ECOM050 Investment Management

投资管理代考 THIS IS AN OPEN BOOK EXAMINATION TO BE CONDUCTED ONLINE. YOU MAY REFER TO ANY OF THE COURSE MATERIALS, OR ANY OTHER SOURCE…

Duration: 3 hours

Answer ALL questions 投资管理代考

THIS IS AN OPEN BOOK EXAMINATION TO BE CONDUCTED ONLINE. YOU MAY REFER TO ANY OF THE COURSE MATERIALS, OR ANY OTHER SOURCE OF INFORMATION. YOU MAY ALSO USE A SPREADSHEET OR CALCULATOR.

YOU CANNOT SUBMIT HANDWRITTEN ANSWERS

ANSWERS ARE TO BE TYPED AND SUBMITTED, IN A SINGLE WORD OR PDF DOCUMENT, TO BOTH QMPLUS & EMAILED TO: [email protected]

PLEASE ENSURE THAT YOUR WORKING IS CLEARLY SHOWN WITH ALL STEPS OF YOUR CALCULATION INCLUDED IN YOUR ANSWER DOCUMENT, INCLUDING ANY FORMULA USED.

When writing formulas, please note the following:

- It is acceptable to use the standard alphabet rather than greek letters. The following are recommended: m for μ, s for σ, w for ω, r for ρ, d for Δ, b for β.

- For mathematical operators: add +, subtract -, multiply *, and divide /.

- Where appropriate, use an underscore to indicate a subscript, e.g., r_f for rf.

- Use the ^ character for power, e.g., x^2 for x2, x^0.5 for √x.

- As an alternative to x^.5 you may type sqrt(x).

- Use brackets as necessary. To make your answer clearer use different brackets where appropriate, e.g., [] {} ().

Examiner: Alfonsina Iona 投资管理代考

Answer ALL Questions

Question 1

(a)Discuss how well the Capital Asset Pricing Model (CAPM hereafter) works. Your answer should include at least three criticisms of beta as used in the CAPM.

[15 marks]

(b) Compare the CAPM with the Multifactor Arbitrage Pricing Theory (APT hereafter) Model.

[15 marks]

(c) What are the main shortcomings of the Multifactor APT models? What the research has proposed to overcome these drawbacks? Discuss fully.

[10 marks]

Question 2 投资管理代考

(a) The Efficient Market Theory states: “if prices are right, there are no easy profit opportunities”. Behavioural Finance argues, instead, that “the absence of profit opportunities does not necessarily imply that prices are right”. Discuss the arguments underlying these statements.

[10 marks]

(b)Behavioural Finance may agree with the Efficient Market theory that using a Passive strategy may be optimal for most investors. Explain the rationale of this conclusion according to each school of thought.

[10 marks]

Question 3

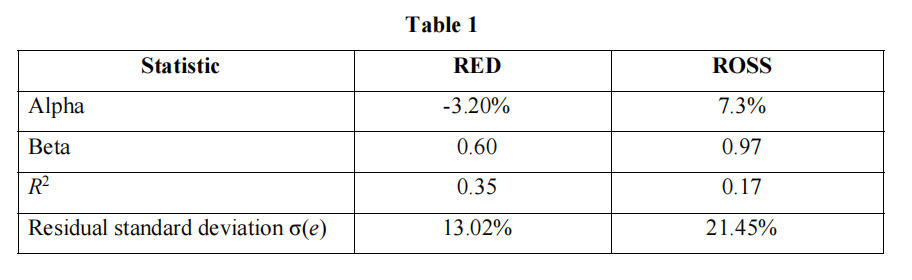

Using an ordinary least squares regression, we regress the annualized monthly percentage excess returns of RED and ROSS stocks against those of a stock market index, over the most recent 5- year period. Regression results are reported in Table 1.

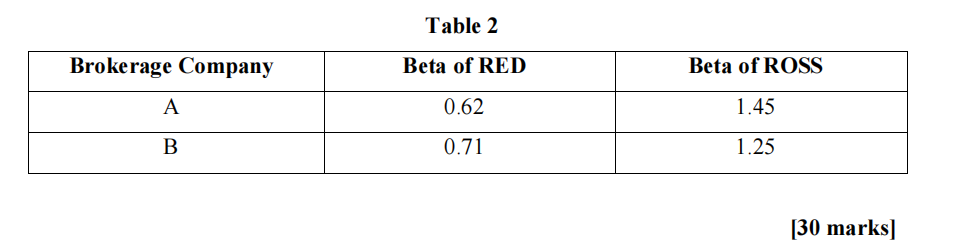

(a) Explain what the regression results suggest to the investment analyst about the risk-return trade-off for each stock over the sample period. Discuss the implications of these results for future risk-return relationships, assuming both stocks were included in a diversified common stock portfolio, according to additional data (as in Table 2) obtained from two Brokerage Companies and based on the most recent two years of weekly returns.

(b)Now, assume that the correlation coefficient between the return of Holm Fund, you are considering for investment, and the market index’s return is 0.70. Find the percentage of the Holm Fund’s specific risk (i.e., non-systematic). Show the steps followed in your answer.

[10 marks]