Exam – Alternative Assessment Task

资金管理代考 ASSESSMENT DURATION: 2 hours and 40 minutes (includes reading, downloading, and uploading time) This is an individual assessment task.

UNIT CODE: BFF5250

UNIT TITLE: Corporate Treasury Management 资金管理代考

ASSESSMENT DURATION: 2 hours and 40 minutes (includes reading, downloading, and uploading time)

- This is an individual assessment task.

- This is an open book exam

- All responses must be included within this document and under individual questions.

- Students are required to answer ALL questions.

- This assessment accounts for 50% of the total in the unit and has a hurdle requirement of 45% to pass the unit.

- You can use any type of calculator

- Upon completion of this assessment task, please upload this document to Moodle using the assignment submission link.

- Your submission must occur within 2h:40m of the official commencement of this assessment task (Australian Eastern Standard Time).

Please read the next page carefully and sign and date the Student Statement before commencing the assessment task. 资金管理代考

| Intentional plagiarism or collusion amounts to cheating under Part 7 of the Monash University (Council) Regulations

Plagiarism: Plagiarism means taking and using another person’s ideas or manner of expressing them and passing them off as one’s own. For example, by failing to give appropriate acknowledgment. The material used can be from any source (staff, students or the internet, published and unpublished works).

Collusion: Collusion means unauthorised collaboration with another person on assessable written, oral or practical work and includes paying another person to complete all or part of the work.

Where there are reasonable grounds for believing that intentional plagiarism or collusion has occurred, this will be reported to the Associate Dean (Education) or delegate, who may disallow the work concerned by prohibiting assessment or refer the matter to the Faculty Discipline Panel for a hearing. |

Student Statement: 资金管理代考· I have read the university’s Student Academic Integrity Policy and Procedures. · I understand the consequences of engaging in plagiarism and collusion as described in Part 7 of the Monash University (Council) Regulations https://www.monash.edu/legal/legislation/current-statute-regulations-and-related-resolutions · I have taken proper care to safeguard this work and made all reasonable efforts to ensure it could not be copied. · I have not used any unauthorised materials in the completion of this assessment task. · No part of this assessment has been previously submitted as part of another unit/course. · I acknowledge and agree that the assessor of this assessment task may for the purposes of assessment, reproduce the assessment and: i. provide to another member of faculty and any external marker; and/or ii. submit it to a text-matching software; and/or iii. submit it to a text-matching software which may then retain a copy of the assessment on its database for the purpose of future plagiarism checking. · I certify that I have not plagiarised the work of others or participated in unauthorised collaboration when preparing this assessment. |

|

Signature: (Type your full name) |

|

Date: |

Privacy Statement 资金管理代考The information on this form is collected for the primary purpose of assessing your assessment and ensuring the academic integrity requirements of the University are met. Other purposes of collection include recording your plagiarism and collusion declaration, attending to the course and administrative matters and statistical analyses. If you choose not to complete all the questions on this form it may not be possible for Monash University to assess your assessment task. You have a right to access personal information that Monash University holds about you, subject to any exceptions in relevant legislation. If you wish to seek access to your personal information or inquire about the handling of your personal information, please contact the University Privacy Officer: [email protected] |

| MARKS ALLOCATED TO QUESTIONS WITHIN THIS ASSESSMENT TASK | |||||||

| Question | 1 | 2 | 3 | 4 | 5 | 6 | TOTAL |

| Allocated Marks | 20 | 15 | 20 | 15 | 15 | 15 | 100 |

| Office Use Only | |||||||

| Mark received | |||||||

| Second marking | |||||||

Question 1 (20 marks) 资金管理代考

Nedib.J Ltd. has a constant gross margin of 35% and a constant EBIT margin of 22%. The following tables contain information from Nedib.J’s accounting statements in 2022 and the projection in 2023.

| From Balance Sheet ($000) | ||||

| Assets | 2022 | Liabilities and

shareholders’ equity |

2022 | |

| Cash | 52 | Accounts payable | 81 | |

| Accounts receivables | 87 | Notes payable | 39 | |

| Inventory | 72 | Total current liabilities | 120 | |

| Total current assets | 211 | Long-term debt | 220 | |

| Fixed assets | 800 | Common stock | ||

| From Statement of Income & Management Projection ($000) | ||

| 2022 | 2023

(projection) |

|

| Total Revenues | 520 | 480 |

| Depreciation | 90 | 100 |

| Interest Expense | 70 | 60 |

Nedib.J expects to invest $20m in 2023. The marginal tax rate is 35%. Answer the following questions:

a.Calculate the book value of equity for Nedib.J 资金管理代考

(2 marks)

b.Calculate the 2022 cash conversion cycle for J. Keep two decimal places.

