Mid-Semester Test

Department of Accounting and Finance

UNIT CODES: BFC5926

金融学mid代考 During an exam, you must not have in your possession, a book, notes, paper, pencil case, mobile phone or any other material/item…

TITLE OF PAPER: Financial Institutions and Markets

TEST DURATION: 60 minutes

READING TIME: 10 minutes

During an exam, you must not have in your possession, a book, notes, paper, pencil case, mobile phone or any other material/item which has not been authorised for the exam or specifically permitted as noted below. Any material or item on your desk, chair or person will be deemed to be in your possession. You are reminded that possession of unauthorised materials in an exam is a discipline offence under Monash Statute 4.1.

AUTHORISED MATERIALS 金融学mid代考

If yes, items permitted are: The only Faculty approved calculators permitted in tests and examinations for all Australian campuses and locations is the HP10bII+ or Casio FX82 (any suffix).

This paper consists of 35 multiple choice questions.

PLEASE CHECK THE PAPER BEFORE COMMENCING.

ALL RESPONSES TO BE RECORDED ON THE GENERAL PURPOSE ANSWER SHEET. NO TEST PAPERS SHOULD BE REMOVED FROM THE EXAMINATION ROOM.

Questions 1 to 35 are all multiple choice questions. You must attempt all questions. Your selected answers must be marked on the General Purpose Answer Sheet provided.

1. Financial institutions facilitate the flow of investment funds:

a. from savers to borrowers.

b. from SSUs to DSUs.

c. from the household sector to the business sector.

*d. any of the above.

2. Direct finance is best exemplified by:

a. the purchase of mutual fund shares.

b. depositing in a credit union.

*c. borrowing from a friend or relative.

d. employee contributions to a pension fund.

3. The key roles in the Australian payments system include: 金融学mid代考

a. regulatory responsibility for controlling risk in the financial system, promoting the efficiency of the payments system and competition in the market for payment services.

b. providing facilities for the final settlement of payment transactions.

c. providing check clearing facilities to banks.

*d. a and b

4. Which of the following is an example of indirect financing?

a. An SSU purchasing a financial claim from a DSU.

b. An SSU purchasing a financial claim from a dealer.

*c. An SSU purchasing a financial claim from a commercial bank.

d. An SSU purchasing a financial claim from an underwriter.

5. Information asymmetry occurs when:

*a. the contracting parties do not have equal access to relevant information and therefore one party is at an advantage.

b. the contracting parties have equal access to relevant information.

c. the contracting parties do not have equal access to relevant information and both parties are at

a disadvantage.

d. the contracting parties have equal access to relevant information and therefore both profit from it.

6. During 2007, John and Mary Smith expect total income of about $225,000 and are budgeting total expenditures of about $180,000. For this budget period, the Smith family is most specifically a(n):

a. DSU

b. business

*c. SSU

d. household

7. The objective of the Reserve Bank of Australia in implementing monetary policy is:

a. printing and issuing of Australia’s currency notes.

b. to stabilise the economy.

*c. control inflation rates within a target range.

d. change the money supply in the economy.

8. The term ‘Reserve Bank of Australia’s independence’ means:

*a. conducting of monetary policy, it is not directly under the authority of the Government or the Prime Minster.

b. has its own board and charter.

c. free of accountability to the Parliament.

d. none of the above.

9. Unemployment should fall if 金融学mid代考

a. wages increase and people expect prices to rise.

*b. wages increase and people expect prices to be stable.

c. interest rates rise more than prices are expected to rise.

d. the money supply decreases.

10. Monetary policy impacts the economy

a. by affecting real spending directly.

b. by affecting real spending through the financial sector.

c. by changing interest rates and the cost of housing.

*d. all of the above

11. Monetary policies directed toward increased economic growth may have what impact upon the value of the dollar in relation to other currencies?

a. increase

*b. decrease

c. no effect

d. none of the preceding

12. A decline in interest rates in financial markets

*a. increases the market value of fixed income securities such as corporate bonds, mortgages and mortgage-backed securities.

b. decreases the market value of fixed income securities such as corporate bonds, mortgages and mortgage-backed securities

c. has no impact on the market value of fixed income securities such as corporate bonds, mortgages and mortgage-backed securities

d. none of the above

13. Which one of the following is not an explanation for paying interest on borrowed money?

a. Interest is the rental cost of purchasing power.

b. Interest is the penalty paid for consuming income before it is earned.

*c. Interest is always paid at the maturity of a loan.

d. Interest is the time value of delayed consumption.

14. ________ real rates are almost always positive; _______real rates may be negative. 金融学mid代考

a. Realised; expected

*b. Expected; realised

c. Government; private

d. Expected; expected

15. If the real rate of interest is 4%, actual inflation for the last year was 5%, and expected inflation is 8%, the Fisher effect predicts what current level of nominal interest rates?

a. 9%

b. 8%

c. 13%

*d. 12%

16. If current market rates on Treasury bonds are 6 per cent and the real growth of the economy has and will be expected to grow at 3 per cent, what is the expected rate of inflation, according to the Fisher effect?

*a. 3%

b. 9%

c. higher than 6%

d. close to zero

17. All but one of the following is associated with economies with very high inflation rates. Which one?

*a. Very few people who wish to borrow at a fixed rate.

b. Little if any long-term debt market.

c. Variable interest rate loans.

d. Reliance on short-term debt contracts.

