Export of Cooking Oil from Australia to China Report

By

Instructor

Course

Institution

Location

Date

Export of Cooking Oil from Australia to China Report

Cooking Oil代写 This paper reports on the trade between Australia and China regarding the importation of cooking oil to China.

Introduction

China is the second leading market for imported foods and beverages (Gale, Hansen, and Jewison, 2015). The United States is the leading importer and exporter of Soybean oil. The total imports in 2016 were over A$130 billion (Wilson, 2008, p. 13). China is the world’s largest consumer of oilseeds and cooking oil (Fan and Eskin, 2012, p. 131). People commonly use peanut oil, vegetable oil, and olive oil. The demand for cooking oil has been on the rise in the last few decades (Fang and Beghin, 2002, p. 745). The country cannot produce enough oil to feed its population.

Thus, it imports from other countries. Australia is among the largest exporters of foods after the United States, Brazil, Canada, Argentina, and Thailand (Export Markets – China, n.d). The value of food and beverage imports from Australia to China amounts to A5.3 billion in 2016 (Gale, Hansen, and Jewison, 2015). The value represents an increase of 40 per cent between 2015 and 2016. The relationship between the two countries is a result of bilateral trade agreements. Cooking Oil代写

China and Australia are trade partners, and all exporters have to do due diligence research on both countries’ laws that regulate imports and exports. Most importantly, it is the supply chain and logistic considerations that are pertinent to the trade. Overall, these factors determine the time and cost of business from Australia to China.

This paper reports on the trade between Australia and China regarding the importation of cooking oil to China.

Import and export trade is a series of activities that all traders need to be aware of. The paper will focus on the analysis of various trade data on cooking export from Australia to China, including export flows, commodity pricing, fleet data, and freight rate. Notably, it will give an overview of the oversea transport system using Capesize Dry Bulk ships. The demand and supply of cooking oil in China market will also be described. Generally, the report will serve as a source of information by international traders, especially between the two countries.

Literature Review Cooking Oil代写

Capesize Dry Bulk Description

Cargo ships and vessels come on different types, and sizes fit to meet the various maritime cargo transportation needs (Marine Insight, 2019). Their categorization of cargo ships partly considers the capacity and partly dimensions. These factors in classification are related to different oceanic and sea canals and canal locks the vessel travel. According to Cabrera (2019), the sizes range from modest handysize carriers with a capacity of 10,000 – 30,000 deadweight tonnage to mammoth VLCC and ULCC supertankers that have the ability to cargoes that are more than 200,000 deadweight tonnage.

In this context Cooking Oil代写

Capesize dry bulk ships are ultra-large cargo ships used to transport large quantities of unpacked products (Xu, Yip, and Marlow, 2011, p. 985). They have a capacity of more than 150,000 deadweight tonnage, and their length range between 1,100 feet to 1,350 feet. As seen in figure 1 below, they larger than Panamax and Suezmax vessels in terms of size and tonnage. Capesize falls in the categories of CLCC, ULCC, VOC, and ULOC (Karan, 2019). Cooking Oil代写

They can be larger than 400,000 deadweight tonnage. The ships are only suitable to serve in large and deepwater terminals in the world. They were primarily made to transport coal and iron ore, but today they are used to transform other commodities such as food and beverages. Due to their large dimensions and deep draught, Capesize is limited only to serve terminals that have deep waters like Yangshan Deepwater Port in Shanghai. Thus, they only serve a small number of ports in the world.

Figure 1: Capesize cargo ship

Additionally, Capesize vessels are also designed as tankers to transport liquid products without barrels or containers.

There are specialized tankers with particular food-grade holds, pumps, and other essential equipment suitable for the transport of either molasses, edible oil, or even wine. The cargo tank has several stainless cylindrical cargo tanks of different diameters ideal for the transportation of consumable liquids.

