BUS239 Management Accounting for Decision-Making

决策管理代写 Duration and submission of exam: upload your completed exam paper to QMplus within three hours of downloading

Duration and submission of exam: upload your completed exam paper to QMplus within three hours of downloading

Important: You must read the instructions on “Guidance on Take Home Examinations” before attempting this paper.

Students with Examination Access Arrangements (e.g. disabilities, specific learning differences such as dyslexia, mental health diagnoses) must attach a completed SpLD coversheet.

This paper contains 4 questions. Answer question 1, and any ONE from the remaining three questions.

Save your work every 10 minutes and upload your final document at the end, before the scheduled time to complete

If you answer more questions than specified, only the first answers (up to the specified number) will be marked.

Declaration of academic integrity for Open Book Timed Examinations: In submitting your exam paper you are formally confirming that during the allocated examnation period you have had no unauthorised conversation about this exam with any persons. Further, you certify that the attached work represents your own thinking, and is entirely your own. Any information, concepts, or words that originate from other sources are cited in accordance with the citation conventions accepted by the School of Business and Management. You are aware of the serious consequences that result from improper discussions with others or from the improper citation of work that is not your own.

All exam papers will be run through plagiarism software (Turnitin) and QMUL’s standard Assessment Offences policy applies.

If you encounter errors in the exam paper or are unable to upload the exam to the QMPlus page for this module, please email the following asking for advice during UK office hours 09.00 to 17.00: sbm-uglevel5@qmul.ac.uk 决策管理代写

Part A- Compulsory

Question 1

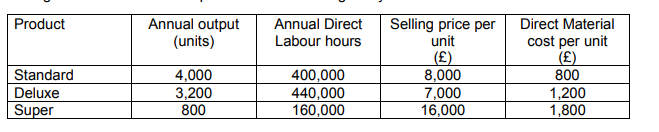

Vinay Plc produces three grades of their products at the same factory: the Standard; Deluxe and Super. The three grades are sold worldwide.

Up to now, the company has absorbed production overheads to the three products on the basis of direct labour hours, but the introduction of activity based costing is being seriously considered. The management accountant has produced the following analysis.

The annual overhead costs to be absorbed to the three products are as follows:

£

Delivery costs to customers 4,800,000

Set-up costs 12,000,000

Purchase order costs 7,200,000

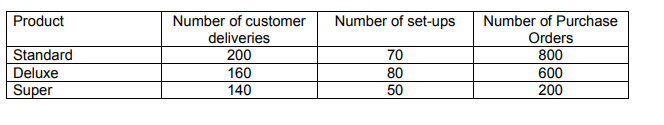

Overhead costs are driven by the following:

Deliveries to customers – The number of deliveries of products to customers’ warehouse.

Set-ups – The number of times the assembly line process is re-set to accommodate a production run of each of the three products.

Purchase orders – The number of purchase orders.

The annual cost driver volumes relating to each activity and for each product are as follows:

All direct workers are paid at a hourly rate of £12. The company holds no stock of direct materials, work in-progress or finished goods.

Required:

a) Calculate the total profit from each of the three products using the following overhead absorption methods:

(i) The existing direct labour hours method. (10 Marks)

(ii) Activity Based Costing method. (20 Marks)

b) Outline the advantages and disadvantages of the two methods of costing used in Part a). Which method do you recommend and why? (20 marks)

(Total: 50 marks)

