Question set代写 Question A a. Depict the price movements of the five equities on one single chart, create a chart on the returns.

Question A

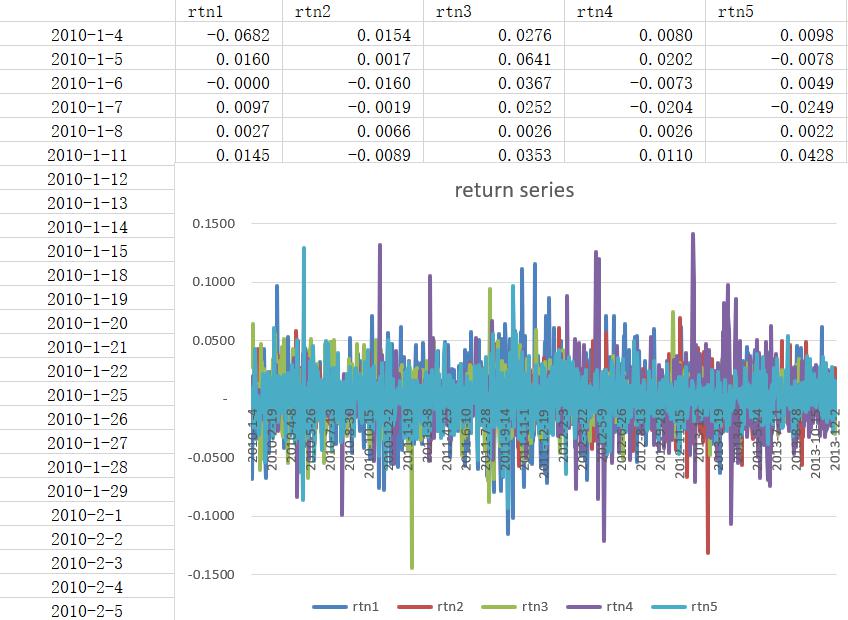

a. Depict the price movements of the five equities on one single chart, create a chart on the returns. Explain what we can see.Question set代写

Sol: step 1, unify the data into US dollar unit;

step 2, plot the new price data on one chart., then we get the pic below.

Step 3, pay attention to Richter Gedeon on 2013-7-11, the price collapsed from 35800 to 3570. remove this unusual point at first. Then plot the log return series of five equities.

Findings: 1) Bank of Japan suffered a sharp fall in price since 2013-05.

2) Apple Computer Inc ‘s return series has the lowest volatility.

3) Richter Gedeon has occurred collapse in 2013-07.

b. Assuming that these prices follow log-normal distribution, define the parameters of the five distributions.Question set代写

Sol: using log-return series, we calculate daily mean and standard deviation.

| daily return | 0.0008 | 0.0010 | 0.0005 | -0.0003 | -0.0001 |

| daily volatility | 0.0254 | 0.0173 | 0.0203 | 0.0227 | 0.0197 |

Then we get the parameter =√‾‾252*daily return and *daily volatility ,

| Volkswagen | Apple Computer Inc | Ford Motor Co | Bank Of Japan | Richter Gedeon | |

| μ | 0.20 | 0.24 | 0.13 | -0.06 | -0.03 |

| σ | 0.40 | 0.27 | 0.32 | 0.36 | 0.31 |

Question B

Main idea: using linear interpolation to get the corresponding yearly rate.Question set代写

For a. time to maturity: 8/12 Year

on 2013-12-6, USDGovt; 12M yearly rate = 0.1443%

USDGovt; 1M yearly rate = 0.0371%

The corresponding yearly rate is 0.1053%.

For b, time to maturity: 9.5 Years

on 2013-12-6, HUFGovt; 108M yearly rate = 5.9005%

HUFGovt; 120M yearly rate = 6.1466%

The corresponding yearly rate is 6.0235%.

For c, time to maturity: 5 years, yearly rate of USDGovt, 60M is 1.5122%.

For d, time to maturity: 5 years, yearly rate of PLNSwap,60M is 3.8476%.

For e, considering EUR Government Bond, with time to maturity 30 years.

yearly rate of EURGovt, 360M is 2.8173%.

Aggregate the data, and use Finance Calculator to calculate the current price of these five Bonds. (detail can be found in Sheet-QB)Question set代写

| Start date | End date | Type | currency | Bond Price (PV) | |

| a | 2013-8-6 | 2014-8-6 | US Treasury Bill | USD | 99.9299 |

| b | 2013-6-6 | 2023-6-6 | Hungarian Fixed Coupon Bond | HUF | 103.3724 |

| c | 2013-12-6 | 2018-12-6 | Hungarian Fixed Coupon Bond | USD | 120.2607 |

| d | 2013-12-6 | 2018-12-6 | Polish Floating Coupon Bond | PLN | 100.0000 |

| e | 2013-12-6 | 2043-12-6 | EUR Government Bond | EUR | 52.2507 |

The expected return and volatility are listed below,

| current time: 2013-12-6 | |||

| Type | expected return | volatility | |

| a | US Treasury Bill | 0.0022 | 0.0170 |

| b | Hungarian Fixed Coupon Bond | 0.0746 | 0.1545 |

| c | Hungarian Fixed Coupon Bond | 0.0136 | 0.0960 |

| d | Polish Floating Coupon Bond | 0.0464 | 0.1268 |

| e | EUR Government Bond | 0.0298 | 0.0955 |

Question C

a. minimize risk

sol: we can find that five bonds have low volatility, if we want to minimize risk, we can only hold US Treasury Bill.

b. Maximize expected return

sol: Apple Computer Inc has the highest expected return, then we can only hold Apple Computer Inc.

c. minimize 1-year-VaR(99%)

sol: we calculate the Value at risk of ten securities, result listed below

| Type | VaR(99%) |

| B-a | 3.67 |

| B-b | 25.62 |

| B-c | 22.76 |

| B-d | 22.01 |

| B-e | 9.15 |

| Volkswagen | 132.82 |

| Apple Computer Inc | 26.07 |

| Ford Motor Co | 7.74 |

| Bank Of Japan | 298.40 |

| Richter Gedeon | 11.02 |

We can hold US Treasury Bill and Ford Motor Co, these two securities have low VaR(99%).Question set代写

Question D

hold from 2013-12-6 to 2014-3-6.

Back test C-a, US Treasury Bill Price will = 100/(1+0.05388%)^0.25 = 99.9865

Return rate = 99.9865/99.9299-1=0.0567%;

Back test C-b, Apple Computer Inc’s return rate = 75.82/80-1=-0.0523;

Back test C-c, Ford Monto Co’s return rate = 15.67/16.7-1=-0.0617

When equal-weighted, the portfolio’s total return is 1/2*(0.0567%-0.0617)=-0.0306

We can find that bonds will outperform equities during the holding period.Question set代写

更多其他: 助学金申请 成品购买 Case study代写 网课代修 数据分析代写 润色修改 代写案例 Assignment代写

您必须登录才能发表评论。