Cooking Oil Cooking Oil代写

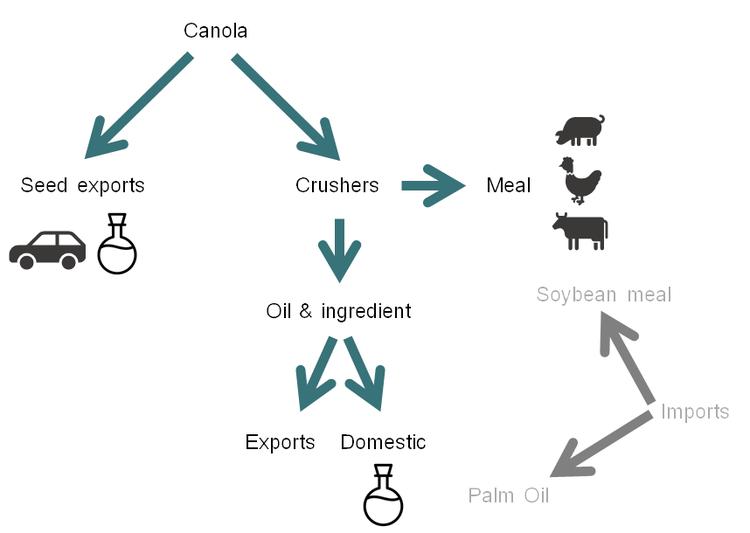

Australian oilseed, oil, and meal are in high demand. Through the various supports in the value chain, including production, processing, distribution, and marketing, the industry produces more than 3 million tons of oilseeds every year (Santella, and Farrel, 2018, p. 3). The major oilseed crops are canola and cottonseed and which accounts for up to 90 per cent of the local production. Other oilseeds produced include soy, sunflower, safflower, peanut, and linseed/linola as seen in figure 4 below.

The oilseed industry in Australia is dynamic, complex and diverse. The export market for the oilseed amounts to over 1 million tons and represents about 20 per cent of the world’s canola trade. China is one of the trade partners where Australia exports surplus oilseeds, oil, and meals. Other significant markets include Japan, Europe, Pakistan, the USA, and Korea. The country is also becoming well-known for it’s quality edible oilseed, such as soybeans and sunflowers.

Figure 2: Production of canola

Figure 3: Canola seeds

Figure 4: Various uses of canola

Notably, Canola is the most significant oilseed in Australia and has put the country at the global export market. Cooking Oil代写

It is a member of a large family called crucifers. The plants are identifiable because of their four yellow flower petals that form the shape of a cross, as shown in figure 2 above. The flowers produce seed pods about 5 centimeters in length. Each plant has about 60 to 100 pods. Each pod contains between 20 to 30 tiny round seeds about one mm in diameter, as shown in figure 3 above. When harvested, the small seeds are crushed to extrude canola oil.

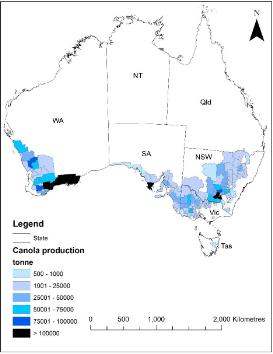

The production for the canola oilseeds is on the rise from 2.7 million hectares in 2018 to 3 million hectares in 2019 (Santella, and Farrel, 2018, p. 4). The expansion in production is due to the favorable climatic conditions in western and eastern Australia regions. It is the third-largest produced commercial crop after wheat and barley. Canola is also the major oilseed in southwest WA to southeastern Australia and into northern NSW, as shown in figure 5 below. Farmers produce canola for both human consumption and animal feeds.

Figure 5: Canola production. (Santella and Farrel, 2016, p. 4)

Supply and Demand for Cooking Oil Cooking Oil代写

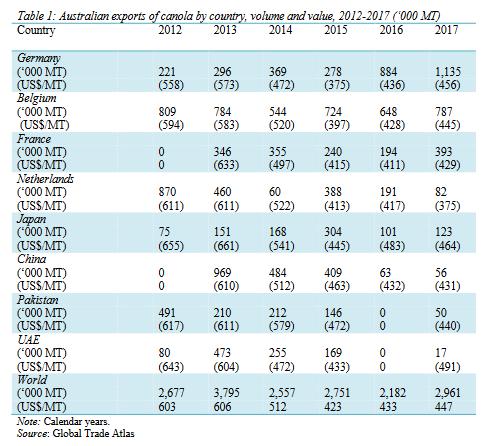

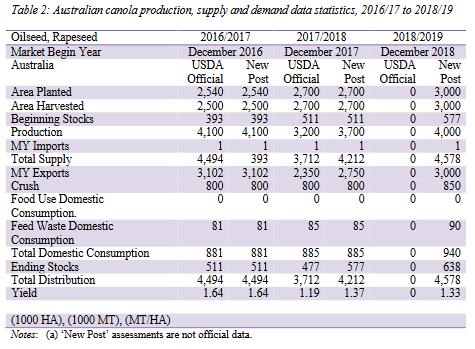

Canola is the main oilseed crop in Australia, amounting to 3 million tons each year (Santella, and Farrel, 2018, p. 3). Domestic consumption of canola amounts to 940,000 MT, representing a 6 per cent increase from the previous consumption level. The local demand for canola products like meal increases at a decreasing rate because of the competition from the imported soybean meal. In year 2018/19, the government forecasted the growth in export to 3 MMT, which is a 9 per cent increase from the previous period.

