, and revenue windfall tax

These are paid after revenue allocation between contractor and the government. In this case, we have a $0 bonus. Assuming all the oil is exported, the contractor pays export excise duty of 5 percent of the revenue with cost recovery added back. That is, {5% * (79.8 + 10)} = $4.49

Figure 1: Chinese PSC term numerical analysis

million. Also, since the price per barrel is assumed to be $80, the revenue windfall tax is $59 in reference to the incremental sliding rate provided by the government. That is, 79.8/80 = 997,500 barrels. The revenue windfall tax is 997,500 * 59 = $58.9 million.

Income tax Fiscal Regime代写

Taxable income is equal to cost recovery plus allocated revenue less operating cost, export excise duty, and revenue windfall tax. In this case, we assumed operating costs to be the cost recovery. As such, {(79.8 + 10) – (4.49 + 58.9) = $16.41 million is the taxable income. Thus, income tax is 25% * 26.41 = $6.6 million.

Net cash flow to the contractor

Figure 2 shows at the right-hand corner to the total revenue for the contractor. It is equal to oil profit allocation plus cost recovery. That is, 79.8 + 10 = $89.8 million. The total outgoing costs for the contractor include export duty, bonus, revenue windfall tax and income tax. The net cash flow is calculated by deducting the outgoing costs from the total revenue. That is, {89.8 – (4.49 + 0 + 58.9 + 6.6) = $19.81 million.

Summary Fiscal Regime代写

Project gross revenue is $100 million

Government take is $80.19 million

Contractor take is $19.81 million

Reference Fiscal Regime代写

- (2019). Global oil and gas guide 2019. Retrieved from https://www.ey.com/Publication/vwLUAssets/ey-global-oil-and-gas-tax-guide-2019/$FILE/ey-global-oil-and-gas-tax-guide-2019.pdf

更多其他: 研究论文代写 Report代写 Case study代写 Proposal代写 Capstone Projects Essay代写 数据分析代写 Review代写 文学论文代写 Academic代写 商科论文代写 论文代写

您必须登录才能发表评论。