Capital Budgeting Simulation Assessment Task (15%)

S1_2021 BFX3999 Finance and Society

Finance报告代写 This assessment debriefs both capital budgeting simulations 1 & 2 over teaching week 7 to 8 and summarises the key takeaways…

Instruction:

This assessment debriefs both capital budgeting simulations 1 & 2 over teaching week 7 to 8 and summarises the key takeaways from the project and is to be completed on an Individual basis.

Provide an executive summary and answer the guided questions below using the foreground reading and the financial data for the firm posted on the simulation website. Each discussion response should be complete and self-supporting (one-line responses are not sufficient). Redundant information should be avoided. You should incorporate relevant information into your responses from the foreground reading wherever possible. Present your discussion in the format of business report. Make sure your discussion answers as many questions listed below as possible to allow for sufficient content.

Feel free to supplement your responses with supplementary charts and graphs where appropriate. Place these figures in the Appendix section of your report and reference them in your discussion.

This report must be typed. You must turn this in electronically via moodle link prior to the project worksheet deadline.

Word limit: 3000 words (exclude tables, figures, appendices and references)

Part 1: Executive Summary Finance报告代写

Prepare a brief summary (One-page max) that highlights your findings contained in this report. The summary should highlight your project selections (for each of the budgeting constraint simulation – Exogenous and Endogenous constraints) in each run, the value created for your shareholders in each run, how you adapted your strategy from each run, and your key takeaways from the simulation.

Part 2: Outcomes (Exogenous Contraints and Endogenous Contraints)

(a) Project Selections

i. What is the level (amount) of capital constraint in each of the simulations?

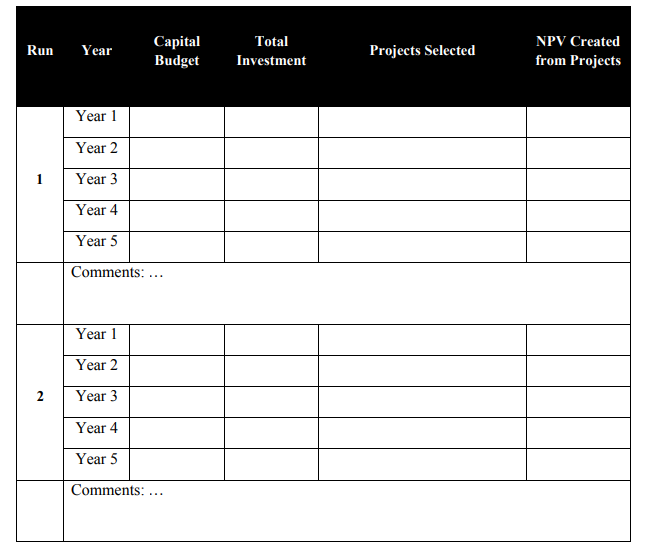

ii. In each of the budget constraint scenarios, summarize your project selections in each year in each simulation run using the suggested table template below as a guide. Briefly comment on those selections. Be sure to mention why these projects were selected, how much value was created, and what outcomes resulted from those investments.

A total of two tables should be reported: One table for exogenous constraint scenario and one for endogenous constraint scenario. For each budget constraint scenario, a maximum of two runs can be reported. (i.e., you can have multiple runs of simulation, but only a maximum of two runs can be reported). Please minimise redundant information.

Table 1: Suggested template of project selections.

General discussion (Guided questions):

- Overall, what was your strategy for selecting projects (ex. corporate strategy, project costs, EBITDA contribution, payback, ranking by NPV, IRR, or PI, etc.)? How different is your strategy across two simulations with different budgeting constraint scenarios?

- Why was the profitability index particularly helpful under capital rationing?

- How did the “lumpy” nature of the projects (i.e. the fact that the projects’ investment requirements each represent sizeable fractions of the total budget) affect the use of the profitability index as a tool under capital rationing?

- Do you feel that your selections, for each of the simulations, represented the “optimal” set? Why or why not?

- How did your investments affect your ability to fund future projects?

- How did the multi-year aspect of the simulation affect your project selection with regard to your project selection strategy?

- Did you choose to invest in either the two proposed acquisitions (i.e. Electronic Toy Manufacturer or Children’s Magazine)? Why did you view the acquisition opportunities as favorable / unfavorable? If you went through with the deal, what influenced your choice between the two acquisition opportunities?

- Which project represented the best and the worst investment throughout the entire simulation for each of the budgeting constraint scenarios? Explain why by citing specific project characteristics (ex. financial characteristics, contributions to strategy, etc.).

(b) Value Creation Finance报告代写

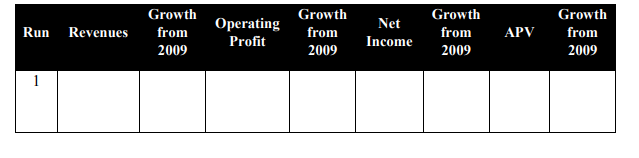

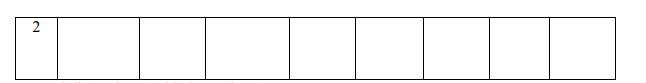

Summarize the value created in the suggested template below. For each of the budgeting constraint scenarios, list the final revenues, operating profit, net income, and company APV from each run and the percentage growth in these values from the starting 2009 values.

A total of two tables should be reported: One table for exogenous constraint scenario and one for endogenous constraint scenario. For each budget constraint scenario, a maximum of two runs can be reported. (i.e., you can have multiple runs of simulation, but only a maximum of two runs can be reported). Again, please minimise redundant information.

Table 2: Suggested template of value creation (over 5 years).

General discussion (Guided questions):

Describe and analyse the value created. What factors influenced how much value was created? Provide a brief synopsis. Be sure to mention what you learned from and how your strategy changed (if at all).

Part C: Conclusions and reflection Finance报告代写

i. Do you think what happened represents the best outcome for your investors? Would you do anything differently in the simulation (i.e. preparation, project analysis, strategy, etc.) if given another chance to perform the simulation? Would have working individually rather than in a group have helped?

ii. Summarize your key takeaways from the simulations. What did you learn from these exercises? What surprised you the most?

Assignment administrative details:

This assignment is designed to test your achievements in the BFX3999 unit learning objectives 1 to 4. This is an individual task. There is a word limit of 3,000 words for this assignment, excluding tables, figures, appendices and references; Students should understand that insufficient content and elaboration (likewise extensively unnecessary contents) may result in poor grade. The report must at least contain discussion for majority of the discussion questions listed above. It should also contain a reference list of the sources in which any the content discussed is based on.

Submission instruction: Finance报告代写

Each individual student will need to submit ONLY a soft copy (word documents).

The report is due before the start of the allocated class in Week 9 (teaching week commencing 03/05/2021). Students must retain a copy of their submitted report until the unit’s final results are released.

Electronic copy version of the assignment should be submitted via moodle before the due date. Heading of the submission must contain the unit code, assessment title, and the student number of all members.

Example: BFX3999 – Cap Bud Simulation Report [01234567]

Late submissions will not be graded and it will automatically result in a zero grade for this component.

All submissions will be heavily scrutinised via Turnitin and compared against other assignment for any potential issues regarding plagiarism.