Canola export market share amount to roughly 15 per cent to 20 per cent. The primary export market is European Union and accounts for 60 per cent of the total canola exports in 2018/19. The EU market has remained the leading destination for canola oil averaging 50 per cent for the last five years. The country also exports to South Korea, Japan, and Malaysia. EU uses canola oil for the production of biodiesel. In Asian market in which China is among the central market, oil is used for human consumption.

Additionally, the export for canola in China has decreased significantly as most exporter focus on the EU biodiesel market (Santella, and Farrel, 2016, p. 9). Cooking Oil代写

Another reason for the decline is the competition from the Canadian canola that is more price competitive when exported into the Chinese market. The export market for Australian canola has not been affected by the quarantine restrictions by the Chinese government over the blackleg disease in canola (Salisbury, Ballinger, Wratten, Plummer, and Howlett, 1995, p. 668). The EU biofuel market is more favorable to exporter because farmers have been certified as sustainable. The EU accepted Australia’s canola as meeting the greenhouse gas saving by 50 to 60 per cent. The table 1 below explains the canola export market.

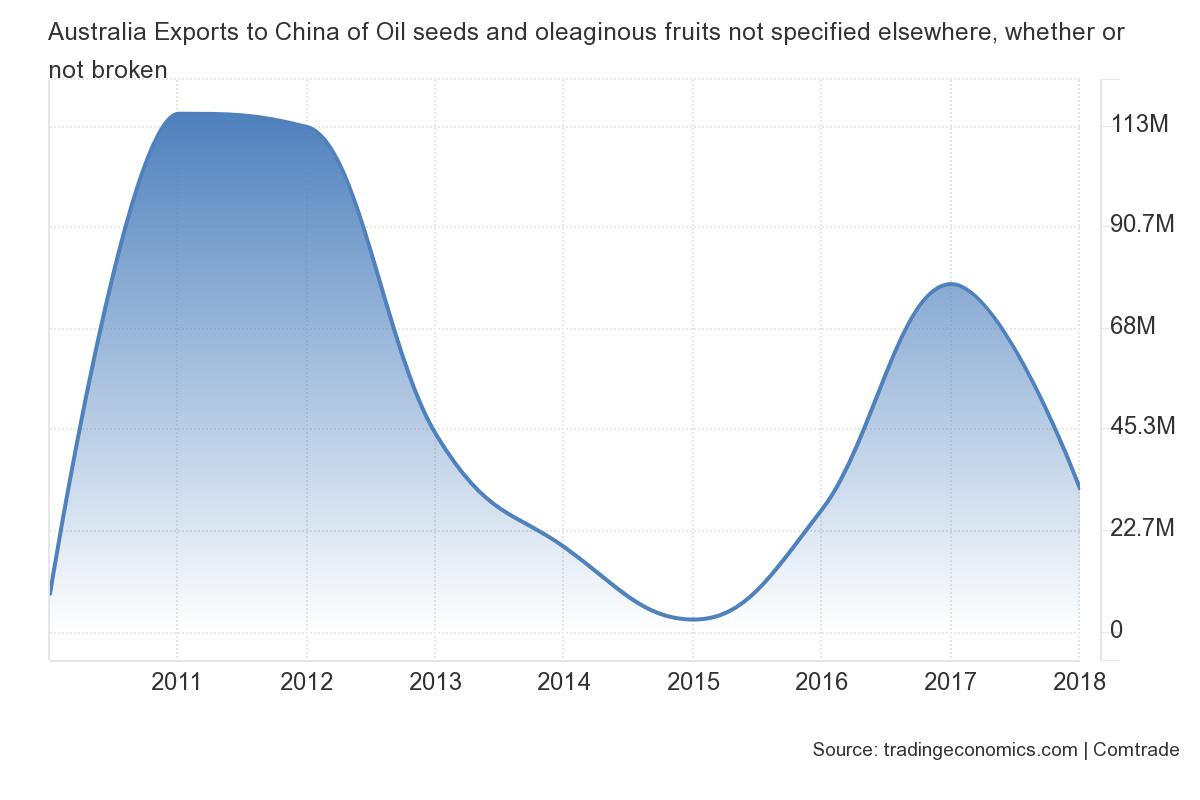

Table 1: Australian export of canola. (Santella and Farrel, 2016, p. 9)

