A440 Exam #1

PRACTICE

Practice代写 All companies described in the exam are publicly-traded companies subject to SEC rules. Please type all answers into this Word document.

This exam is “open-book” / “open-note” but “closed” people. The Honor Code attestation at the bottom of this page reflects that you are attesting you did not receive any help from others in completing this exam, nor did you provide any help to others.Practice代写

Please type all answers into this Word document.

I will not answer questions about the exam while it is being taken. If you believe you need more information or anything is unclear, write down your assumptions next to the relevant question / answer. I will consider those notes / assumptions while grading.Practice代写

All companies described in the exam are publicly-traded companies subject to SEC rules.

There are 25 questions that are worth 125 points in total. Questions are not of equal value, and partial credit will be awarded when work is shown.Practice代写

————————————————————————————————————————————————————————————————————————————–

By submitting your exam electronically, you acknowledge that you are a part of a learning community at the Foster School of Business that is committed to the academic standards of honesty, respect, and integrity, and that you adhered to these standards while completing this exam.Practice代写

You further attest to neither providing any help nor receiving any help from other students on this exam.

Questions 1 through 10 [2 points each]

- Typically, the largest one-day response to a firm’s earnings announcement happens on the trading day after the announcement is made.

Circle one: True / False

- Regulation FD was enacted as a result of concerns about improper use of non-GAAP measures.

Circle one: True / False

- Detailed executive compensation information is disclosed in a company’s proxy statement (DEF 14A).

Circle one: True / False

- Earnings announcement always occur concurrently (i.e., at the same time) as the firm’s filing of the 10-Q.

Circle one: True / False

- In general, market price and fundamental value tend to be equal.

Circle one: True / False

- Earnings management is not an issue when equity-based incentives are used.

Circle one: True / False

- A company’s significant accounting policies are typically discussed in footnote __ of its 10-Q and 10-K.

- What would cause an accruals ratio to be negative?

- A younger firm (e.g., Lyft) and older firm (e.g., Ford) release earnings on the same day. Both have a similar forecast error. To which release is the market likely to react more strongly?

Circle one: younger firm / older firm / about the same

- Provide one example of accruals management andone example of operations management.

Question 11 [15 points]

