Financial Distress – And Why Hedging Adds Value

Financial代写 Profit can be seen as a cash flow growing in perpetuity, with present value equal to Pi/(r – g) This is our expectation.

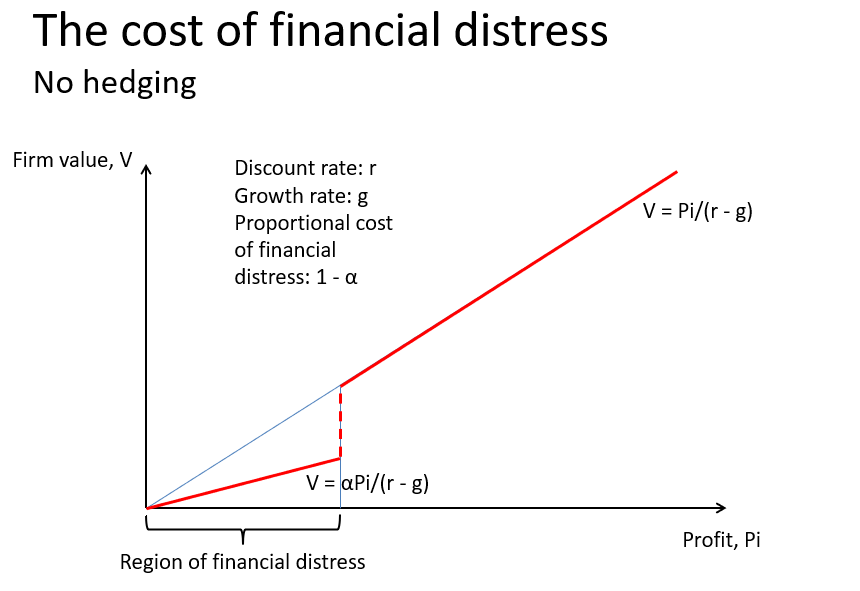

Profit can be seen as a cash flow growing in perpetuity, with present value equal to Pi/(r – g)

This is our expectation. Financial代写

Where the distress region is entered, costs are incurred through being in a less financially healthy position.

Some fraction of the firm is lost where we enter financial problems.

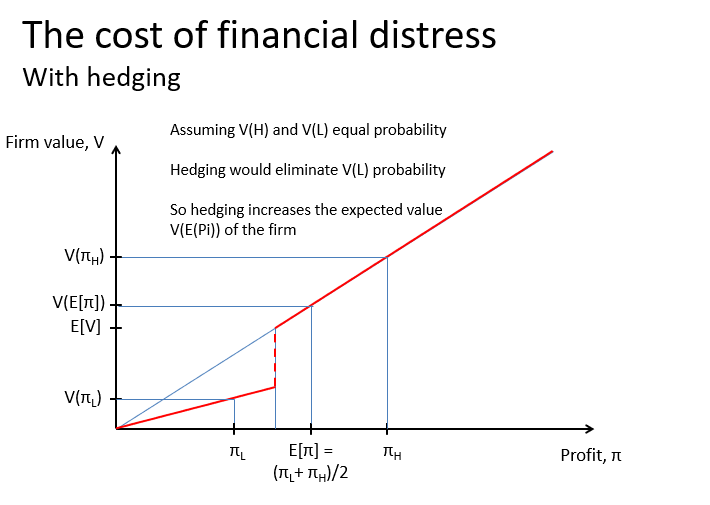

Without hedging, there is chance that profit variability will mean entering the distress region. With hedging, we can reduce volatility to the extent that keeps it out this region.

This is illustrated in this rather simplistic diagram, where there are two potential outcomes, and the hedge makes one absolutely certain.

Hedging is a zero-initial value contract only in isolation. Its value comes from reduced volatility in earnings components.

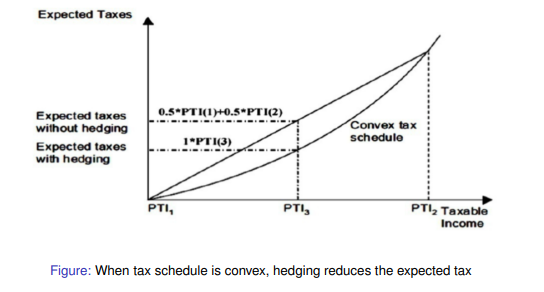

- Making profit less likely to go above a tax bracket

- Reducing costs associated with possible distress

- Investors / contractors will demand less compensation

Arguments against Hedging Financial代写

- Shareholders well diversified and can make own hedging decisions

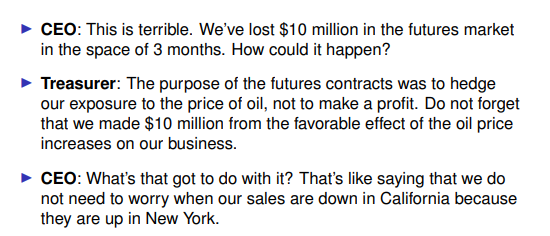

Hedging can Lose Money!