Commonwealth Scientific and Industrial Research Organization (CSIRO) revealed that Australian canola has a higher saving on greenhouse emission and hence can be used to achieve the EU targets on emission requirements (Santella, and Farrel, 2016, p. 9). As such, farmers have access to the EU export market through certification by the EU Renewable Energy Directive. When certified as sustainable, canola fetches premium prices in the EU biofuel market. Table 2 below summarised the demand and supply of canola in Australia.

Table 1: Australian export of rapeseed. (Santella and Farrel, 2016, p. 9) Cooking Oil代写

Although farmers are reducing exports to China, there is a rising demand for edible oil in the country. China is the largest consumer of oilseeds and cooking oil. Peanut oil, vegetable oil, and olive oil are common cooking oil in the country. In 2017, the market for olive oil in China increased to 43,000 tons. It is also the largest importer of soybeans. They present opportunities for Australian farmers to diversify to more production of olive oil and soybeans, which are on high demand in China.

Methodology Cooking Oil代写

The report uses secondary data from Bloomberg, World Bank Statistics, Tradewinds, and Lloyds List and UNCTAD Review of Maritime Transport. The various data collected include the amount of oil export from Australia to China, Pricing for the oil products, Fleet data, and the freight rate index. The data will be analyzed quantitatively for the trends and changes in the market. The finding will then be presented and discussed concerning the research topic. The conclusion will then be derived from the results.

Analysis and Results Cooking Oil代写

Australian Export to China

| Product Group | Export (US$ Thousand) | Export Product Share (%) |

| All Products | 68095677.03 | 100 |

| Capital goods | 890209.61 | 1.31 |

| Consumer goods | 3210565.21 | 4.71 |

| Intermediate goods | 3497820.15 | 5.14 |

| Raw materials | 60373138.12 | 88.66 |

| Animal | 1889637.85 | 2.77 |

| Chemicals | 954306.55 | 1.4 |

| Food Products | 2007967.54 | 2.95 |

| Footwear | 10701.27 | 0.02 |

| Fuels | 9309576.48 | 13.67 |

| Hides and Skins | 575175.48 | 0.84 |

| Mach and Elec | 676109.9 | 0.99 |

| Metals | 1844361.29 | 2.71 |

| Minerals | 44090041.21 | 64.75 |

| Miscellaneous | 416194.16 | 0.61 |

| Plastic or Rubber | 75222.77 | 0.11 |

| Stone and Glass | 888725.59 | 1.31 |

| Textiles and Clothing | 2380029.73 | 3.5 |

| Transportation | 54270.4 | 0.08 |

| Vegetable | 1672159.3 | 2.46 |

| Wood | 1251197.5 | 1.84 |

Table 2: Export data (Source: WITS Worldbank)

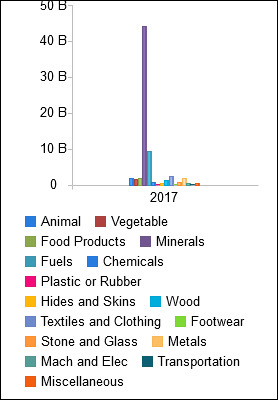

Figure 6: Australian export to China (Source: WITS Worldbank)

Table 1: Australian shipping of canola to China. (Santella, and Farrel, 2016)

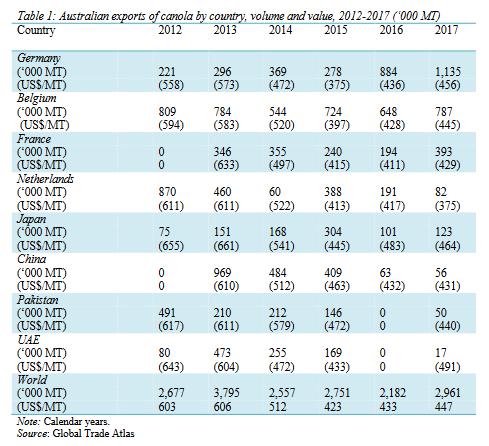

Figure 7: Australia cooking oil export to China

Regarding the data above, the export of food products to China constitutes 2.9 per cent of the total shipping. Mainly the shipping for cooking has been on the decline since 2013, as indicated in figure 7 above. Canola is the main export oil product to China market and amounted to 56,000 MT in 2017. The export to China market has been on a declining trend from 969,000 MT in 2013 to 56,000 MT in 2017. The decrease has been attributed to farmers shifting to the EU market that is offering premium prices compared to the China market.