18. Interest rates move ______ with expected inflation; _____ with economic activity.

a. directly/inversely

b. inversely/inversely

*c. directly/directly

d. inversely/directly

19. If a $1000 par value bond has an 8% coupon (annual payments) rate, a 4-year maturity, and similar bonds are yielding 11%, what is the price of the bond?

a. $1,000.00

b. $880.22

*c. $906.93

d. $910.35

20. A $1000 bond with a coupon rate of 10%, interest paid semiannually, matures in eight years and sells for $1120. What is the yield to maturity?

a. 10.8%

b. 11.0%

*c. 7.9%

d. 7.6%

21. Price risk and reinvestment risk partly offset each other: 金融学mid代考

a. when interest rates decline, a bond’s price increases, resulting in a capital gain, but the gain is partly offset by lower coupon reinvestment income.

b. when interest rates rise, the bond suffers a capital loss but the loss is partly offset by higher coupon reinvestment income.

c. when bond yield above its coupon rate.

*d. a and b.

22. If market interest rates fall after a bond is issued, the

a. face value of the bond increases.

b. investor will sell the bond.

*c. market value of the bond is increasing.

d. market value of the bond is decreasing.

23. Which of the following risks will not affect zero coupon bonds?

a. Price risk

*b. Reinvestment risk

c. Credit risk

d. Default risk

24. The source of data for a yield curve might be:

a. bond yield by issuers over time.

b. historical Treasury security yields.

c. realized Treasury security yields by time.

*d. outstanding Treasury security yields by maturity.

25. An upward sloping yield curve indicates that security investors expect future interest rates to _____ and security prices to ______. 金融学mid代考

a. fall; fall.

b. fall; rise.

*c. rise; fall.

d. rise; rise.

26. A downward sloping yield curve indicates that future short-term rates are expected to ______ and outstanding security prices will _______.

*a. fall; rise.

b. fall; fall.

c. rise; rise.

d. rise; fall.

27. Calculate the one-year forward rate three years from now if three- and four-year rates are 5.50% and 5.80%, respectively?

a. The rate cannot be calculated from the information above.

b. 6.2%

*c. 6.7%

d. 5.6%

28. How much interest is earned in the third year on a $1,000 deposit that earns 7% interest compounded annually?

a. $70.00

*b. $80.14

c. $105.62

d. $140.00

29. Assume the total expense for your current year in college equals $20,000. Approximately how much would your parents have needed to invest 21 years ago in an account paying 8% compounded annually to cover this amount?

a. $952

b. $1,600

c. $1,728

*d. $3,973

30. How much must be invested today in order to generate a five-year annuity of $1,000 per year, with the first payment one year from today, at an interest rate of 12%? 金融学mid代考

*a. $3,604,78

b. $3,746.25

c. $4,037.35

d. $4,604.78

31. Your real estate agent mentions that homes in your price range require a payment of approximately $1,200 per month over 30 years at 9% interest. What is the approximate size of the mortgage with these terms?

a. $128,035

b. $147,940

*c. $149,140

d. $393,120

32. How long must one wait (to the nearest year) for an initial investment of $1,000 to triple in value if the investment earns 8% compounded annually?

a. 9

*b. 14

c. 22

d. 25

33. The salesperson offers, “Buy this new car for $25,000 cash or, with appropriate down payment, pay $500 per month for 48 months at 8% interest.” Assuming that the salesperson does not offer a free lunch, calculate the “appropriate” down payment.

a. $1,000.00

*b. $4,520.64

c. $5,127.24

d. $8,000.00

34. What is the present value of the following payment stream, discounted at 8% annually: $1,000 at the end of year 1, $2,000 at the end of year 2, and $3,000 at the end of year 3? 金融学mid代考

*a. $5,022.11

b. $5,144.03

c. $5,423.87

d. $5,520.00

35. A cash-strapped young professional offers to buy your car with four, equal annual payments of $3,000, beginning two years from today. Assuming you’re indifferent to cash versus credit, that you can invest at 10%, and that you want to receive $9,000 for the car, should you accept?

a. Yes; present value is $9,510.

b. Yes; present value is $11,372.

*c. No; present value is $8,645.

d. No; present value is $7,461.

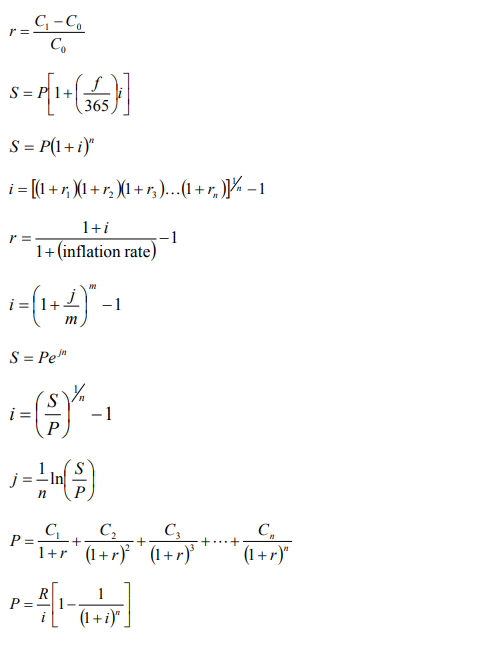

FORMULAE SHEET.