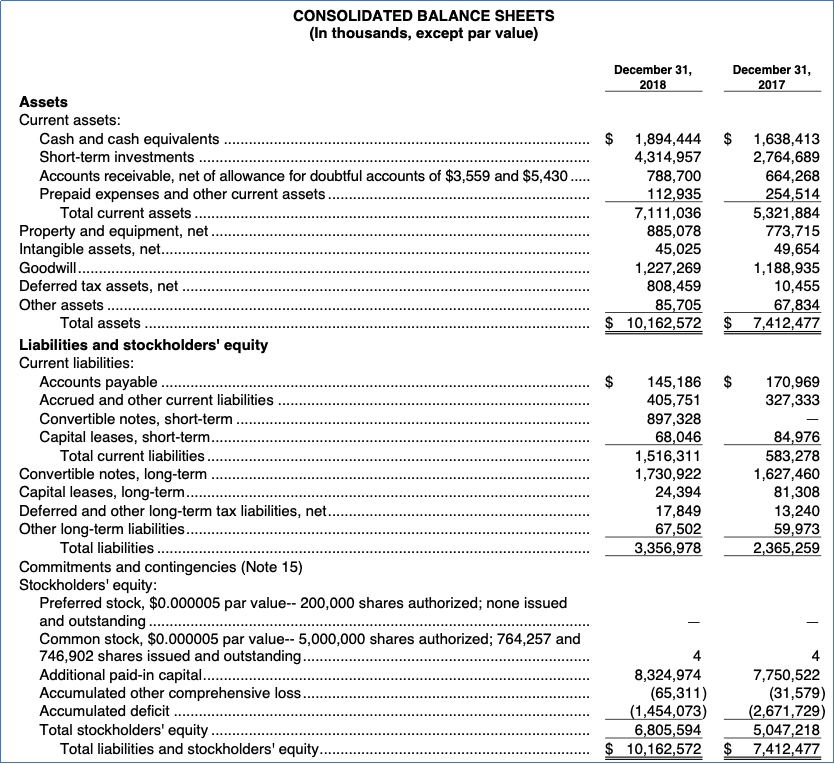

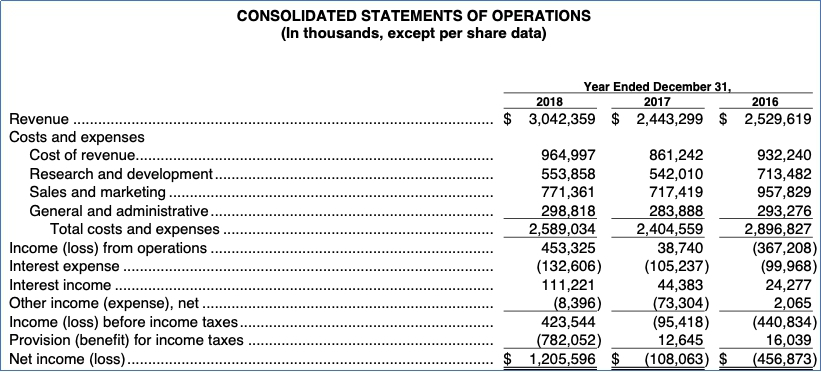

Refer to Exhibit A (at the end of this exam packet) to answer the following questions.Practice代写

a. Calculate the DuPont ratios for the company for the most current year (FY 2018). [6 points]

b. The company expenses its research and development (R&D) costs as it incurs them. Your boss informs you that, given the nature of the company’s R&D, a 4-year, straight-line amortization period is appropriate. For the most current year, calculate how total assets andnet income change after adjusting for the 4-year, straight-line amortization period. As in class, you may assume that the R&D costs for the most current year (FY 2018) occurred at the end of the year (i.e., do not amortize any of the FY 2018 R&D expense). [9 points]

Question 12 [4 points]

What are common-sized (i.e., vertical) financial statements and how can they be used for projecting future years’ financial statements?Practice代写

Question 13 [8 points]

(a) What does the efficient market hypothesis (EMH) state? [2 points]

(b) Is the theory a descriptive or normative theory, and why? [3 points]

(c) Explain the concept of “drift” that occurs after a news release and explain its connection to the EMH. [3 points]

Question 14 [4 points]

Sun Devil Co.’s earnings release highlights that its “unique paying customers” increased 40% from the prior quarter. The metric does not have a comparable GAAP measure. What else, if anything, must Sun Devil Co. do to comply with Regulation G?Practice代写

Question 15 [6 points]

(a) Your classmate complains to you that learning about earnings quality is a waste of time when analyzing companies’ financial statements. What would you say to help convince him / her otherwise? [3 points]

(b) Discuss two indicators of earnings quality and how they shed light on the likelihood that a company has misstated earnings. [3 points]

Question 16 [6 points]

For each scenario below, indicate how you expect the market to respond and explain why.Practice代写

(a) Showing profitable net income and a decline in year-over-year revenue. [2 points]

(b) Showing top-line (i.e., revenue) and bottom-line (i.e., income) that exceeded consensus expectations. [2 points]

(c) Meeting consensus earnings expectations and lowering guidance for next fiscal year earnings. [2 points]

Question 17 [15 points]

In the early 2000s, the SEC became concerned about the number of firms reporting non-GAAP measures, eventually leading to the implementation of Regulation G.Practice代写

(a) What was the basis for the SEC’s concern? [4 points]

(b) What other options did the SEC have for addressing its non-GAAP concerns, and why do you think it chose Regulation G rather than those other options? [4 points]

(c) How has the use of non-GAAP measures changed after the implementation of Regulation G? [3 points]

(d) Provide two examples of valuable non-GAAP measures. [4 points]

Question 18 [6 points]

- In general, firms account for their assets, liabilities, and stockholders’ equity at historical cost. However, FASB has recently promoted greater use of fair value accounting, where firms must adjust balance sheet items to reflect the market value.

