MSTM 5200

INDIVIDUAL ASSIGNMENT

accounting代写 1. Write your name and student number on all the sheets completed. 2. Please label your files submitted in the following format…

1. Write your name and student number on all the sheets completed.

2. Please label your files submitted in the following format First_Last_Student No_5200Individual Assignment e.g. Supinder_Babra_123456_5200 Individual Assignment.

3. The assignment has two sections

a. Section A – Academic Honest – this must be signed and submitted else the assignment cannot be marked – Copy and paste into the document you submit for marking

b. Section B –Answer – 3 questions (95 marks Total)

4. There are 7 pages (including the cover page). Make sure you have them all.

5. All work will must be your own and state any necessary assumptions as needed.

6. Show all calculations for part marks where required.

Section A accounting代写

Academic integrity is fundamental to learning and scholarship at the Schulich School of Business Participating honestly, respectfully, responsibly, and fairly in this academic community ensures that the Schulich degree that you earn will be valued as a true indication of your individual academic achievement, and will continue to receive the respect and recognition it deserves.

While I don’t expect to encounter instances of cheating in this class, you should be aware that I take academic integrity very seriously, and that there are significant consequences if you are caught cheating or engaging in academic misconduct. Examples of misconduct on tests and exams:

• Misrepresenting your identity

• Submitting an altered test for re-grading

• Submitting work done as group or collaborating on an exam that must be done individually

Please sign the box below acknowledging the academic integrity statement above

Section B (15 marks) accounting代写

Question 1

In a perfect world, investors, board members, and executives would have full confidence in companies’ financial statements. They could rely on the numbers to make intelligent estimates of the magnitude, timing, and uncertainty of future cash flows and to judge whether the resulting estimate of value was fairly represented in the current stock price. And they could make wise decisions about whether to invest in or acquire a company, thus promoting the efficient allocation of capital.

Unfortunately, that’s not what happens in the real world, for several reasons. First, corporate financial statements necessarily depend on estimates and judgment calls that can be widely off the mark, even when made in good faith. Second, standard financial metrics intended to enable comparisons between companies may not be the most accurate way to judge the value of any particular company—this is especially the case for innovative firms in fast-moving economies—giving rise to unofficial measures that come with their own problems. Finally, managers and executives routinely encounter strong incentives to deliberately inject error into financial statements.

Despite the raft of reforms, corporate accounting remains murky. Companies continue to find ways to game the system, while the emergence of online platforms, which has dramatically changed the competitive environment for all businesses, has cast into stark relief the shortcomings of traditional performance indicators.

• Why are these issues still around? You can discuss your opinion on this issue, providing examples of your prior experiences (personal or professional) or current experience on the matter as necessary to support your arguments. (5 marks)

• Discuss at least 5 areas where there are potential disasters in financial statements and why. Be specific with examples rather than generic remarks? (10 marks)

Conclude all your answers with supporting arguments and research if necessary, on the issue

Question 2 – 25 marks accounting代写

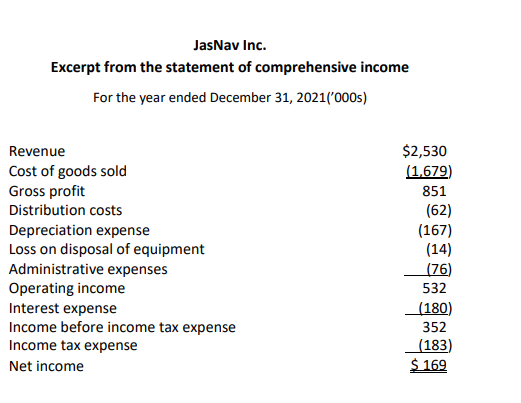

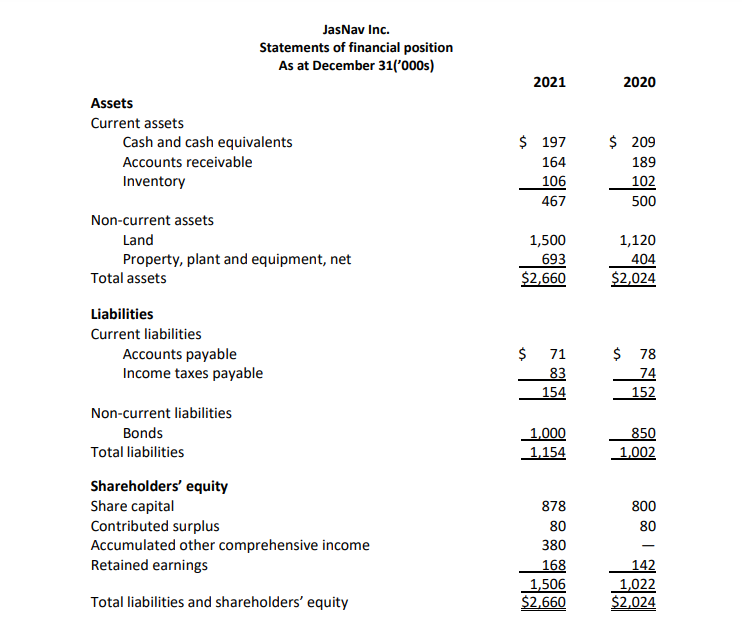

You have been provided with the following information, which has been prepared inaccordance with IFRSs.

The following notes accompany the financial statement. All numbers are in ’000s:

1. Non-current assets — property, plant and equipment had the following transactions:

a) During the year, a piece of equipment that had originally cost $120,000 and had a netbook value of $24 was sold.

b) Land was revalued at $1,500 on January 1, 2021.

2. The company paid dividends of $143 during the year.

3. Assume all bonds were issued at par.

4. JasNav reports interest expense and interest revenue as an operating activity, whiledividends paid are reported as a financing activity.

Required:

a) Prepare the statement of cash flows for the year to December 31, 2021, for JasNav using the indirect method to calculate the cash flows from operating activities.

b) Prepare the cash flow from operating activities section of the statement of cash flows usingthe direct method.

Question 3 – 60 marks accounting代写

If your company has been subject to a takeover, please use the new entity that has emerged as a result.

Retrieve the most recent company annual report and based on this document create a report with the following

1. Define the company Operations – 5 marks

2. What is the company Strategy – 5 marks

3. Provide an industry assessment for your company – 10 marks

4. Describe three items on the company balance sheet. One must be from Noncurrent assets, one from Non-Current Liabilities and the last from the Equity section. Provide an explanation of the following – 10 marks

▪ Why the company records these on the statements

▪ How do they value the item

▪ Any changes in the account over the past few years

5. Look at the company cash flow statement

▪ Copy the statement into you document as an image and describe what happened during the year – 5 marks

▪ Provide some explanations of the activity over the year – 5 marks

6. Perform a financial ratio assessment of the company and provide explanations and thoughts on the ratios. Make sure to explain what is the cause of the change in the ratio – 20 marks

All work must be clearly cited (APA format preferred)