Homework

STAT代写 Answer the following questions by performing the appropriate analysis. Please use this document inserting space where necessary. When···

Instructions: STAT代写

Answer the following questions by performing the appropriate analysis. Please use this document inserting space where necessary. When finished, upload the exam in Word.docx format. And attach a copy of your do-file(s) showing the commands used to answer the questions.

- Describe the five assumptions behind the classical linear regression model. And the diagnostic tests discussed in class, the commands you would use in Stata to test each of them. How you would determine if they were violated. And what you can do to correct it if the assumption has been violated or the diagnostic indicates something may be unusually affecting the results of the regression.

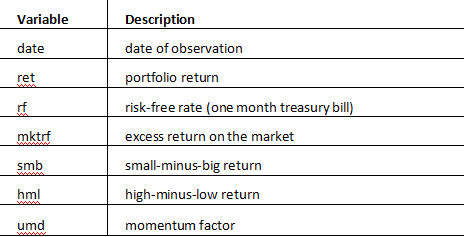

- Use the dtadata file to complete the table in (a) and explain the performance in (b). The data file contains the monthly returns of the value-weight Class Portfolio with the following variables:

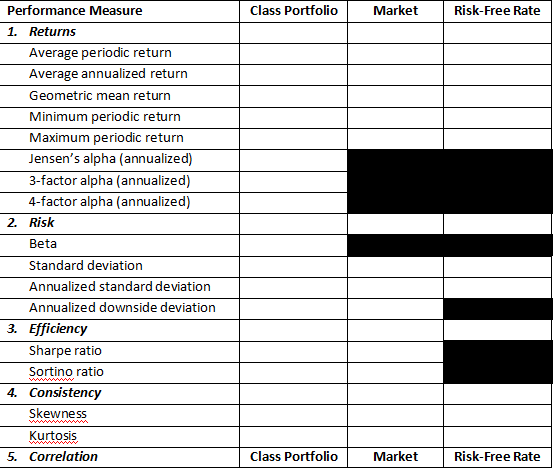

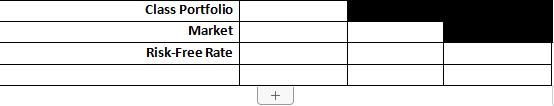

- Calculate performance statistics for the Class Portfolio, the market. And the risk-free rate over the entire period and complete the table below. (Hint: The market return = excess return on the market + risk-free rate.)

-

Summarize the performance of Class Portfolio using the results presented in the table above. STAT代写

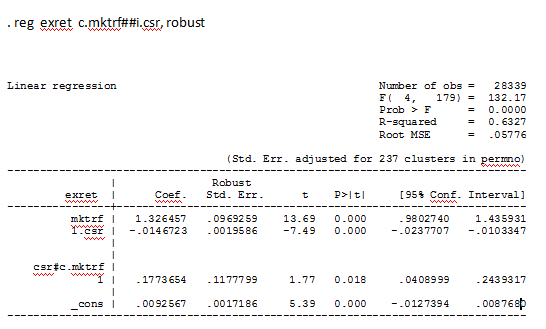

- You are interested in studying the effect of a CSR (corporate social responsibility) initiative on stock performance. And have collected 237 events where the firm announced the beginning a CSR program. You want to use the CAPM as the model of expected returns. And have downloaded the needed return and factor data for the 60 months before. And 60 months after the announcement. You have created a new variable named csrwhich is a dichotomous indicator (dummy) variable that. Takes the value of one (csr =1) in the months after the program is initiated. And zero (csr=0) otherwise. For all observations you regress the monthly excess return of the firms’ stock (exret) on the excess return of the market (mktrf) using full interaction factor variable notation (##) with the replace indicator variable to get the following output.

Answer the following questions: STAT代写

- What is the annualized excess performance (Jensen’s Alpha) of the firms before the start of the CSR program?

- What is the annualized excess performance (Jensen’s Alpha) of the firms after starting the CSR program?

- What is the Beta of firms before the start of the CSR program?

- What is the Beta of firms after starting the CSR program?

- Interpret your findings from A-D above?

- Is there anything else that may be done to help determine if the changes were actually caused by the CSR program? If so, what?

- The Covid-19 pandemic has effected stocks in various ways. For this question you are to examine the sensitivity of returns of the Class Portfolio using the Carhart 4-factor model beginning 01Jan2014 (last 86 months of the dtain Question 2 above). To accomplish this, you will need to create an indicator variable that takes the value of 1 during the Covid-19 pandemic and 0 otherwise. Assuming the pandemic began 01Feb2020, you create an indicator variable named covid with the following command and answer the following questions:

. gen covid = (date >= td(01feb2020)) STAT代写

- Run the Carhart 4-factor model regression on the excess returns of the Class portfolio. And add an interaction with the covid indicator variable on all of the factors (refer to the event study lectures to see how this is done). Paste the results of the regression below (the screenshot of your output in STATA). Use White’s test for homoskedasticity (estat imtest, white) using 0.05 level of confidence to test whether or not standard errors need to be adjusted due to heteroskedasticity.

- What factors are significant at the 0.05 level of confidence?

- What is the annualized 4-factor alpha beforethe Covid-19 pandemic?

- What is the annualized 4-factor alpha duringthe Covid-19 pandemic?

- Run the following margins command and paste the results below (the screenshot of your output in STATA).

. margins covid, dydx(mktrf smb hml umd) - Using the output in (e) above, interpret the effects of Covid-19 on each factor.

更多其他:代写作业 数学代写 物理代写 生物学代写 程序编程代写 统计代写