Question 2 决策管理代写

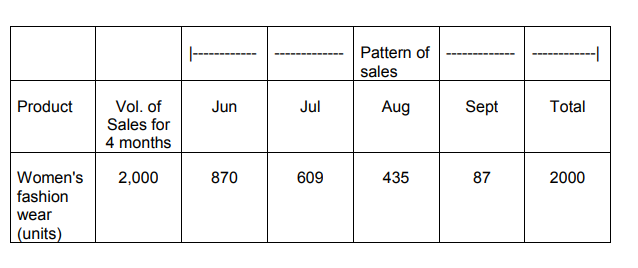

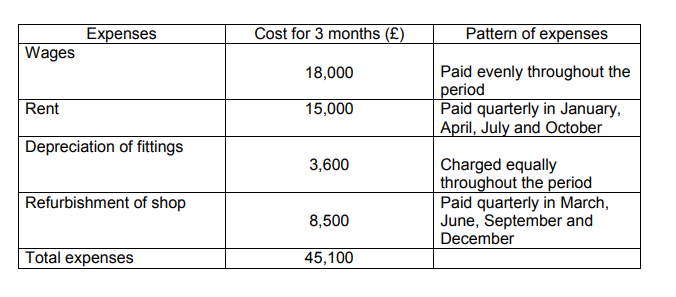

Nadia has a women’s fashion wear shop on the high street in the West End of London. She expects to have £1,000 left in the bank at the end of May. She is concerned about her plans to purchase women’s fashion wear over the summer and the effects it will have on her bank balance.

Thus she has forecast her volume and pattern of sales for the coming months of June, July, August and September. Nadia has also calculated the expenses incurred running the business for the three months of June July and August. Nadia’s forecasts for the next few months are:

Opening stock of a month is 75% of that month’s sales. Purchase price is £9.20/unit and Selling price is £29.90/unit. Purchases and sales are both in cash.

Required:

Prepare the following budgets:

a) The sales and purchases budget in units for the 3 months; (15 marks)

b) The cash budget, showing both the monthly and the total for the three months (June, July & August):

(i) Receipts from customers and payments to suppliers from women’s fashion wear trading;

(ii) Expense payments; &

(iii) Movements on cash balance. (20 marks)

c) Comment on your findings in a) and b) and advise Nadia (15 marks)

Total 50 marks

Question 3 决策管理代写

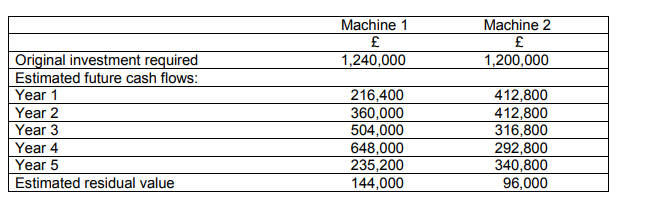

Lacie Plc will require various additional machinery and equipment once the new factory has been acquired. For part of its manufacturing operations a specific machine is necessary and two such machines have been identified for possible investment:

The company requires a return of 14% on their investment.

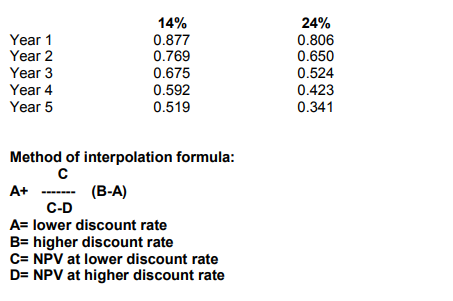

The present value of £1 received at the end of ‘n’ years, given a 14% and 24% rates of interest is as follows:

Required:

a. Calculate for both machines:

i. The Payback Period.

ii. The Net Present Value at 14% discount rate.

iii. The Internal Rate of Return, using the method of interpolation

(30 marks)

b. From your calculations which machine should Joey Plc select and why?

(5 marks)

c. Discuss the advantages and disadvantages of the three investment techniques you have used in your appraisal of the two machines.

(15 marks)

Total: 50 marks

Question 4 决策管理代写

The Management Accountant of Nilay Plc (a clothing retailer) is considering implementing the Balanced Scorecard, however, he read the following article and has issues concerning the model:

Non-financial measures just don’t add up:

Executives are discovering that measuring intangibles is a poor way to judge a company’s performance, writes Robert Bruce:

Non-financial performance measurement was supposed to be the answer to management’s woes. All those financial results were backward-looking and told you nothing about how the business was running. Only if intangibles such as employee loyalty and customer satisfaction were measured would companies boost shareholder value and investors gain a real understanding of what was happening.