(8 marks)

c.Assuming J’s inventory, receivables, payable days, gross profit margin, and net profit margin do not change in 2023 (same as in 2022):

i.Calculate J’sestimated Net Income in 2023. Keep two decimal places.

(2 marks)

ii.Calculate J’sestimated FCFF in 2023. Keep two decimal places.

(8 marks)

Question 2 (15 marks) 资金管理代考

Company MU is a publicly listed renewable energy company with a credit rating of BBB. Currently, MU has 12 million shares outstanding with share price $10 and an equity beta of 1.8. MU can borrow at a rate of the risk-free rate plus 350 basis points. MU’s marginal tax rate is 35% and its market D/E ratio is 2.2. The company ETA is a private firm in the same industry. The treasurer of ETA picks MU as the comparable firm in order to calculate its cost of capital. ETA’s marginal tax rate is 30%. ETA’s cost of debt is 580 basis points and market D/E ratio is 2.8. The current risk-free rate is 2.5%. The expected market return is 10%.

i.Calculate MU’s WACC. Express answers in percentage points and keep two decimal places (e.g. 99.99%).

(6 marks)

ii.Calculate MU’s asset beta. Keep two decimal places (e.g. 99.99).

(3 marks)

iii.Calculate ETA’s WACC. Express answers in percentage points and keep two decimal places (e.g. 99.99%).

(6 marks)

Question 3 (20 marks)

Answer the following questions. 资金管理代考

a.VAX Inc. can borrow $30K for three months from a bank at an APR(Annual Percentage Rate) of 10.2%. The loan has a loan origination fee of 2.5% on the principal of the loan; paid upfront. The bank also requires VAX to keep 5% of the loan’s principal in a compensating balance account as long as the loan is outstanding. The bank pays interest of 0.65% APR with quarterly compounding on the compensating balance account. Calculate the effective annual rate (EAR) of this loan. Keep two decimal places, e.g. 9.99%.

(3 marks)

b.BAX Inc. can purchase goods from its supplier on terms of 1.5/20, net 45.

i.Calculate the effective annual cost (EAR) of the trade credit. Keep two decimal places, e.g. 9.99%.

(3 marks)

ii.BAX can borrow from the bank with monthly compounding APR at 24%. Would BAX utilise the loan or the trade credit? Show your work.

(3 marks)

c.CAX Inc. can borrow $25 thousand for three months from a bank at an APR of 6%. The loan has a loan origination fee of 2.0% on the principal of the loan charged when loan expires in three months. The bank also requires that CAX Inc. keep an amount of 7% of the face value of the loan in a compensating balance account as long as the loan is outstanding. The bank pays interests of 0.5% APR with quarterly compounding on the compensating balance account.

i.Calculate the effective annual rate (EAR) of this loan. Keep two decimal places, e.g. 9.99%.

(3 marks)

ii.What would be the EAR if the 2.0% loan origination fee would be charged upfront?

(3 marks)

iii.Would CAX Inc. prefer to pay the loan origination fee upfront or when the loan expires?

(2 marks)

Question 3 (Continued)

d.XAX Inc. can borrow $1.5 million for two months from a bank at an APR of 8.0%,using its inventory as collateral. The bank requires that a warehouse arrangement be used. The warehouse fee is $50 thousand, payable at the end of the loan. The loan has a loan origination fee of 1.0% on the principal of the loan charged when the loan expires. Calculate the (EAR) of this loan. Keep two decimal places, e.g. 9.99%.

(3 marks)

Question 4 (15 marks) 资金管理代考

Tate Inc. places an order to purchase a machine from an Italian firm, Breville Inc., Tate and Breville agree on a transaction price of €350,000 that will be transferred in two years.

a.Tate considers a forward contract to hedge against the currency fluctuations. The current two-year Euro-Dollar forward exchange rate is €0.92/$. If Breville agrees to the forward contract,how much will it cost (in dollars) for Tate to purchase €350,000 in two years?

(4 marks)

b.The Euro-Dollar spot exchange rate today is €0.90/$, and the dollar-denominated risk-free rate is 2.5% per year, while the euro-denominated risk-free rate is 3% per year. Should Tate enter the forward contract with the forward rate of €0.92/$ or pursue a cash-and-carry strategy?

(4 marks)

c.Tate considers a currency option instead of the forward contract. Which option should Tate purchase a call or put option?

(2 marks)

d.What is the price (in dollars) Tate is willing to pay for the option selected in Part C, if it uses Black Scholes option pricing? The exchange rate has 40% volatility and the strike price of the option is Take the forward exchange rate from (a) and the spot exchange rate and the interest rates from (b).

