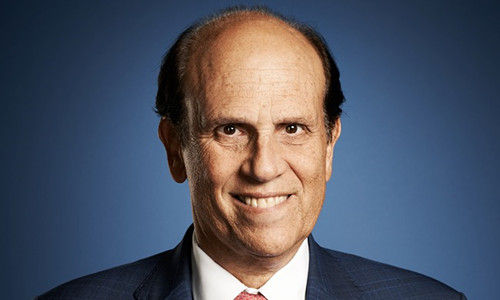

Michael Milken: The Junk Bond King

Name

Institution

Michael Milken: The Junk Bond King

Michael Milken代写 The Junk Bond King:Many could argue that the only worthwhile innovation in the world of finance is the ATM.

Many could argue that the only worthwhile innovation in the world of finance is the ATM.

The ATM has revolutionized how transactions are made with quick of access to cash without having to visit the bank. But rather the greatest and most recent innovation in finance history was not ATM, quick cash without having to queue notwithstanding, but the junk bond.

Junk bonds remain popular today, and they are commonly referred to as high-yield bonds. The fact that the innovation behind them help solve the ubiquitous problem of enabling lower-rated companies to access capital finance and credits through bonds. This innovation helped industries grow which could not have had a chance were it not for junk bond financing. The brainchild behind this noble creation was none other than a man in his early 70’s ex-convict who was legally banned to never be active in his own game-Mike Milken. He was one of the greatest names in Wall Street.

Mike, who is Jewish, was born in Encino in California (Cohan, 2017). His father was an accountant, and the mother was a housewife. Not much of his early life is known, but his father afforded them a comfortable life. He joined Birmingham High School before studies in Berkeley. He distinguished himself as a go-getter hardworking lad than his contemporaries. He later attended Wharton School of Finance in Pennsylvania to study finance. At that time he realized how he could make money out of bonds from low rated companies as compared to high rated ones. At the same time create a supply of such bonds using unscrupulous methods.

Ready with his new ideas, he joined Drexel Burnham Lambert who was set to create junk bonds for the companies. Michael Milken代写

The bonds were issued and underwritten by the Drexel Burnham. This idea created an option of finance for not only the small credit unworthy companies but also big corporations to finance ambitious projects. This created demand and supply of finance thus making Drexel and Milken unprecedentedly rich and junk bond financing trend became well known in the finance market but not their underhand operations.

Although Mike made a fortune out of his ingenious innovation, his lifestyle never changed. To him, it was about proving that you are smarter than the rest. Through Drexel, they continued with their cover-ups while taking advantage of their gullible clients. To him, it was his interest first and above thus defrauding majority of them. Their actions led to a massive loss of a job in the United States and the economy was clutching at straws.

In the midst of economic disasters in the U.S, Drexel was hit by scandals in 1989 and Dennis Levine, one of its inside jobs, was arrested causing alarm to the investors and clients. He later pleaded guilty that shed a cloud of doubts to the operations of Drexel. Eventually, the whole operations of illegal financial practices were unearthed, and Mike was investigated and arrested for financial crimes. He was later cowed to pleading guilty of securities and reporting the violation and sentenced to 22 months in prison, a fine, and lifetime ban to never engage in the securities market.

Milken was not driven by personal avarice but aimed to democratize finance market. Michael Milken代写

He aimed at overturning the existing forces and create his revolutionary approach to financing using junk bonds. It is, therefore, easier to say personal endeavors for societal change drove him, that is “doing business to do good.” Today, Mike is revered by many as finance revolutionist whose principal on junk bond has transcended over generations.

References Michael Milken代写

Cohan, W. (2017). Here’s how you make a comeback on Wall Street — The Michael Milken Story. Retrieved from https://www.businessinsider.com/michael-milken-biography-2012-8?IR=T#milken-moved-his-junk-bond-trading-desk-from-new-york-to-los-angeles-on-the-4th-of-july-in-1978-6