But the experience of those who have poured their efforts into basing strategy on what nonfinancial measurement tells them suggests another story. Research by David Larcker, Ernst & Young professor of accounting at the Wharton School at the University of Pennsylvania, suggests that companies are “attempting to apply a seemingly endless set of measurement frameworks, models and laundry lists of measures being pushed by consultants”. In their frustration at not seeing the benefits they have been promised they are “simply measuring an ever-increasing number of measures to avoid missing anything important”. 决策管理代写

Prof Larcker takes a refreshingly straightforward view of all this. “There has been this gigantic push into non-financials”, he says.“It’s a good idea but it’s pretty damn hard to do. In our research we saw people doing the measurement but not getting the benefits.” An example was the experience of a large fast-food chain. “They thought that reducing employee turnover was the name of the game,” says Prof Larcker. So a series of costly initiatives was implemented, including anniversary bonuses. The theory was that if you retained staff this would create high satisfaction and motivation; that would improve customer service with a resulting effect on the bottom line. The system ran for several years

“but then someone said: ‘Before we write these cheques let’s find out if it is working.’” Proper statistical analysis showed it was achieving none of its goals.

Among other things, the fast-food chain found that, for example, only turnover among supervisors had any relation to financial performance and that the more profitable stores had higher overall employee turnover. This is the problem with non-financial measurement. Unlike financial measurement it has no rules to stick by. When Prof Larcker talked to the managers involved, they simply said that it stood to reason that employee retention had to

make things more profitable.

“Too much is based on management folklore and intuition,” he says. “People say it over and over again and after a while they believe it.” Managers believed the links between the nonfinancial measures and the expected results were self-evident. They believed that implementing measures that encouraged customer loyalty had to lead inexorably to higher profits and shareholder value. As Prof Larcker’s research shows, “such assumptions are

often half-baked or wrong”.

He says that one problem is that it is “rare in an organisation to challenge one’s superiors”, so that even if someone has doubts there is little they can do about it. He suggests that managers should operate what he calls a “gut check” and simply ask themselves: “Is it true?” “The idea of 100% satisfied customers is very nice. But maybe 85% is good enough and trying to reach 100% is expensive. You could lose more by going for the 100%,” says Prof Larcker. 决策管理代写

One of his investigations into the value of non-financial measurements was at Citibank, where they were used to calculate bonuses in retail branches. “The result was that they paid out bonuses when they were hitting non-financial targets but not (when they were hitting) their financial targets.” The staff simply became confused and angry. In a survey, 55% said they agreed that “when it comes to score card bonuses, I have no idea who gets what and why”. And, as one of the managers pointed out:

“We are paying out large bonuses but our profits are going down.”

Non-financial measurement is also worryingly vague, he argues. “Non- financial measures are easier to manipulate than financials. There are no agreed methods of measuring.” And it is also hard to gain a true picture because the data tends to be in different places. Marketing, for example, will have some and finance some more and “they don’t talk to each other”.

Prof Larcker’s background was in engineering and for him the answer is simple: “There needs to be research into whether these things really do create value. If this was an engineering or a medical problem it would have to be scrutinised and evidence evaluated.” For him the problem is that business managers are ready simply to go along with the intuitive. “Management needs to be much more rigorous with non-financial measures,” he says.

Source: Bruce, Robert (2004) ‘Non-financial measures just don’t add up’. Financial Times 决策管理代写

Required

(a) Referring to the above, explain and analyse the importance of non-financial measures in evaluating performance to Nilay Plc.

(20 marks)

(b) Assess the implications of JIT for an effective tool to be used with the Balanced Scorecard. (30 Marks)

(Total 50 marks)