Group 33 AcF 305 Coursework

代写金融作业 EUR liabilities’ HC value moves with changes in the HC/EUR exchange rate. When the EUR is not available to hedge the exposure…

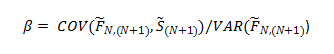

EUR liabilities’ HC value moves with changes in the HC/EUR exchange rate. When the EUR is not available to hedge the exposure in the futures market, we need a cross-hedge with another currency. We choose beta to minimize the volatility of the hedged cash-flow position. Beta denotes the futures contracts that must be bought to hedge a foreign currency outflow. 代写金融作业

![]()

We need to regress the spot rate against the futures rate in foreign currency. We use historical data to do this. 代写金融作业

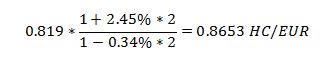

Initially, with a direct hedge, we have a contract that is available in EUR and expires on 15 April 2022, with size 500,000. Beta is then equal to 1 given that markets are efficient in pricing securities, the spot rate would be perfectly correlated with the futures rate. A 6 month futures contract at 15 Oct 2021 is 0.87 HC/EUR, using the covered interest parity equation.

To hedge a EUR 500,000 outflow, we would buy 500,000 EUR Future for 432,650 HC; this would involve posting an initial margin and a maintenance margin as security, which would fluctuate with changes in the futures price, to keep the end result (cumulative cash flows) the same as the contract we entered into. 代写金融作业

Assuming a direct EUR hedge is unavailable, we calculate the covariance between the 3-month FC1 futures, and the HC/EUR spot price. We then calculate the variance on the futures, to estimate beta, or contracts that would need to be bought to hedge against a EUR 500,000 outflow. We estimate beta as 0.0243, and the Futures rate at 15/10/2021 as 1.165 HC/FC1.

| Futures | COV(Fn,n+3,S) | VAR(Fn,n+3) | Beta 代写金融作业 |

| FC1 | 0.000269 | 0.011064 | 0.024338 |

| FC2 | -0.001018 | 0.107566 | -0.009465 |

When attempting to hedge 500,000 EUR against a forward contract on FC1, we would choose 0.02434 FC1 futures contracts, with price 71225 HC

When we’re limited to a 12-Month HC/EUR Futures hedge, when the payables is due in 6-Months, we calculate beta as 0.7770 contracts in a 0.9118 HC/EUR Future at 15/10/2021, meaning 455900 HC will be exchanged for 500,000 EUR in total. 代写金融作业