Pricing Data Cooking Oil代写

The pricing for cooking oil in the export market is determined by various factors, including production costs, labour, tariff rates, and import duty, and freight costs. For simplicity, the paper will assume that canola is the leading and only exported product to China.

The cost of production will include input costs, machinery, and land cost. The initial costs include land preparations and the purchase of seeds. The cost of tillage is $160 per acre, and the harvesting cost is $60 per acre. The total expenses per acre, including variable and fixed, is approximately $180. Assuming the gross return of $220 per acre, the returns to land, capital, and management can be $40 per acre. A comparison between the expected yield and production costs shows that farmers need to sell canola at $11/cwt. This is the local price for raw canola oilseed.

At the international market, the pricing will include freight costs, taxes, excise duties, and other expenses. Cooking Oil代写

The exports to China are tariff-free. Australian exports are free to negotiate for both prices and terms with Chinese business partners. Also, exporters have to account for exchange rates to maintain the profit margins. Below is the estimation of the cost of the production of canola.

| Planted area | 1,200 ha |

| Estimate yield | 1.45 t/ha |

| Estimated production | 1,740 t |

| Fixed costs | |

| Insurance and general expenses | $100,000 |

| Finance | $80,000 |

| Depreciation/capital replacement | $70,000 |

| Drawings | $60,000 |

| Other | $30,000 |

| Variable costs | |

| Seed and sowing | $48,000 |

| Fertilizer and application | $168,000 |

| Herbicide and application | $84,000 |

| Insect/fungicide and application | $36,000 |

| Harvest costs | $48,000 |

| Crop insurance | $18,000 |

| Total fixed and variable costs | $742,000 |

| Per tonne equivalent (total costs + estimated production) | $426/t |

| Per tonne costs | |

| Levies | $3/t |

| Cartage | $12/t |

| Freight to port | $22/t |

| Total per tonne costs | $37/t |

| Cost of production port track Equiv. | $463.44 |

| Target profits (20%) | $93.00 |

| Target price (port equiv.) | $556.44 |

Table 3: Estimated cost of producing and selling price for canola.

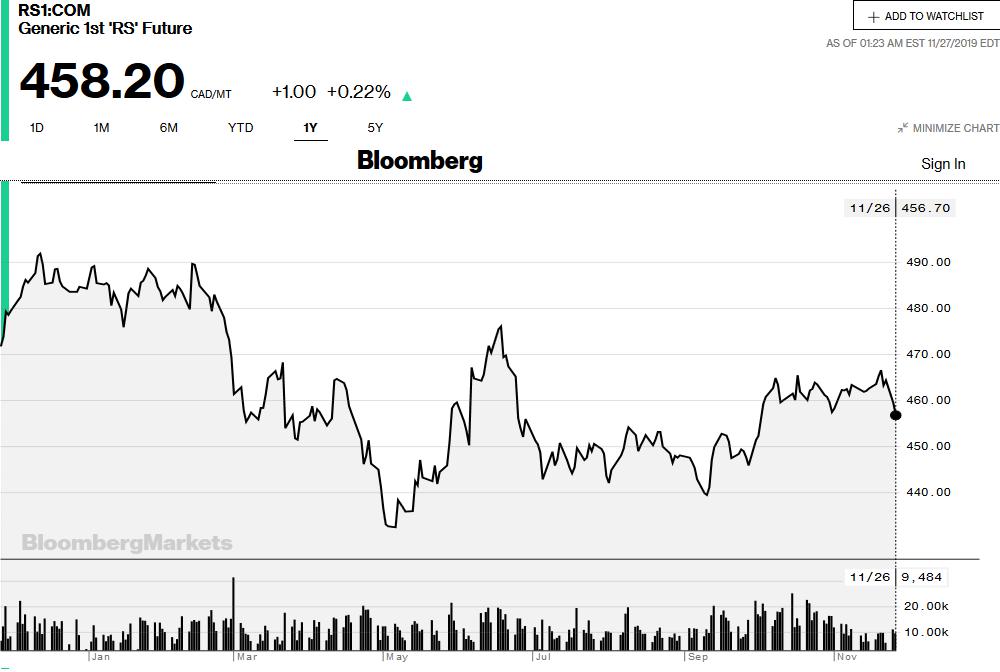

Figure 8: Canola average global prices. (Bloomberg)