(5 marks)

Question 5 (15 marks) 资金管理代考

TADA Inc. is concerned with the Value at Risk (VaR) of its shareholdings. TADA Inc. holds $20 million worth of Enphase Inc. shares; $15 million of SolarEdge Inc. shares and $25 million worth of Zoom Inc. shares. TADA Inc. assumes that the standard deviation of yearly stock returns are 0.28, 0.30 and 0.32 for Enphase, SolarEdge, and Zoom, respectively. Further, TADA assumes that all daily stock returns follow a normal distribution with zero mean.

a)Calculate the individualdaily 99% VaR for TADA’s holdings in Enphase, SolarEdge, and Zoom

(4 marks)

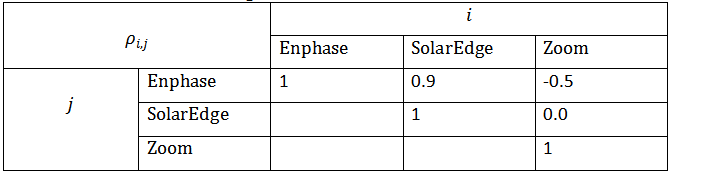

b)TADA estimates the following correlations

Calculate the daily 99% VaR of TADA’s entire portfolio of shareholdings.

(4 marks)

c)Assess the validity of the distributional assumptions that are incorporated into TADA’s VaR estimate. (use your own words)

(4 marks)

d)How could the VaR method be altered to alleviate its problems? Name one possible alteration and what are the weaknesses of the alternative methodology? (use your own words)

(3 marks)

Question 6 (15 marks) 资金管理代考

The market-value balance sheet of ADA Savings and Loans is as follows:

| Market Value (in $ million) | Duration (Years) | |

| Assets | ||

| Cash Reserves | 25 | 0 |

| Auto Loans | 125 | 2 |

| Mortgages | 150 | 11 |

| Total Assets | 300 | |

| Liabilities | ||

| Checking and Savings | 110 | 0 |

| Certificates of Deposit | 80 | 1 |

| Long-Term Financing | 80 | 8 |

| Total Liabilities | 270 | |

| Owner’s Equity | 30 | |

| Total Liabilities and Equity | 300 |

a.Based on the market-value balance sheet for ADA Savings and Loans, what is its equity duration? Keep two decimal places (e.g. 9.99). 资金管理代考

(5 marks)

b.ADA Savings and Loans would like to reduce its equity duration to five years by converting mortgages to auto loans. What is the value of loans that ADA should sell? Express answers in the units of million dollars and keep two decimal places (e.g. $99.99 million).

(5 marks)

c.Describe (in your own words) some of the weaknesses of the duration matching method.

(5 marks)

This section of the page is intentionally left blank

Standard Normal Probability

For instance:

(1) in the case z = 1.25, ;Prob(X<1.25)=N(1.25)=0.8944;

(2) z at 95th percentile is ; z at 90th percentile is .

| z | 0 | 0.01 | 0.02 | 0.03 | 0.04 | 0.05 | 0.06 | 0.07 | 0.08 | 0.09 |

| 0 | 0.5 | 0.504 | 0.508 | 0.512 | 0.516 | 0.5199 | 0.5239 | 0.5279 | 0.5319 | 0.5359 |

| 0.1 | 0.5398 | 0.5438 | 0.5478 | 0.5517 | 0.5557 | 0.5596 | 0.5636 | 0.5675 | 0.5714 | 0.5753 |

| 0.2 | 0.5793 | 0.5832 | 0.5871 | 0.591 | 0.5948 | 0.5987 | 0.6026 | 0.6064 | 0.6103 | 0.6141 |

| 0.3 | 0.6179 | 0.6217 | 0.6255 | 0.6293 | 0.6331 | 0.6368 | 0.6406 | 0.6443 | 0.648 | 0.6517 |

| 0.4 | 0.6554 | 0.6591 | 0.6628 | 0.6664 | 0.67 | 0.6736 | 0.6772 | 0.6808 | 0.6844 | 0.6879 |

| 0.5 | 0.6915 | 0.695 | 0.6985 | 0.7019 | 0.7054 | 0.7088 | 0.7123 | 0.7157 | 0.719 | 0.7224 |

| 0.6 | 0.7257 | 0.7291 | 0.7324 | 0.7357 | 0.7389 | 0.7422 | 0.7454 | 0.7486 | 0.7517 | 0.7549 |

