Module Code and Title: BUS340 Financial Markets and Institutions

Financial Markets代考 Duration and submission of exam: upload your completed exam paper to QMPlus within three hours of downloading

Duration and submission of exam: upload your completed exam paper to QMPlus within three hours of downloading

Important: You must read the instructions on “Guidance on Take Home Examinations” before attempting this paper.

Students with Examination Access Arrangements (e.g. disabilities, specific learning differences such as dyslexia, mental health diagnoses) must attach a completed SpLD coversheet.

This paper contains three questions. Please answer ALL parts of the three questions.

All answers must be handwritten and uploaded as a PDF document.

Declaration of academic integrity for Open Book Timed Examinations: In submitting your exam paper you are formally confirming that during the allocated examination period you have had no unauthorised conversation about this exam with any persons. Further, you certify that the attached work represents your own thinking, and is entirely your own. Any information, concepts, or words that originate from other sources are cited in accordance with the citation conventions accepted by the School of Business and Management. You are aware of the serious consequences that result from improper discussions with others or from the improper citation of work that is not your own.

All exam papers will be run through plagiarism software (Turnitin) and QMUL’s standard Assessment Offences policy applies.

[This paper contains Three questions. Please answer ALL parts of the Three questions.]

Question 1 Financial Markets代考

a) A bond you are evaluating has a 10% coupon rate (compounded semiannually), a $1,000 face value, and is 10 years from maturity.

i) If the required rate of return on the bond is 5%, what is its fair present value? Show your workings.

[3 marks]

ii) If the required rate of return on the bond is 7%, what is its fair present value? Show your workings.

[3 marks]

iii) If the required rate of return on the bond is 10%, what is its fair present value? Show your workings.

[3 marks]

iv) What do your answers to parts (i) through (iii) suggest about the relation between required rate of return and present values?

[1 mark]

b) A U.S. FI has US$250 million worth of one-year loans earning an average rate of return of 7.5 percent (i.e. initial investment is US$250 million worth). In addition, the FI also has one-year single-payment Canadian dollar loans of Canadian dollar C$110 million earning 8.5 percent (i.e. initial investment is US$100 million worth). The FI’s total funding source is US$350 million in US dollar $ one-year CDs, on which they are paying 4.24 percent interest rate. Initially (at the beginning of the investment period), the exchange rate is C$1.10 per US$1. The one-year forward rate is C$1.14 per US$1. What is the bank’s dollar percent spread if they hedge fully using forwards? Financial Markets代考

[12 marks]

c) Darby Minerals wants to hire an investment banker to sell four million shares of stock to the public. Darby is considering using either a firm commitment or a best efforts offering.

i) If Darby goes with a firm commitment, the offer price will be $18.00 per share and the spread (i.e., the gap between offer price and the price paid by the investment banker) will be 45 cents a share and all four million shares will be sold. The actual sale price to the public is $16.85. What is the proceeds to Darby from the sale of stock in the firm commitment? What is the investment banker’s gain or loss? Ignore any other costs and expenses.

[3 marks]

ii) Suppose that Darby uses a best efforts offering. The actual sale price to the public is again $16.85 and the investment banker charges 8 cents per share sold as commission. Assume that in the best efforts offer only 1.85 million shares can be sold. What is the proceeds to Darby from the sale of stock in the best efforts offering? What is the investment banker’s gain or loss? Ignore any other costs and expenses.

[3 marks]

d) Bank Rosemary currently has $800 million in transaction deposits on its balance sheet. The Federal Reserve has currently set the reserve requirement at 11% of transaction deposits. If the Federal Reserve increases the reserve requirement to 12%, calculate the change in bank deposits. Show the balance sheet of Bank Rosemary and the Federal Reserve System just before and after the full effect of the reserve requirement change. Assume Bank Rosemary withdraws all excess reserves and gives out loans and that borrowers eventually return all of these funds to Bank Rosemary in the form of transaction deposits.

[12 marks]

[Total: 40 marks]

Question 2 Financial Markets代考

a) How can using indirect finance rather than direct finance reduce agency costs associated with monitoring funds demanders? [8 marks]

b) Consider an investor who, on January 1, 2021, purchases a TIPS bond (semiannual coupon payment) with an original principal of $100,000, an 7.18% annual coupon rate, and 7 years to maturity.

i) If the semiannual inflation rate during the first six months is 1.02%, calculate the principal amount used to determine the first coupon payment and the first coupon payment (paid on Jun 30, 2021).

[6 marks]

ii) From your answer to part i, calculate the inflation adjusted principal at the beginning of the second six months.

[2 mark]

iii) Suppose that the semi-annual inflation rate for the second six-month period is 1.14%. Calculate the inflation-adjusted principal at the end of the second six-months (on December 31, 2021) and the coupon payment to the investor for the second sixmonth period.

[6 marks]

c) Upon graduating from college this year, you expect to earn $25,000 per year. If you get your MBA, in one year you can expect to start at $35,000 per year. Over the year, inflation is expected to be 5 percent. In today’s dollars, how much additional (less) money will you make from getting your MBA (to the nearest dollar) in your first year?

[8 marks]

[Total: 30 marks]

Question

a) Solve the questions below on stock evaluation and stock investment return: 7.27

i) You are evaluating Home Depot (HD) stock. This stock is expected to experience supernormal growth in dividends of 7 percent over the next 7 years. Following this period, dividends are expected to grow at a constant rate of 3 percent. The stock paid a dividend of $7 last year, and the required rate of return on the stock is 11 percent. What is the stock’s fair present value? Show your workings.

[12 marks]

ii) An investor has a 35 percent ordinary income tax rate and a 18 percent long-term capital gains tax rate. The investor holds stock in a firm that could pay its usual $2 per share dividend or reinvest the cash in the firm. The stock price is currently $53 per share. If the firm does not pay the dividend, the share price will rise. If it pays the dividend, the share price will stay the same. By how much must the share price rise if the dividend is not paid in order to make the investor indifferent between receiving the dividend or not?

[6 marks]

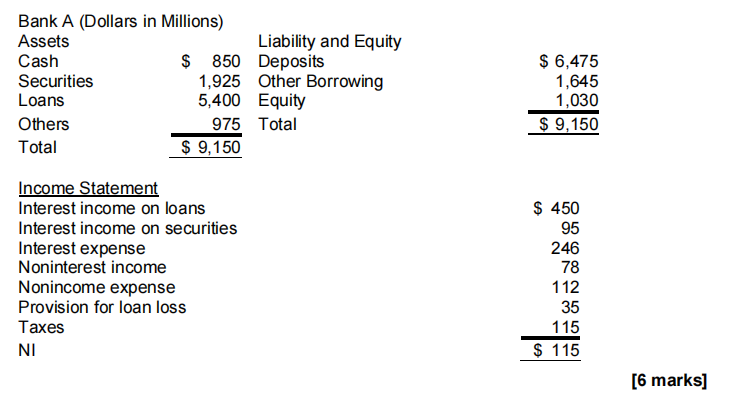

b) Bank A has the following financial statement. Calculate its ROA and ROE.

c) What functions do the 12 Federal Reserve Banks perform?

[6 marks]

[Total: 30 marks]