The global prices for canola oil are not constant and change with time and season of the year. There are so many factors that affect canola price prospects ranging from production costs to consumer trends to shipping and logistics, from new products uses government regulations and trade barriers to commodity substitutability. They all affect the marginal supply and demand of the canola. Other factors that determine the level of prices include the changes in the cost of production, as outlined in table 3 above. The production costs constitute of canola oilseed production, transport, and levies at the port. Additionally, Capesize freight rate charges have been volatile over the years due to shifts in demand and supply.

Moreover, there are close competitors for canola in the global market, including U.S soybean. The U.S export of soy to China and other countries will affect the price of canola significantly. Besides the impact of production and consumption rates, the currency exchange rates in buying oilseeds also affect global canola prices (Chi, and Cheng, 2016, p. 18). Notably, the massive oil market for soybean, rapeseed, palm, and sunflower follows a similar price pattern.

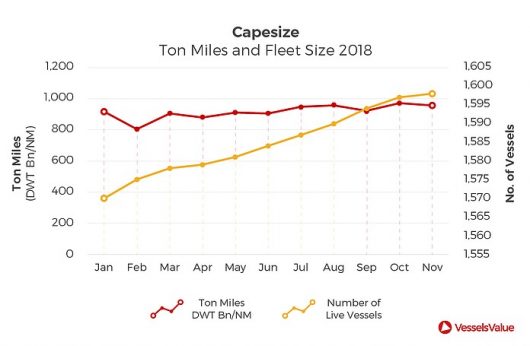

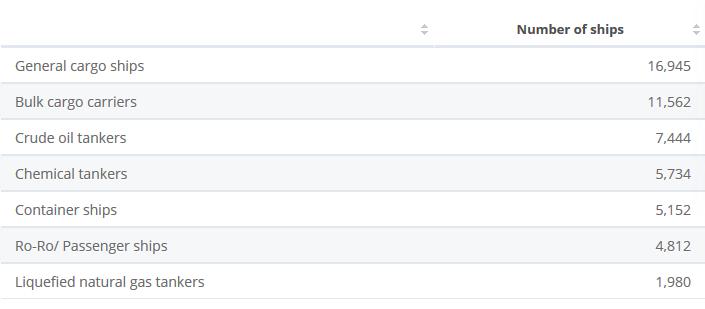

Fleet Data Cooking Oil代写

According to Statista, the number of bulk cargo carriers in which Capesize belongs is 11,562 (Statista, 2019). However, the number of vessels that is operational at a specific time one with the market. According to UNCTAD data, Australian owns seven oil tankers and four bulk carriers as of 2019. Below are the graphs (9 & 10) of deadweight in billion transported and the fleet used around the world. The number of Capesize has been volatile over the year owing to the trade wars between the US and China and the decline in trade between Brazil, Australia, and China. The market uncertainties have made buyers of raw materials cautious as the market took a steep dip in autumn, disrupting bulk chipping.

Figure 9: Capesize fleet size. (World Maritime)

Figure 10: Fleet size (Statista)

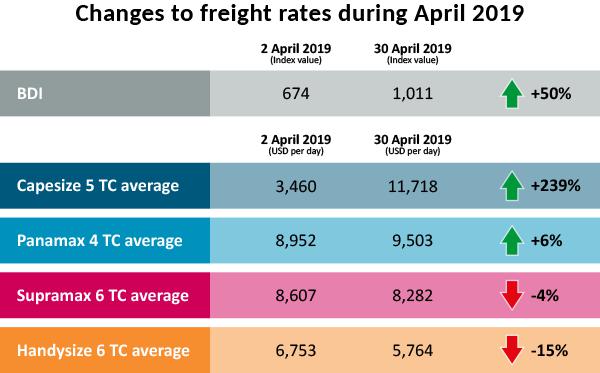

The Freight Rate Index Cooking Oil代写

As indicated in figure 11 below, the dry bulk freight has been a rollercoaster in 2019. After a long time decline with the lowest being in early 2016, the index for Handysize, Supramax, and Panamax segments began to rise in early 2019 (Sand, 2019). However, the index for Capesize lost all the buoyancy in early 2019. The weak rates are blamed on Brazil. Both Australia and Brazil iron-ore exports to China are the main drivers of Capesize prices (Benzinga, 2019).