- From a financial statement user’s perspective, what are the potential benefits of fair value accounting? [3 points]

- For what types of assets and liabilities would fair value accounting likely to be most appropriate? [3 points]

Question 19 [7 points]

a. Explain why industry and competition analysis is important when analyzing a firm’s financial statements and position, and provide an example from class. [4 points]

b. How can Porter’s four forces be used to analyze competition within a market or industry? [3 points]

Question 20 [4 points]

How does fundamental value typically compare to price for firms with “sustainable” or “social” missions, and why?Practice代写

Question 21 [4 points]

Equity-based compensation can help ensure managers focus on longer term outcomes. However, as observed in the Sunbeam case, equity-based incentives alone are not always sufficient. What other methods can help mitigate manager misbehavior?Practice代写

Question 22 [4 points]

Why do company managers provide earnings guidance (i.e., forecast subsequent period earnings)? What incentives do managers face when providing earnings guidance?

Question 23 [4 points]

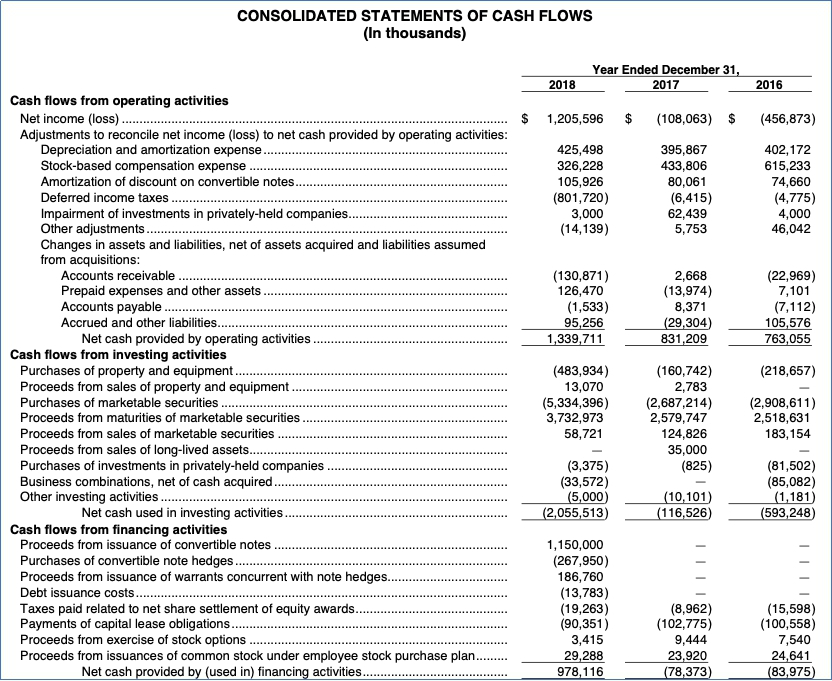

- Refer to the Consolidated Statement of Cash Flows in Exhibit A.

- Review the company’s net cash flow from operations, investing, and financing. Based on this, estimate where the company is in its lifecyle (early, middle, or late) and explain why.

Question 24 [12 points]

Refer again to the Consolidated Statement of Cash Flows in Exhibit A.Practice代写

a. Calculate the accruals ratio for FY 2018 andFY 2017. [6 points]

b. Identify two non-cash differences and calculate the adjusted accruals ratio for FY 2018 and FY 2017 after adjusting for the two items. [6 point

Question 25 [6 points]

(a) What is the difference between accruals management and operations management? [3 points]

(b) Identify the three determinants of accruals quality and provide one example of each. [3 points]

EXHIBIT A

Note: Average assets for 2017 was $7,141,421 (in thousands).

Note: Research and development expense for FY 2015 was $806,648 and for FY 2014 was $691,543 (both in thousands)

更多其他:Review代写 Case study代写 数据分析代写 网课代修 助学金申请

您必须登录才能发表评论。