| 0.7 | 0.758 | 0.7611 | 0.7642 | 0.7673 | 0.7704 | 0.7734 | 0.7764 | 0.7794 | 0.7823 | 0.7852 |

| 0.8 | 0.7881 | 0.791 | 0.7939 | 0.7967 | 0.7995 | 0.8023 | 0.8051 | 0.8078 | 0.8106 | 0.8133 |

| 0.9 | 0.8159 | 0.8186 | 0.8212 | 0.8238 | 0.8264 | 0.8289 | 0.8315 | 0.834 | 0.8365 | 0.8389 |

| 1 | 0.8413 | 0.8438 | 0.8461 | 0.8485 | 0.8508 | 0.8531 | 0.8554 | 0.8577 | 0.8599 | 0.8621 |

| 1.1 | 0.8643 | 0.8665 | 0.8686 | 0.8708 | 0.8729 | 0.8749 | 0.877 | 0.879 | 0.881 | 0.883 |

1.2 |

0.8849 | 0.8869 | 0.8888 | 0.8907 | 0.8925 | 0.8944 | 0.8962 | 0.898 | 0.8997 | 0.9015 |

| 1.3 | 0.9032 | 0.9049 | 0.9066 | 0.9082 | 0.9099 | 0.9115 | 0.9131 | 0.9147 | 0.9162 | 0.9177 |

| 1.4 | 0.9192 | 0.9207 | 0.9222 | 0.9236 | 0.9251 | 0.9265 | 0.9279 | 0.9292 | 0.9306 | 0.9319 |

| 1.5 | 0.9332 | 0.9345 | 0.9357 | 0.937 | 0.9382 | 0.9394 | 0.9406 | 0.9418 | 0.9429 | 0.9441 |

| 1.6 | 0.9452 | 0.9463 | 0.9474 | 0.9484 | 0.9495 | 0.9505 | 0.9515 | 0.9525 | 0.9535 | 0.9545 |

| 1.7 | 0.9554 | 0.9564 | 0.9573 | 0.9582 | 0.9591 | 0.9599 | 0.9608 | 0.9616 | 0.9625 | 0.9633 |

| 1.8 | 0.9641 | 0.9649 | 0.9656 | 0.9664 | 0.9671 | 0.9678 | 0.9686 | 0.9693 | 0.9699 | 0.9706 |

| 1.9 | 0.9713 | 0.9719 | 0.9726 | 0.9732 | 0.9738 | 0.9744 | 0.975 | 0.9756 | 0.9761 | 0.9767 |

| 2 | 0.9772 | 0.9778 | 0.9783 | 0.9788 | 0.9793 | 0.9798 | 0.9803 | 0.9808 | 0.9812 | 0.9817 |

| 2.1 | 0.9821 | 0.9826 | 0.983 | 0.9834 | 0.9838 | 0.9842 | 0.9846 | 0.985 | 0.9854 | 0.9857 |

| 2.2 | 0.9861 | 0.9864 | 0.9868 | 0.9871 | 0.9875 | 0.9878 | 0.9881 | 0.9884 | 0.9887 | 0.989 |

| 2.3 | 0.9893 | 0.9896 | 0.9898 | 0.9901 | 0.9904 | 0.9906 | 0.9909 | 0.9911 | 0.9913 | 0.9916 |

| 2.4 | 0.9918 | 0.992 | 0.9922 | 0.9925 | 0.9927 | 0.9929 | 0.9931 | 0.9932 | 0.9934 | 0.9936 |

| 2.5 | 0.9938 | 0.994 | 0.9941 | 0.9943 | 0.9945 | 0.9946 | 0.9948 | 0.9949 | 0.9951 | 0.9952 |

| 2.6 | 0.9953 | 0.9955 | 0.9956 | 0.9957 | 0.9959 | 0.9960 | 0.9961 | 0.9962 | 0.9963 | 0.9964 |

| 2.7 | 0.9993 | 0.9993 | 0.9993 | 0.9993 | 0.9994 | 0.9994 | 0.9994 | 0.9994 | 0.9994 | 0.9994 |

| 2.8 | 0.9996 | 0.9996 | 0.9996 | 0.9996 | 0.9996 | 0.9996 | 0.9996 | 0.9996 | 0.9996 | 0.9996 |

| 2.9 | 0.9997 | 0.9998 | 0.9998 | 0.9998 | 0.9998 | 0.9998 | 0.9998 | 0.9998 | 0.9998 | 0.9998 |

| 3 | 0.9999 | 0.9999 | 0.9999 | 0.9999 | 0.9999 | 0.9999 | 0.9999 | 0.9999 | 0.9999 | 0.9999 |