It has resulted in low Chinese iron ore demand and iron ore supply disruption in the two leading exporters. The freight rates have therefore hit $3,460 per day on 2 April. The Capesize market rate had increased to $12,582 per day by May. In April, the Baltic Dry Index (BDI) is dominated by Capesize shipping. The index rose 50 per cent on the back of a 239 per cent increase in rates for Capesize ships.

Figure 11: Freight index rate changes. (Source: BIMCO)

Conclusion Cooking Oil代写

In summation, the cooking oil market is a lucrative global business. However, the market is very volatile owing to the shifts in freight rates, global prices, and high competition from substitutes. Canola and olive oilseeds can be the best investment choices for Australian exporter. The Chinese market for the product is growing, and there exist many incentives that have culminated in freeing trade between the two countries.

Nonetheless, the primary consideration in Australia and China export market is freight rates and market regulations and key trading partnerships. The demand and supply for Australian oilseeds are driven by Canada exports, U.S soybean exports, and EU demand for canola oilseeds. The cost of production and global prices, notwithstanding, exported market timing determines profitability.

References Cooking Oil代写

Benzinga. 2019. Why Are Capesize Dry Bulk Shipping Rates Still Sliding? Yahoo Finance. Available from https://finance.yahoo.com/news/why-capesize-dry-bulk-shipping-135918460.html

Chi, J., and Cheng, S.K., 2016. Do the exchange rate volatility and income affect Australia’s maritime export flows to Asia? Transport Policy, 47, pp.13-21.

Cabrera, N., 2019. The most common types of cargo ships. ShipLilly. Available from https://www.shiplilly.com/blog/the-most-common-types-of-cargo-ships/

Export Markets – China. n.d. Food and beverage to China: Trends and opportunities. Available from https://www.austrade.gov.au/Australian/Export/Export-markets/Countries/China/Industries/Food-and-beverage

Fan, L., and Eskin, N.M., 2012. Frying oil use in China. Lipid Technology, 24(6), pp.131-133.

Fang, C., and Beghin, J.C., 2002. Urban demand for edible oils and fats in China: Evidence from household survey data. Journal of Comparative Economics, 30(4), pp.732-753.

Gale, H.F., Hansen, J., and Jewison, M., 2015. China’s growing demand for agricultural imports. USDA-ERS Economic Information Bulletin, (136).

Karan, C., 2019. What is the Difference between Handymax and Capesize Vessels? Marine Insight. Available from https://www.marineinsight.com/types-of-ships/what-is-the-difference-between-handymax-and-capesize-vessels/

And

Marine Insight. 2019. The ultimate guide to ship sizes. Available from https://www.marineinsight.com/types-of-ships/the-ultimate-guide-to-ship-sizes/

Sand, P., 2019. Dry bulk: A struggling market gets all hyped up by Capesize volatility. Available from https://www.bimco.org/news/market_analysis/2019/20190611_2019_02_drybulk

Statista. 2019. A number of ships in the world merchant fleet as of January 1, 2019, by type. Statista. Available from https://www.statista.com/statistics/264024/number-of-merchant-ships-worldwide-by-type/

Santella, R., and Farrel, R., 2016. This Report Contains Assessments of Commodity and Trade Issues Made by Usda Staff and Not Necessarily Statements of Official US Government Policy. USDA Foreign Agricultural Service: Washington, DC, USA, p.11.

Salisbury, P.A., Ballinger, D.J., Wratten, N., Plummer, K.M. and Howlett, B.J., 1995. Blackleg disease on oilseed Brassica in Australia: a review. Australian Journal of Experimental Agriculture, 35(5), pp.665-672.

Wilson, R.F., 2008. Soybean: market-driven research needs. In Genetics and genomics of soybean (pp. 3-15). Springer, New York, NY.

Xu, J.J., Yip, T.L., and Marlow, P.B., 2011. The dynamics between freight volatility and fleet size growth in dry bulk shipping markets. Transportation research part E: logistics and transportation review, 47(6), pp.983-991.

更多其他:Report代写 研究论文代写 Essay代写 Proposal代写 Case study代写 艾莎代写 Admission Review代写 文学论文代写 Academic代写